The main category of NFT News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of NFT News.

You can use the search box below to find what you need.

[wd_asp id=1]

Join Our Telegram channel to stay up to date on breaking news coverage

As the DeFi space thrives, market activity is crucial to a project’s growth and potential. With the rapid evolution of decentralized finance, these platforms are reshaping how we think about traditional finance, offering decentralized alternatives for lending, borrowing, trading, and more. In this dynamic landscape, specific tokens stand out, not just for their technological innovations but also for their consistent performance in the market.

This article explores some of the leading DeFi tokens, including Hedera Hashgraph (HBAR), Aave (AAVE), Raydium (RAY), and Jupiter (JUP). With impressive growth in market price and user engagement, these tokens are shaping the future of decentralized finance. Let’s look at their recent performance and how they contribute to the evolving DeFi ecosystem.

Hedera Hashgraph is a decentralized platform for building fast, secure, scalable applications. Aave Protocol is a decentralized lending platform built on Ethereum. It enables users to lend, borrow, and earn interest on digital assets. Raydium is an automated market maker (AMM) platform built on the Solana blockchain. Jupiter is one of the largest DeFi protocols on the Solana network, reaching impressive transaction volumes. Let’s dive deeply into why these tokens are some of the leading DeFi tokens by market activity today.

Hedera Hashgraph is a decentralized platform for building fast, secure, scalable applications. Unlike traditional blockchains, it uses a unique technology called Hashgraph, which enables high transaction throughput and low fees. The network is governed by a global council of leading organizations, ensuring transparency and long-term stability.

Its native token, HBAR, powers the ecosystem by fueling transactions, smart contracts, and network services. HBAR is also interested in helping maintain network security and integrity. As adoption grows, HBAR continues to play a key role in supporting Hedera’s performance-driven DLT infrastructure.

Hedera is trading at $0.2132, reflecting a 3.09% increase in the last 24 hours. Over the past week, it has surged by 20.59% and experienced a solid 26.47% rise over the past 30 days. With a price range of $0.2018 to $0.2137, Hedera shows positive performance, signaling growing investor confidence in its potential.

gm and hello future. It’s a new era for Hedera.

The Hedera ecosystem just leveled up with a fresh identity, strategic upgrades, and new leadership designed to bring alignment across the board. 🧵 pic.twitter.com/fWY2O6KUIk

— Hedera (@hedera) May 8, 2025

Hedera has entered a new era with a fresh identity and strategic upgrades, including a shift from the HBAR Foundation to the Hedera Foundation, focusing on ecosystem and retail growth. The leadership transition includes Sylvester as President and Mance Harmon as Chair-Elect, reinforcing Hedera’s commitment to governance and enterprise adoption. The Hedera network remains the backbone of the digital economy, focusing on transparency, decentralization, and real-world utility.

This evolution positions Hedera for greater growth and efficiency, attracting more enterprise adoption and decentralized applications. Investors can expect stronger governance and a sharper focus on innovation, ensuring that Hedera remains a leading layer of trust in the digital economy.

Aave Protocol is a decentralized lending platform built on Ethereum. It enables users to lend, borrow, and earn interest on digital assets. By depositing cryptocurrencies into liquidity pools, users contribute to the protocol’s funds, which can then be lent to other users. Aave offers two types of tokens: aTokens, given to lenders to accumulate interest, and AAVE tokens, which represent the platform’s native currency.

The AAVE token plays a crucial role in the governance of the Aave ecosystem, allowing holders to propose and vote on protocol changes. Additionally, a portion of the platform’s fees is used to buy back AAVE tokens, reducing the token’s supply and increasing its scarcity over time.

Aave is priced at $224.62, a 2.55% increase in the last 24 hours. The token has performed exceptionally well over the past week, rising by 26.61%, and has surged by 64.57% over the previous 30 days. Aave shows strong momentum with a price range between $214.73 and $225.54, reflecting positive market sentiment and investor confidence.

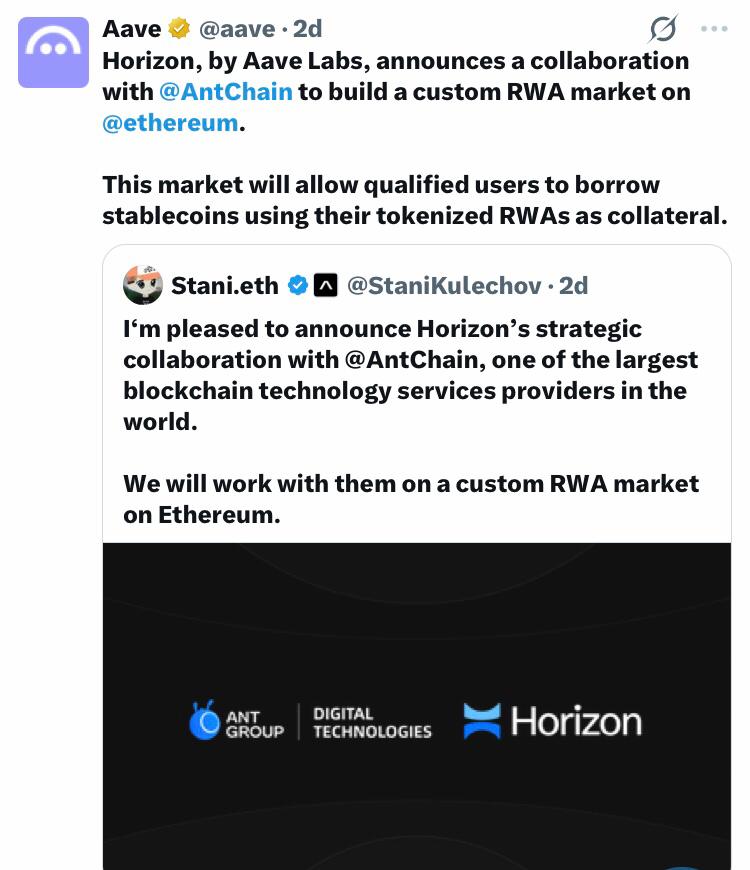

Horizon by Aave Labs has partnered with AntChain to create a custom Real-World Asset (RWA) market on Ethereum. This collaboration will enable qualified users to borrow stablecoins using tokenized RWAs as collateral, marking a significant step toward integrating real-world assets with decentralized finance.

This partnership enhances the DeFi ecosystem by bridging traditional assets with blockchain technology, providing greater liquidity and access to borrowing. This development allows investors to diversify collateral options and engage with tokenized real-world assets, unlocking new possibilities for the DeFi space.

SUBBD is an AI-powered platform revolutionising content monetisation in the creator-subscriber economy. Combining AI tools and Web3 enables creators to manage and monetise content, efficiently cutting out middlemen. With features like AI live streams, voice generators, and a 24/7 personal assistant, SUBBD offers a decentralised alternative to platforms like OnlyFans.

The $SUBBD token powers the platform, enabling access to content, offering tips, and facilitating creator requests. Currently in presale at $0.055375, with over $376,000 raised, the token provides exclusive perks, VIP access, and a 20% annual return through staking. Ten per cent of the total supply is allocated for airdrops and rewards.

From an idea to AI generated reality, if you can describe it, you can make it on SUBBD 📷

What idea would you bring to life?

📷: @ValentinacruzAi pic.twitter.com/bupxve9Sc1— SUBBD (@SUBBDofficial) May 7, 2025

It has also been featured on major cryptocurrency platforms, including Cryptonomist, Coinspeaker, Bitcoinist, 99Bitcoins, and TradingView via NewsBTC, highlighting its growing presence in the AI and Web3. With its increasing influence, $SUBBD is gaining rapid traction. The launch of the AI Personal Assistant further strengthens its position, offering creators continuous fan engagement and support. As AI and Web3 redefine digital content, $SUBBD shapes the future of creator income.

Raydium is an automated market maker (AMM) platform built on the Solana blockchain. It bridges liquidity and order books with Serum, Solana’s top decentralized exchange. Raydium’s AMM provides on-chain liquidity to Serum’s order book, enabling users to access the entire Serum ecosystem seamlessly.

Users can earn yield by providing liquidity through staked digital assets and participating in liquidity farming. Additionally, Raydium offers token swapping, trading, and the opportunity to participate in Initial DEX Offerings (IDOs).

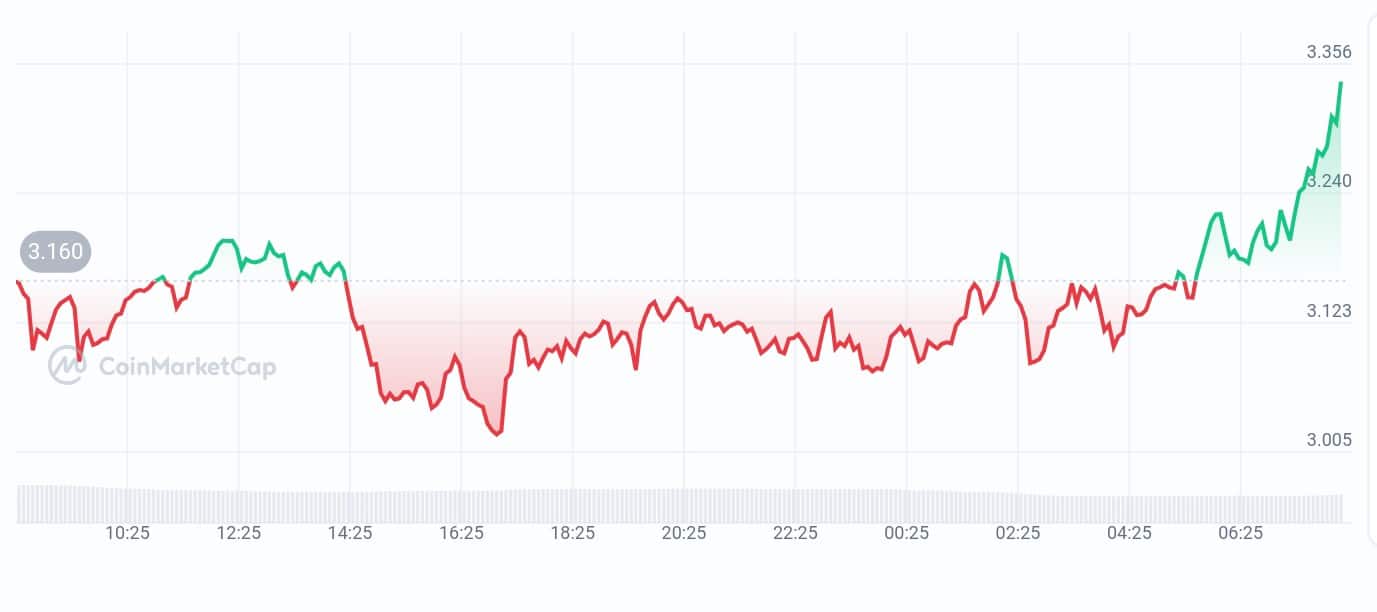

Raydium is trading at $3.34, with a notable 5.81% increase in the last 24 hours. Over the past week, it has seen a solid 23.12% gain; in the previous 30 days, the token has surged by 87.24%. With a price range of $3.00 to $3.33, Raydium’s strong performance reflects positive momentum and investor confidence, indicating a bullish sentiment in the market.

Introducing the LaunchLab Leaderboard 🏆

Trade pre-migrated LaunchLab tokens and climb the leaderboard to become eligible for daily rewards.

Start trading now to maximize your RAY rewards, the trenches are calling 🪖 pic.twitter.com/XijvaQ0RFz

— Raydium (@RaydiumProtocol) May 7, 2025

LaunchLab has introduced the LaunchLab Leaderboard, where users can trade pre-migrated LaunchLab tokens and earn RAY rewards based on their trading volume. The leaderboard is updated daily, and users can participate by trading tokens on any of LaunchLab’s integrated partner platforms.

This new feature gamifies the trading experience, incentivizing users to increase their trading volume to climb the leaderboard and earn rewards. It enhances the utility of LaunchLab tokens while promoting the platform’s integrated partners. For investors, it encourages active participation in the ecosystem and offers a way to earn rewards through strategic trading, boosting liquidity, and engagement.

In November 2023, Jupiter, one of the leading DeFi tokens, became one of the largest DeFi protocols on the Solana network, reaching impressive transaction volumes. As one of the industry’s most advanced swap aggregation engines, Jupiter delivers essential liquidity infrastructure for the Solana ecosystem. Moreover, Jupiter is expanding its DeFi product offerings, featuring a comprehensive suite that includes Limit Order, DCA/TWAP, Bridge Comparator, and Perpetuals Trading.

The JUP token acts as a governance token, allowing community members to participate in decision-making processes, including the approval and voting on key aspects of the Jupiter platform.

Jupiter is trading at $0.5948, reflecting a 6.35% increase in the last 24 hours. Over the past week, the token has seen a significant 37.11% gain; in the previous 30 days, it has surged by 55.08%. With a price range between $0.5475 and $0.5919, Jupiter’s strong performance signals a positive market sentiment and growing investor interest.

Jupiter Mobile has launched Universal Send, a feature that enables users to send any token—like SOL, USDC, or even meme coins—anywhere in the world with ultra-low fees. The service allows users to send money instantly without needing a wallet from the recipient; if the recipient doesn’t claim the tokens, they can be returned to the sender.

Universal Send significantly lowers the barriers to crypto adoption, making it easier for users to send and receive funds globally. By offering gasless transactions and simple claim methods, it caters to crypto enthusiasts and newcomers, enhancing the utility of Solana-based tokens in everyday transactions. For investors, this streamlines the process of onboarding new users and could expand the reach of Solana’s ecosystem into everyday financial use cases.

Best Wallet – Diversify Your Crypto Portfolio

Join Our Telegram channel to stay up to date on breaking news coverage

NODE provides broad exposure to digital transformation companies and digital assets instruments. Active management rebalances the fund in line with crypto market cycle indicators, bringing dynamic volatility management to investing in the onchain economy.

NODE may invest most or all of its net assets in Digital Transformation Companies and/or Digital Asset Instruments, but does not invest directly in digital assets or commodities. Digital asset instruments may involve risks from investing in digital asset ETPs, including extreme market volatility and limited investor protections, as these ETPs are not registered under the Investment Company Act of 1940 or the Commodity Exchange Act and do not offer the investor protections provided under those Acts.

VanEck is announcing the launch of the VanEck Onchain Economy ETF (CBOE: NODE), an actively managed fund that provides exposure to companies at the forefront of digital asset adoption.

NODE offers diversified exposure to a wide range of companies powering the onchain economy. At launch, holdings include crypto-native companies like miners, exchanges and holding companies; energy and infrastructure providers; fintech and blockchain-integrated e-commerce platforms; and datacenter and compute infrastructure. The portfolio is adjusted dynamically as market conditions evolve, based on each company’s sensitivity to bitcoin.

The investment team manages overall exposure to maintain a lower volatility profile than many pure-play crypto strategies. This approach is designed to help investors stay allocated through market cycles, while preserving the flexibility to add exposure when valuations reset and dislocations create more attractive opportunities. NODE’s mandate also allows for investment in bitcoin and other crypto-linked exchange-traded products (ETPs) to supplement direct company exposures.

NODE holdings include companies already active in the onchain economy, whether by holding or mining bitcoin, providing infrastructure or energy to miners, or enabling digital asset adoption through fintech or traditional finance platforms. The investment team will also consider any company that has clearly communicated plans to engage in this space, as evidenced through public filings, earnings calls or investor materials.

“The portfolio will not be static. As new companies enter the universe through IPOs, spinouts or strategy shifts, we will continuously update our investable universe. We will also adjust beta and volatility to maintain responsible exposure to bitcoin and to businesses driving the growth of the onchain economy, avoiding over-allocation to high-beta names during frothy markets and preserving buying power for future opportunities. The goal is to offer a risk profile investors can stick with, alongside the liquidity and transparency of an ETF,” said Matthew Sigel, VanEck’s Head of Digital Assets Research and Portfolio Manager for NODE. “By taking a broader view of the onchain economy, NODE can deliver both diversification and liquidity. Categorizing assets by their bitcoin sensitivity lets us fine-tune the portfolio across market cycles, with a goal of ramping up volatility when risk is rewarded and dialing it back when caution is key.”

NODE joins a family of digital asset and digital asset-focused ETFs from VanEck that also includes the VanEck Digital Transformation ETF (Nasdaq: DAPP), an index-tracking fund designed to provide exposure to companies participating in digital assets economies.

“DAPP continues to deliver a key means of adding passive, market-tracking exposure to pureplay companies at the forefront of the digital assets transformation. Meanwhile, NODE provides a powerful tool for investors seeking bitcoin and crypto exposure with a more measured risk profile, offering potentially lower volatility than pure-play strategies, with the flexibility to add exposure during periods of market stress,” added Sigel.

VanEck’s X feed, @vaneck_us, is a go-to source for updates on the firm’s digital assets efforts, and the firm’s digital assets research team is a prolific producer of insights on this space.

About VanEck

VanEck has a history of looking beyond the financial markets to identify trends that are likely to create impactful investment opportunities. We were one of the first

Today, VanEck offers active and passive strategies with compelling exposures supported by well-designed investment processes. As of 4/30/2025, VanEck managed approximately

Since our founding in 1955, putting our clients’ interests first, in all market environments, has been at the heart of the firm’s mission.

Disclosures

This is not an offer to buy or sell, or a recommendation to buy or sell any of the securities, financial instruments or digital assets mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, tax advice, or any call to action. Certain statements contained herein may constitute projections, forecasts and other forward-looking statements, which do not reflect actual results, are for illustrative purposes only, are valid as of the date of this communication, and are subject to change without notice. Actual future performance of any assets or industries mentioned are unknown. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. VanEck does not guarantee the accuracy of third party data. The information herein represents the opinion of the author(s), but not necessarily those of VanEck or its other employees.

Digital asset instruments may be subject to risks associated with investing in digital asset exchange-traded products (“ETPs”), which include the historical extreme volatility of the digital asset and cryptocurrency market, as well as less regulation and thus fewer investor protections, as these ETPs are not investment companies registered under the Investment Company Act of 1940 (“1940 Act”) or commodity pools for the purposes of the Commodity Exchange Act (“CEA”).

The technology relating to digital assets, including blockchain, is new and developing and the risks associated with digital assets may not fully emerge until the technology is widely used. Digital asset technologies are used by companies to optimize their business practices, whether by using the technology within their business or operating business lines involved in the operation of the technology. The cryptographic keys necessary to transact a digital asset may be subject to theft, loss, or destruction, which could adversely affect a company’s business or operations if it were dependent on the digital asset. There may be risks posed by the lack of regulation for digital assets and any future regulatory developments could affect the viability and expansion of the use of digital assets.

VanEck Onchain Economy ETF (NODE) Risk Disclosures:

The Fund may invest nearly all of its net assets in either Digital Transformation Companies and/or Digital Asset Instruments. The Fund does not invest in digital assets or commodities directly.

An investment in the Fund involves a substantial degree of risk and is not suitable for all investors. Investors in the Fund should be willing to accept a high degree of volatility in the price of the Fund’s Shares and the possibility of significant losses. An investment in the Fund is not a deposit with a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Therefore, you should consider carefully various risks before investing in the Fund, each of which could significantly and adversely affect the value of an investment in the Fund.

An investment in the Fund may be subject to risks which include, among others, risks related to investing in digital transformation companies, digital asset instruments, commodities and commodity-linked instruments, subsidiary investment, commodity regulatory (with respect to investments in the subsidiary), tax (with respect to investments in the subsidiary), gap, liquidity, derivatives, new fund, regulatory, non-diversified, small- and medium-capitalization companies, foreign securities, emerging market issuers, market, operational, active management, authorized participant concentration, no guarantee of active trading market, trading issues, fund shares trading, premium/discount risk and liquidity of fund shares, industry concentration, cash transactions, underlying investment vehicle, and affiliated investment vehicle risks, all of which may adversely affect the fund. Emerging market issuers and foreign securities may be subject to securities markets, political and economic, investment and repatriation restrictions, different rules and regulations, less publicly available financial information, foreign currency and exchange rates, operational and settlement, and corporate and securities laws risks. Small- and medium-capitalization companies may be subject to elevated risks.

Commodities and commodity-linked instruments may be subject to further risks, including tax and futures contracts risk. This risk may be adversely affected by “negative roll yields” in “contango” markets. The Fund will “roll” out of one futures contract as the expiration date approaches and into another futures contract with a later expiration date. The “rolling” feature creates the potential for a significant negative effect on the Fund’s performance that is independent of the performance of the spot prices of the underlying commodity. The “spot price” of a commodity is the price of that commodity for immediate delivery, as opposed to a futures price, which represents the price for delivery on a specified date in the future. The Fund would be expected to experience negative roll yield if the futures prices tend to be greater than the spot price. A market where futures prices are generally greater than spot prices is referred to as a “contango” market. Therefore, if the futures market for a given commodity is in contango, then the value of a futures contract on that commodity would tend to decline over time (assuming the spot price remains unchanged), because the higher futures price would fall as it converges to the lower spot price by expiration. Extended period of contango may cause significant and sustained losses. Additionally, because of the frequency with which the Fund may roll futures contracts, the impact of contango on Fund performance may be greater than it would have been if the Fund rolled futures contracts less frequently.

VanEck Digital Transformation ETF (DAPP) Risk Disclosures:

The Fund will not invest in digital assets (including cryptocurrencies) (i) directly or (ii) indirectly through the use of digital asset derivatives. The Fund also will not invest in initial coin offerings. Therefore the Fund is not expected to track the price movement of any digital asset.

Investors in the Fund should be willing to accept a high degree of volatility in the price of the Fund’s Shares and the possibility of significant losses. An investment in the Fund involves a substantial degree of risk. An investment in the Fund is not a deposit with a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Therefore, you should consider carefully various risks before investing in the Fund, each of which could significantly and adversely affect the value of an investment in the Fund.

An investment in the Fund may be subject to risks which include, among others, risks related to investing in digital transformation companies, special risk considerations of investing in Canadian and Chinese issuers, equity securities, small- and medium-capitalization companies, information technology sector, financials sector, foreign securities, emerging market issuers, market, operational, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount and liquidity of fund shares, non-diversified and index-related concentration risks, all of which may adversely affect the Fund. Emerging market issuers and foreign securities may be subject to securities markets, political and economic, investment and repatriation restrictions, different rules and regulations, less publicly available financial information, foreign currency and exchange rates, operational and settlement, and corporate and securities laws risks. Small- and medium-capitalization companies may be subject to elevated risks.

Investing involves substantial risk and high volatility, including possible loss of principal. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

©️ Van Eck Securities Corporation, Distributor, a wholly owned subsidiary of Van Eck Associates Corporation

666 Third Avenue,

Phone: 800.826.2333

Email: info@vaneck.com

View source version on businesswire.com: https://www.businesswire.com/news/home/20250514445170/en/

Media

Chris Sullivan

Craft & Capital

chris@craftandcapital.com

Source: VanEck

From a trading perspective, the audit completion by Paradex Network could create short-term bullish momentum for DeFi tokens, particularly those associated with similar protocols or ecosystems. While Paradex’s native token data is not explicitly available in real-time at the time of writing, traders can look at proxy indicators such as trading volume spikes in comparable DeFi tokens like Uniswap (UNI) and Aave (AAVE). As of 11:00 AM UTC on May 14, 2025, UNI recorded a 3.1% price increase to $7.85 with a 24-hour trading volume of $142 million, up 18% from the previous day, according to CoinMarketCap. Similarly, AAVE traded at $86.50, up 2.7%, with a volume of $98 million, reflecting a 15% surge. These movements suggest that positive DeFi news, such as audits, can drive volume and price appreciation across the sector. For Paradex, if its token is listed or becomes tradable, traders should watch for initial price pumps driven by sentiment, followed by potential profit-taking. Cross-market analysis also reveals a correlation between DeFi token performance and broader crypto market risk appetite, as evidenced by Bitcoin’s steady climb above $62,000 in the same period. Additionally, institutional interest in audited DeFi projects could grow, as security remains a top concern for large capital inflows. Traders might consider long positions on DeFi tokens with upcoming audits or related news, while setting stop-losses below key support levels to manage volatility risks.

Technical indicators further support a cautious but opportunistic approach to trading around this news. For instance, the DeFi Pulse Index (DPI), which tracks major DeFi tokens, showed a relative strength index (RSI) of 58 as of 12:00 PM UTC on May 14, 2025, indicating neither overbought nor oversold conditions, per TradingView data. The 24-hour trading volume for DPI increased by 12% to $5.6 million, reflecting moderate but growing interest. On-chain metrics also provide insight: Ethereum gas fees, often correlated with DeFi activity, spiked by 9% to an average of 25 Gwei in the last 24 hours, according to Etherscan data at 1:00 PM UTC on May 14, 2025, suggesting heightened network usage potentially tied to DeFi transactions. For Paradex-specific trading, if its token or related pairs become available, traders should monitor volume changes and order book depth on major exchanges for signs of liquidity influx. Correlations between DeFi tokens and Ethereum (ETH), which traded at $2,980 with a 1.9% gain as of 2:00 PM UTC on May 14, 2025, per CoinGecko, remain strong, with a 0.85 correlation coefficient over the past week, based on CryptoCompare data. This suggests that ETH’s price stability or upward movement could amplify gains in DeFi tokens post-audit announcements. Lastly, sentiment analysis from social media platforms indicates a 14% increase in positive mentions of DeFi projects on May 14, 2025, per LunarCrush metrics, aligning with Paradex’s news release. Traders should remain vigilant for breakout patterns above resistance levels in relevant trading pairs while keeping an eye on broader market trends.

In summary, Paradex Network’s smart contract audit completion is a pivotal event for DeFi traders, signaling enhanced project credibility amid a recovering crypto market. While direct price data for Paradex’s token isn’t available at this time, proxy indicators from UNI, AAVE, and ETH suggest potential trading opportunities in the DeFi sector. With institutional focus on security intensifying, audited projects could attract significant capital inflows, making this a space to watch for both short-term gains and long-term portfolio additions. Always trade with risk management strategies in place, given the inherent volatility of crypto markets.

Jakarta, Pintu News – Although Solana (SOL) has decreased in value today, May 13, strong fundamental analysis points to a potential price increase of up to $300.

On-chain data shows that the Solana blockchain has outperformed all other layer one and layer two networks, a bullish indicator for the token.

On Monday, the SOL briefly touched the $180 mark before experiencing strong rejection as traders took profits, which led the price back to $171.

Check out the full analysis here!

Solana price is currently in a decisive phase, trying to break the resistance line of the ascending parallel channel that has rejected it several times. However, by successfully defending the centerline support, the chances of breaking the upper resistance are opening up, which could trigger further price gains.

In addition, a golden cross formation looks set to occur as the 20-day EMA moves up and approaches convergence with the 200-day EMA. If these two trend lines continue to show the same pattern and cross, this could trigger the next bullish phase for SOL prices past the $177 resistance level, towards the previous record high of $296, and potentially reach $300.

The RSI indicator also confirmed that momentum is still bullish, with a reading of 69 indicating strong buying pressure. This suggests that Solana (SOL) may soon cross $200.

Also read: X SEC account hacker gets caught up in the law, sentenced to 2 years in prison!

In terms of revenue generated by decentralized applications (dApps), the Solana blockchain has surpassed all other layer one and layer two networks last week. According to data from DeFiLlama, Solana’s revenue exceeded $50 million, with network dominance reaching 51.6%, more than three times that of Ethereum (ETH) at just 14.23%.

This revenue growth is a bullish indicator for SOL prices as it could boost investor confidence and push up the price of the altcoin. Data from DappRadar also shows that in the last seven days, dApp volume on the Solana network increased by 50% to $1.61 billion, while transactions during the week reached $138 million.

This surge may be related to the SOL meme coin craze that has pushed their market capitalization above $14 million.

Read also: LAUNCHCOIN Skyrocketed Over 200% Today May 14, 2025, What’s the Main Factor?

Open interest for Solana continues to show an upward trend, and despite recent price drops, this metric continues to rise and recently reached $6.92 billion, the highest level since late January.

The increase in open interest indicates high confidence among traders that SOL prices will continue to rise. This underlines Solana’s positive price forecast, as the bulls target the next key level above $200 and reach a new record high above $300.

Therefore, as the Solana blockchain continues to grow and outperform other layer one and layer two networks, SOL prices may continue to trend upwards and potentially reach new highs above $300.

With a range of favorable technical and fundamental indicators, the upside outlook for Solana (SOL) looks very bright. The combination of strong price defense, increasing open interest, and dApp revenue dominance puts Solana in a great position to reach higher market values in the near future.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

From a trading perspective, the buzz around web3 gaming highlighted by Yat Siu’s discussion could drive short-term volatility in gaming tokens. Traders should monitor pairs like AXS/USDT and SAND/USDT on major exchanges such as Binance and Coinbase for potential breakout opportunities. For instance, AXS/USDT saw a 24-hour trading volume of $45 million as of 8:00 AM UTC on May 14, 2025, a 12% increase compared to the previous day, indicating growing interest. Similarly, SAND/USDT recorded a volume of $38 million, up 9% in the same period, as per data from CoinGecko. The correlation between stock market performance and crypto assets is also worth noting. As tech stocks on the Nasdaq continue to rally, institutional money flow into crypto markets often increases, particularly into niche sectors like web3 gaming. This could create a favorable environment for gaming tokens if sentiment remains bullish. Additionally, the discussion led by Yat Siu may influence retail investor behavior, potentially driving up demand for tokens associated with Animoca Brands’ portfolio, such as SAND. Traders should also watch for any follow-up announcements or partnerships in the web3 gaming space, as these could act as catalysts for price spikes. Risk appetite appears to be shifting toward speculative assets, with the Crypto Fear & Greed Index reading 68 (Greed) as of May 14, 2025, suggesting a market open to high-risk, high-reward plays like gaming tokens.

Diving into technical indicators, AXS is showing bullish momentum with its price above the 50-day moving average of $6.95 as of May 14, 2025, at 10:00 AM UTC, while the Relative Strength Index (RSI) stands at 58, indicating room for further upside before overbought conditions. SAND, on the other hand, is testing resistance at $0.43, with an RSI of 55, suggesting potential for a breakout if volume sustains, based on TradingView data. On-chain metrics further support this narrative, with Axie Infinity’s active addresses increasing by 8% to 25,000 over the past week as of May 14, 2025, per DappRadar insights. The Sandbox also reported a 5% uptick in transaction volume, reaching $1.2 million in the last 24 hours. These metrics highlight growing user engagement, a critical factor for long-term value in gaming tokens. Meanwhile, the correlation between crypto and stock markets remains evident, as institutional investors often view blockchain gaming as an extension of tech innovation. For instance, a spike in investments in tech ETFs like the Invesco QQQ Trust, which gained 0.6% on May 13, 2025, often precedes inflows into crypto sectors like gaming. This cross-market dynamic suggests that a continued rally in tech stocks could amplify gains in tokens like AXS and SAND. Traders should remain cautious, however, as sudden shifts in broader market sentiment could trigger pullbacks in speculative assets. Monitoring Bitcoin’s dominance, currently at 54.3% as of May 14, 2025, per CoinMarketCap, will also provide clues on whether altcoins, including gaming tokens, have room to outperform.

In summary, the conversation on web3 gaming led by Yat Siu underscores the growing relevance of this niche in the crypto ecosystem. With concrete trading data and cross-market correlations pointing to potential opportunities, investors can position themselves in gaming tokens while keeping an eye on stock market trends and institutional flows. The interplay between tech stock performance and crypto sentiment remains a key driver for sectors like web3 gaming, offering both risks and rewards for informed traders.

Cryptocurrency exchange Bybit has announced the shutdown of its non-fungible token (NFT) marketplace.

In an April 1 announcement, Bybit warned its users that its NFT marketplace will cease operations on April 8 at 4:00 pm (UTC). Furthermore, at that time, the exchange will also shut down its Inscription Marketplace and its initial decentralized exchange offering initiative.

The announcement explains that the measures are part of Bybit’s “efforts to streamline our offerings.” The decision follows a similar decision by major NFT marketplace X2Y2 announced earlier this week.

Charu Sethi, president at NFT-focused Polkadot and Kusama chain Unique Network, told Cointelegraph at the time that the market moved on from speculative to utility-based:

“The speculative phase focused on collectibles and trading is over, but NFTs are now entering their next growth era as core infrastructure enabling massive opportunities in gaming, AI, fan engagement and content authentication.“

The non-fungible token market at large is seeing a significant downturn. Daily NFT trading volume was over $18 million 364 days ago and stands at $5.34 million at the time of publication — a 70% fall.

Related: Bitcoin NFTs, layer-2 and restaking hype ‘completely gone’

The fall is even more dire when contrasted with the heights reported on Dec. 17, 2024, when volume exceeded $113.6 million. Since then, volume has fallen by over 95%.

NFT marketplace daily trading volume. Source: Token Terminal

Weak investor interest in speculative NFTs is felt throughout the market. Reports resurfaced earlier today show that NFT project Gutter Cat Gang (GCG) saw a rocky token launch of its GANG token on Apechain on March 31, attributed to a “technical issue” by a third party. However, others pointed to reportedly low interest in the token.

Related: Bybit: 89% of stolen $1.4B crypto still traceable post-hack

Data shared online indicated that the project only attracted 3.66 Ether (ETH), worth about $6,800, in its token sale. This is a far cry from the project’s $1 million target — but the team has not yet addressed those claims.

A late March report shows that NFT sales dropped sharply in the first quarter of 2025, plunging 63% year-over-year. Still, the report points out some outliers such as Doodles, Milady Maker and Pudgy Penguins all outperforming expectations.

Magazine: Trump-Biden bet led to obsession with ‘idiotic’ NFTs —Batsoupyum, NFT Collector

DeFi Technologies Inc. (NasdaqCM: DEFT), a company bridging traditional capital markets with decentralized finance, has been officially added to the NASDAQ Composite Index as of May 13, 2025.

This inclusion follows the company’s recent commencement of trading on the Nasdaq Capital Market under the ticker symbol “DEFT” on May 12, 2025. The move marks a significant milestone for DeFi Technologies, enhancing its visibility and accessibility to a broader spectrum of institutional and retail investors.

The addition to the NASDAQ Composite Index is a noteworthy achievement for DeFi Technologies, reflecting the company’s growing market presence and the increasing acceptance of decentralized finance within mainstream financial markets.

The company’s shares, previously quoted on the OTC Markets, will continue to be listed on the CBOE Canada and Börse Frankfurt exchanges, but the transition to Nasdaq underscores its commitment to transparency, regulatory compliance, and expansion.

DeFi Technologies enters the index with a robust financial position, reporting C$61.9 million (US$44.7 million) in cash, USDT, and other digital asset treasury holdings as of April 30, 2025. The company did not raise new capital as part of the Nasdaq listing, highlighting its operational strength and financial health.

Its diversified business model spans subsidiaries such as Valour Inc. (offering exchange-traded products for digital assets), Stillman Digital (a digital asset liquidity provider), Neuronomics AG (AI-powered quantitative trading strategies), and DeFi Alpha (internal arbitrage and trading division).

CEO Olivier Roussy Newton described the Nasdaq listing and index inclusion as a historic moment for both the company and the digital asset industry, emphasizing DeFi Technologies’ mission to provide equity investors with direct access to decentralized finance and innovative digital asset products.

With its addition to the NASDAQ Composite Index, DeFi Technologies is poised to benefit from increased market visibility, improved liquidity, and broader investor access, further solidifying its role as a pioneer at the intersection of traditional finance and the rapidly evolving decentralized finance sector.

TORONTO, May 12, 2025 /PRNewswire/ – DeFi Technologies Inc. (the “Company” or “DeFi Technologies“) (Nasdaq: DEFT) (CBOE CA: DEFI) (GR: R9B), a financial technology company bridging the gap between traditional capital markets and decentralized finance (“DeFi“), is pleased to announce that its common shares (the “Common Shares“) will begin trading today on the Nasdaq Capital Market (“Nasdaq“). under the symbol “DEFT”.

Upon commencement of trading on Nasdaq, the Company’s Common Shares will cease to be quoted on the OTC Markets. DeFi Technologies will continue to trade on the CBOE Canada (CBOE CA: DEFI) and the Börse Frankfurt exchanges (GR: R9B).

The Nasdaq listing did not involve any capital raising activity as DeFi Technologies maintains a strong financial position of C$61.9M (US$44.7M) in cash, USDT, and other digital asset treasury holdings as of April 30, 2025.

“This Nasdaq listing marks a historic moment—not just for DeFi Technologies, but for the broader digital asset industry. We are proud to be the first company of our kind to offer equity investors direct exposure to decentralized finance, institutional-grade trading infrastructure, and dozens of the world’s most innovative digital assets. This milestone reinforces our commitment to making the decentralized economy more accessible to traditional investors.”

— Olivier Roussy Newton, CEO of DeFi Technologies

Shareholder Call to Discuss Q1 2025 Financial Results

The Company is also pleased to announce it will conduct a shareholder call on Tuesday, May 14, 2025, at 12:00 PM EST to discuss its financial performance for the three months ending March 31, 2025.

IMPORTANT – To register for the webcast, see below:

When: May 14, 2025

Time: 12:00 PM EST

Topic: DeFi Technologies Q1 2025 Financial Results

Register in advance for this webinar:

https://zoom.us/webinar/register/WN_nvCladwFTt2ChW2Yswg0gQ

After registering, you will receive a confirmation email containing information about joining the webinar.

About DeFi Technologies

DeFi Technologies Inc. (Nasdaq: DEFT) (CBOE CA:DEFI) (GR: R9B) is a financial technology company bridging the gap between traditional capital markets and decentralized finance (DeFi). As the first Nasdaq-listed digital asset manager of its kind, DeFi Technologies offers equity investors diversified exposure to the broader decentralized economy through its integrated and scalable business model. This includes Valour Inc., its subsidiary offering access to over 65 of the world’s most innovative digital assets via regulated exchange traded products (ETPs); Stillman Digital, a digital asset prime brokerage focused on institutional-grade execution and custody; Neuronomics, which develops quantitative trading strategies and infrastructure; and DeFi Alpha, the company’s internal arbitrage and trading business line. With deep expertise across capital markets and emerging technologies, DeFi Technologies is building the institutional gateway to the future of finance. Follow DeFi Technologies on Linkedin and X/Twitter, and for more details, visit https://defi.tech/

DeFi Technologies Subsidiaries

About Valour

Valour Inc. and Valour Digital Securities Limited (together, “Valour“) issues exchange traded products (“ETPs”) that enable retail and institutional investors to access digital assets in a simple and secure way via their traditional bank account. Valour is part of the asset management business line of DeFi Technologies. For more information about Valour, to subscribe, or to receive updates, visit valour.com.

About Stillman Digital

Stillman Digital is a leading digital asset liquidity provider that offers limitless liquidity solutions for businesses, focusing on industry-leading trade execution, settlement, and technology. For more information, please visit https://www.stillmandigital.com

About Reflexivity Research

Reflexivity Research LLC is a leading research firm specializing in the creation of high-quality, in-depth research reports for the bitcoin and digital asset industry, empowering investors with valuable insights. For more information please visit https://www.reflexivityresearch.com/

About Neuronomics AG

Neuronomics AG is a Swiss asset management firm specializing in AI-powered quantitative trading strategies. By integrating artificial intelligence, computational neuroscience and quantitative finance, Neuronomics delivers cutting-edge solutions that drive superior risk-adjusted performance in financial markets. For more information please visit https://www.neuronomics.com/

Cautionary note regarding forward-looking information:

This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to the trading of the Common Shares on Nasdaq; the shareholder call; the pursuit by DeFi Technologies and its subsidiaries of business opportunities; and the merits or potential returns of any such opportunities. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of DeFi Technologies, as the case may be, to be materially different from those expressed or implied by such forward-looking information. Such risks, uncertainties and other factors include, but is not limited the acceptance of exchange traded product by exchanges; change in valuation of digital assets held by the Company; growth and development of decentralised finance and digital asset sector; rules and regulations with respect to decentralised finance and digital assets; general business, economic, competitive, political and social uncertainties. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

THE CBOE CANADA EXCHANGE DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

SOURCE DeFi Technologies Inc.

Diving deeper into the trading implications, the acceleration of web3 gaming presents unique opportunities for crypto investors. Tokens tied to gaming ecosystems, such as IMX, Axie Infinity (AXS), and The Sandbox (SAND), are likely to see sustained interest as adoption grows. On May 13, 2025, at 12:00 PM UTC, AXS recorded a 5.8% price surge to $7.82 on Coinbase, with trading volume up by 28% to $42 million in the same 24-hour window. Similarly, SAND climbed 4.9% to $0.43 on Binance, with volume increasing by 19% to $35 million. These movements suggest that traders are positioning themselves for long-term growth in web3 gaming. Additionally, the correlation between gaming tokens and broader crypto market sentiment is evident, as Bitcoin (BTC) held steady at $62,300 on May 13, 2025, at 1:00 PM UTC, with a marginal 1.2% increase, providing a stable backdrop for altcoin rallies. For traders, this creates opportunities to leverage gaming token momentum through spot trading or futures contracts, especially on pairs like IMX/USDT and AXS/BTC. However, risks remain, as hype-driven pumps can lead to sharp corrections if adoption metrics fail to match expectations.

From a technical perspective, gaming tokens are showing bullish indicators following the Token2049 news. As of May 13, 2025, at 2:00 PM UTC, IMX’s Relative Strength Index (RSI) on the 4-hour chart stood at 68 on Binance, nearing overbought territory but still signaling strong buying pressure. The 50-day Moving Average (MA) for IMX was crossed decisively at $2.05 earlier in the day, confirming a short-term uptrend. On-chain data also supports this momentum, with IMX wallet activity increasing by 12% over the past 48 hours, as reported by on-chain analytics platforms. For AXS, the RSI hovered at 65 on Coinbase at the same timestamp, while trading volume for the AXS/USDT pair reached a 7-day high of $18 million in a single 4-hour candle. SAND’s Bollinger Bands tightened on the 1-hour chart, suggesting an imminent breakout, with volume spiking to $10 million between 1:00 PM and 2:00 PM UTC. These indicators point to potential entry points for swing traders targeting quick gains. Moreover, the correlation between web3 gaming tokens and AI-driven crypto projects is noteworthy, as many gaming platforms leverage AI for enhanced user experiences. Tokens like Render Token (RNDR) saw a parallel 3.5% increase to $10.25 on May 13, 2025, at 3:00 PM UTC, reflecting shared tech-driven sentiment.

Finally, the intersection of web3 gaming and broader markets, including stocks, cannot be ignored. Gaming-related crypto assets often move in sync with tech stocks like NVIDIA and AMD, which power blockchain and gaming infrastructure. While specific stock data for May 13, 2025, isn’t available in real-time, historical correlations suggest that positive tech stock performance could amplify crypto gaming token gains. Institutional money flow into crypto, often influenced by stock market risk appetite, may also increase as web3 gaming gains traction. Traders should monitor ETF inflows related to blockchain and tech sectors for signs of capital rotation. In summary, the Token2049 revelation about web3 gaming’s rapid growth offers actionable insights for crypto traders, with gaming tokens like IMX, AXS, and SAND presenting clear trading opportunities as of May 13, 2025.

FAQ:

What is driving the recent surge in web3 gaming tokens?

The surge in web3 gaming tokens like IMX, AXS, and SAND is largely driven by the accelerated growth of the sector, as highlighted at Token2049 on May 13, 2025. Increased adoption of play-to-earn models and NFT integrations, coupled with bullish technical indicators and volume spikes, are fueling market interest.

How can traders capitalize on web3 gaming token momentum?

Traders can capitalize by focusing on spot trading or futures for pairs like IMX/USDT and AXS/BTC on exchanges like Binance and Coinbase. Monitoring technical indicators such as RSI and Moving Averages, as seen on May 13, 2025, can help identify entry and exit points for short-term gains.

On May 9, 2025, the crypto market saw a strong rally, with Bitcoin (BTC) breaking above $103,000 for the first time since January. Ethereum (ETH) and many altcoins also posted significant gains, pushing the total global crypto market capitalization above $3.22 trillion.

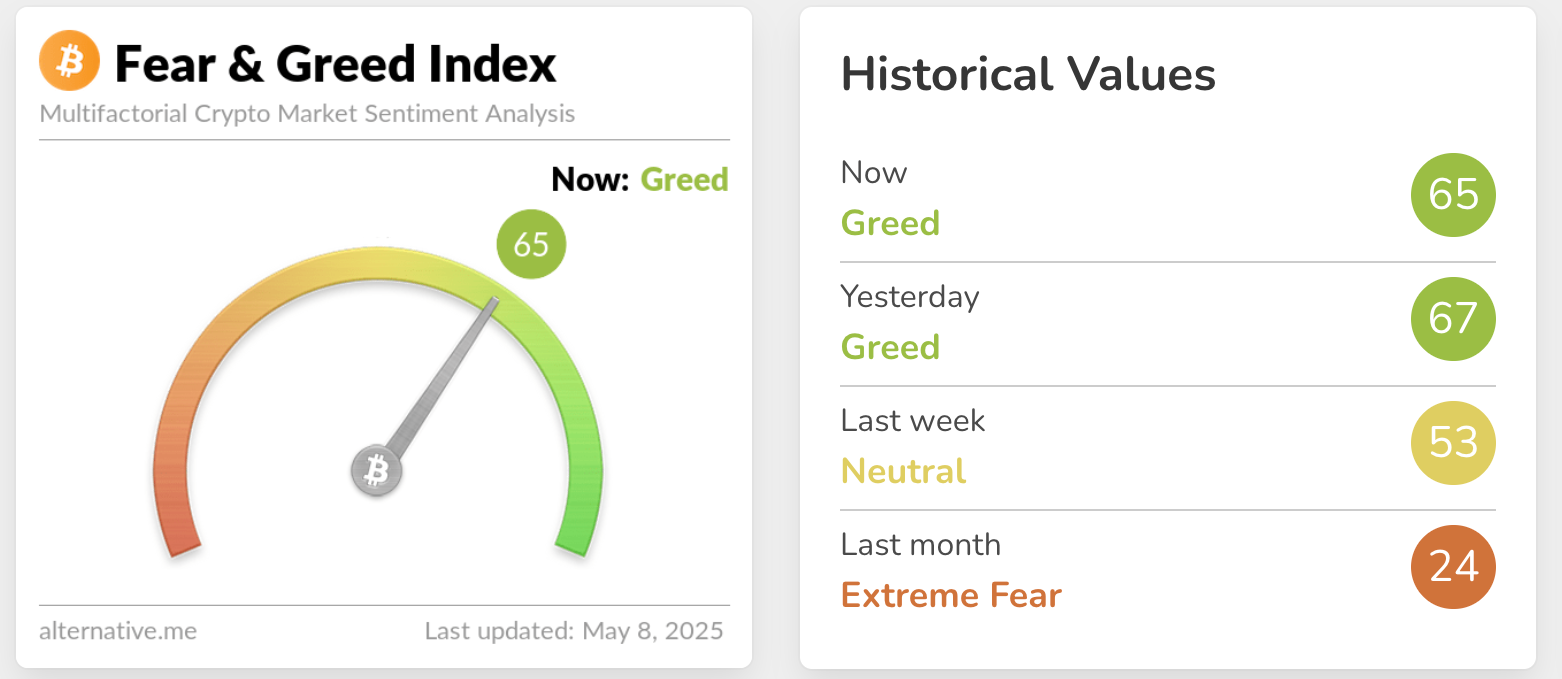

The Fear & Greed Index jumped from 48 (neutral) to 63 (greed) in just three days. According to Santiment, the number of retail wallets buying BTC and ETH has increased sharply since the beginning of the week.

So, what’s driving this impressive recovery?

Source: Alternative.me

U.S. jobless claims data released on May 8 showed a slight decline to 228,000 filings, down from 241,000 the previous week. The earlier spike was largely attributed to seasonal factors in New York State and not indicative of a broader trend in layoffs.

Learn more: Bitcoin Price Surpasses $100k amid Trade Optimism

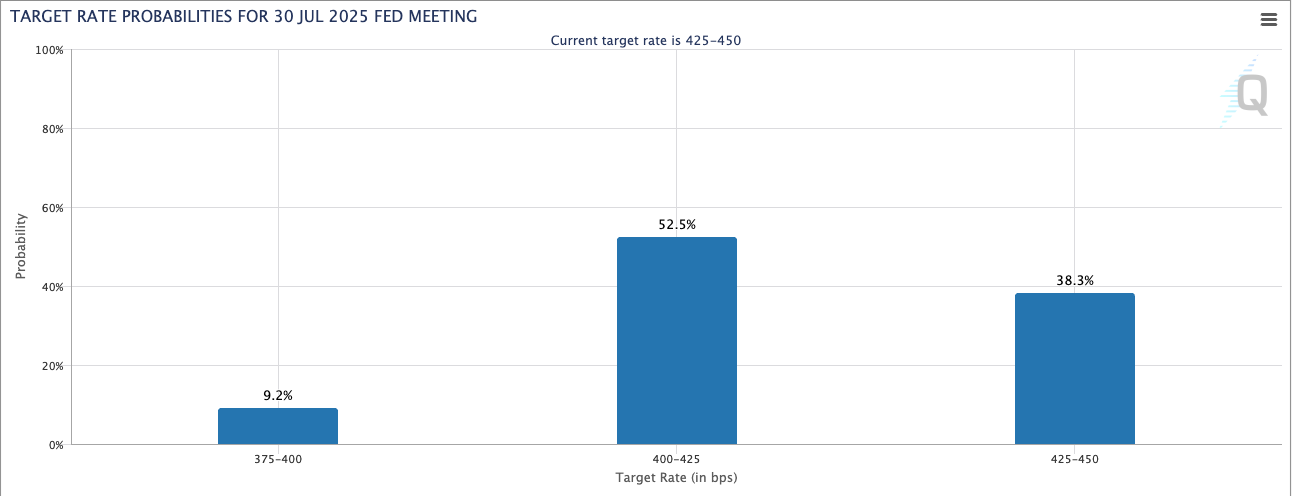

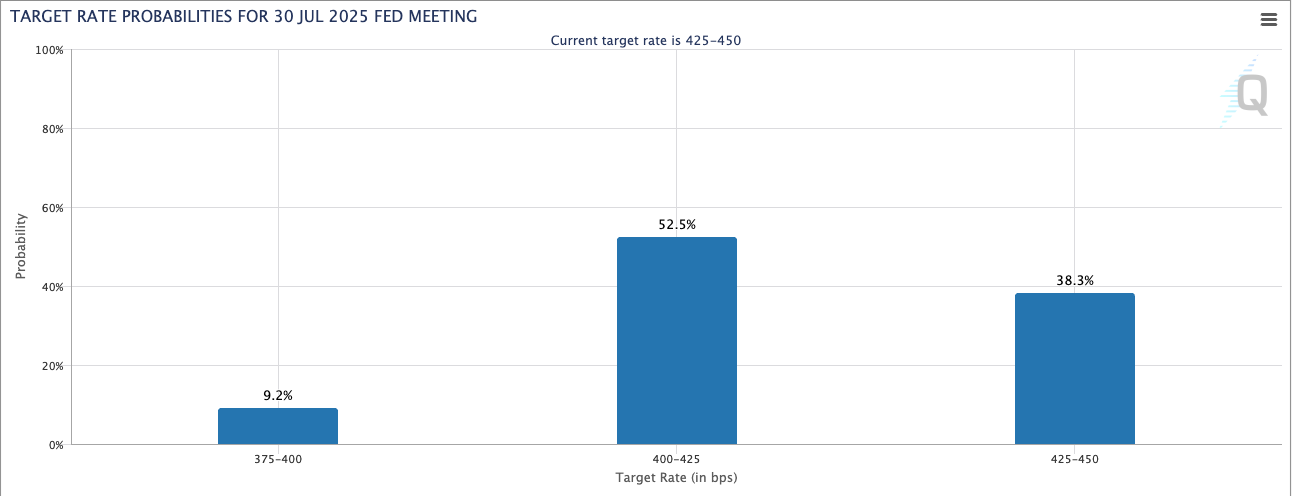

Still, investors remain concerned about the health of the U.S. economy, interpreting the Fed’s decision to keep rates steady at 4.25%–4.50% as a sign that recession risks are being weighed. As a result, expectations of rate cuts in Q3 2025 continue to support risk assets, including cryptocurrencies.

Source: CME Groups

The 10-year U.S. Treasury yield fell to 4.38%, while the DXY index (which measures the strength of the U.S. dollar) dropped to a three-week low, signaling a shift in capital toward speculative assets.

Another key factor is growing concern over stagflation – a scenario in which economic growth slows while inflation remains high, prompting investors to seek store-of-value assets like Bitcoin.

With the Fed holding rates steady and offering no clear guidance on cuts in June, markets are increasingly pricing in a more dovish monetary stance in the quarters ahead.

In this environment, Bitcoin, often referred to as “digital gold,” has emerged as a compelling hedge, particularly as the dollar weakens and macro uncertainty rises.

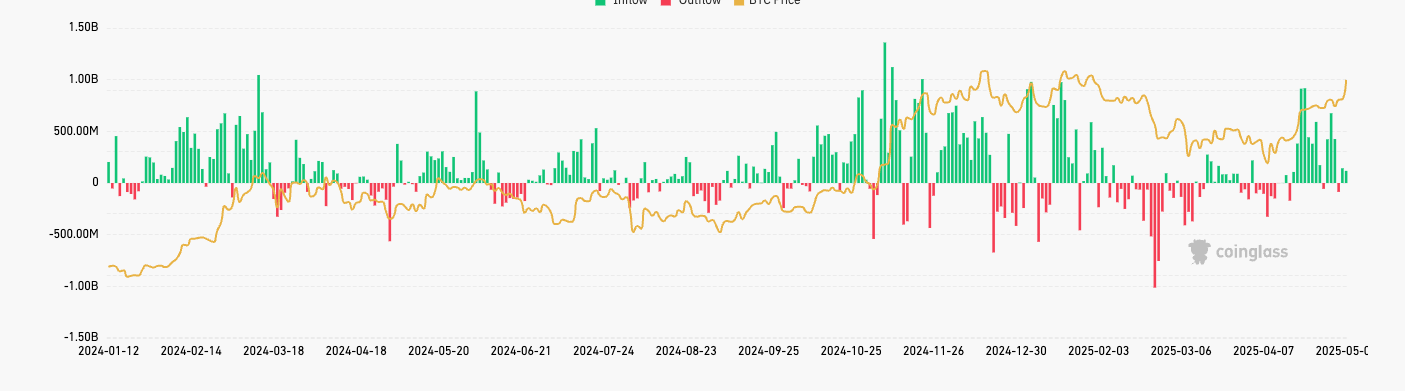

In the first week of May 2025, U.S.-listed Bitcoin ETFs witnessed robust inflows, highlighting growing institutional interest in digital assets.

On May 8, 2025, alone, total inflows into Bitcoin ETFs reached $117.4 million, with:

Over the past three weeks, Bitcoin ETFs have attracted more than $5.3 billion in cumulative inflows, underscoring a surge in demand from traditional investors.

Notably, since the start of 2025, IBIT has surpassed the SPDR Gold Shares (GLD) in net inflows, with over $6.96 billion, signaling a shift from gold to Bitcoin as a preferred store of value asset.

Source: CoinGlass

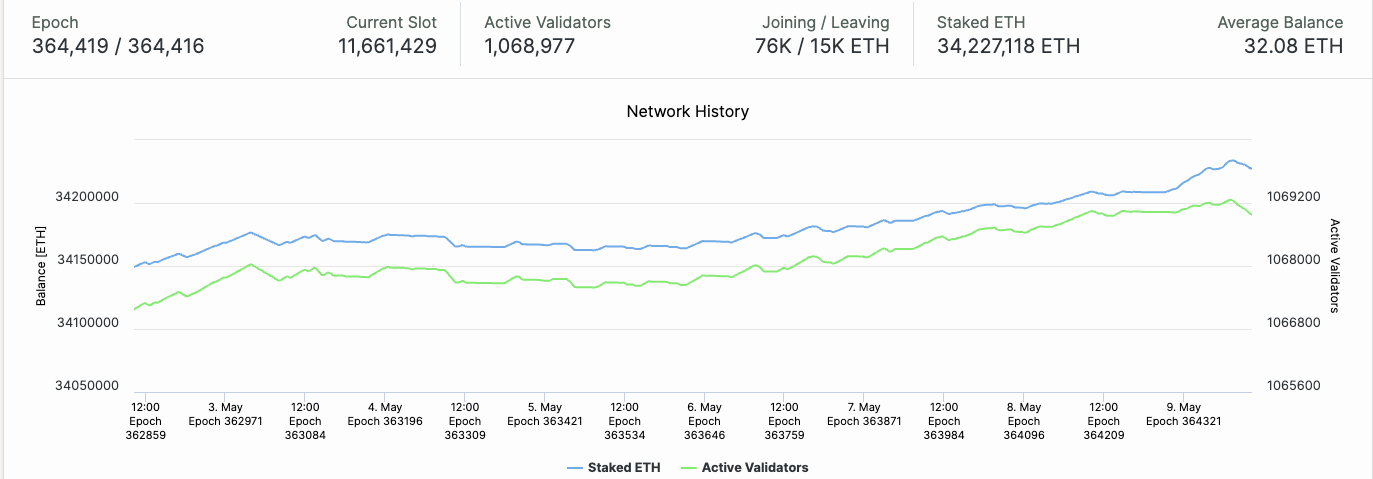

Ethereum has rallied nearly 20% over the past 7 days, driven primarily by two key catalysts. The successful rollout of the Pectra upgrade on May 7, which improves network performance and streamlines staking, and speculation that the SEC may approve one or more spot Ethereum ETFs ahead of the May 23 deadline.

The Pectra upgrade not only enhances transaction experience and scalability but also revises staking parameters, making it easier for retail investors to participate in ETH staking – a factor that could drive long-term holding demand.

Learn more: ETH Price Prediction after Pectra Upgrade in May

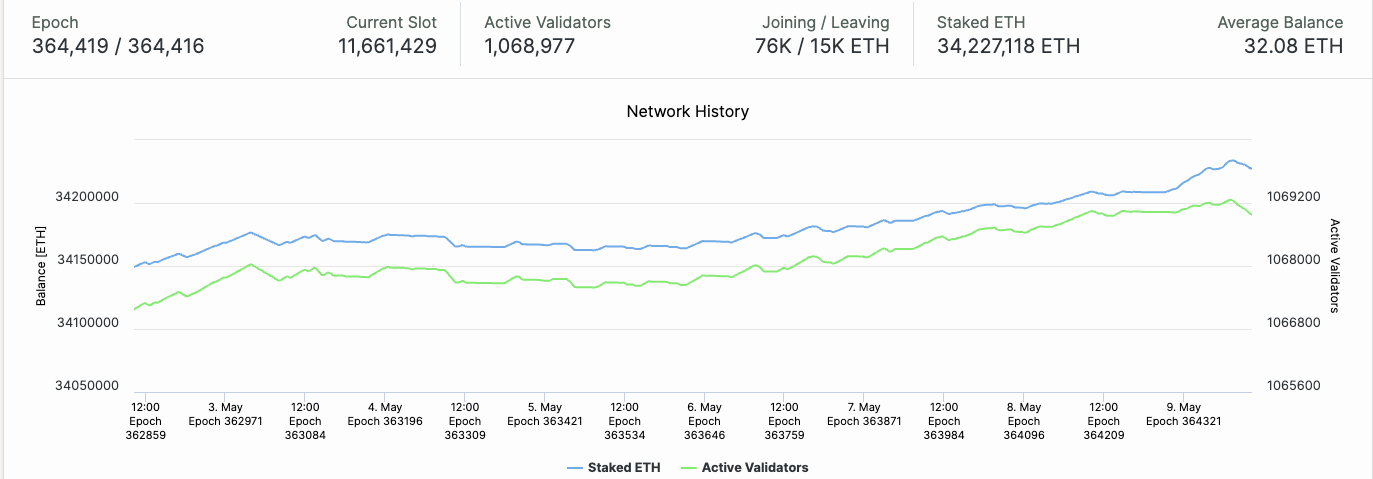

According to BeaconScan, over 400,000 ETH have been added to staking in the three days following the upgrade, marking the largest spike since January 2024.

Number of Ethereum validator after Pectra – Source: Beaconcha

Additionally, Bloomberg reports that the SEC held several closed-door meetings with ETF issuers last week, sparking speculation of a potentially favorable surprise decision – much like the approval of spot Bitcoin ETFs earlier this year.

Amid ongoing global geopolitical uncertainty, a new statement from U.S. President Donald Trump has helped lift market sentiment. Trump announced that the U.S. is preparing to unveil a major trade deal with a “very respected” country, widely interpreted by analysts to mean the United Kingdom.

Markets quickly took this as a signal that the U.S. may be softening its trade stance, potentially easing tensions with key partners after a prolonged period of tariffs and protectionist policies.

🇺🇸 JUST IN: President Trump announces a “major trade deal” news conference scheduled for tomorrow at 10:00 AM in the Oval Office with “a big, and highly respected country.” pic.twitter.com/irsood0JRZ

— Cointelegraph (@Cointelegraph) May 8, 2025

The positive mood spilled over into risk assets such as equities and cryptocurrencies. The U.S. dollar weakened, while stocks and Bitcoin surged, reflecting a return of speculative capital amid growing optimism for a more stable global trade environment.

The total crypto market capitalization (TOTAL) has rebounded strongly from the $2.4 trillion support zone and is now holding steady above $3.2 trillion. This recovery coincides with the RSI breaking out of oversold territory and approaching 70, indicating strong bullish momentum.

Moreover, the move above the 200-day moving average further confirms that a short-term uptrend has been firmly established.

This rally is not isolated to crypto alone – traditional financial markets are also trending higher:

These moves reflect a growing appetite for both safe-haven and speculative assets. In this context, crypto appears to be benefiting from broader global market dynamics, rather than rallying in isolation.

Source: TradingView

The strong rally on May 9 was the result of multiple converging factors: expectations of a Fed rate cut, continued institutional inflows into Bitcoin ETFs, the successful Ethereum upgrade, and a rapid improvement in investor sentiment.

However, for the rally to become sustainable, the market still needs further confirmation. Two upcoming events will be critical:

These will serve as key turning points that could shape the crypto market’s short-term trajectory.

Read more: Will Bitcoin Price Reaching $100k Trigger Another Sell-Off?