The main category of NFT News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of NFT News.

You can use the search box below to find what you need.

[wd_asp id=1]

BOCA RATON, FL, April 22, 2025 (GLOBE NEWSWIRE) — Janover Inc. JNVR today announced that it has officially changed its corporate name to DeFi Development Corporation, reflecting its evolution into a crypto treasury vehicle designed for public market investors.

In connection with the name change, the Company will change its ticker to the symbol “DFDV” on the Nasdaq at a future date.

“This marks the beginning of a new chapter for the business,” said Joseph Onorati, Chief Executive Officer of DeFi Development Corporation. “Our mission is to bring transparent, crypto-native capital allocation into the public markets — and this name change reflects that commitment.”

To accompany the transition, the Company will also be launching a new website — www.defidevcorp.com — which will feature key treasury disclosures, including current Solana (SOL) balances, SOL per share (“SPS”), and other key metrics that provide public market investors with clear visibility into treasury positioning.

The name and future ticker change do not affect the Company’s legal structure, business operations, or existing financial reporting obligations. Shareholders are not required to take any action in connection with the change.

Further updates will be provided via regular press releases and regulatory filings.

About DeFi Development Corporation

DeFi Development Corporation, formerly Janover Inc. JNVR, has adopted a treasury policy under which the principal holding in its treasury reserve on the balance sheet will be allocated to Solana (SOL). In adopting its new treasury policy, the Company intends to provide investors a way to access the Solana ecosystem. The Company’s treasury policy is expected to provide investors economic exposure to SOL investment.

We are an AI-powered online platform that connects the commercial real estate industry by providing data and software subscriptions as well as value-add services to multifamily and commercial property professionals as we connect the increasingly complex ecosystem that stakeholders have to manage.

We currently serve more than one million web users annually, including multifamily and commercial property owners and developers applying for billions of dollars of debt financing per year, professional service providers, and thousands of multifamily and commercial property lenders including more than 10% of the banks in America, credit unions, real estate investment trusts (“REITs”), debt funds, Fannie Mae® and Freddie Mac® multifamily lenders, FHA multifamily lenders, commercial mortgage-backed securities (“CMBS”) lenders, Small Business Administration (“SBA”) lenders, and more. Our data and software offerings are generally offered on a subscription basis as software as a service (“SaaS”).

Forward-Looking Statements

This release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “believe,” “project,” “estimate,” “expect,” strategy,” “future,” “likely,” “may,”, “should,” “will” and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the following: (i) fluctuations in the market price of SOL and any associated impairment charges that the Company may incur as a result of a decrease in the market price of SOL below the value at which the Company’s SOL are carried on its balance sheet; (ii) the effect of and uncertainties related the ongoing volatility in interest rates; (iii) our ability to achieve and maintain profitability in the future; (iv) the impact on our business of the regulatory environment and complexities with compliance related to such environment including changes in securities laws or other laws or regulations; (v) changes in the accounting treatment relating to the Company’s SOL holdings; (vi) our ability to respond to general economic conditions; (vii) our ability to manage our growth effectively and our expectations regarding the development and expansion of our business; (viii) our ability to access sources of capital, including debt financing and other sources of capital to finance operations and growth and (ix) other risks and uncertainties more fully in the section captioned “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and other reports we file with the SEC. As a result of these matters, changes in facts, assumptions not being realized or other circumstances, the Company’s actual results may differ materially from the expected results discussed in the forward-looking statements contained in this press release. Forward-looking statements contained in this announcement are made as of this date, and the Company undertakes no duty to update such information except as required under applicable law.

Investor Contact:

ir@defidevcorp.com

Media Contact:

Prosek Partners

pro-ddc@prosek.com

SoarFun, a web3 gaming hub, is pleased to announce its strategic partnership with OpenLoot, a marketplace that supports game developers and publishers. This partnership aims to give more rewards and fun and many opportunities to users to win different rewards. Both platforms will work on expanding the entire web3 gaming infrastructure. SoarFun has revealed this groundbreaking news to the web3 gaming community through its official X account.

SoarFun focuses on high-frequency trading, and blockchain mining in the Telegram Open Network (TON) ecosystem, while OpenFun is dealing NFTs, tokens, and wallet-free onboarding efficiently. By this, it means that users will enjoy from such a gaming experience that, they had not seen before in the history of games. Users will be provided free buffering games with high frequency that will never interrupt mining and create a wallet-free onboarding.

Both platforms will work on the same principle that they work on the enhancement and betterment of gaming technology. SoarFun will use its high-frequency engine to ensure distortion free trading, while OpenLoot will use its end-to-end encryption features to keep secrecy. With these modifications, users feel free to trade with other developers and work for the betterment of their services all over the world.

The partners will use each other specifications for the benefit of their users to build, the world’s best infrastructure for gaming. This will increase the NFT liquidity through SoaorFun, On the other hand, OpenLoot manages the privacy and security of assets. Both partners ensure their users that they will enhance the scalability, low-fee transactions, security, and speed. In the future users will be able to make smart contracts for games.

Jakarta, Pintu News – Hayden Adams, founder of Uniswap , stated that Solana is more suitable for decentralized finance development directly at Layer 1 (L1) than Ethereum .

According to him, Solana has a better roadmap, team, and approach to DeFi in L1. This statement sparked a debate regarding the future of blockchain architecture in the crypto ecosystem.

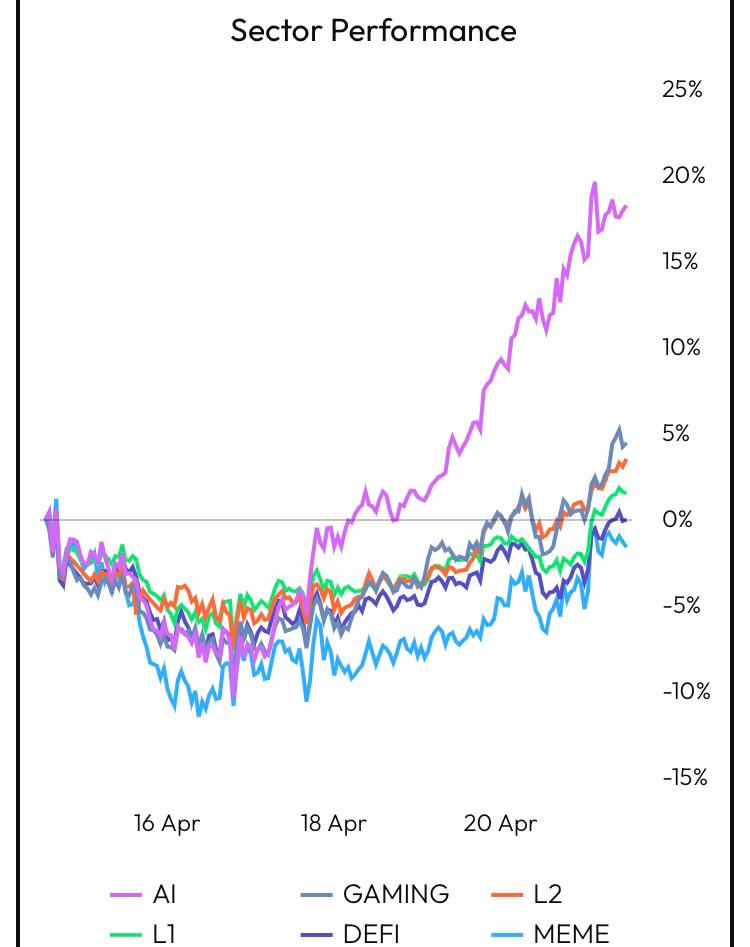

Ethereum has adopted a modular approach with a focus on Layer 2 (L2) solutions to improve scalability. However, Adams criticized this approach for adding complexity and reducing efficiency.

He argues that Solana , with its monolithic architecture, is more efficient in handling DeFi transactions directly on the L1. This makes Solana more attractive to DeFi developers and users who want speed and low cost.

On the other hand, David Hoffman of Bankless argues that Ethereum remains the natural home for DeFi. He emphasizes that Ethereum has unparalleled decentralization and uptime, making it the most reliable smart contract platform.

According to Hoffman, as much economic activity as possible should reside on Ethereum’s L1. However, this view is challenged by Solana’s increasing popularity among DeFi developers.

Solana attracts attention with its high throughput and low transaction fees. Platforms like Raydium , a Solana-based DEX, have surpassed Uniswap’s trading volume in a 30-day period, with $122 billion compared to $96 billion. This shows a shift in user and developer interest to the Solana ecosystem.

In addition, the launch of the Solana ETF in Canada and increased staking activity demonstrate the rapid growth of the Solana ecosystem.

Ethereum still holds a large market share and institutional support, but must act quickly to maintain its position. Adams advises Ethereum to stay focused on its L2 roadmap, although he is open to an L1-focused scalability approach with certain compromises.

Read also: CryptoCurb Shocks the Market with Bold Prediction: Solana Set to Skyrocket to $2,000!

However, he warned that a change in direction without a clear consensus could jeopardize the Ethereum ecosystem.

Overall, Hayden Adams’ statement highlights an important debate in the cryptocurrency world regarding the most effective blockchain architecture for DeFi.

While Ethereum relies on L2 solutions for scalability, Solana offers a simpler and more efficient L1 approach. These developments suggest that the future of DeFi may no longer be dominated by a single platform, but rather by an ecosystem that can offer speed, efficiency, and low fees to its users.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

Join Our Telegram channel to stay up to date on breaking news coverage

Decentralized Finance (DeFi) is rewriting the rules of traditional finance, offering a world where transactions happen directly between peers without the need for banks or intermediaries. Built on the power of blockchain, DeFi is unlocking a new era of transparency, accessibility, and financial freedom. Within this dynamic landscape, a select group of tokens are not merely participating but leading the way. From Uniswap’s collaboration with Across to introduce ERC-7683 to Pendle, offering a scalable, DeFi-native alternative to traditional over-the-counter (OTC) fixed-income markets, innovation in the DeFi space is accelerating.

Lido reinforces its network resilience and broadens its validator set with the launch of its new Community Staking Module (CSM). DeepBook’s recent deployment on the SUI Network is boosting accessibility and efficiency in on-chain trading, fostering a more decentralized ecosystem. These groundbreaking developments are reshaping the way we perceive financial markets. As DeFi continues to evolve, tokens like these are leading the charge, driving a new wave of innovation and growth that’s redefining the future of finance. Today, let’s dive into some of the leading DeFi tokens by market activity.

Uniswap is a decentralized exchange (DEX) that enables seamless token swaps using the Automated Market Maker (AMM) model. Pendle is a DeFi protocol that tokenizes future yield streams, allowing users to trade or lock in yields without collateral. Lido enables liquid staking, allowing users to stake assets like Ethereum while maintaining liquidity through tokens and earning rewards without needing to run a validator. DeepBook is a decentralized order book protocol on Sui, offering low-fee, on-chain trading with improved liquidity for DeFi. Let’s dive in fully to unveil why these tokens are some of the Leading DeFi Tokens by Market Activity Today.

Uniswap is a pioneering DeFi project that introduced the Automated Market Maker (AMM) model, transforming how users trade cryptocurrencies. As one of the largest decentralized exchanges (DEXs), Uniswap enables users to swap tokens directly from their wallets, eliminating the need for intermediaries. It has become a cornerstone of the DeFi ecosystem by offering seamless, permissionless trading and inspiring the development of numerous AMM-based platforms.

UNI, Uniswap’s governance token, was introduced to respond to rising competition from projects like SushiSwap. Its launch through a retroactive airdrop rewarded early users and set a new standard in DeFi token distribution. UNI allows holders to vote on key protocol upgrades and decisions, reinforcing community-driven development. Beyond governance, UNI represents an essential component in the decentralized finance landscape, symbolizing user participation and protocol sustainability.

Uniswap (UNI) trades at $5.437, marking a 3.77% increase in the past 24 hours. Its daily price performance ranged between a low of $5.159 and a high of $5.494. With a market capitalization of $3.44 billion, Uniswap remains a foundational pillar in decentralized finance, powering one of the largest decentralized exchanges on the Ethereum network. Its recent price movement reflects continued interest and trust in DeFi protocols amid a gradually strengthening market.

Less fragmentation, more liquidity

ERC-7683 is the first cross-chain standard designed to solve liquidity fragmentation through a universal filler network

Co-authored by Uniswap Labs and Across ⤵️

— Uniswap Labs 🦄 (@Uniswap) April 14, 2025

Uniswap Labs and Across have co-authored ERC-7683, a new cross-chain standard to solve liquidity fragmentation. It enables users to create secure, intent-based cross-chain orders that fillers compete to execute, streamlining the process and improving efficiency.

ERC-7683 reduces fragmentation and simplifies cross-chain transactions, thereby enhancing liquidity and improving the user experience across DeFi. With 70+ apps and chains already supporting it, the standard positions Uniswap and Across as leaders in DeFi infrastructure, potentially boosting adoption, developer activity, and long-term value for the ecosystem.

Pendle is an innovative DeFi protocol that introduces a new way to trade yield by enabling the tokenization and exchange of future yield streams through an Automated Market Maker (AMM) system. Built to enhance the utility of yield-generating assets, Pendle allows users to unlock additional value by either locking in future yields upfront or gaining direct exposure to them. It opens up a new layer of opportunity in decentralized finance by providing holders and traders with flexible access to future income streams without requiring underlying collateral.

PENDLE, the native token of the Pendle protocol, plays a crucial role in governance and incentivization within its decentralized finance (DeFi) ecosystem. It supports user participation in decision-making processes and helps secure liquidity across supported markets as Pendle continues to integrate with major protocols, such as Aave and Compound. Its token stands at the center of a unique value proposition, expanding the possibilities of yield management and trading in the DeFi space.

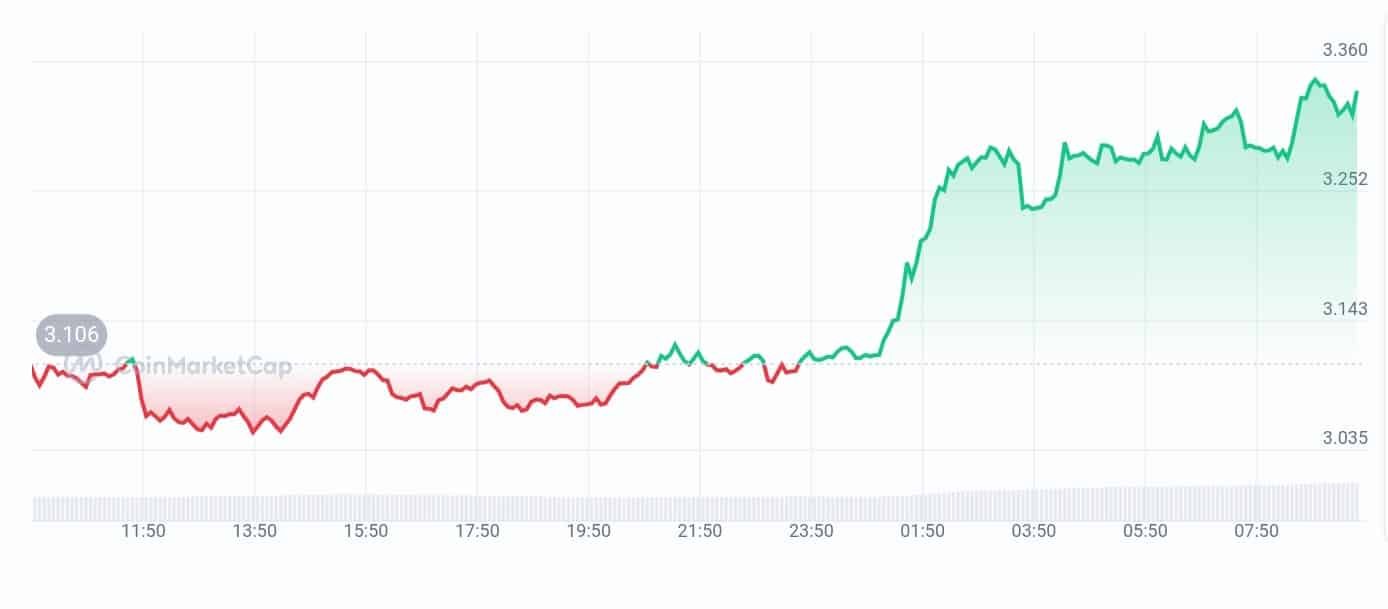

Pendle is trading at $3.336, showing a substantial 7.38% gain over the past 24 hours and an impressive 27.89% rise over the last month. Within the day, its price ranged from a low of $3.047 to a high of $3.345. Backed by bullish market sentiment, Pendle continues to gain momentum as more investors recognize its unique position in the DeFi space, enabling users to tokenize and trade future yields.

Fixed yield is here to stay, and Pendle is leading the way.

Last year, we settled over $21 billion of PTs, generating over $1.5 billion in yield and welcomed 320,000 new users, a five-fold increase from the year before.

Pendle is emerging as the de facto fixed-income… pic.twitter.com/pGSiZdGF3p

— Pendle (@pendle_fi) April 17, 2025

Pendle highlights its massive growth, having settled over $21 billion in Principal Tokens (PTs), generated a yield of over $1.5 billion, and onboarded 320,000 new users. With this momentum, Pendle is positioning itself as the leading fixed-yield marketplace in the DeFi space.

This growth solidifies Pendle’s role as a core component of DeFi infrastructure, providing transparent and efficient fixed-income opportunities. For users, it means reliable yield options. Pendle offers a scalable, DeFi-native alternative to traditional over-the-counter (OTC) fixed-income markets for investors and institutions, therefore making it one of the leading DeFi tokens by market activity today.

SUBBD is an AI-powered platform revolutionising content monetisation in the creator-subscriber economy. Combining AI tools and Web3 enables creators to manage and monetise content, efficiently cutting out middlemen. With features like AI live streams, voice generators, and a 24/7 personal assistant, SUBBD offers a decentralised alternative to platforms like OnlyFans.

The $SUBBD token powers the platform, enabling access to content, offering tips, and facilitating creator requests. Currently in presale at $0.055225, with over $212,610 raised, the token provides exclusive perks, VIP access, and a 20% annual return through staking. Ten per cent of the total supply is allocated for airdrops and rewards.

New milestone unlocked! ❤️🔥❤️🔥

More than $200,000 raised in the $SUBBD token presale!

👉 https://t.co/dLCKejpxpp pic.twitter.com/h1Zn6NA9aU

— SUBBD (@SUBBDofficial) April 19, 2025

It has also been featured on major cryptocurrency platforms, including Cryptonomist, Coinspeaker, Bitcoinist, 99Bitcoins, and TradingView via NewsBTC, highlighting its growing presence in the AI and Web3 space. With its increasing influence, $SUBBD is gaining rapid traction. The launch of the AI Personal Assistant further strengthens its position, offering creators continuous fan engagement. As AI and Web3 redefine digital content, $SUBBD shapes the future of creator income.

Lido DAO is a DeFi protocol that offers liquid staking solutions, primarily for Ethereum and other Proof-of-Stake blockchains. It addresses a key limitation in traditional staking by allowing users to maintain liquidity while earning staking rewards. Through Lido, users receive tokens, such as stETH, that represent their staked assets and can be utilized across various decentralized finance (DeFi) platforms. This innovation enhances the flexibility of staking and lowers the entry barrier by enabling users to stake smaller amounts without needing to operate a validator themselves.

LDO is the governance token that powers the Lido protocol and decentralized autonomous organization (DAO). It gives holders voting rights on major protocol decisions, including validator management and upgrades. Functioning as an ERC-20 token, LDO plays a central role in maintaining the decentralized nature of Lido’s liquid staking system. LDO supports a model within the broader DeFi ecosystem that integrates staking and liquidity, driving increased participation and utility in decentralized finance.

Lido DAO is trading at $0.7474, marking a 5.57% increase against the dollar in the past 24 hours and a modest 1.01% gain over the week. With a market cap of approximately $671 million, the token’s price fluctuated between a low of $0.7003 and a high of $0.7513 within the day. As a leading liquid staking solution, Lido continues to draw attention, particularly as staking demand within the Ethereum ecosystem increases.

The evolution of Lido CSM in (almost) 5 min💡

Watch as @d_gusakov breaks down the proposed goals and high-level features of CSM v2.

— Lido (@LidoFinance) April 18, 2025

Since its launch in October 2024, Lido’s Community Staking Module (CSM) has allowed over 300 independent node operators to join its Ethereum protocol. By enabling permissionless validator access backed by stETH bonds, CSM has enhanced decentralization and security while bringing over 8,000 ETH into the network.

CSM strengthens Lido’s resilience and expands its validator base, signaling a shift toward greater decentralization. This evolution improves network health and long-term protocol sustainability for investors, laying the groundwork for CSM v2 and deeper ecosystem participation in 2025.

DeepBook is a decentralized central limit order book (CLOB) protocol designed to enhance trading performance within the DeFi space, leveraging the high-speed capabilities and low fees of the Sui blockchain. Unlike traditional AMM models,

DeepBook enables fully on-chain order routing, matching, and settlement, offering a robust and composable infrastructure for advanced trading strategies. Its design provides deeper liquidity and tighter spreads, making it an essential liquidity layer for Sui’s broader DeFi ecosystem and a suitable venue for institutional-grade market makers.

Should one be introduced, DeepBook’s token, though not yet specified, would likely play a vital role in governance, incentivization, and ecosystem participation. The protocol already contributes significantly to decentralized finance by providing traders and liquidity providers with more precise control and efficiency in price execution. Its fully on-chain architecture positions it as a foundational component in the future of DeFi on Sui, with the potential to redefine how liquidity is aggregated and utilized across decentralized markets.

Deepbook is currently priced at $0.09599, reflecting a substantial 14.75% increase in the past 24 hours and a 26.91% rise over the past week against the dollar. The token’s price performance has ranged from a low of $0.08104 to a high of $0.09632 over the last 24 hours. This upward momentum highlights the growing interest in Deepbook, which could indicate increased market activity or adoption.

DeepBook v3.1 is live on @SuiNetwork

Permissionless pools. Lower fees. Deeper liquidity.

This upgrade marks a new era for onchain trading — designed for builders, traders, and everyone in between.

Let’s break it down 👇 pic.twitter.com/Ke8zpMRiWA

— DeepBook Protocol on Sui (@DeepBookonSui) April 16, 2025

DeepBook v3.1 has been launched on the Sui Network, introducing permissionless pools, lower fees, and enhanced liquidity for on-chain trading. This upgrade caters to builders, traders, and users, offering a more efficient and scalable trading experience.

This update enhances the accessibility and efficiency of on-chain trading, fostering a more decentralized ecosystem. For traders and investors, it offers reduced fees and better liquidity, improving the overall user experience and attracting more participants to the Sui Network.

Best Wallet – Diversify Your Crypto Portfolio

Join Our Telegram channel to stay up to date on breaking news coverage

Opinion by: Amitej Gajjala, co-founder and CEO of KernelDAO

Bitcoin is the principal asset of the cryptocurrency world and even one of the world’s top 10 most valuable assets, recognized for its role as a store of value. Yet a huge percentage of the Bitcoin BTCUSD supply remains dormant for years, meaning the crypto market only works with a fraction of the circulating supply each year.

This idle Bitcoin has an enormous amount of untapped financial potential.

Bitcoin’s principal narratives are “store of value” and “never sell.” Today’s decentralized finance (DeFi) tools, however, enable yield gain by holding Bitcoin and taking advantage of dormant Bitcoin, which just sits in investors’ wallets and does nothing.

Existing dormant Bitcoin is not being fully utilized

Dormant Bitcoin has not been used for long periods, usually one or more years. According to Glassnode, as of early 2025, the active supply that has not moved in more than one year is approximately 62%.

This Bitcoin is held in wallets that show no activity on the blockchain and remain inactive for various reasons. These could be intentional long-term holding strategies or even permanent loss as a result of negligence or the death of their users.

Let’s put aside the rest of the reasons and focus on long-term Bitcoin holding strategies. The existence of this group implies that they could enter the market at any time, producing significant volatility in the price of Bitcoin. Why aren’t we using that Bitcoin in DeFi right now?

Activating dormant Bitcoin will make waves in the market

If large quantities of dormant Bitcoin were to reactivate immediately, it could significantly affect the cryptocurrency market, creating a noticeable event. These movements could dramatically affect Bitcoin’s price in a negative way due to potential selling pressure and influence the market with a significant increase in active circulating supply.

Recent: Stablecoin presence key to blockchain legitimacy, says ZachXBT

If the reactivated Bitcoin is, however, reintegrated into productive DeFi ecosystems rather than sold en masse, it could provide liquidity without destabilizing the market. With that amount of active liquidity, Bitcoin would not only be a “store of value” but also a productive asset with utility and application.

Let’s look at the announcement of the creation of a Bitcoin strategic reserve in the United States. One of the key points of this reserve is that it will follow budget-neutral strategies without selling the estimated 198,000 BTC held by the government. Those conditions are perfect for putting this Bitcoin into restaking and using it in DeFi to obtain rewards. Just picture all the gains the US could make by using most of its Bitcoin reserves in that way, without selling.

We need to explore Bitcoin’s potential in DeFi

Integrating dormant Bitcoin into DeFi platforms offers interesting Bitcoin and decentralized finance opportunities. Bitcoin would encourage transactions and fees on the network to support miners. The total value locked (TVL) in DeFi will be tremendous compared to all the liquidity Bitcoin will add to the DeFi market.

Advances like wrapped tokens and crosschain bridges have enabled Bitcoin holders to engage in flash loans, lending, staking, restaking and yield farming on DeFi platforms. The current levels are, however, insufficient and will not be the only way to take advantage of this enormous liquidity injection.

As of March 10, Bitcoin’s TVL in DeFi stood at over $5 billion, according to DefiLlama data. This represents only 6% of the TVL of all the current blockchains on the market, with Ethereum the king at 52.56% with $48 billion. If Bitcoin became the new king of TVL in DeFi, it would only need to use some of the dormant Bitcoin mentioned above.

In this scenario, Bitcoin will provide more stability to DeFi, as its holders, including institutional and long-term investors, are not prone to selling during market downturns. In addition, activating even a small fraction of currently idle Bitcoin could unlock billions of dollars of liquidity for decentralized finance applications.

The best way to use BTC in DeFi is restaking

Today, restaking is emerging as an innovative, engaging way to integrate Bitcoin into DeFi while maintaining its appeal as a conservative, secure investment vehicle. Restaking enables holders to stake their assets in decentralized protocols and earn passive income while contributing to the economic security of the network.

This mechanism offers several benefits, including passive income with minimal risk and economic security, by supporting the development of new products. It parallels traditional finance by offering predictable returns while preserving capital, which appeals more to conventional investors.

Restaking aligns with the conservative mindset typical among many Bitcoin holders, allowing them to participate in innovations within the DeFi space. Restaking is desirable for every Bitcoiner to obtain yield with their reserves.

Dormant Bitcoin is a massive opportunity for DeFi

Dormant Bitcoin is a vast, untapped reservoir within the Web3 ecosystem. By integrating Bitcoin into DeFi platforms today, individual investors and the broader ecosystem will significantly benefit from the increased stability, liquidity and growth opportunities.

Opinion by: Amitej Gajjala, co-founder and CEO of KernelDAO.

A big week for NFTs as CryptoPunks maintained their leadership in digital collectibles. During the past seven days, CryptoPunks sold for more than $1.2 million through ten specific sales, as reported by Phoenix Group. These outstanding statistics represent both the financial worth and cultural appeal of these NFTs while showing continued popularity despite Web3’s maturity phase.

The CryptoPunk #3873 became the top-selling NFT after it exchanged hands for 165 ETH, equivalent to a value of $260k. The Punk showcases timeless CryptoPunk character through its black sunglasses and slick appearance while proclaiming coolness and high social status. The one single transaction generated 20% of the entire week’s sales value while contributing to the series’ successful performance.

The other major sale of the week was CryptoPunk #5963 because it received 88 ETH, which equated to $142,140. This Punk CryptoPunk wore a blue bandana while displaying rugged characteristics to create a distinctive attraction toward collectors who value unique traits in their digital art.

The sale of CryptoPunk #1820 reached 72.7 ETH and amounted to a price of $119,270. Attractive elements characterize CryptoPunks #1820 due to its pixel-based artwork, which became renowned for minimalist designs. The CryptoPunk #1999 gained 65 ETH, which equaled $104,820 and increased in value from its western-inspired cowboy hat design.

The sale of CryptoPunk #7163 achieved 62.5 ETH worth $100,780. This punk punk featured a combination of a hat and pipe and received major appeal from purchasers because of its noir aesthetic trend.

CryptoPunks ranked below the top category continue to attract important price tags reaching six figures in USD value, as evidence shows they capture substantial market demand.

CryptoPunk #8619 sold for 62.4 ETH, or $98,770. The crypto community admired this pixel art piece for its unique presentation that set it apart. CryptoPunk #9610 was acquired for 55 ETH, which translates to a value of $87,310. Its relaxed style, together with the blue hat element, brought an up-to-date and friendly personality to the exclusive line of punks.

CryptoPunk #8832 achieved a successful sale at a price of 53.7 ETH, which translates to an amount of $86,580. Bright pink coloring in this CryptoPunk made it noticeable among other entries. CryptoPunk #5921 immediately followed with its 52 ETH purchase, which amounted to $84,050. This punk’s combination of its classic havoc haircut and rectangular frames brought in an elegant edge to its appearance.

CryptoPunk #2056 finished as the tenth-highest seller by exchanging for 53 ETH worth $83,630. The punk character revealed its cool demeanor through sunglasses and cigars as it successfully appealed to purchasing customers.

SoonChain, a popular AI-driven gaming L2 blockchain, has recently announced its latest partnership with Crypto Rumble, a well-known game operating entity working within the Zypher L3 network. The collaboration focuses on enhancing the AI-Driven Web3 gaming. The joint endeavor will leverage the strengths of both the entities to merge the AI with blockchain gaming.

SoonChain’s partnership with Crypto Rumble focuses on utilizing the artificial intelligence to boost blockchain-based gaming. Crypto Rumble presents a remarkable merger of RPG elements, card mechanism, as well as elimination-style competition. The platform has already onboarded more than 400,000 players along with logging up to 2M on-chain interactions.

Additionally, Rumble utilizes smart contracts apart from zero-knowledge proofs for the provision of a gasless and smooth consumer experience. In this respect, it eliminates usual blockchain-related barriers while maintaining transparency and decentralization. Hence, the collaboration intends to strengthen the integration of artificial intelligence within the Web3 gaming. It benefits from SoonChain’s L2 and L3 connectivity infrastructure for the improvement of automation, scalability, and gameplay.

According to SoonChain, the partnership pays significant attention to trustlessness and security of the transfers parallel to real-time responsiveness. The partnership goes beyond just a technical upgrade as it facilitates players with frictionless and smarter gaming. The strategic alliance includes the combination of the scalable infrastructure of SoonChain with the vigorous AI mechanics and gameplay of Crypto Rumble. In this way, both the entities are attempting to set unique standards for the decentralized entertainment’s future.

DeFi protocols have redefined the financial world by allowing operations of various services without the involvement of traditional intermediaries.

With the growth of the DeFi ecosystem, it has become essential to measure its achievement through metrics like TVL, which gauges the entire quantity of assets locked in each protocol that constitutes this virtual ecosystem. This metric shows reliable and popular protocols and their capability to attract and safeguard assets. Today’s data by DefiLlama highlighted the top 10 DeFi protocols, analyzing shifts within the DeFi market.

Ethereum has continued to maintain its status as a leader in the DeFi landscape. As per the latest data from DefiLlama, Ethereum currently holds a whopping $46.89 billion in TVL, dropping by 7.93% over the past month. This drop signals rising competition within the DeFi sector where alternative blockchains like Solana, Binance Smart Chain (BSC), and TRON are attracting more users with their more rapid processing times and lower transaction fees. The TVL share of SOL, BSC, and TRX rose by 6.51%, 3.25%, and 5.15%, respectively over the same period. However, ETH still controls a bigger DeFi market share, showcasing its continued significance as the key network for DApps.

With a TVL of $7.37 billion, SOL is the second largest and most popular project in the DeFi. Solana’s TVL has risen by 6.51% over the past month to its current $7.37 billion TVL. Some of the factors that have led to this surge is the tremendous growth of meme coin trading in the network. Solana’s rising DEX trading activities and expanded daily transactions are other catalysts for its network expansion.

Third on the list is BSC, which currently controls a $5.54 billion TVL, making it the third-most-popular DeFi protocol. Binance Smart Chain has gained robust momentum in recent weeks, registering an increase of 3.25% in TVL in the past month. This surge comes as DEX trading volume and speculative activity on the network continue to rise. The rise in trading activity shows increased adoption of BSC’s ecosystem, as more customers choose the blockchain for faster transaction speed and lower gas fees.

Tron took fourth place with a $4.91 billion TVL, an increase of 5.15% over the past month. This shows that the Tron ecosystem is seeing rapid growth. Its DeFi market expansion is propelled by the increasing demand for TRX, a native token powering the Tron blockchain, which is being utilized to pay for gas fees.

Furthermore, the surge of DEX volume to almost $129 million in the previous day alone highlights Tron network’s expansion. The protocol has also recorded an increase in daily active addresses by over 2.6 million, which comes at a time when USDT stablecoin trading activity has massively increased on the platform. Over recent years, Tron has emerged as the preferred network for stablecoins transactions, majorly USDT.

Bitcoin clinched the fifth spot with a $3.73 billion TVL. However, its DeFi is facing pressure, with its share of TVL dropping by 48.63% over the past month. This decrease in momentum reflects challenges in maintaining its market share.

Over the past seven days, Bitcoin was the third in the DeFi market in terms of TVL, following Solana and Ethereum. Currently, it has dropped to number 5.

The decline suggests that other faster blockchains like SOL, BSC, and TRX continue to attract users due to their affordable fees and rapid transaction speed, therefore drawing liquidity away from BTC and ETH. Despite the drop, Bitcoin restaking service continues booming in the DeFi, a major catalyst sustaining its TVL.

Other protocols that stand out due to their outstanding DeFi TVL include Base, Berachain, Arbitrum, Sui, and Avalanche. Base took the sixth position with a $2.84 billion TVL, a decrease of 7.52% over the past 30 days.

While Berachain settled on position seven with a $2.5 billion TVL, it was followed by Arbitrum, which had a $2.12 billion TVL. Sui and Avalanche occupied positions 9 and 10 with $1.22 billion and $1.21 billion TVL, respectively.

Although the data highlighted significant shifts in the DeFi world, market value as gauged by TVL shows extensive adoption and market confidence in these projects.

Let’s explore why the BNB price surge could be near as Kraken announces BNB listing on April 22. Binance Coin gains momentum with rising demand in blockchain gaming.

BNB has experienced an underwhelming day as the price has not seen a significant change today. At the time of the press, Binance Coin is trading at $592 and has recorded a 0.12% daily growth. As of today, the yearly BNB price surge has reached 5.70%. Such price stability can be viewed as positive; however, some investors see this token as a speculative investment. As such, they want substantial growth in value. Luckily, a rally in price could be close, as in Binance Coin news, we have an announcement for the BNB Kraken listing. Additionally, there is also a report about the BNB’s climb in blockchain gaming.

In an X post from the official X account of Kraken Exchange, we got an announcement related to Binance Coin. Based on this announcement, BNB will be listed on the Kraken exchange on April 22. Although Binance coin is the fourth-largest non-stablecoin cryptocurrency, it has not yet been offered on the Kraken exchange. The BNB Kraken listing can be beneficial to both parties as BNB gains enhanced accessibility and Kraken gains more transaction volume. Following this listing, we can also expect a BNB price surge on April 22. This is because Kraken is one of the biggest crypto exchanges in the industry, exposing a number of new investors to BNB.

📅 Save it: April 22 @1400 UTC!$BNB @BNBChain is being listed on Kraken

ℹ️ Deposits and withdrawals are enabled, markets are currently in post-only mode

Deposit here ⤵️https://t.co/Z1IdWAby3W

*Geographic restrictions apply pic.twitter.com/JHkdx03fbB— Kraken Exchange (@krakenfx) April 17, 2025

It was also mentioned that users can now deposit and withdraw Binance coins before the date of the actual listing. Kraken will be enabling users to access BNB pairs with major currencies, like USD, USDC, EUR, and USDT. However, access to some pairs will be limited for users in specific geographical locations. One of the catalysts behind this sudden listing could be the recent change in BNB regulatory conditions. In recent years, BNB has been cleared of some regulatory doubts and limitations, leading to increased confidence in this currency.

Another interesting Binance Coin news is a new report about the surge in blockchain gaming on the Binance blockchain. Recently, the number of Web3 games on this chain increased significantly, as market data shows 1,400 games played in March 2025 alone. When compared to its peak in December 2021, we see a nearly 40% increase in volume and transactions. In the past 30 days, BNB Chain has also recorded 9 million unique wallet interactions. However, the industry, in general, has seen a decrease in transactions and growth rate, with the biggest decline being in 2022 and 2023.

We also have another positive report about the Binance price, as it has shown great resilience. The report from CryptoQuant shows that in the recent market cycle, BNB price has been much more stable compared to other altcoins. The on-chain data shows that some altcoins have fallen nearly 90% from their peaks. However, Binance Coin and Bitcoin show the least decline among the top cryptocurrencies. This comes as BNB hit its new all-time high in the current market cycle. The report compared BNB with other top altcoins like ADA and MATIC, all showing sharper declines and higher volatility.

With a major listing coming and the dominance of Binance Coin on blockchain gaming increasing, the future seems bright. Additionally, when a BNB rally takes place, investors will have higher confidence in the BNB price surge to keep its gains. As a result of the recent piece resilience, the community can expect a lower chance of correction for BNB compared to other coins. Additionally, this token’s connection to the Binance exchange guarantees that demand will always remain high.

Amid the continuous evolution of the NFT world, several projects are getting notable attention across the community, specifically on the social media. As per the data from Phoenix Group, the top NFT coins in line with the social activity include $RENDER, $ICP, and $FET. Additionally, the top ten players in this respect also include $APE, $ME, $RARE, $XTZ, $STX, $AXS, and $PENGU.

As of April 18, $RENDER is the top non-fungible token in the case of social media activity. Over the past twenty-four hours, it has recorded 3.8K engaged posts and 462.5K interactions. Subsequently, $ICP is the 2nd in the list of top NFTs with 3.6K engaged posts as well as 242.1K interactions. Apart from that, $FET has secured the 3rd spot among the top NFT projects with 319.8K social interactions and 3.4K engaged posts.

Following that, the $APE has effectively witnessed 2.6K engaged posts along with 299.7K interactions on social media. Additionally, $ME currently stands in the 5th place among the leading NFTs on social media. Its interactions and engaged posts on social media have reached 1.0M and 2.4K respectively. Along with that, $RARE enjoys the 6th top position on social media with its engaged posts and interactions reaching 2.3K and 181.6K respectively.

Phoenix Group’s list of prominent non-fungible tokens in terms of social activity adds $XTZ in the 7th rank. It reportedly accounts for 2.3K engaged posts and 123.0K interactions. After that, $STX has gained the 8th position with 170.8K interactions and 2.2K engaged posts. The 9th top NFT in this respect is $AXS with 1.9K engaged posts as well as 74.4K interactions. Coming after that, $PENGU is the 10th top NFT based on social activity, securing 286.9K interactions and 1.7K engaged posts.