The main category of NFT News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of NFT News.

You can use the search box below to find what you need.

[wd_asp id=1]

Could December 5 finally be the day Treasure NFT Withdrawal fully resumes? This is the biggest question among users after the platform missed its earlier promise of reopening withdrawals on December 1, 2025. With the official confirmation of a BlackRock-linked strategic capital cooperation and the TreasureNFT funding round beginning, the community is now watching the next steps closely.

Treasure Fun, a Web3 revenue platform powered by NFT collections and AI-driven algorithmic trading, is entering a crucial phase. The platform’s dual earnings system—trading rewards and referral rewards—had attracted rapid global growth, but withdrawal delays raised concerns. Now the company claims it is ready for a major rebound.

The latest update on Treasure NFT confirms that the first funding round has officially begun, marking the platform’s biggest step toward restoring full operations.

Source: X

On December 1, 2025, TreasureNFT inked a cooperation agreement with the international strategic capital division under BlackRock. As officials inform, the first capital injection has already started, while these funds are going to be used to:

Stabilize operations on the platform

Protecting user assets

Process pending withdrawals

Support global ecosystem recovery

The team explained that the requested processing will be prioritized with early-login users, especially those who were affected by the login downtime.

To manage the huge volume of support requests, TreasureNFT introduced a Level-based reporting system. Only users unable to log in are required to submit their UID, Full name, and Level.

These details must be submitted only through Level 4 and above leaders. The platform has clearly stated that customer service will not reply to individual messages, a move aimed at streamlining verification. Users who can access their accounts are instructed to log in immediately and complete verification so their:

The platform had promised a return to normal operations on December 1, but the date passed without full withdrawal restoration. Now, officials say the new expected withdrawal date is December 5, aligning with the finalization of the first funding round and account-verification cleanup.

This raises the central question: Is Dec 5 the final date for Treasure NFT Withdrawal?

Based on current announcements, the funding round is underway, user data is being re-verified, and backend systems are being upgraded. These steps strongly indicate that Dec 5 is positioned as the realistic restoration date, though users remain cautious given past delays.

As the Treasure NFT Fun withdrawal time approaches the new December 5 target, the platform stands at a defining crossroads. The BlackRock-backed funding round, tightened verification process, and early-login prioritization suggest real progress—but users will judge success only when the process actually resume. For now, Dec 5 is the day the entire community is waiting for.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

In the ever-volatile world of cryptocurrency, GameFi is emerging as a beacon of resilience and excitement. Despite broader market pressures, the sector has surged from 15th to second place week-on-week on DeFiLlama’s narrative tracker. This climb signals growing investor interest in blockchain-based gaming, where play-to-earn mechanics meet decentralized finance (DeFi). But what’s driving this momentum? Enter

GameFi isn’t without its challenges. The sector’s total market cap experienced a modest 1% dip to around $9 billion, reflecting caution among traders. More starkly, trading volume cratered by 77% to just $1.3 billion. Where have all the GameFi degens gone? Many are hunkered down in the trenches, wary of the ongoing bearish sentiment.

Yet, glimmers of hope persist. CoinMarketCap’s Fear & Greed Index ticked up from 25 to 29 over the week, hinting at a subtle shift toward greed. This improvement comes as prediction markets continue to dominate headlines, but GameFi’s rapid ascent on narrative leaderboards suggests it’s nipping at their heels.

These metrics paint a picture of a sector under pressure but poised for rebound, much like a gamer respawning after a tough level.

The biggest catalyst this week? TRUMP, the high-profile meme-inspired token tied to political fervor, is making waves by diving headfirst into GameFi. Long known for its speculative rallies during election cycles, TRUMP is pivoting toward interactive Web3 experiences. Recent announcements reveal partnerships with leading GameFi platforms, including the launch of a Trump-themed play-to-earn game where players can stake tokens, battle in arenas, and earn real yields.

This isn’t just hype—TRUMP’s integration brings massive visibility. Imagine NFT collectibles of iconic moments, governance via in-game votes, and rewards tied to real-world events. Early adopters are buzzing about potential airdrops and exclusive alpha access, drawing in both crypto natives and mainstream gamers. As TRUMP allocates a portion of its treasury to GameFi development, it’s injecting fresh liquidity and credibility into the space.

“GameFi isn’t just games—it’s the future of ownership in entertainment. With TRUMP’s entry, we’re seeing politics, memes, and blockchain collide in epic fashion.”

This move aligns perfectly with GameFi’s core ethos: turning fun into financial opportunity. Expect TRUMP to catalyze user growth, with on-chain metrics already showing spikes in active wallets.

Web3 gaming optimism is building on multiple fronts. DeFiLlama’s tracker doesn’t lie—GameFi’s narrative score reflects surging social mentions, developer activity, and capital inflows. While prediction markets like Polymarket steal the spotlight for their real-world utility, GameFi offers something irreplaceable: immersive escapism with economic upside.

Key drivers include:

Contrast this with fading hype around other narratives. Projects like WOD (World of Dypians) are sliding amid a lack of new catalysts and sector-wide risk aversion. Without fresh updates or viral marketing, even established names struggle to hold ground.

While the macro picture is mixed, standouts are thriving:

| Project | Market Cap | Key Feature |

|---|---|---|

| AXS (Axie Infinity) | $1.2B | Play-to-earn pioneer |

| GALA | $800M | Ecosystem of games |

| TRUMP GameFi Initiative | Emerging | Meme-powered battles |

Prediction markets remain hot, but GameFi’s blend of entertainment and DeFi is proving more sticky. Watch for crossovers, like integrating oracle data for dynamic in-game economies.

Looking forward, GameFi news points to a brighter horizon. With TRUMP’s splashy entry, expect a wave of celebrity and meme coin integrations. Combine this with Ethereum’s Dencun upgrade reducing costs and Apple’s potential Web3 app store openness, and the stars are aligning.

For degens and builders alike, now’s the time to position. Stake in resilient protocols, farm yields in top games, and keep an eye on DeFiLlama for the next narrative shift. GameFi isn’t just surviving—it’s evolving into the next trillion-dollar frontier.

Ready to level up your crypto game? Dive into GameFi today and turn pixels into profits.

What is GameFi? GameFi merges gaming with DeFi, letting players earn crypto through gameplay.

Why is TRUMP entering GameFi? To leverage its community for viral growth and real utility in Web3 entertainment.

Is GameFi a good investment? High risk, high reward—DYOR and focus on projects with strong teams and roadmaps.

How to get started in Web3 gaming? Wallets like MetaMask, explore marketplaces like OpenSea, and play free-to-start titles.

Discuss this news on our Telegram Community. Subscribe to us on Google news and do follow us on Twitter @Blockmanity

Did you like the news you just read? Please leave a feedback to help us serve you better

Disclaimer: Blockmanity is a news portal and does not provide any financial advice. Blockmanity’s role is to inform the cryptocurrency and blockchain community about what’s going on in this space. Please do your own due diligence before making any investment. Blockmanity won’t be responsible for any loss of funds.

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Friday 12 December 2025, a new crypto game carrying the name of U.S. President Donald Trump has been making headlines, but the details show something pretty unusual for what is supposed to be a Web3 launch. Players can simply skip the crypto side completely, so it feels more like a Web2 style game dressed up in blockchain branding than an actual Web3 title.

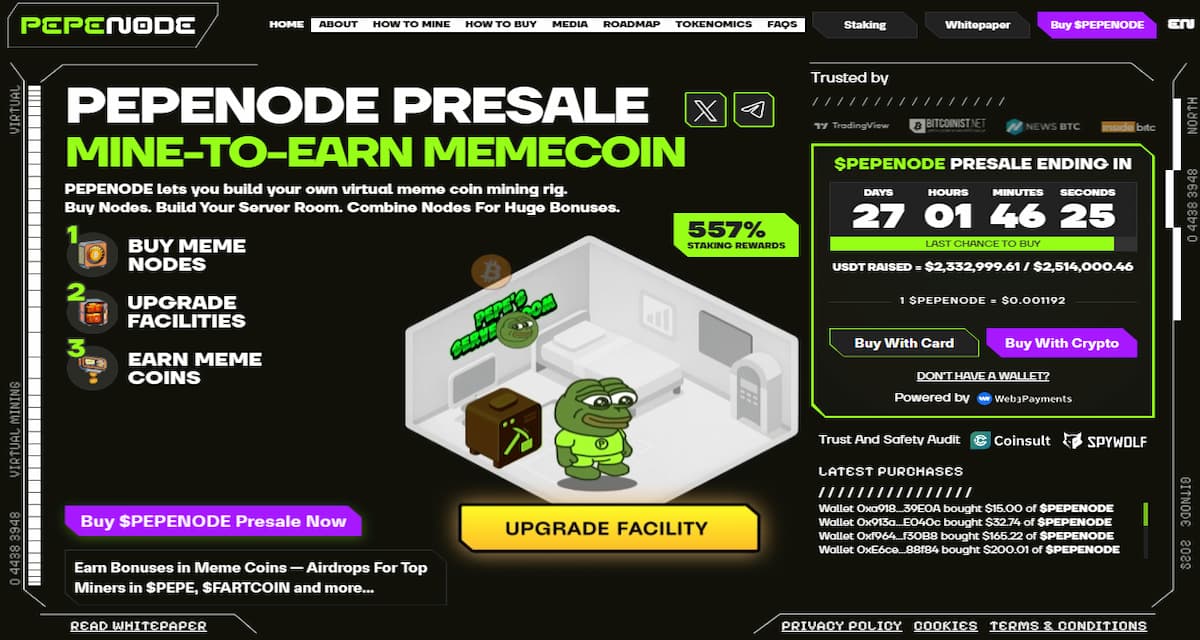

Pepenode (PEPENODE), on the other hand, goes in the opposite direction and is built as a fully Web3 native game where the blockchain rails hold up the whole system. Instead of recycling the same broken Play to Earn templates that came apart with Axie, StepN, and last year’s Telegram games, Pepenode is rolling out crypto’s first mine to earn meme coin setup that is designed with long term sustainability in mind.

While some projects are just tiptoeing around GameFi experiments, Pepenode is openly committing to the idea that if GameFi is going to move forward, then it should evolve in a serious and complete way.

For investors who want to back what might end up as the first actually sustainable crypto game economy, the presale is already live at $0.0011873 per PEPENODE.

Still, the time frame is tight, because Pepenode has recently confirmed that the presale will finish in 27 days. Once that date passes, the only way to get PEPENODE will be through exchanges, where the price might never revisit the low levels seen during presale.

A recent post from the TrumpMeme X account announced that pre registration has opened for an officially licensed Trump themed game. Named Trump Billionaires Club, the site shows Trump in an Apprentice style role, and the gameplay is described around rolling dice, picking up properties, getting involved in the stock market (strangely skipping the crypto market), and climbing up a flashy high roller style ladder.

Players are told they will get the chance to “Live the High Roller Lifestyle as you race to become the Ultimate TRUMP Billionaire!” but the real hook is the share of $1 million worth of Official Trump (TRUMP) tokens on offer.

The game plugs into Open Loot to handle digital collectibles, something crypto natives will instantly recognize as a pretty classic Web2.5 mechanic dressed in Web3 language. But if you look a bit closer at the website, it becomes clear that the whole game keeps running perfectly fine even if nobody touches the blockchain part at all.

In fact, Web3 participation is clearly marked as optional, and players are allowed to use regular non crypto payment options for transactions. So when the game proudly says “Your empire, on chain,” but everything works off chain anyway, it raises the question where this so called empire is actually supposed to live.

All of that underlines that the game, even if it turns out fun, is not really trying to fix any of the long running GameFi problems that pushed millions of newcomers into crypto through gaming, only for them to bail out again when token economies fell apart.

If blockchain gaming is really going to advance, those issues need proper answers, not just a new theme or famous face. And right now, the project that is seriously trying to tackle them is not a Monopoly style rebrand, but the mine to earn ecosystem being built around Pepenode.

Pepenode starts with a simple pitch, it is crypto mining turned into a virtual strategy game. But once you look past the surface, it is clear the project is quietly trying to strip out the broken foundations of old school GameFi.

The planned gameplay does not drop users into a dull loop of tapping, clicking, or running around the same track. Instead, it throws them into a silent, empty server room that more or less challenges them to build something that actually works.

Every action a player takes, like buying new nodes or upgrading parts of the facility, is paid for using PEPENODE, and every decision has real consequences. If you pair up the wrong nodes, your rig turns unstable and starts crawling, but if you find the right combinations, suddenly your setup is pushing out tokens like a well tuned farm, which makes the whole thing feel closer to engineering than casual playing, and that is very much the idea.

Unlike a title that leans on a Web3 label and a Trump inspired costume to feel relevant, Pepenode treats the word simulation literally. The team is already hinting at mechanics that mirror the problems real miners face every day, from heat spikes and power drain to system stability issues, basically the whole messy package, just without sending your home electricity bill through the roof.

And yes, players do earn PEPENODE from the setups they build, but the token’s job does not end there. The more PEPENODE is spent in game to fine tune a rig, the more chance there is to unlock higher tier rewards, including big meme coin assets like Pepe (PEPE) and Fartcoin (FARTCOIN).

The crucial part is that every upgrade also burns PEPENODE, with 70% of those tokens taken out of circulation for good. That means player progress does not blow up supply, it actually tightens it, so the busier the game becomes, the more scarce PEPENODE turns over time.

This mix of thoughtful base building, meaningful spending decisions, and rewards that crypto users actually want is why Pepenode is already being talked about as a serious contender for the first GameFi model that is really built with long term durability in mind.

Right now, while the presale is still open, early supporters can grab PEPENODE and directly support the ongoing development of the game. Tokens are available through the Pepenode presale site, where buyers can pay with ETH, BNB, USDT (ERC-20 or BEP-20), or even regular credit and debit cards.

Buyers are free to connect through pretty much any major wallet, including Best Wallet, which many users see as one of the top crypto and Bitcoin wallets available today. Pepenode is already listed inside Best Wallet’s Upcoming Tokens discovery feed, so users can buy, track, and later claim their tokens inside the app without extra hassle.

The project’s smart contract has also gone through a full Coinsult audit, giving early participants added confidence in the security and integrity of the underlying code.

Anyone who wants to stay in the loop can follow Pepenode on X and Telegram for fresh news and updates.

Hamster Kombat, widely recognized as one of the fastest-growing play-to-earn (P2E) gaming ecosystems in the Web3 landscape, continues to attract global attention with its distinctive blend of classic puzzle-solving and blockchain-enabled rewards. One of its most celebrated features, the Hamster Kombat Daily Cipher, has evolved into a cultural phenomenon within the Telegram-based gaming community. Every 24 hours, thousands of users log in to decode secret messages and earn in-game bonuses and $HMSTR tokens, the native asset powering the Hamster Kombat economy.

As the game expands across multiple regions, the Daily Cipher has become more than just a mini-game. It has transformed into a daily ritual for players who enjoy a hybrid experience combining Morse-code challenges, strategy-driven interaction, and on-chain token rewards. With Web3 gaming accelerating rapidly and Telegram mini-apps attracting millions of active users, Hamster Kombat’s approach stands out as a model for accessible, mobile-first crypto adoption.

This report provides an in-depth look into the Daily Cipher for December 13, 2025, how the system works, and why Hamster Kombat has become a central player in the gamified blockchain space.

The Hamster Kombat Daily Cipher is a recurring 24-hour puzzle challenge in which players decode Morse-code sequences composed of dots and dashes. The final decoded message typically forms a word or phrase, which players must enter into the app to claim their rewards. These rewards range from chip bonuses used for in-game upgrades to mining boosts that increase a user’s ability to earn $HMSTR tokens.

What makes the Daily Cipher unique is its ability to merge traditional problem-solving techniques with blockchain-native incentives. Morse code—a 19th-century form of communication—sits at the heart of a Web3 game hosted entirely on Telegram, creating a remarkably accessible experience for players of all backgrounds. This pairing of analog codebreaking and digital token rewards has allowed Hamster Kombat to stand out from other titles in the growing P2E market.

Also, read this article: Binance Word of the Day Answer 11 December 2025 to discover more exciting tasks and rewards for challenges!

Active players often describe the cipher as the “brain exercise” portion of Hamster Kombat, offering an alternative to the more action-oriented mini-games. By participating daily, users not only improve their puzzle-solving abilities but also steadily accumulate in-game resources.

Hamster Kombat differentiates itself from most Web3 games by operating exclusively through Telegram, one of the world’s most widely used messaging platforms. This design choice eliminates the need for separate mobile apps, wallet installations, or complex onboarding. With over 800 million monthly active users, Telegram offers an immediate global audience.

Through the Telegram mini-app environment, Hamster Kombat integrates:

This interwoven system allows players to earn, store, and spend their $HMSTR tokens without leaving Telegram. The platform’s smooth interface ensures beginners can participate within minutes, accelerating Hamster Kombat’s viral adoption throughout 2025.

Status:

Coming Soon – Stay Tuned for the Official Cipher Update

Once the verified Morse code sequence for the December 13 challenge becomes available, hokanews will publish the fully decoded answer to ensure players can claim rewards without delay.

For users new to Hamster Kombat or those looking to improve their efficiency, here is the complete breakdown of how to solve the Daily Cipher.

Open Telegram

This is where the entire Hamster Kombat experience takes place.

Find the Daily Cipher Icon

The Cipher icon appears within the Hamster Kombat interface. Players tap it to begin the challenge.

Activate Cipher Mode

Once tapped, the screen shifts—often turning red—to confirm activation.

This mode sets the stage for Morse-code interaction, preparing users to decode the incoming signals.

Decoding Morse code requires recognizing the difference between short and long taps:

Short Tap = Dot (·)

Long Tap = Dash (−)

Timing is crucial. Players must pay attention to pauses:

Players convert each code sequence into letters, and eventually a complete word or phrase emerges. While it may seem challenging at first, Morse-code decoding becomes intuitive with practice. Many players report significant improvement after just a few days of participation.

After decoding the full message:

Type the message into the input field

Submit the answer

Receive instant chips or bonuses

The reward is automatically credited to the user’s profile, where it can be used for:

The seamless reward distribution is one of the primary reasons for the game’s exponential growth.

For players aiming to maximize gains, several essential strategies have proven effective across the Hamster Kombat community.

Daily missions offer some of the highest passive returns in the game. Regular participation ensures consistent chip accumulation and steady mining growth.

Events typically include:

These events often produce far higher earnings than casual daily gameplay.

One of Hamster Kombat’s most competitive features, the Toxin Challenge allows players to earn up to 1 million coins per day. It remains one of the biggest single-event payouts in the entire platform.

Players are encouraged to:

This challenge can significantly accelerate account progression and mining capacity.

Hamster Kombat includes multiple side games and elite-tier missions that reward users with bonus chips and temporary boosts. These activities are designed to keep users engaged while offering meaningful rewards.

Mini-games often focus on:

Reflex skills

Strategy

Accuracy

Time challenges

Elite missions, meanwhile, offer higher difficulty but larger prizes.

Regular participation ensures a growing $HMSTR balance.

Hamster Kombat demonstrates a blueprint for how future Web3 experiences may be designed—accessible, mobile-native, and integrated into applications consumers already use daily. Instead of requiring players to download specialized crypto wallets or navigate complicated blockchain interfaces, Hamster Kombat simplifies the process into a familiar messaging environment.

The app’s growth throughout 2025 mirrors broader industry trends:

The rise of micro-mining experiences

The expansion of Telegram mini-games

The proliferation of token-reward systems

Increased interest in crypto-enabled mobile gaming

Hamster Kombat’s Daily Cipher represents the intersection of these trends, showing how simple game mechanics can attract millions when combined with real incentives.

As Hamster Kombat continues expanding globally, the Daily Cipher has grown into a signature feature that keeps users returning every day. It blends logic, timing, and curiosity with blockchain-powered benefits—creating an experience that is both educational and rewarding.

Cracking Morse code, claiming $HMSTR tokens, upgrading mining levels, and participating in community-driven events all contribute to an ecosystem that feels alive and constantly evolving. The Daily Cipher for December 13, 2025, will soon be updated, and players are encouraged to check hokanews for real-time solutions and future updates.

For many players, this daily ritual has become a pathway into the broader world of Web3 innovation. With its dynamic challenges and reward mechanisms, Hamster Kombat is positioned to remain a leading force in Telegram-based crypto gaming.

hokanews.com – Not Just Crypto News. It’s Crypto Culture.

Writer

@Erlin

Erlin is an experienced crypto writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides insights into the latest trends and innovations in the digital currency space.

Check out other news and articles on Google News

XRP price today: XRP is trading around $2.00 on Friday, December 12, 2025, down roughly 1.5% on the day in the latest aggregated feed, with an intraday range near $1.98–$2.05.

That dip is catching attention because it’s happening on a headline-heavy day for the Ripple ecosystem: U.S. regulators moved Ripple closer to a national trust bank, a new spot XRP ETF is hitting U.S. markets, and “wrapped XRP” is expanding XRP’s reach into DeFi on other major blockchains. The short version: today’s XRP weakness looks less like a single “bad XRP headline” and more like a mix of macro risk-off, profit-taking, soft on-chain/derivatives signals, and technical resistance near the $2 area—even as longer-term fundamentals get fresh catalysts.

XRP’s decline today is best explained as several pressures stacking at once rather than one decisive negative trigger:

A key backdrop is broader crypto market caution following what multiple analysts described as a hawkish rate cut and ongoing uncertainty about inflation and growth. FXStreet notes heightened volatility as investors digested the Fed decision and its implications for risk assets. [1]

Mainstream coverage echoed the same idea: a widely expected rate move can become a “sell the news” event in crypto if it was already priced in—or if investors don’t like the forward guidance. Fast Company specifically pointed to the idea that traders had fully priced in the cut and then sold anyway, adding broader macro concerns as contributors. [2]

Ripple-related regulatory progress is meaningful—but it’s not a same-day demand switch for the XRP token.

For example, the U.S. Office of the Comptroller of the Currency (OCC) granted preliminary conditional approval for Ripple’s national trust bank charter (and other major crypto firms) — a major legitimacy milestone, but still conditionaland not a full bank in the traditional sense. [3]

BeInCrypto made the point directly: the move strengthens infrastructure and institutional positioning, but may not create an immediate XRP price surge by itself. [4]

If a market is positioned aggressively long, big bullish headlines can trigger breakouts. But if positioning is cautious and activity is cooling, the same headlines can land with a shrug.

FXStreet reported slowing XRP Ledger activity (fewer active addresses compared with earlier November levels) and suppressed retail/derivatives demand, with XRP futures open interest stabilizing around $3.72B in its dataset. [5]

Separately, a Bitcoinist report citing Glassnode data said XRP’s total transaction fees (a proxy for activity) fell sharply from a February peak, describing an ~89% drop to levels not seen since 2020 in that metric’s moving average. [6]

And CryptoPotato highlighted a Santiment view that XRP looked “undervalued” on a 30‑day MVRV reading—often a contrarian setup—but it also described speculative activity as muted, reinforcing the idea of a market waiting for a stronger catalyst. [7]

Crypto markets are extremely sensitive to perceived “supply events,” especially when coins move toward exchange-linked wallets.

Coinpedia reported that 75M XRP (roughly $152M at the time of its report) was sent to a wallet tied to Binance after a broader internal shuffle involving hundreds of millions of XRP—activity flagged by Whale Alert. Whether or not it ultimately represents selling, traders often treat exchange-directed transfers as a near-term risk factor. [8]

From a purely market-structure standpoint, XRP is sitting at a psychologically important zone. FXStreet described XRP holding the $2.00 area while also noting overhead pressure from short-term moving averages and nearby resistance levels (with support markers not far below). [9]

In plain English: it doesn’t take much selling to push XRP down when it’s trapped under resistance—especially if the broader market is cautious.

Even with the dip, today’s news flow is substantial. Here are the major XRP/Ripple-linked developments dated Dec. 12, 2025:

Reuters reported that the OCC granted preliminary approval for several crypto firms—including Ripple—to establish or convert into national trust banks, enabling broader nationwide operations (but not traditional deposit-taking). [10]

Axios emphasized the same core point: these charters are a significant regulatory step, but they do not allow taking deposits, offering savings accounts, or providing FDIC insurance. [11]

The OCC’s own letter to Ripple (dated Dec. 12, 2025) confirms the approval is preliminary and conditional, with final authorization dependent on pre-opening requirements. [12]

Why this matters for XRP:

Multiple reports tied the trust-bank approvals to the post‑GENIUS Act environment. Congress.gov shows the GENIUS Act became Public Law in July 2025, establishing a U.S. framework for payment stablecoins. [13]

Circle’s statement on its own OCC conditional approval explicitly described the charter milestone as aligned with GENIUS Act compliance, illustrating how stablecoin issuers are positioning for that regulatory regime. [14]

Why this matters for XRP:

Ripple’s press release (Dec. 12, 2025) announced that AMINA Bank became the first European bank to use Ripple’s licensed end-to-end payments solution, targeting near real-time cross-border payments for AMINA’s clients and bridging fiat and stablecoin rails. [15]

Ripple also stated Ripple Payments has broad global coverage and has processed more than $95B in volume. [16]

Why this matters for XRP:

Hex Trust’s Dec. 12 release said it will issue and custody wrapped XRP (wXRP), a 1:1-backed representation of XRP designed for DeFi and cross-chain utility, launching with over $100M in stated total value locked (TVL) and supporting trading and liquidity pairing (including with RLUSD) across multiple chains. [17]

FinanceFeeds framed the rollout as a landmark cross-chain expansion for XRP’s liquidity and use cases beyond the XRP Ledger, using an institutional custody framework and LayerZero-based interoperability. [18]

Why this matters for XRP:

Crypto Briefing reported that 21Shares launched its XRP ETF (ticker TOXR) on Cboe BZX after the SEC declared the registration effective, and noted the fund tracks a regulated XRP benchmark with a 0.3% annual fee. [19]

The 21Shares factsheet lists TOXR with an inception date of Dec. 11, 2025, an expense ratio of 0.30%, and shows it as a digital asset ETF trading on Cboe BZX (with the stated pricing benchmark). [20]

Meanwhile, FXStreet reported XRP spot ETF inflows around $16M on Thursday, with cumulative inflows near $971Mand net assets around $930M in its cited dataset—suggesting ETF demand has not disappeared even as spot price softens. [21]

Why this matters for XRP:

Here are the most widely referenced “next checkpoints” from today’s market analysis coverage:

FXStreet’s technical commentary repeatedly centers the market around the $2.00 area, with nearby downside levels flagged just beneath and overhead resistance zones that must be reclaimed for momentum to flip. [22]

A reasonable way to frame the setup for readers:

Beyond headlines, analysts are watching:

The trust bank story is big, but it’s also procedural. The OCC letter makes clear Ripple’s approval is preliminary, and final authorization depends on meeting conditions. [26]

That means future “catalyst moments” could include:

XRP’s dip near $2 on Dec. 12, 2025 is happening despite a cluster of ecosystem-positive developments—OCC conditional trust-bank progress, new ETF access, a European banking integration, and DeFi expansion via wrapped XRP. [27]

The more consistent explanation is that short-term market structure and sentiment (macro uncertainty, cautious derivatives positioning, on-chain softness, and technical resistance) are overpowering the immediate price impact of longer-horizon headlines. [28]

As always in crypto: big infrastructure headlines can be the beginning of a narrative, not the moment the chart turns green.

Disclosure: This article is for informational purposes only and is not financial advice.

1. www.fxstreet.com, 2. www.fastcompany.com, 3. www.reuters.com, 4. beincrypto.com, 5. www.fxstreet.com, 6. bitcoinist.com, 7. cryptopotato.com, 8. coinpedia.org, 9. www.fxstreet.com, 10. www.reuters.com, 11. www.axios.com, 12. www.occ.gov, 13. www.congress.gov, 14. www.circle.com, 15. ripple.com, 16. ripple.com, 17. www.hextrust.com, 18. financefeeds.com, 19. cryptobriefing.com, 20. cdn.21shares.com, 21. www.fxstreet.com, 22. www.fxstreet.com, 23. www.fxstreet.com, 24. www.fxstreet.com, 25. www.fxstreet.com, 26. www.occ.gov, 27. www.reuters.com, 28. www.fxstreet.com

Disclaimer: This summary was created using Artificial Intelligence (AI)

Web3 gaming is transforming the gaming industry by allowing players to truly own their digital items. Instead of game companies holding full control over assets, currencies and progress, players can trade, sell or transfer them freely. This shift represents one of the most significant changes in how value and power are distributed in gaming.

Web3 and blockchain technologies have ushered in a new era where the relationship between developers and players is becoming more balanced. Projects, marketplaces, and even platforms like Longfu demonstrate how digital ownership and decentralization can transform the way players interact with online systems. Instead of being trapped in closed ecosystems, players can verify ownership of digital items and interact with them across multiple platforms and marketplaces. For many gamers, this creates financial value and emotional investment, as in-game items are no longer disposable or solely controlled by the publisher. The concept of ownership that transcends the boundaries of a single game is shaping a new culture around gaming and the digital economy.

In traditional games, players spend money to purchase skins, characters, items, and upgrades, but they don’t actually own them. All of these assets are under the license of a specific game. If the game is shut down or a player is banned, everything they purchased is lost.

No product data found.

Web3 addresses this issue by using blockchain and NFTs to prove ownership. Each in-game asset has a unique identifier recorded in a public ledger. This allows players to purchase, trade, or hold assets independently of the game. This change provides immutability and transparency to assets.

For example, players who purchase limited-edition weapon skins in Web3 games can resell them on the open market. This creates scarcity and value similar to physical collectibles, rather than simply temporary digital bonuses. The concept of digital ownership also encourages long-term engagement because players know their investment has value beyond mere entertainment.

Another major change introduced by Web3 games is tokenomics. Instead of using virtual currencies that have no value outside the game, Web3 games often include tokens that operate on decentralized markets. Players can earn these tokens through gameplay, achievements, or staking models.

This earning mechanism gives players a stake in the success of the game’s ecosystem. Early supporters, active players, and community contributors are rewarded financially. This model encourages loyalty and engagement in a way that differs from traditional battle pass systems or premium currencies.

Tokenomics can also help fund development. Games can be partially supported through token sales or community investment, rather than relying solely on publishers or advertising. This creates a shared interest structure where the community is encouraged to support the game, improve it, and help it grow through word-of-mouth recommendations and participation.

One of the biggest promises in Web3 gaming is interoperability. This means items or characters may one day be able to move between different games, platforms, or metaverses. While this vision is still in its infancy, many companies and developers are actively building frameworks to support it.

Interoperability gives digital assets a life beyond a single game. A sword purchased in one fantasy game could become a decorative item in a social metaverse or a badge in another. This flexibility moves the industry closer to a digital universe where items have meaning because of the players, not just the game itself.

Developers benefit from being part of a shared ecosystem where assets have value across multiple experiences. Players benefit because purchases become multi-faceted investments rather than locked-in expenses.

Web3 gaming is still in its infancy, but the ideas behind true ownership and an open digital economy are changing the way players and developers perceive the value of gaming.

As Web3 gaming continues to evolve, TON Station has emerged as one of the most active and engaging platforms built directly inside Telegram. For millions of daily players seeking instant rewards, faster progression, and accessible gameplay, the TON Station Daily Combo remains one of the most efficient ways to earn points with minimal effort. If you are looking for the verified TON Station Daily Combo for December 12, 2025, this in-depth guide provides everything you need to know, from today’s promo code update to strategy tips that can help you climb the leaderboard more quickly.

TON Station is a Telegram-based play-to-earn game powered by The Open Network (TON), designed to reward users for completing tasks, quests, and interactive activities. It enables players to accumulate in-game points that can eventually be exchanged for real $TONS tokens, making it one of the more practical reward-driven experiences in today’s Web3 market.

The Daily Combo is an important part of this system. It allows players to enter a four-card combination once every 24 hours. If the combination is correct, players instantly receive a reward, often significantly larger than rewards from regular in-game tasks. For beginners, the Daily Combo is especially appealing because it minimizes the guesswork. Most players simply check trusted TON Station communities, such as official Telegram groups and media partners like hokanews, to obtain the verified combination before entering it into the game.

Though simple in concept, the Daily Combo has become one of the most anticipated features, attracting both casual and competitive players who rely on these daily rewards to accelerate progress.

At the time of writing, the official TON Station Daily Combo code for December 12, 2025, has not yet been released.

Today’s Promo Code: Coming Soon

Promo codes typically drop at unpredictable hours through official TON Station social channels, Discord servers, and Telegram groups. Players often monitor these channels closely since promo codes usually remain valid only for one-day cycles. When the correct combination becomes available, it is typically confirmed and reposted through community-led platforms like hokanews.

The speed at which players enter the code often determines whether they receive their bonus before the daily reset at midnight.

Although the Daily Combo for December 12 is still pending release, players are encouraged to stay alert and check periodically. There are multiple reasons why completing the Daily Combo today can provide significant advantages.

TON Station is recognized for its generous daily reward system. The Daily Combo requires almost no time to complete and offers comparatively higher returns than other in-app tasks. A correct entry grants an immediate boost in points, helping players advance through the game with less manual effort.

For extra rewards, check out TON Station Daily Combo Today 08 December 2025 Ari and explore more thrilling tasks!

Progression within TON Station is tied to activity level and points earned. The Daily Combo allows players to jump ahead quickly, especially when combined with other in-game missions. As users accumulate more points, they unlock additional rewards, features, and sometimes priority access to new game updates or token conversions.

TON Station does not operate in isolation. Many users simultaneously participate in other similar Telegram-based games such as Metropolis World, Kokodi Game, Pixelverse, or Notcoin. These games often share a common audience and encourage cross-platform engagement. By completing the Daily Combo alongside these additional quests, users can maximize their daily earning potential across all platforms.

For players committed to staying active across multiple ecosystems, the Daily Combo is an essential part of an efficient daily gaming routine.

Because the Daily Combo does not require complex gameplay, new users can participate from day one without needing prior experience. It provides an easy pathway for individuals who want to gradually explore the Web3 environment.

While the promo code for December 12 is still “Coming Soon,” it will eventually be published on official TON Station channels throughout the day. Users should be aware of the following sources:

Official TON Station Telegram Channel

The developers often release the combination directly through Telegram.

TON Station Discord Servers

Many new updates, including promo codes and event announcements, appear first in Discord communities.

Web3 News Outlets and Partner Sites

Trusted media platforms such as hokanews frequently verify and publish the Daily Combo once confirmed.

TON Station Social Media Accounts

X (formerly Twitter), Instagram, and community-driven Facebook groups regularly share updates.

Promo codes expire at midnight each day, so players must act quickly to claim rewards before the 24-hour cycle resets.

Redeeming the Daily Combo is a straightforward process. Even players who are new to TON Station can complete the steps in under a minute.

Search for the TON Station bot inside Telegram or use the official link provided on the platform’s website. Once the bot loads, you will see the main game interface.

Inside the bot interface, look for the Daily Combo menu item. The layout may vary slightly depending on updates, but it is typically located within the main navigation dashboard.

Once the correct daily combination is available, enter the four-card sequence exactly as provided by trusted sources. Accuracy matters, as incorrect combinations will fail to trigger the reward.

After entering the combination, submit it and wait for system confirmation. If correct, the bonus points will immediately be added to your account balance.

These points can then be saved, spent, or combined with other daily missions to maximize your daily credit total.

To understand why players consistently return to TON Station, it is important to consider how daily participation benefits long-term progress. TON Station’s design strongly encourages user consistency, offering various advantages to players who log in each day.

Many rewards in the game increase in value the longer a player maintains a daily streak. Missing even one day can reset progress, making consistency a key factor for maximizing rewards.

As players accumulate more points, they move closer to obtaining convertible $TONS tokens. These tokens can have real monetary value depending on market conditions.

The Daily Combo serves as a central anchor for daily gameplay. Since it requires only a few seconds to complete, many players begin their day with the Daily Combo and proceed to additional tasks afterward.

Daily engagement means users stay informed about new events, limited-time bonuses, and special promotions that may offer exclusive prizes.

For users who want to extract maximum value from TON Station, there are several strategies commonly used by experienced players:

Promo codes are sometimes released early in the day. Entering them as soon as they are available helps avoid missing the midnight reset.

Following several TON Station communities ensures you receive the correct code quickly, reducing the risk of misinformation.

Engaging in other TON ecosystem games increases your overall token earnings.

Streak bonuses provide exponential value and can multiply daily rewards significantly.

The TON Station Daily Combo remains one of the most valuable tools for earning fast, effortless rewards within the TON Web3 gaming ecosystem. Whether you are a long-time player or a newcomer exploring Telegram-based Web3 games, the Daily Combo offers a simple yet powerful opportunity to boost your progress every day.

Although the December 12, 2025 Daily Combo code is still pending release, staying connected to official TON Station channels and media platforms like hokanews will ensure you receive the verified combination the moment it becomes available.

Until then, continuing to engage with TON Station’s daily quests, streak missions, and bonus tasks is the best way to remain competitive and accelerate your journey toward earning real $TONS tokens.

hokanews.com – Not Just Crypto News. It’s Crypto Culture.

Writer

@Erlin

Erlin is an experienced crypto writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides insights into the latest trends and innovations in the digital currency space.

Check out other news and articles on Google News

The blockchain gaming sector is shifting to more sustainable economics and has improved sentiment and market maturity as it recalibrates its outlook, reported the Blockchain Game Alliance (BGA).

The Web3 gaming advocacy group said in its annual state of the industry report released on Wednesday that the sector is “moving beyond its speculative origins toward a more operationally disciplined, product-led future.”

In a survey of over 500 global blockchain gaming professionals, the level of optimism rebounded to 65.8% from its 2024 lows, with the focus shifting from token economics to sustainable revenue models.

“The clearest indicator of the industry’s broader transition lies in its reorientation toward sustainable economics.”

Growth is now anchored in delivering high-quality games, resilient revenue models, and payment infrastructure to support real-world commerce at scale, the report noted.

A tough period for Web3 gaming

Blockchain and Web3 gaming have shifted from peak euphoria in 2021, driven by a play-to-earn explosion and speculative capital, to a low point in 2024, following the collapse of P2E models, a decline in confidence, and a drying up of funding, with studios closing and reputations being damaged.

Related: Investors target ‘fun-first’ crypto games as funding jumps 94% in July

Annual funding dropped dramatically to $293 million in 2025, down from $4 billion in 2021, forcing teams toward leaner, bootstrap-focused operations. Top-tier venture firms paused all new Web3 gaming investments, and project token prices collapsed more than 90% from cycle peaks.

Between 80% and 93% of Web3 games failed, with average lifespans of only months and studios that raised millions couldn’t sustain operations without continuous capital injections.

On the path to recovery

Several developments were cited as contributing factors to the recovery of the beleaguered sector, including regulatory shifts and the growing popularity of stablecoins.

Animoca Brands co-founder Yat Siu said recent crypto-friendly shifts in US regulations mean that companies no longer need to rely on setting up nonprofit foundations when planning token launches.

The BGA said that stablecoins were transformative for Web3 games, they gave gamers “fast, low-cost, borderless transactions without the volatility associated with other crypto assets.”

Additionally, nearly 30% of survey respondents cited high-quality game launches as the most important factor for industry growth.

Immutable’s vice president of global sales, Andrew Sorokovsky, said that “despite the negative headlines, blockchain gaming is now one of crypto’s most proven sectors — where quality projects are thriving and real adoption is taking hold.”

Magazine: XRP’s ‘now or never’ moment, Kalshi taps Solana: Hodler’s Digest

As Web3 gaming continues to accelerate, Hamster Kombat remains one of the most talked-about play-to-earn titles in the industry. The game’s Daily Combo feature, introduced as a strategic reward mechanic, has turned into a daily ritual for millions of players across the globe. Whether you are a newcomer exploring the basics or a long-time player hunting for higher earnings, today’s Daily Combo for 11 December 2025 brings another opportunity to secure substantial in-game rewards, including the highly sought-after 5 million coin bonus.

With its growing ecosystem, seamless Telegram integration, and consistent reward updates, Hamster Kombat has positioned itself as a leader in mobile-first Web3 gaming. Today’s coverage will walk you through everything you need to know about the Daily Combo, how to complete it efficiently, and why this feature has become one of the most popular reward systems in the game.

The Daily Combo is a structured reward event designed to encourage players to interact with specific in-game assets, strengthen their card collection, and explore new mechanics. Unlike the traditional coin-mining flow, the Daily Combo requires players to complete or upgrade a set of three designated cards to unlock a fixed reward of 5 million coins. These cards may come from various categories such as Markets, PR and Team, Legal, or Specials.

The concept is simple but impactful: every day, a unique combination is released, promoting both engagement and progression. This ensures that the community remains active while continuously advancing through the game’s leveling and skill-building systems.

The Daily Combo banner appears at the top of the “Mine” interface, making it easy for players to locate and participate. Once the necessary cards are upgraded or purchased, players simply need to click the “Complete Combo” button to receive their reward instantly.

This feature also aligns with Hamster Kombat’s broader mission of blending gamification with blockchain-based incentives. By tying rewards to upgraded assets rather than random tasks, the system reinforces a sense of strategy and long-term progression.

Today’s Daily Combo challenges players to acquire or level up a specific set of cards. While the exact cards may vary per user and time zone, the mechanics remain consistent across the global player base.

The available Daily Combo can be accessed through the Mine menu. Players should check the promotion carefully, as December’s Daily Combo events change frequently. Participating promptly is crucial since each combination is only available for a 24-hour period.

This daily activity is part of the marketing section of the game, and completing it provides not only the 5 million coin reward but also contributes to account progression, helping players unlock more powerful features and new areas of gameplay.

Despite the high rewards offered, the Daily Combo remains easy to complete. Here is a detailed breakdown of the process for players at all levels:

Hamster Kombat runs entirely through Telegram, making it one of the most accessible blockchain games available. You do not need separate applications, EVM wallets, or complex onboarding procedures.

After launching the bot, open the main game interface.

Once the interface loads, tap the “Mine” button. This section displays your mining tools, upgrades, and the Daily Combo prompt.

At the top of the screen, you will see the Daily Combo banner, which highlights the three target cards for the day.

Cards are typically categorized in one of the following sections:

Markets

PR and Team

Legal

Specials

Players must either buy the designated cards or upgrade their existing versions to meet the required level.

This step may require some planning, especially for newer players who are still building up their basic coin reserves.

After the required upgrades are completed, simply tap the “Complete Combo” button. The system will confirm your action and immediately credit your account with 5 million coins.

This reward is consistent for all players and remains one of the most valuable daily bonuses available in the game.

The Daily Combo is far more than a routine bonus. It represents a carefully crafted incentive system designed to promote healthy gameplay patterns, retain users, and accelerate economic progression within the game.

The most active Hamster Kombat users often engage with the Daily Combo system as part of their daily habit. Completing it each day generates a steady stream of coins that can be used for:

Players who remain consistent benefit significantly more than those who log in sporadically.

Each required card upgrade strengthens a player’s overall mining capability and efficiency. Over time, these improvements compound, enabling users to generate more coins even when they are not actively playing.

With the Daily Combo awarding 5 million coins, new players can catch up with long-time users much faster than before. This inclusive pacing is one reason Hamster Kombat continues to attract widespread adoption.

Hamster Kombat consistently updates events such as:

Daily Cipher

Mini-games

Toxin Challenges

Elite Missions

Community Events

The Daily Combo acts as a central pillar of these activities, providing baseline rewards that help players participate more competitively in other parts of the ecosystem.

To optimize your $HMSTR coin balance, it is important to combine the Daily Combo with other earning methods. Players who diversify their efforts typically earn significantly more each day.

Daily tasks offer some of the highest coin payouts in the game. Completing each task regularly builds a strong base of earnings.

This competitive mode provides one of the largest rewards available: up to 1 million coins daily for tournament winners.

Mini-games offer quick, enjoyable ways to collect additional tokens. While their rewards are smaller compared to major challenges, they help boost your balance steadily.

Elite Missions represent advanced tasks designed for experienced players. These missions often offer exclusive rewards that can significantly speed up progression.

Hamster Kombat rewards consistent activity. Logging in daily ensures access to all bonus features, event notifications, and special promotions.

Hamster Kombat’s success is attributed to its simplicity, instant accessibility, and reliable reward mechanics. By integrating blockchain-based rewards into a Telegram interface, the game removes barriers that traditionally limit Web3 adoption. Players of all backgrounds can participate without requiring prior crypto knowledge.

The Daily Combo feature is an example of how Hamster Kombat continues to innovate. By offering large but achievable rewards, the game encourages sustained engagement while allowing users to enjoy meaningful progress regardless of their experience level.

As the ecosystem expands, many analysts expect Hamster Kombat to introduce additional layers of gameplay, new token utilities, and more structured events. For now, the Daily Combo remains one of the most reliable and rewarding features available to users.

The Hamster Kombat Daily Combo for 11 December 2025 offers yet another opportunity for players to earn a substantial 5 million coins with just a few simple steps. By completing the required card upgrades, participating in daily events, and maintaining consistent engagement, players can significantly enhance their progression within the game’s fast-growing ecosystem.

For both beginners and long-term players, the Daily Combo remains a crucial part of the Hamster Kombat experience. With its seamless integration, high payout, and role in strengthening player development, this feature continues to be a pillar of the game’s daily reward system.

Whether you are playing casually or pursuing top-tier rankings, taking advantage of the Daily Combo is essential to maximizing your potential earnings and maintaining a competitive edge in the world of Hamster Kombat.

hokanews.com – Not Just Crypto News. It’s Crypto Culture.

Writer

@Erlin

Erlin is an experienced crypto writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides insights into the latest trends and innovations in the digital currency space.

Check out other news and articles on Google News

DeFi Technologies Inc./ Key word(s): Miscellaneous

TenX Protocols, a DeFi Technologies Advisory Client and Venture Investment, Debuts on TSX Venture Exchange as “TNX” Following Successful $30 Million Financing

10.12.2025 / 22:25 CET/CEST

The issuer is solely responsible for the content of this announcement.

TORONTO, Dec. 10, 2025 /PRNewswire/ — DeFi Technologies Inc. (the “Company” or “DeFi Technologies“) (Nasdaq: DEFT) (CBOE CA: DEFI) (GR: R9B), a financial technology company bridging the gap between traditional capital markets and decentralized finance (“DeFi”), is pleased to announce that TenX Protocols Inc. (“TenX“), one of DeFi Technologies’ advisory clients and venture portfolio companies, began trading on the TSX Venture Exchange (“TSX-V“) under the ticker symbol TNX today, December 10, 2025. The listing follows the successful completion of a subscription receipt financing that formed part of TenX’s go-public transaction and brings total capital raised in 2025 to more than C$33 million.

The financings included participation from leading digital asset investors and institutions, including Borderless Capital, HIVE Blockchain Technologies, Chorus One, and DeFi Technologies.

Stillman Digital, DeFi Technologies’ wholly owned trading subsidiary, will work with TenX to provide institutional trade execution services and market intelligence that support efficient treasury deployment across multiple blockchain networks.

“TenX is led by a proven team and is emerging as a leader in blockchain infrastructure. Their TSXV listing is a significant step in their growth,” said Andrew Forson, President of DeFi Technologies. “The partnership fits naturally with DeFi’s Advisory platform, Stillman Digital’s trading infrastructure, and Reflexivity Research’s market insights as TenX expands its treasury and staking services across high performance networks.”

TenX is focused on generating recurring revenue across high-performance Layer 1 networks including Solana, Sui, and Sei. The company operates institutional-grade staking infrastructure, validator services, and digital asset treasury strategies that give public investors direct exposure to the growth of emerging Web3 ecosystems. The listing expands TenX’s access to capital markets and supports its strategy to scale participation across multiple blockchain environments.

TenX is led by industry veterans Mat and Filip Cybula, who previously founded and exited Cryptiv, and by CTO Geoff Byers, a long-time blockchain engineer and former CTO of Tetra Trust. Their experience in custody, infrastructure, and secure systems positions TenX as a strong entrant in the digital asset treasury and staking sector

About DeFi Technologies

DeFi Technologies Inc. (Nasdaq: DEFT) (CBOE CA: DEFI) (GR: R9B) is a financial technology company bridging the gap between traditional capital markets and decentralized finance (“DeFi”). As the first Nasdaq-listed digital asset manager of its kind, DeFi Technologies offers equity investors diversified exposure to the broader decentralized economy through its integrated and scalable business model. This includes Valour, which offers access to one hundred of the world’s most innovative digital assets via regulated ETPs; Stillman Digital, a digital asset prime brokerage focused on institutional-grade execution and custody; Reflexivity Research, which provides leading research into the digital asset space; Neuronomics, which develops quantitative trading strategies and infrastructure; and DeFi Alpha, the Company’s internal arbitrage and trading business line. With deep expertise across capital markets and emerging technologies, DeFi Technologies is building the institutional gateway to the future of finance. Follow DeFi Technologies on LinkedIn and X/Twitter, and for more details, visit https://defi.tech/

DeFi Technologies Subsidiaries

About ValourValour Inc. and Valour Digital Securities Limited (together, “Valour“) issues exchange traded products (“ETPs”) that enable retail and institutional investors to access digital assets in a simple and secure way via their traditional bank account. Valour is part of the asset management business line of DeFi Technologies. For more information about Valour, to subscribe, or to receive updates, visit https://valour.com.

About Stillman DigitalStillman Digital is a leading digital asset liquidity provider that offers limitless liquidity solutions for businesses, focusing on industry-leading trade execution, settlement, and technology. For more information, please visit https://www.stillmandigital.com

About Reflexivity ResearchReflexivity Research LLC is a leading research firm specializing in the creation of high-quality, in-depth research reports for the bitcoin and digital asset industry, empowering investors with valuable insights. For more information please visit https://www.reflexivityresearch.com/

Cautionary note regarding forward-looking information: This press release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information includes, but is not limited to the listing of common shares of TenX; the partnership between TenX and Stillman Digital, DeFi Advisory and Reflexivity Research; the regulatory environment with respect to the growth and adoption of decentralized finance; the pursuit by the Company and its subsidiaries of business opportunities; and the merits or potential returns of any such opportunities. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information. Such risks, uncertainties and other factors include, but is not limited the acceptance of Valour exchange traded products by exchanges; growth and development of decentralised finance and digital asset sector; rules and regulations with respect to decentralised finance and digital assets; fluctuation in digital asset prices; general business, economic, competitive, political and social uncertainties. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

THE CBOE CANADA EXCHANGE DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

For further information, please contact: Press, KCSA Strategic Communications, defi@kcsa.com; Johan Wattenstrom, Chief Executive Officer, ir@defi.tech, (323) 537-7681

Logo – https://mma.prnewswire.com/media/2843007/DeFi_Technologies_Inc__TenX_Protocols__a_DeFi_Technologies_Advis.jpg

View original content:https://www.prnewswire.com/de/pressemitteilungen/tenx-protocols-a-defi-technologies-advisory-client-and-venture-investment-debuts-on-tsx-venture-exchange-as-tnx-following-successful-30-million-financing-302638500.html

10.12.2025 CET/CEST Dissemination of a Corporate News, transmitted by EQS News – a service of EQS Group.

The issuer is solely responsible for the content of this announcement.

The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases.

2243646 10.12.2025 CET/CEST

Saving the news in databases or any forwarding of the news to third parties in a commercial context or for commercial purposes is only permitted with the prior written consent of EQS Group AG.