Category: Crypto News, News

Solana Price Prediction: After Breaking Key Support, Is $140 the Final Stop Before a Reversal?

Solana faces growing technical pressure after losing key support levels, with participants closely watching for signs of a deeper correction or a breakout setup.

After holding strong for months, Solana just got edged out by SUI in one of its most important metrics: stablecoin transfer volume. It’s a rare stumble for the high-speed chain, and it comes as SOL struggles to stay above critical technical levels.

Solana Loses Ground as SUI Tops Stablecoin Transfer Charts

Solana just faced a rare slip in dominance, getting overtaken by SUI in monthly stablecoin transfer volume for the first time. July’s data from Artemis shared by Torero_Romero shows SUI hitting $224.3B in transfers, slightly ahead of Solana’s $210.7B. While this doesn’t erase Solana’s broader ecosystem strengths, it signals that other chains are starting to chip away at its transactional lead.

Solana slips behind in stablecoin transfer volume for the first time, signaling a shift in on-chain momentum. Source: Torero_Romero via X

The bigger concern is momentum. Solana had comfortably led this metric for months, and getting outpaced, especially by a newer chain, raises slight caution. If Solana doesn’t reassert itself in the coming months, this could lead to weaker price action.

Solana Price Eyes Untapped Support Zones

While Solana wrestles with on-chain competition, its chart paints an equally cautious picture. As shared by Hardy, the price has broken below the recent consolidation band and is now eyeing the $151 and $148 zones, areas marked by untapped weekly and daily levels. These zones have yet to be tested and may serve as strong reaction points if sellers push lower in the short term.

Solana breaks below consolidation range, with eyes now on untested support at $151 and $148 as potential bounce zones. Source: Hardy via X

Structurally, the market remains in a corrective phase after peaking near $206, and the failure to hold mid-range demand suggests that buyers aren’t ready to step in with conviction just yet.

Solana Price Prediction Signals Another Leg Down

Solana’s corrective trend shows no signs of easing just yet. Analyst Karman_1s charts a projected path where price may first attempt a recovery toward the $170 zone, an area that aligns with descending resistance. However, as highlighted on the chart, this bounce is likely to face rejection, setting the stage for a deeper move into the $150 to $145 support region.

Solana faces rejection near $170 resistance, with downside targets now focused on the $150–$145 region. Source: Karman_1s via X

The clean rejection from both trendline resistance and the prior breakout level adds weight to the bearish continuation thesis. This outlook builds on the broader market weakness as a risk-off situation emerges again.

Contrary View: Solana’s Cup and Handle Pattern Hints at Long-Term Breakout

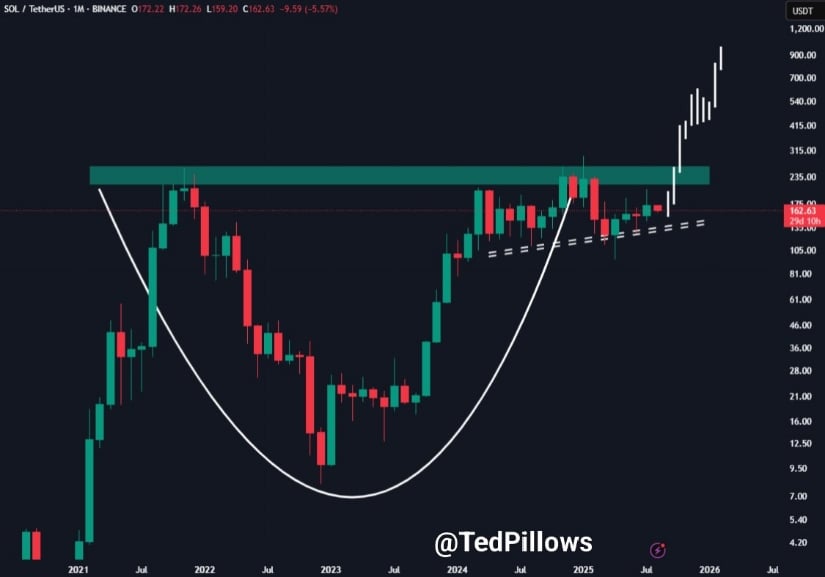

While recent technicals and on-chain shifts have painted a cautious tone for Solana, analyst TedPillows offers a broader perspective. His chart shows a potential cup and handle pattern forming on the higher timeframe, with a projected neckline breakout that could send Solana price beyond its all-time highs. This setup suggests that even if the price dips toward the $140 to $150 zone, the broader structure remains firmly bullish.

Solana forms a potential cup and handle pattern, hinting at a long-term breakout beyond previous all-time highs. Source: TedPillows via X

The chart stands out for its long consolidation curve, reinforcing the idea that Solana’s current correction may just be the “handle” before a major move. Network activity remains strong, and if support holds, the next breakout could be structural.

Final Thoughts: Can Solana Turn This Correction Into a Comeback?

Solana may be losing short-term momentum, both on-chain and on the charts, but zooming out reveals a different picture. The emergence of a potential cup and handle formation, supported by strong network fundamentals, makes the long-term Solana price prediction more hopeful than it might seem right now. This correction could be a healthy pause rather than a full-blown reversal.

If SOL holds the $140 to $150 zone and regains momentum, that larger breakout scenario toward new all-time highs remains very much on the table. Still, near-term risks can’t be ignored. Solana’s failure to reclaim $170 and repeated tests of lower support indicate that bears are still in control. But if the bullish structure completes as analysts like TedPillows suggest, this recent dip could turn out to be the final “handle” before a breakout that surprises many.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: