Category: Crypto News, News

Solana Price Prediction: ARK Invest Deal and $311M Inflows Fuel Rally Towards ATH Levels

Solana is testing a key resistance zone after record institutional inflows and ARK Invest’s strategic staking move, signaling a potential breakout.

Under the surface of Solana’s recent price movement lies a mix of structural strength and institutional momentum. The announcement of ARK Invest’s institutional staking partnership, along with a record $311 million in weekly inflows, is having a major positive impact on price.

Currently hovering near the $190 to $194 resistance zone, Solana is testing a region that could determine whether the asset reclaims its bullish trend or pauses for consolidation.

ARK Invest Taps SOL Strategies for Institutional Solana Staking

In a notable move for the Solana ecosystem, Cathie Wood’s ARK Invest has officially partnered with SOL Strategies to handle its institutional staking needs through the Digital Asset Revolutions Fund. This is a major achievement for the Solana ecosystem. ARK Invest manages over $20 billion in assets under management.

Solana secures institutional backing as ARK Invest partners with SOL Strategies for high-volume staking operations. Source: SOL Strategies via X

Beyond the validation it brings, this kind of institutional involvement often translates into stronger price support. Large-scale staking operations reduce circulating supply, tightening available tokens on the market. Paired with ARK’s credibility, this could spark renewed investor interest and push Solana further into the spotlight.

Solana Sees Record $311M Weekly Inflows as Institutions Pour In

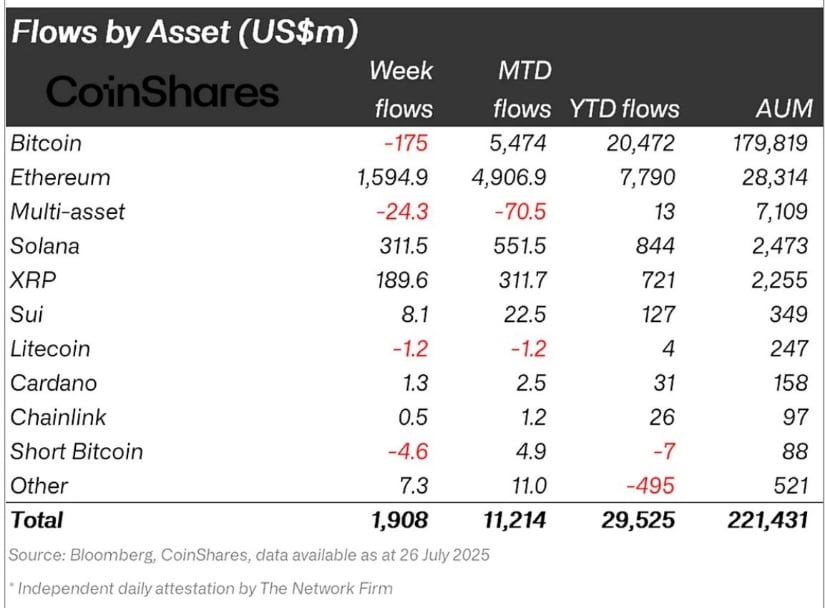

After a major bullish development, Solana just logged its largest-ever weekly inflow, $311 million across ETPs, ETFs, and funds, according to CoinShares data. That’s not just a new high, it’s three times the previous record. The scale of capital rotation suggests deeper institutional conviction, particularly at a time when other top assets like Bitcoin saw outflows.

Solana logs a record $311M in weekly inflows, tripling its previous high and signaling rising institutional conviction. Source: SolanaFloor via X

This kind of volume can’t be ignored on the price front. With $551 million in inflows month-to-date, and momentum still building, the surge could put consistent upward pressure on SOL’s market value.

Solana Pushing Through Sell Wall With Eyes on $235

Solana is now testing a key resistance band between $190 and $194, an area that previously acted as a sell wall and short-term ceiling. As highlighted by CW8900, this zone represents the first major hurdle before the next liquidity cluster, located around $210 and then $235.

Solana challenges key resistance at $194 as volume builds, with $235 eyed as the next major liquidity target. Source: CW8900 via X

The current structure shows a steady climb backed by rising volume, and price is attempting to pierce through this supply region with multiple intraday rejections already absorbed.

This technical breakout attempt comes on the heels of back-to-back bullish catalysts, including ARK’s institutional staking adoption and a record $311 million in weekly inflows. If SOL can secure a clean close above the $194 range, momentum could quickly extend toward the $210 mark, with $235 remaining the higher-timeframe target should the rally continue.

Solana Fractal Structure Suggesting Breakout Above All-Time High

Solana’s weekly chart is starting to show signs of something bigger unfolding. Trader Tardigrade outlines a compelling long-term structure where price action has been compressing in a wide accumulation range, marked by two failed breakout attempts on both sides.

Solana’s weekly fractal hints at a breakout past $260 as accumulation structure tightens and key levels come under pressure. Source: Trader Tardigrade via X

These “false moves” have helped establish well-defined horizontal boundaries, which are now being tested again. With the recent institutional inflows and price reclaiming key zones, the probability of a real breakout, rather than another trap, is increasing.

If SOL clears the upper boundary of this weekly range, the path opens towards its former all-time high around $260, with potential for fresh price discovery beyond that.

Contrary Views: ABC Correction Still on the Table for Solana

While momentum has favored the bulls lately, not all traders are ruling out the possibility of a near-term pullback. As highlighted by OxonTrading, Solana’s 4H chart may be shaping up into a textbook ABC corrective wave. With waves (A) and (B) seemingly completed, a potential (C) leg could drag price back toward the $172 to $174 region before the uptrend resumes. This zone also aligns with previous intraday support, making it a reasonable technical target for a short-term dip.

Solana’s 4H chart may be forming an ABC corrective wave, with a potential dip toward $172–$174 before trend continuation. Source: OxonTrading via X

This perspective offers a more cautious counterbalance to the recent bullish flood, especially after SOL’s aggressive push into the $190 resistance band. Even in trending markets, ABC corrections are common and healthy, allowing the market to reset leverage and sentiment.

Final Thoughts: Is Solana Poised for a Breakout or a Breather?

Solana’s recent surge, backed by institutional inflows, ARK Invest’s strategic entry, and a technically strong setup, has brought it to a critical tipping point. With $311M in weekly inflows and the $190 to 194 zone under attack, bulls are clearly in control for now. If SOL pushes past $194 and holds, the door toward $210 and eventually $235 could swing wide open, especially with momentum and liquidity aligning on higher timeframes.

That said, not everyone’s buying the hype without caution. The possibility of a short-lived ABC correction remains on the radar, with $172 to $174 offering a likely reset zone.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: