Category: Crypto News, News

Solana Price Prediction: ETF Filing Boosts Sentiment as $218 Resistance Looms

Solana approaches a decisive moment as ETF optimism meets $218 resistance, leaving participants watching for the next breakout move.

Solana price continues to attract attention as both institutional and retail narratives are starting to converge. The latest news of a Solana ETF filing has injected fresh optimism into the market, while technical charts show the price nearing key support levels.

Solana ETF Filing Adds Institutional Catalyst

In the latest news from Cointelegraph, Canary Capital has officially filed for a Solana ETF that not only holds SOL but also stakes it. This is a significant shift from earlier filings seen in the crypto space, as it highlights the growing institutional interest in staking.

Solana gets an institutional boost as Canary Capital files for a staking-enabled ETF. Source: Cointelegraph via X

If approved, such a product could drive consistent demand for SOL while reducing circulating supply. Similar narratives around Bitcoin and Ethereum ETFs have historically added fuel to their rallies, and now Solana finds itself in a similar spotlight.

Solana Price Approaches Its Long-Term Trendline

Solana is once again testing its major ascending trendline. This level has repeatedly acted as dynamic support across the past few months, with each touch sparking strong rebounds.

Solana retests its long-term trendline, with Crypto Batman calling it a key support zone. Source: Crypto Batman via X

Crypto Batman believes that the latest pullback places SOL near this critical zone, which now serves as a make-or-break level for bulls. If buyers defend it, the case for another upward leg strengthens. But a breakdown here could shift momentum and open the door to deeper retracements.

Wyckoff Accumulation Points Towards Higher Targets

Analyst ZYN shared a Wyckoff accumulation chart, suggesting Solana is in its final phase before a potential breakout. According to his view, this could be the “last big dip” before a Q4 rally that could set the stage for a move towards $500 this cycle.

Wyckoff signals Solana may be in its final accumulation phase before a Q4 breakout. Source: ZYN via X

The chart shows Phase D transitioning into Phase E, a stage typically associated with expansion after months of accumulation. If the pattern holds, Solana price prediction could be preparing for a multi-month uptrend fueled by fresh capital inflows.

Solana Price Today and Market Overview

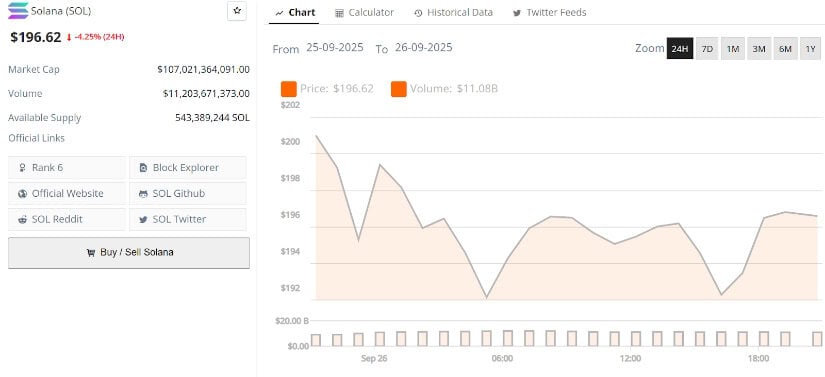

Data from Brave New Coin shows Solana trading at around $196, down 4% in the past 24 hours. Market capitalization sits near $107 billion, with daily trading volume above $11 billion.

Solana current price is $196.62, down 4.25% in the last 24 hours. Source: Brave New Coin

Despite the short-term dip, Solana’s on-chain activity remains strong, and its high position in market rankings underscores its continued relevance. The ETF filing, coupled with strong structural setups, gives SOL Solana price reasons to hold a bullish bias.

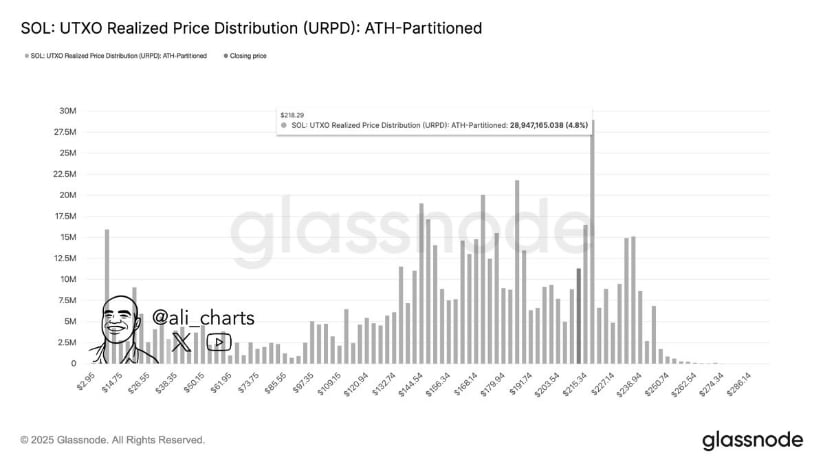

$218 Supply Wall as Key Resistance

Solana’s chart is facing strong resistance at the $218 level, where on-chain data shows a heavy cluster of realized prices. Analyst Ali Martinez notes that this zone has historically acted as a major supply wall, with many holders likely to sell into any retest. This concentration of potential sell pressure makes it one of the most important hurdles in the current structure.

Solana faces heavy resistance at $218, a key supply wall that could decide its path towards higher targets. Source: Ali Martinez via X

A clean breakout above $218 would shift the outlook back in favor of the bulls, setting the stage for a move toward $250 and possibly $300. Until that breakout happens, however, this supply wall remains the key obstacle standing in the way of bullish Solana price prediction.

Final Thoughts

Solana’s outlook is now shaped by a mix of catalysts and caution. The ETF filing highlights institutional interest, while Wyckoff accumulation patterns and the long-term trendline suggest technical strength. Yet, immediate resistance at $218 looms large, and failure to reclaim it could prolong sideways action.

For participants, the key lies in watching both the trendline support and the $218 supply barrier. Holding one and breaking the other would confirm bullish continuation. With institutional demand potentially entering the picture, Solana’s outlook could favor the bulls.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: