Category: Forex News

Staggering $750 Million BTC Withdrawn From Crypto Exchanges

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

According to on-chain analytics firm IntoTheBlock, a staggering $750 million worth of Bitcoin (BTC) was withdrawn from various crypto exchanges on March 14, as Bitcoin rose to a fresh all-time peak of almost $73,798.

IntoTheBlock reported that over $750 million in BTC were withdrawn from exchanges in the past 24 hours, which is the highest since May 2023. The Bitfinex and Kraken exchanges account for the majority of these withdrawals, totaling $524 million and $130 million, respectively.

Bitcoin recorded its fourth-cycle all-time high this week, pushing sentiment one step closer to euphoria. The classic wealth transfer from the HODLer cohort to speculators is now well underway, according to Glassnode, with significant upticks in spot profit-taking, and demand for futures leverage.

The exodus of Bitcoin from exchanges can be seen as a positive sign of investor confidence in the long-term value of Bitcoin, as investors choose to secure their holdings independently.

Bitcoin price drops

Bitcoin fell below $70,000 after reaching a new high for the fifth time in seven days as investors retreated from risky assets across financial markets.

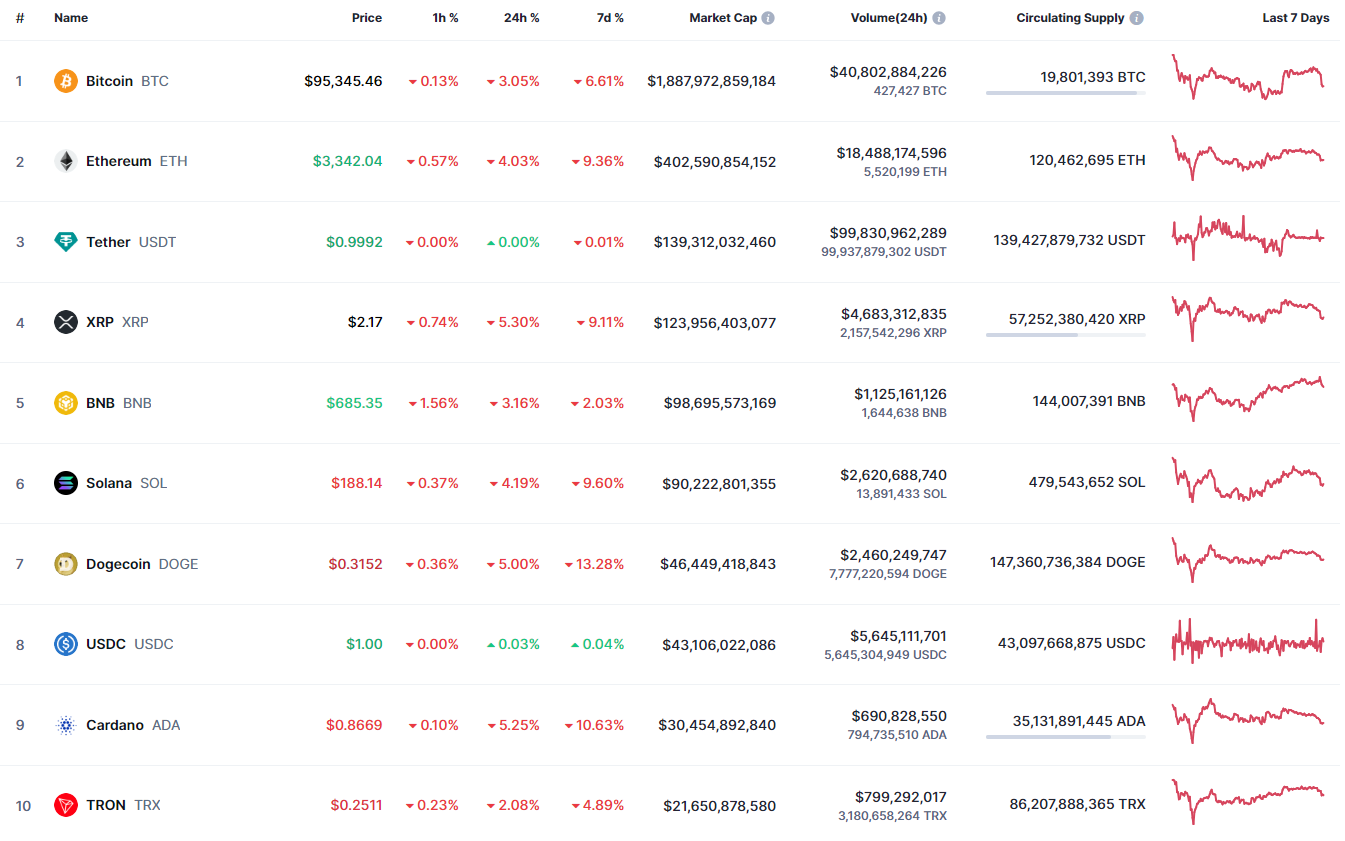

The largest cryptocurrency slid as much as 9% to $65,565, after previously reaching an all-time high of $73,797. Other tokens, like Ethereum, Shiba Inu and XRP, also plummeted.

U.S. equities and cryptocurrencies slumped as another strong inflation report bolstered betting that the Federal Reserve may not be in a hurry to cut interest rates, even as some sectors of the economy show symptoms of slowing. Low interest rates tend to increase the appeal of cryptocurrencies.

While investors wait to see where Bitcoin goes next, crypto expert Ali believes it has created a stable support zone between $64,750 and $66,700, with 382,000 addresses holding more than 275,000 BTC.

Monitoring this level closely may be critical, Ali noted, as losing it might move attention to the next significant demand zone between $60,760 and $62,790, which is protected by 797,500 addresses and over 298,000 Bitcoin.

In contrast, Bitcoin faces tough resistance between $70,180 and $71,340. This barrier is fortified by 533,300 addresses, which collectively own 433,000 Bitcoin.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: