The main tag of Crypto News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Dogecoin (DOGE) Price Prediction: Dogecoin Bullish Breakout Eyes $0.42 as Chart Signals Align

Dogecoin builds momentum as whale accumulation, bullish patterns, and long-term channel support spark speculation of a breakout toward $0.42—and potentially beyond.

Rising trading volume and renewed market optimism further reinforce Dogecoin’s potential for a sustained uptrend in the coming weeks.

Bullish Momentum Gathers Pace

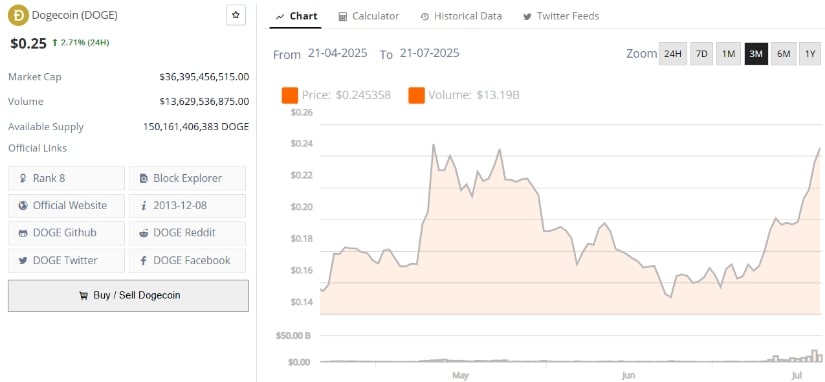

Dogecoin (DOGE) has seen a significant upswing in recent days, surging over 17% in the past week. This performance places it firmly in the spotlight among altcoins, especially as the broader crypto market cap edges toward $4 trillion. Currently trading near the $0.25 resistance zone, DOGE’s price action is drawing considerable interest from analysts and investors alike.

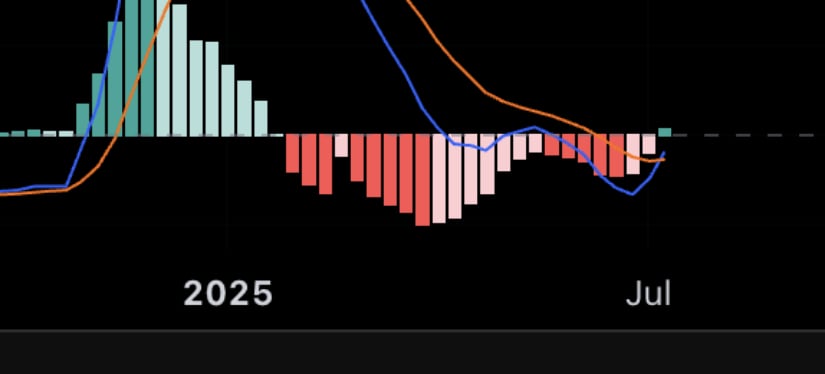

Dogecoin ($DOGE) is forming a double bottom pattern, indicating a potential move toward the $0.42 target. Source: Ali Martinez via X

According to Ali Martinez, a prominent crypto analyst, Dogecoin’s price structure has formed a classic double bottom—a pattern that historically signals a potential reversal to the upside. “The recent rally toward $0.24 completes the ‘W’ shape on the chart,” Martinez noted, suggesting that a confirmed breakout above the $0.25 neckline could trigger a powerful rally. If confirmed, this could see Dogecoin rise as high as $0.42, representing a potential gain of over 80% from current levels.

Technical Structure Supports Uptrend

The double bottom formation, characterized by two low points between April and June separated by a mid-May peak, is now approaching its critical resistance level. Market participants are closely watching the $0.25 mark for a sustained breakout. Should this level be breached with volume support, it would confirm the bullish setup and reinforce confidence in higher price targets.

The TradingView post indicates Dogecoin (DOGE) is showing bullish momentum and may be on track for a breakout to a new all-time high. Source: wolffxtrader on TradingView

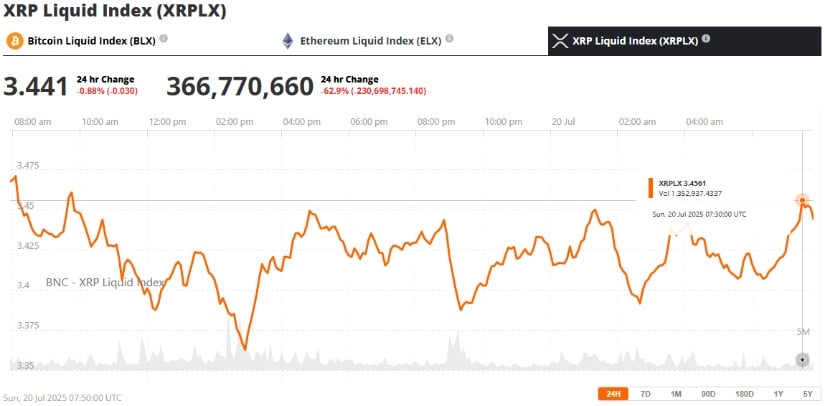

Daily trading volume has surged by over 100%, signaling increased market participation. With DOGE now trading at approximately $0.25, its market capitalization has climbed to $34.95 billion, maintaining its rank as the ninth-largest cryptocurrency and the top memecoin.

Whale Accumulation Signals Institutional Interest

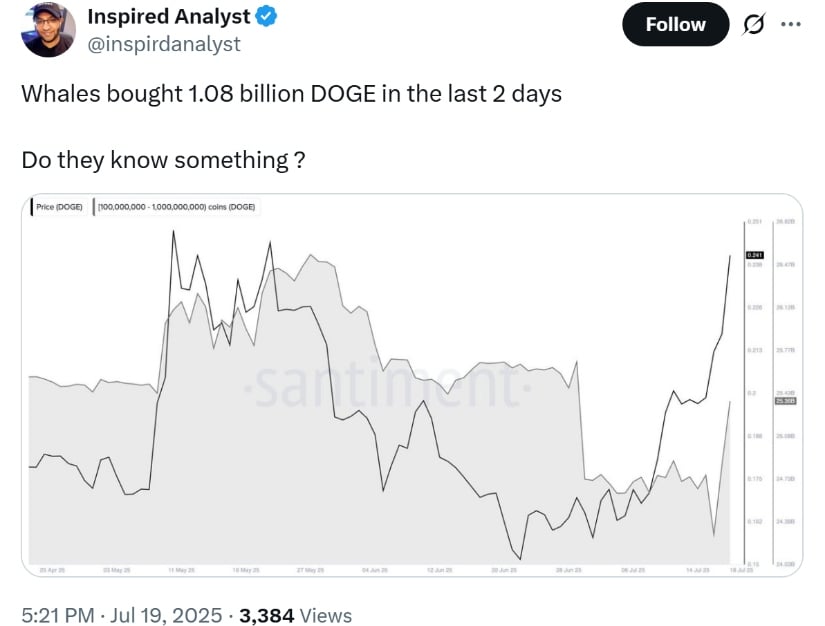

Parallel to technical developments, Dogecoin has also seen a sharp increase in whale activity. On-chain data shows wallets holding 100 million to 1 billion DOGE have devoured over 1.08 billion tokens in the past 48 hours. The buildup came after DOGE price surges beyond the $0.24 threshold, a sign of strategic accumulation by major wallet holders.

Whales accumulated 1.08 billion DOGE in the past two days, signaling growing bullish interest. Source: @inspirdanalyst via X

Such intense purchasing is generally considered to be a sign of bullish price momentum. Historically, whale accumulation has been consistent with bullish trends and has been observed to result in long-term rallies. The majority of such wallets are believed to be held by institutions or long-term investors, further supporting the bullish narrative.

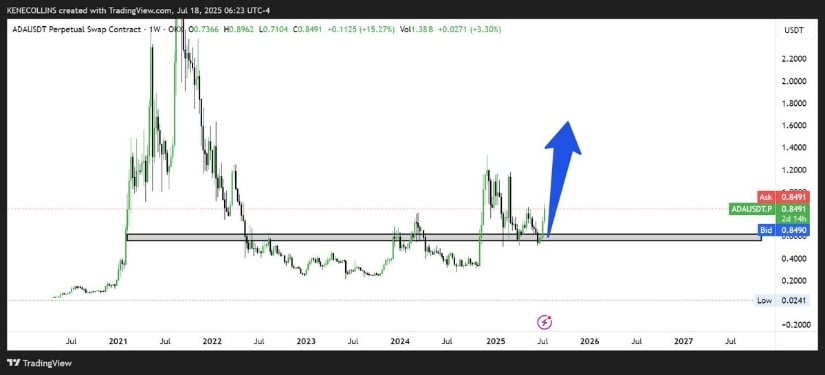

Rising Channel Gives Way to Higher Targets

Technical analysis by Crypto Yoddha shows Dogecoin moving in an ascending parallel channel that began in early 2023. The channel features successively higher highs and successively higher lows, which is a reflection of a bullish market structure. The recent bounce in the area of $0.15 confirms this support channel, and a rising volume and bullish weekly candles boost confidence in the upward trend.

If Dogecoin remains within this channel, then the upper boundary suggests scope for a move to $0.80. Having this channel midline act as support would be crucial to maintaining the current uptrend.

Can Dogecoin reach $1?

The dogecoin prospect of crossing the symbolic $1 hurdle is once again in discussion. Crypto Yoddha opines that so long as DOGE is above its long-term trendline and still holding respect for its bullish channel, the path to $1 is on the cards. The resistance levels are at around $0.30 to $0.36, and a slow upward climb to $1 is on the cards if market sentiment and volume are favorable.

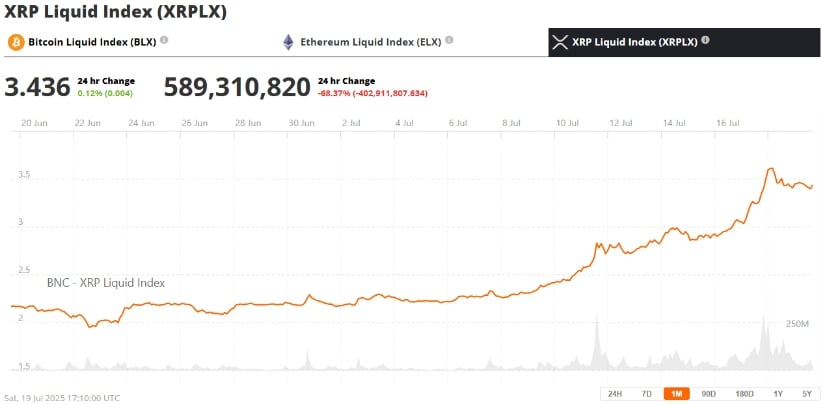

Dogecoin (DOGE) was trading at around $0.25, up 2.71% in the last 24 hours at press time. Source: Brave New Coin

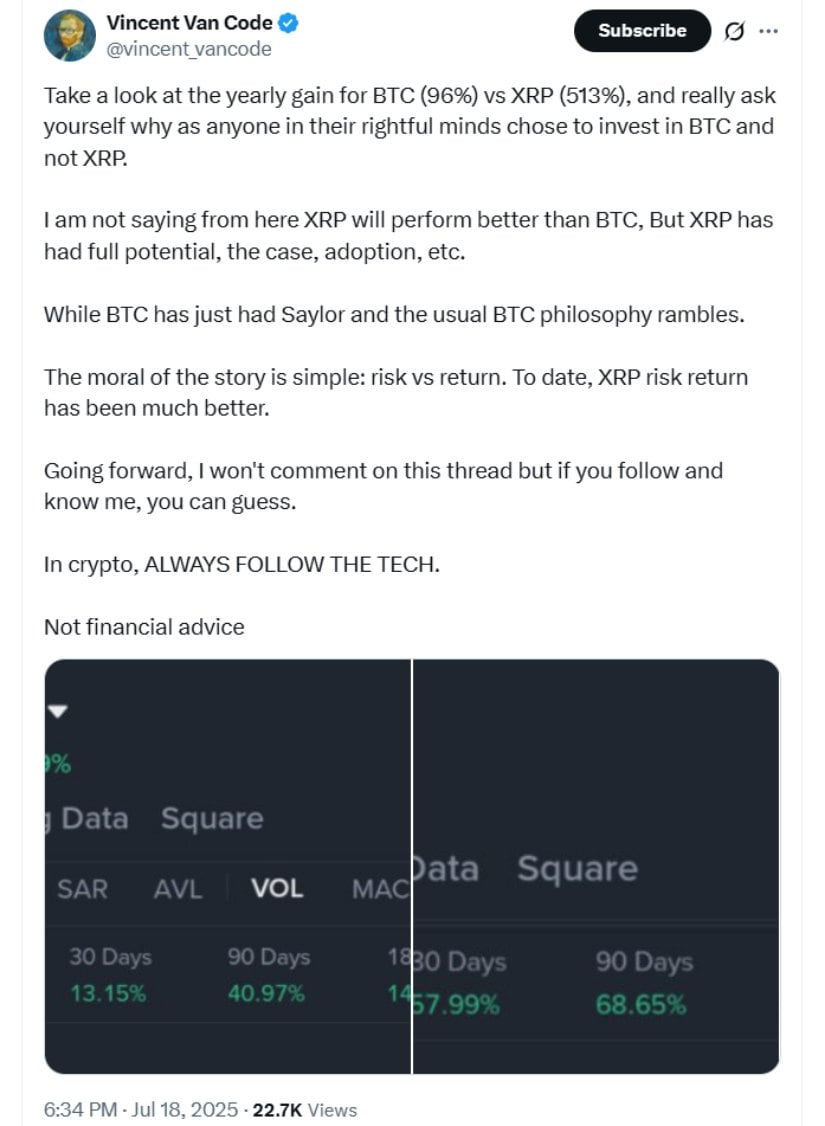

This view is also held by other observers, such as Trader Tardigrade, who references Dogecoin’s recent 4-year cycle. According to him, DOGE has followed a pattern of multi-year consolidations followed by explosive yearly rallies—in 2017, 2021, and potentially again in 2025. “If history rhymes, Dogecoin may be entering the early stages of a new long-term rally,” Tardigrade commented.

Outlook and Key Levels to Watch

With Dogecoin currently sitting just below a critical resistance level , the next few trading sessions could be decisive. A confirmed breakout above $0.25, supported by volume and sustained momentum, could validate a move toward $0.42 in the short term. Continued whale accumulation, positive sentiment, and the technical structure all point to a bullish bias.

However, failure to break above this level could result in a retest of lower support zones between $0.13 and $0.15. Traders and investors will be watching closely to see whether Dogecoin can transition from a promising setup to a full-blown breakout.

Dogecoin Price Today:

- Current Price: $0.25

- 24H Change: +2.71%

- Market Cap: $36.39 billion

- Trading Volume: Up 108.5%

As the crypto market continues to evolve, Dogecoin’s combination of technical strength, growing investor interest, and increasing institutional participation may well shape its trajectory toward the next major psychological barrier—and perhaps a renewed shot at the elusive $1 mark.