The main tag of Crypto News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Solana Stalls at $165 During Pump.Fun $5.6B Launch

Solana

SOL

$164.1

24h volatility:

0.6%

Market cap:

$88.00 B

Vol. 24h:

$14.43 B

price traded sideways near $163 on Monday, July 14, stalling below the $165 resistance despite positive sentiment within the broader altcoin markets.

While Bitcoin

BTC

$120 047

24h volatility:

0.9%

Market cap:

$2.39 T

Vol. 24h:

$67.78 B

hit new all-time highs and triggered double-digit breakouts across altcoins like Ethereum

ETH

$3 008

24h volatility:

0.3%

Market cap:

$363.10 B

Vol. 24h:

$40.12 B

, Ripple

XRP

$2.95

24h volatility:

3.1%

Market cap:

$174.47 B

Vol. 24h:

$10.83 B

, and Sui

SUI

$3.85

24h volatility:

9.6%

Market cap:

$13.29 B

Vol. 24h:

$1.00 B

, with each climbing past $3,000, $3, and $4 respectively, Solana has returned just 9.2% over the past week.

Notably, this underperformance comes even as sentiment surrounding the Solana ecosystem remains positive.

The slowdown in SOL price momentum coincided with the high-profile token launch of Pump.Fun, a memecoin generator platform built on Solana.

After raising $500 million during its weekend ICO across major CEXs, PUMP went live for trading on July 14 with a $5.6 billion fully diluted valuation, opening at $0.0056 and briefly peaking at $0.0065.

$PUMP trading is now live!

thank you to all who participated in the $PUMP public sale. it’s time to build the future of crypto and social media on Solana.

we couldn’t be more excited for what’s to come! pic.twitter.com/6p7qdXLb1t

— pump.fun (@pumpdotfun) July 14, 2025

However, demand overwhelmed several platforms. Kraken and Bybit faced severe user backlash due to technical failures during the presale. Both exchanges pledged compensation, Kraken through secondary market purchases and Bybit via fee rebates.

Our records indicate that some clients arrived on time for the $PUMP sale but were unable to complete their orders due to system constraints. The sale was fully allocated in under sixty seconds and demand far exceeded available supply.

We reviewed internal order logs and client…

— Arjun Sethi (@arjunsethi) July 12, 2025

This chaotic rollout may have diverted liquidity and attention from SOL itself. First, investors may have rotated capital into PUMP, dampening near-term demand for SOL.

Second, the controversy surrounding exchange access likely dampened investor confidence especially with Solana’s infamous history of costly network outages during periods of peak market activity in recent years.

Against this backdrop, SOL may remain capped below $170 in the short term until the uncertainty surrounding the Pump.Fun token launch clears.

Solana Price Prediction: Bulls Eye $179 as Key Resistance Holds

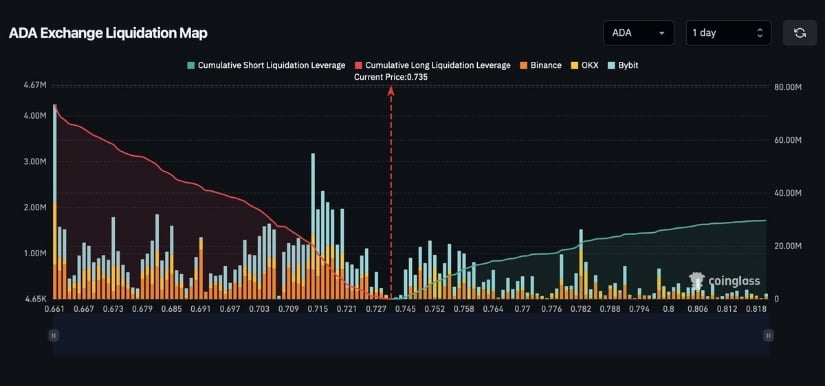

Solana’s price remains trapped below the $165 ceiling despite a broader altcoin rally. The chart shows that SOL tested the $170 resistance twice within 48 hours but failed to break higher, suggesting strong seller presence at that level. However, price action continues to hold above the red support zone at $153, which now acts as a bullish pivot.

Solana price prediction | SOLUSDT

If buyers reclaim $165 on a daily close, the next upside target lies at $179, which aligns with the upper Donchian channel. The RSI hovers near 63, leaving room for another leg up before conditions turn overheated.

Volume remains neutral, indicating consolidation rather than capitulation. A breakdown below $153 would invalidate this bullish setup and expose SOL to potential retracement towards the $144 support. For now, consolidation above $160 suggests bulls are preparing for another breakout attempt.

Solaxy Presale Gains Traction as Solana Ecosystem Heats Up

As Solana projects like Pump.Fun dominate market headlines, infrastructure plays are seeing renewed attention. Now live in presale, Solaxy ($SOLX), Solana’s first Layer-2 chain, Solaxy aims to power the next generation of Solana-native applications, from DeFi to meme tokens.

Solaxy Presale

With staking rewards up to 71%, early SOLX buyers gain high-yield exposure to one of 2025’s most anticipated launches. As SOL attempts to clear $165, capital rotating into Solana ecosystem infrastructure could accelerate. The Solaxy token contract is live, and staking has already begun, visit the official Solaxy website to join.

The post SOL Price Analysis: Solana Stalls at $165 During Pump.Fun $5.6B Launch appeared first on Coinspeaker.