The main tag of Crypto News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Why Analysts Are Backing RTX To Hit Over ADA

PRESS RELEASE

Published November 15, 2025

Cardano has been stuck below the $0.60 mark and traders are arguing whether it will rise in the short run. Although ADA has established a developed network with institutional coverage

Analysts forecast that it may move to $0.73-$0.87 in the short term, with December highs of about $0.90 and long-term goals in 2026. It can double or even triple the current levels, but an unrealistic increase would be needed to hit $5.

In the meantime, Remittix is quietly building some real buzz with some sharp-eyed investors on the hunt to find the next crypto rocket. It already has $28 million scooped and more than 40,000 verified backers who are not fooling around at just $0.1190 a token.

Cardano: Stability With Limited Upside

Analysts tracking ADA’s performance have pointed out that Cardano’s “next big move” may not be very big at all. Predictions for the short term put ADA somewhere between $0.73 and $0.87, with some December peaks estimated near $1.

These aren’t bad numbers, but they reflect the reality of a mature ecosystem that often moves at a slower pace.

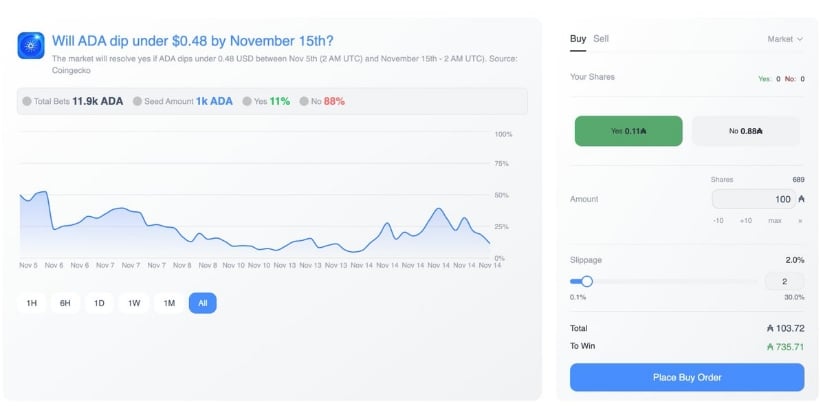

As of mid-November 2025, ADA trades between $0.50 and $0.564 and sits in a narrow range & traders hoping for a major breakout.

Technical charts still offer a path toward higher prices, and a strong December could push ADA upward, but even optimistic forecasts push Cardano only toward $1.50-$2.00 through 2026. That’s a multi-year climb that depends heavily on adoption trends that aren’t guaranteed.

Remittix: Fast-Moving Infrastructure Play

Remittix is a new L2 crypto protocol that aims to make cross-border payments easier. It is not based on the speculative projects, as it already has a working beta wallet that transfers crypto-to-bank transfers in 30+ countries, supports 40+ cryptocurrencies, and 30+ fiat currencies.

It has collected over $28 million and over 40,000 verified holders. This has guaranteed institutional backing and ensured its listings on key exchanges like BitMart and LBank.

Key advantages of Remittix:

- Crypto-to-bank transfers across 30+ countries, eliminating intermediaries

- Functional beta wallet, actively used by thousands of testers

- CertiK #1 pre-launch ranking, ensuring security and credibility

- 15% referral rewards in USDT, fostering self-reinforcing adoption

Why Investors Are Watching the Divergence

Cardano’s path to meaningful appreciation relies on network effects, incremental adoption, and external catalysts such as ETF approvals. Growth is predictable. Remittix, by contrast, leverages adoption momentum and real-world usage, giving it an asymmetric risk-reward profile: Real talk, it could climb from $0.1190 straight up as more folks pile in and trading flows get deeper.

The $250,000 community giveaway highlights the growing urgency to participate. With over 370,000 entries, demand is rising while availability remains limited. Early participants also earn daily referral rewards, encouraging them to actively promote the platform and increasing adoption.

Bottom Line

Cardano provides stability and measured returns for investors comfortable with slower growth. Remittix offers a rare opportunity for rapid expansion, driven by working infrastructure and a clear product-market fit in global payments.

For those deciding where to position themselves, the choice is simple: wait for ADA’s steady appreciation or participate in a project where adoption, utility, and referral-driven growth could create exponential returns.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

COMTEX_470270694/2909/2025-11-15T05:37:05