The main tag of Crypto News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Price Prediction Strengthens as Ripple Consolidates at $2.95

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

XRP is once again drawing heavy attention as whales stack up millions of tokens during a dip. With price forecasts hinting at higher levels, traders are watching closely. At the same time, MAGACOIN FINANCE is gaining traction as a rival altcoin many believe could deliver bigger percentage returns in this cycle.

XRP Whales Scoop 30 Million XRP in 24 Hours

Fresh data from on-chain tracker Ali Martinez shows wallets holding between 1 million and 10 million XRP boosted their stockpile from 6.74 billion to 6.77 billion in a single day. This equals about 30 million XRP added while prices pulled back to the $2.84 range.

Large holders often buy during dips, and this time was no different. Whale Alert also spotted over $812 million worth of XRP shifted between anonymous wallets. While some of these were likely exchange shuffles, the scale of the transfers has fueled interest in what could be next.

At press time, XRP trades around $2.87, down slightly over the week. Yet the ability of whales to keep buying dips shows confidence in further upside. With ETF speculation building and institutional players circling, the pattern of quiet accumulation is hard for traders to ignore.

XRP Price Prediction: Analysts See Price Targets Up to $7

Market watchers are keeping a close eye on XRP’s near-term floors and ceilings. Ali Martinez suggests holding above $2.71 could open the way for $3.60, with multiple rebounds already seen at this level. Javon Marks goes further, pointing to a possible path toward $4.80, which would mark a 66% move from current prices.

Even more ambitious projections highlight a stretch target near $7.14 if XRP maintains its breakout strength. Analysts argue that the coin has been consolidating for months, and a successful break could reset its multi-year price range.

Other voices in the XRP community, such as developer Harry Harald, also believe $4 is “the next stop”. His return after months away has added weight to bullish sentiment, with many traders seeing the timing as a sign of an approaching surge.

MAGACOIN FINANCE: An Altcoin to Watch Beside XRP

While XRP continues to capture attention, MAGACOIN FINANCE is being tipped as a rival worth serious attention. Analysts point out that with its price still under $0.0005, a “cancel a zero” move would not be far-fetched if buying continues. Whales appear to be rotating here too, especially with growing rumors of a decentralized exchange listing.

The altcoin now counts over 18,000 holders, and many believe it could easily outpace XRP in percentage returns. If XRP climbs 3x in this bull run, MAGACOIN could deliver 10x due to its entry-level pricing and expanding utility. FOMO is already spreading, and curiosity around its fundamentals continues to grow.

How Traders Can Position

Whale activity in XRP and growing excitement around MAGACOIN FINANCE suggest this market cycle is far from quiet. Traders looking to diversify may want to keep both assets on their radar. XRP’s price forecasts look constructive, but smaller-cap coins like MAGACOIN carry higher upside in percentage terms.

For those considering entry, it may be wise not to wait too long. Visit the official MAGACOIN FINANCE channels to learn more:

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

Conclusion

Conclusion

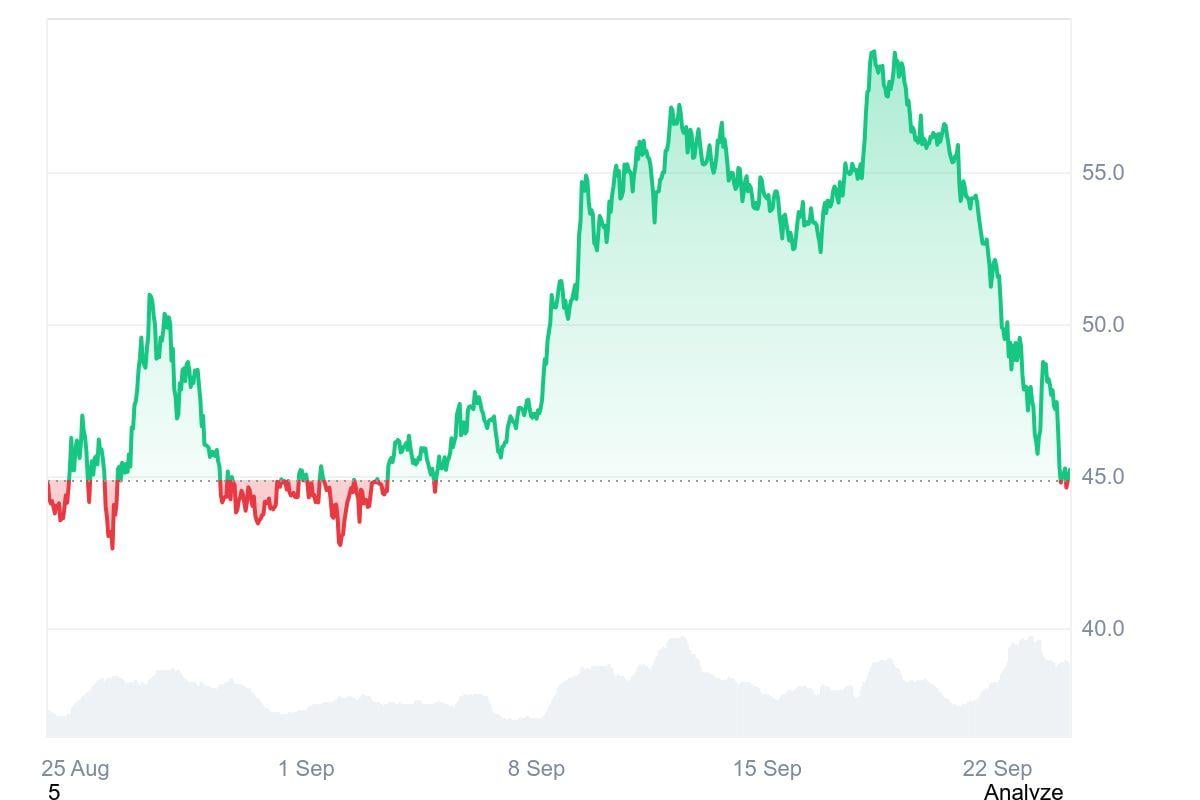

Although the Fed rate cuts inspired a pump to the high $50 area, HYPE fell below its 20-day EMA on September 21. Analysts believe

Although the Fed rate cuts inspired a pump to the high $50 area, HYPE fell below its 20-day EMA on September 21. Analysts believe