The main tag of Crypto News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Solana Price Prediction: Analysts Highlight $280 Resistance Level as Remittix Nears $30M Milestone

Solana (SOL) is receiving institutional renewal after the introduction of the first U.S. spot Solana ETF that raised more than $56 million in first-day trading volume. With a current price of about $194, SOL has recovered from its lows as analysts believe it can potentially soar to $280 in November due to inflows in ETFs, staking demand, and positive technical indications.

In the meantime, Remittix (RTX) the PayFi app that supports crypto and fiat payments has already passed the $27.7 million threshold in its private funding and is close to the $30 million mark. The high growth crypto is appealing to institutional and retail investors looking to be exposed to utility-driven blockchain expansion.

SOL’s Approaching Breakout: Solana price prediction Signals

Institutional momentum is building rapidly beyond ETF products, with major financial firms integrating Solana into their offerings. Fidelity Digital Assets expanded its trading suite to include SOL for both retail and institutional U.S. investors in late October 2025, while Hong Kong approved its first Solana ETF through ChinaAMC.

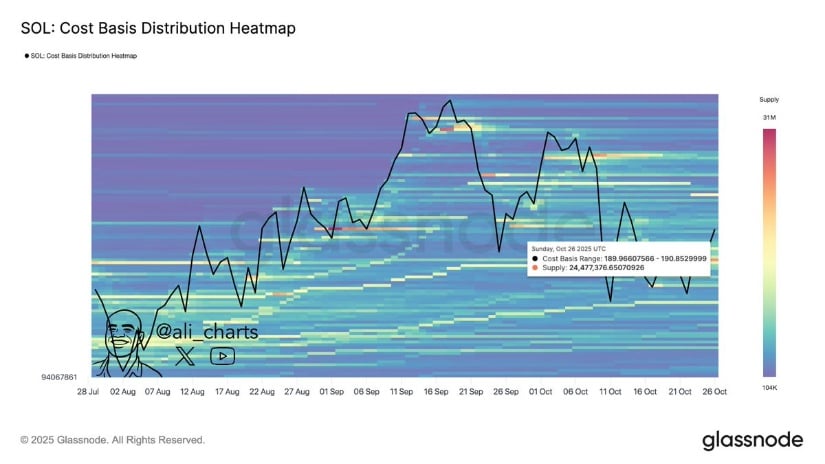

Solana CME futures open interest surged to an all-time high of $1.49 billion, up sharply from $1 billion in August, underscoring the depth of institutional demand following the ETF launch.

Staking inflows have climbed to $1.72 billion, with products like the REX-Osprey Solana Staking ETF attracting over $12 million in first-day volume

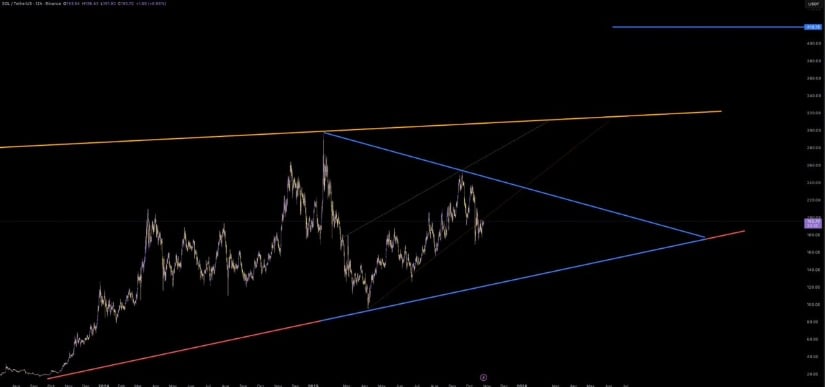

The latest Solana price prediction has the token eyeing a $240-$280 range this November as momentum builds across its ecosystem. On-chain data show strong staking flows and rising TVL, while analysts are beginning to say early buyers are already up and positioning for the next leg.

A breakout above Rs $245 could trigger rapid upside toward Rs $280, according to bullish charts and sentiment. That said, failure to hold Rs $200 range would jeopardize the solana price prediction optimism.

Why Remittix (RTX) Could Outshine Even SOL

Now let’s shift into an upcoming powerhouse. While SOL grabs headlines, a utility-first project is quietly building infrastructure that investors are calling “the real deal.”

This next-level DeFi project and low gas fee crypto has already surpassed $27.7 Million in funding and gearing up for a mega-announcement near $30 Million. Early buyers are already up and the community is buzzing.

In comparison to many speculative tokens, this cross-chain DeFi project offers real bank-fiat ramp features, mobile wallet arrival in Q3, and listings on major centralized exchanges confirmed. If you’re looking for early stage crypto investment with high-growth crypto potential, this one checks off the boxes where many others simply hype.

Why Remittix Is Gaining Traction

- Global Reach: send crypto directly to bank accounts in 30+ countries

- Real-World Utility: built for actual use — not just speculation

- Security First: audited by CertiK; ranked #1 for pre-launch tokens

- Wallet Coming Q3: mobile-first with real-time FX conversion

This combination of utility, traction, and scarcity is what top crypto under $1 investors are already watching. Don’t let this slide into “should’ve gotten in” territory.

$250,000 Giveaway + Referral Surge: Time to Act

Here’s the gut-check moment: the $250,000 community giveaway is active, and the referral program now pays 15% of each new buyer’s investment back in USDT, claimable every 24 hours through the dashboard. Early users are sharing links and stacking rewards—some are already talking thousands weekly.

With over 40,000 holders and 370,000 entries on the giveaway gleam page, momentum is stacking fast. Whales are loading in ahead of the wallet reveal. The clock is ticking and this isn’t just “watch” time; it’s “act now or regret later” time.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: The content above is presented for informational purposes as a paid advertisement. The Tribune does not take responsibility for the accuracy, validity, or reliability of the claims, offers, or information provided by the advertiser. Readers are advised to conduct their own independent research and exercise due diligence before making any decisions based on its contents and not go by mode and source of publication. Investments in cryptocurrencies are subject to high market risks and volatility; readers should seek professional advice before investing.