The main tag of Crypto News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Solana Price Prediction: Whale Activity and ETF Buzz Fuel Hopes for a Breakout Towards $400

Solana price is showing renewed strength as whales and institutions align bullishly, with price consolidating near key support ahead of a potential breakout move.

Solana’s recent price action is drawing fresh attention as both whales and institutions start aligning on the bullish side. After weeks of sideways movement, momentum is quietly building again, fueled by large leveraged positions, growing ETF optimism, and consistent on-chain accumulation near key supports.

Crypto Whale Siding Bullish on Solana

Fresh data shared by Ash Crypto reveals a prominent whale with a 100% win rate doubling down on bullish exposure, expanding a large BTC long position while simultaneously opening a 10x leverage long on Solana. Such synchronized positioning across Bitcoin and Solana signals a potential bullish rally ahead.

A major whale with a flawless track record opens a 10x long on Solana, signaling rising confidence in its next bullish leg. Source: Ash Crypto via X

With Solana consolidating near key technical supports and Bitcoin showing strong trend continuation, the positioning adds confluence to the bullish thesis forming.

Institutional Buying Strengthening Solana’s Outlook

Institutional flows appear to be reinforcing this narrative, as Whale Insider reported that Bitwise clients purchased $69.5 million worth of SOL, a substantial commitment amid growing expectations for a potential ETF approval. These inflows mark one of the largest recent allocations into Solana.

Such consistent institutional buying has been a stabilizing force for Solana’s price action, helping absorb volatility even during broader market pullbacks. With large entities accumulating rather than distributing, liquidity continues to tighten, creating the conditions for a strong upside expansion once momentum returns.

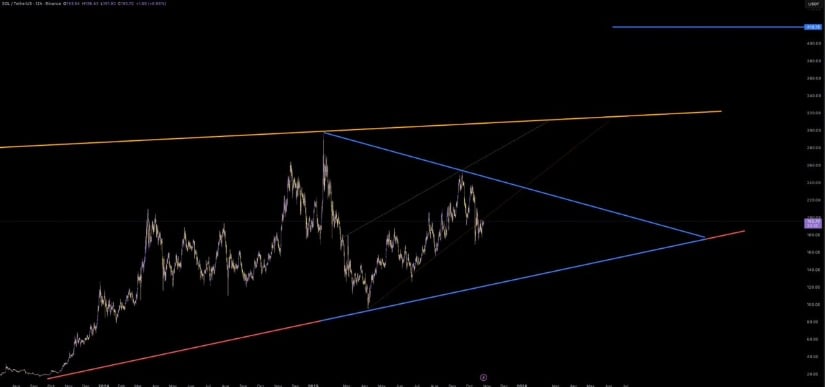

Solana Price Prediction: Triangle Breakout Could Target $400

A large symmetrical triangle continues to define Solana’s macro structure, as visualized by Azyra. Price action is compressing between the converging trendlines, with current support holding near $180 to $190 and resistance positioned near $260 to $270. Historically, such macro triangles precede explosive breakouts once momentum converges with liquidity inflows.

Solana’s symmetrical triangle structure hints at a potential breakout, eyeing $400. Source: Azyra via X

If Solana price manages to break above the upper boundary, the measured move projection implies a potential rally towards $400 and beyond, coinciding with the analyst’s forecast. The setup resembles Solana’s 2021 expansion pattern, a long consolidation followed by vertical acceleration once price structure resolves in favor of bulls.

Successful Retest Could Set the Stage for Continuation

The latest analysis by Kamran Asghar highlights Solana’s clean retest of $195, the previous breakout resistance now acting as support. Maintaining this zone is technically crucial, as it aligns with both horizontal structure and Fib retracement confluence.

Solana successfully retests $195 support, reinforcing breakout strength and setting sights on $207 and $235 targets ahead. Source: Kamran Asghar via X

If SOL Solana price sustains above $195, the next short-term targets lie at $207, followed by $230 to $235, as mapped by the Fibonacci 2.618–3.618 extensions. Each retest within this range strengthens the breakout validity, suggesting that the ongoing consolidation may serve as a preparation phase for the next impulsive advance.

$189 Identified as a Key Support

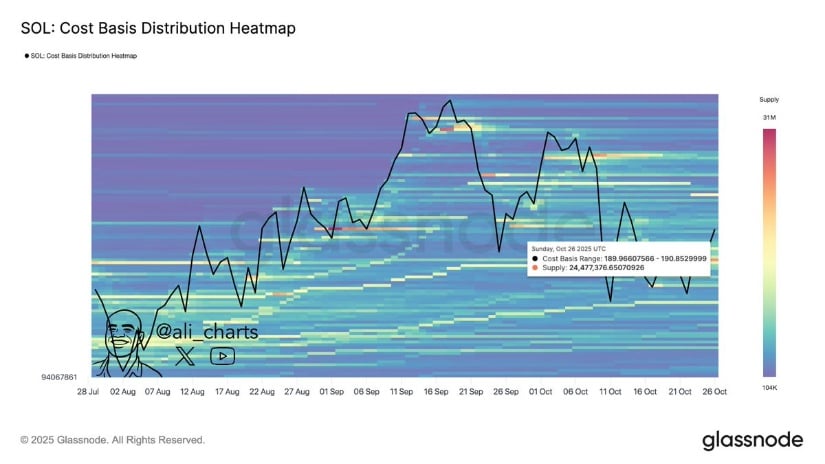

On-chain data from Ali Martinez further validates Solana’s solid support foundation. According to Glassnode’s cost-basis heatmap, over 24.5 million SOL were accumulated between $188 and $190, forming one of the largest buying clusters of the current cycle.

Over 24.5 million SOL were accumulated between $188 and $190. Source: Ali Martinez via X

This accumulation band represents a strong defense zone where long-term holders continue to add to their positions. As long as the Solana price remains above this range, downside risk appears limited, providing the structural backing needed for sustainable upside continuation.

Final Thoughts: Smart Money and Institutional Driving Solana Price

Both on-chain and off-chain data now point towards synchronized confidence in Solana’s trajectory. Institutional inflows, whale positioning, and solid technical structures are combining to create one of the strongest bullish backdrops in months.

Holding above $189 to $195 remains the key condition for continuation, while any breakout beyond $260 could ignite momentum towards $400. With market sentiment stabilizing and liquidity deepening, Solana appears poised to reclaim its leadership role among Layer-1 assets, supported by both price structure and real capital inflow.