The main tag of Crypto News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Bullish Options Spike Signals Massive

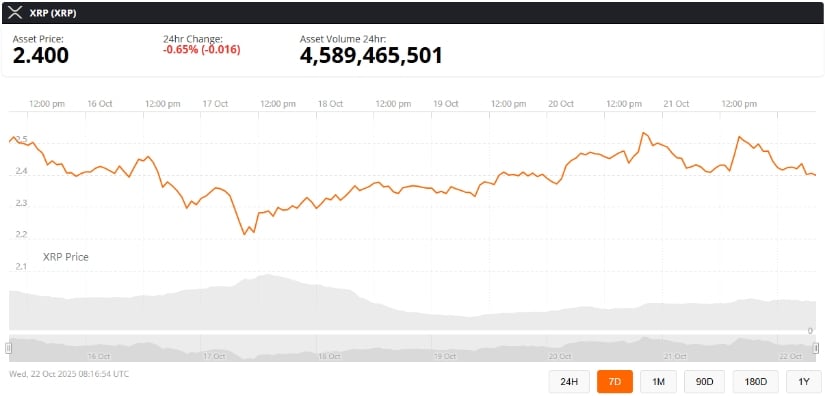

The XRP market is drawing fresh attention as a concentrated bullish options spike hints at a major altcoin rotation. Traders and institutions are repositioning from Bitcoin and Ethereum, with XRP and Solana emerging as high-conviction plays that could drive outsized short-term gains and renewed XRP momentum.

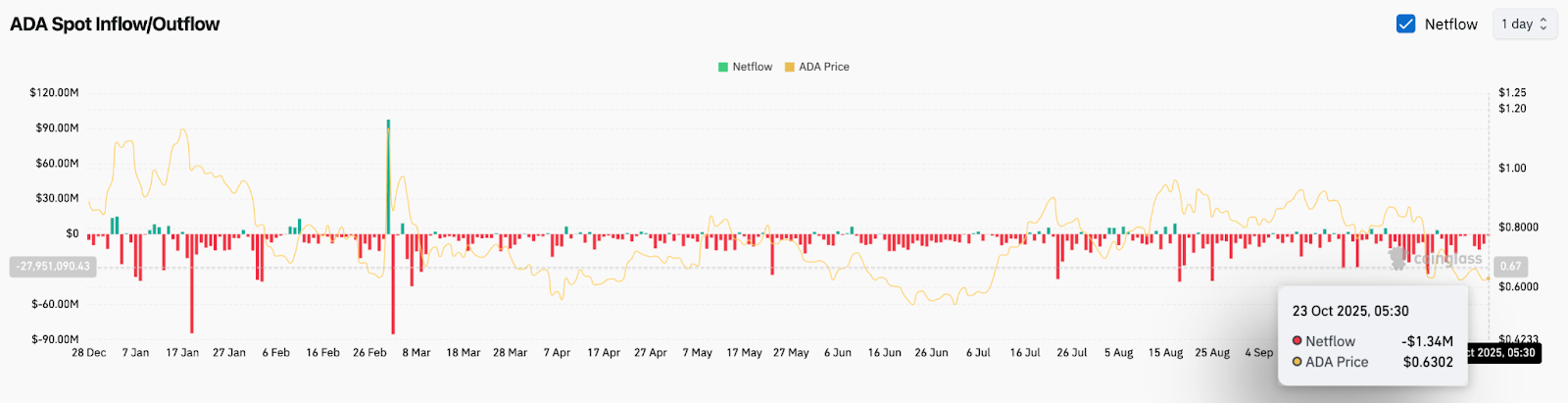

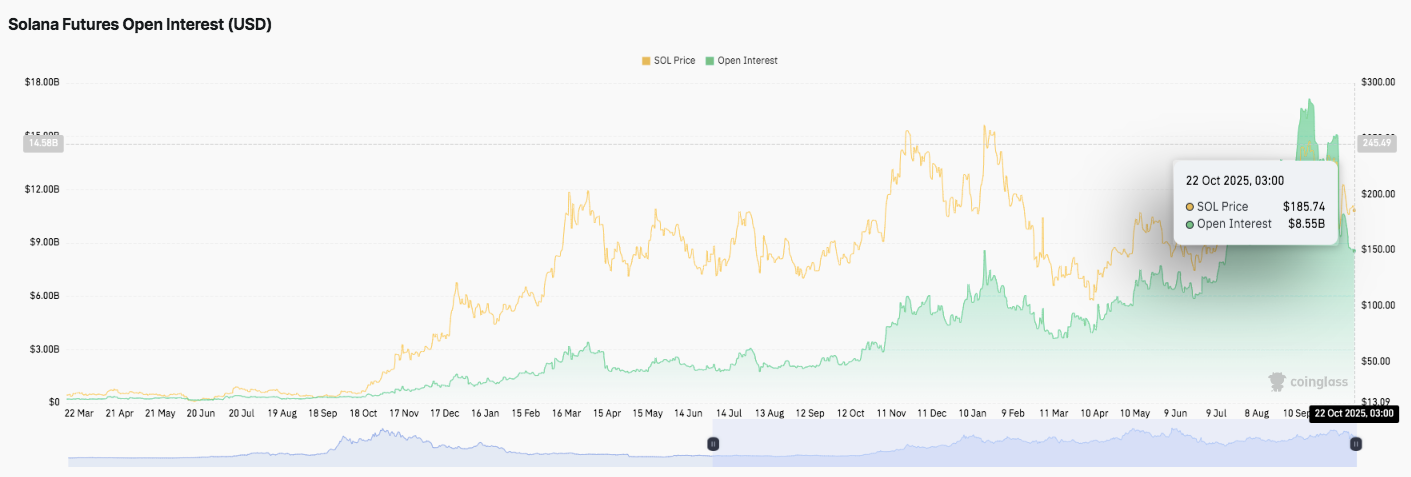

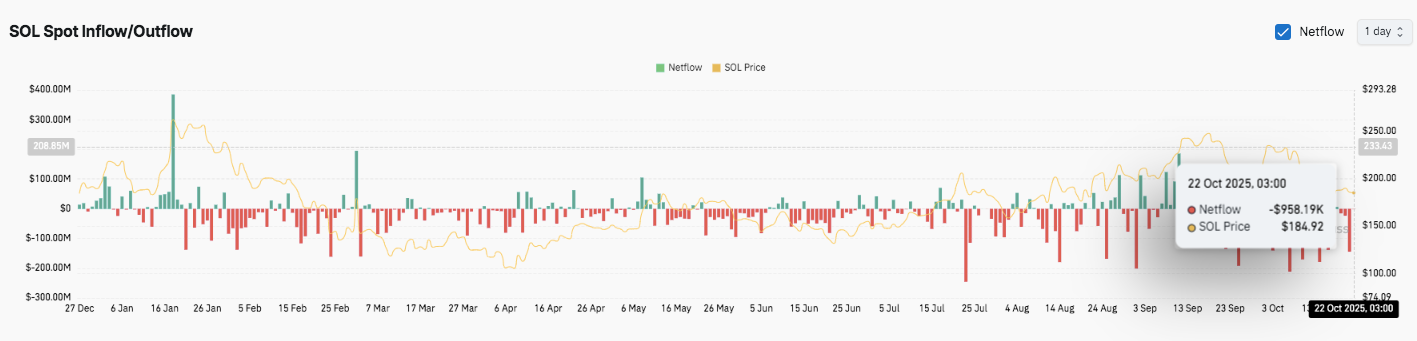

Derivative platforms such as Deribit, OKX and CME show a notable rise in call option volumes and open interest on XRP and SOL, signaling elevated bullish positioning in crypto options flow. On-chain data from Glassnode and Santiment records earlier BTC and ETH inflows to exchanges, followed by net outflows into altcoin-focused liquidity pools-consistent with a Bitcoin to altcoin shift.

Historical rotations from BTC/ETH into liquid altcoins typically align with sustained call-heavy options flows, tighter implied volatility skews, and subsequent price appreciation. This pattern underpins current XRP news and the growing narrative that XRP momentum could accelerate if capital continues rotating into majors like XRP and SOL.

XRP Price Prediction and Market Context

Recent market flows show a clear shift in attention toward XRP after a surge in call buying and rising open interest on derivatives platforms. Traders cite concentrated options activity in near- and mid-term expiries as a catalyst for short-term volatility and potential squeezes when liquidity thins.

On-chain metrics back the trade narrative. Increased transfers, higher active address counts and swelling wallet activity point to renewed utility and speculative demand that often precede price moves.

At the same time, broader sentiment across the altcoin space has turned notably risk-on – a factor further fueled by the growing buzz around early-stage projects such as PEPENODE Presales https://pepenode.io/. These presales are attracting significant attention from retail and early investors seeking exposure to utility-driven ecosystems before listings. This surge in presale participation reflects a wider shift toward diversification beyond the top assets like XRP and ETH.

While XRP’s near-term outlook hinges on liquidity flows and macro sentiment, parallel momentum from presale-driven projects like PEPENODE https://pepenode.io/ underscores the market’s appetite for innovation and community-led value creation. Both trends – established assets gaining speculative traction and emerging tokens drawing presale demand – illustrate a synchronized phase of renewed optimism within the crypto sector.

Current market dynamics driving XRP interest

Derivatives data reveal outsized call purchases at strike bands above recent levels, pushing open interest XRP higher versus the 30-day average. Market makers watching options flows may adjust hedges in ways that pressure the spot market.

Correlation patterns have changed. The XRP correlation BTC ETH has weakened on intraday and weekly readings, suggesting altcoin independence and the potential for isolated rallies disconnected from Bitcoin and Ether.

Technical outlook for XRP

XRP technical analysis highlights key zones to watch. Immediate support rests near recent swing lows while a resistance band sits at prior multi-month highs and round-number clusters that attract liquidity.

Moving averages matter. Short-term XRP moving averages such as the 10-20 EMA crossing above 50-100 MA would confirm bullish momentum. Traders track XRP RSI shifts from neutral toward overbought during rapid, options-driven moves.

Tactical considerations include exchange orderbook depth at resistance and the presence of institutional block trades that can amplify short-term moves.

Macro factors and regulatory developments

Macro liquidity crypto conditions shape risk appetite. Easier liquidity, lower Treasury yields and risk-on equity sentiment tend to favor capital rotation into higher-beta coins like XRP and Solana.

Regulatory direction remains a major variable. Any statements from the SEC XRP or new U.S. regulatory decisions XRP can rapidly change sentiment, affecting inflows and liquidity for the token.

Traders should monitor macro headlines and legal updates closely as sudden enforcement actions or adverse rulings could undo options-driven rallies and reverse flows into safer assets.

Altcoin Rotation: Why XRP and SOL Could Outperform BTC and ETH

The market shows signs of capital shifting into select altcoins. Recent flow data points to a concentrated options activity that can push spot markets. Traders must watch how these flows intersect with on-chain and macro signals to time exposure.

Interpretation of the bullish options spike

Large surges in call volume relative to puts signal trader conviction for upside. Dealers hedging heavy call flows can create gamma-driven moves that lift the underlying asset. When open interest clusters near key strikes and options expiries crypto approach, market makers may rebalance, producing squeezes toward those strikes.

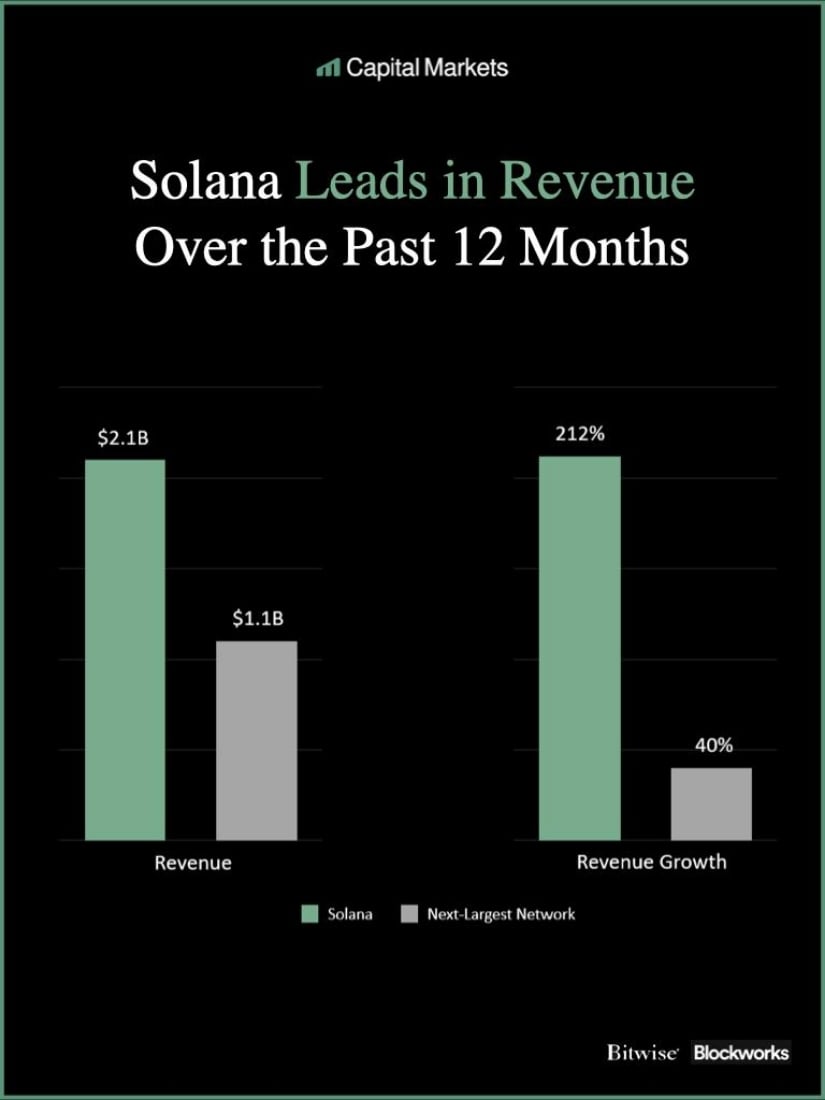

Comparative strengths of XRP and Solana

XRP fundamentals rest on settlement speed and payments use cases that appeal to banks and remittance firms. Solana throughput gives it an edge for high-frequency dApps and low-fee trading, supporting NFTs and DeFi activity. Comparing XRP vs Solana highlights different utility vectors that can attract distinct capital sources.

Institutional and retail demand shifts

Institutional flows crypto, custody integrations, and new exchange listings XRP can reduce friction for large buyers. Retail sentiment XRP often shows up earlier in search trends and social volumes, creating momentum that complements institutional accumulation. Combined inflows from both channels can amplify options-driven price moves XRP and SOL.

Risks and mitigations for traders and investors

Altcoin volatility can spike around expiries and illiquid strikes, raising options risk and widening spreads. Good crypto risk management means sizing positions to account for that volatility. Use stop-losses, stagger entry across expiries, and hedge large spot positions with protective puts to limit downside.

Monitor open interest distribution and flow reports to anticipate options-driven price moves XRP.

Track developer activity and on-chain metrics as altcoin fundamentals signals for longer-term conviction.

Apply position sizing best practices and avoid over-leveraging during rotations.

Buchenweg 15, Karlsruhe, Germany

For more information about Pepenode (PEPENODE) visit the links below:

Website: https://pepenode.io/

Whitepaper: https://pepenode.io/assets/documents/whitepaper.pdf

Telegram: https://t.me/pepe_node

Twitter/X: https://x.com/pepenode_io

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.