Dogecoin Price Prediction

Dogecoin won’t go away, and market tone suggests the OG meme coin is coiling for advance. Liquidity across majors has thickened, spreads improved, and volatility looks compressed, not broken. Alongside DOGE, Maxi Doge ($MAXI) keeps sliding onto watchlists as a rotational play if meme momentum returns. When this cocktail appears, traders refresh their Dogecoin price prediction frameworks and ask a question. Can DOGE hold a base long enough for rotation to kick in, or are we stuck chopping until a stronger catalyst? Quiet tells matter, especially order book depth, funding discipline, and steady spot bids.

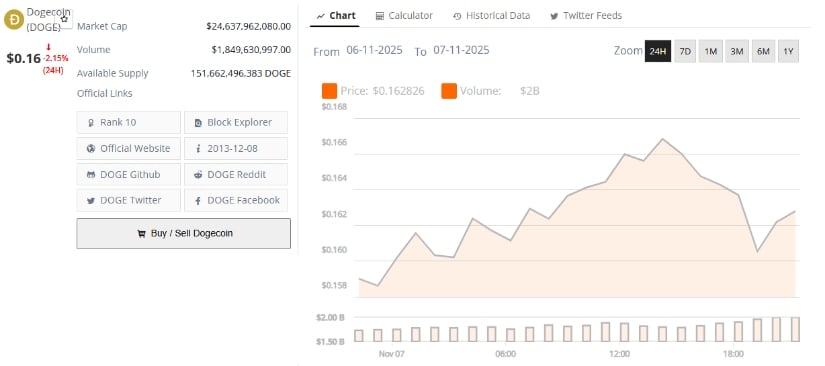

Market Snapshot And Why It Matters

Markets still orbit Bitcoin and Ethereum (https://coinmarketcap.com/currencies/ethereum/), but leadership often rotates during transition weeks and that’s where DOGE steals time on stage. When BTC prints higher lows while funding is calm risk appetite expands outwards towards higher beta names that the crowd already understands. DOGE fits that bill with an accessible narrative, deep familiarity and enough liquidity to absorb attention without breaking. Look for spot demand leading derivatives on green days, quick absorption of shallow dips and spreads that stay orderly during pushes because those ingredients often mean patient accumulation not tired churn.

Structure, Levels And What Pros Watch

DOGE looks like a compressed spring after weeks of narrowing ranges and cleaner respect for obvious moving averages (https://www.binance.com/en/academy/articles/moving-averages-explained). That doesn’t mean it’s a moonshot it just means the odds of an expansion when liquidity pockets align with momentum. The checklist is simple which is why it works. Do prior resistance zones flip into support after a break, do pullbacks hold above the midpoint of the last impulse and does open interest build without funding racing ahead of price. Traders who care about survival scale into confirmed retests rather than chase every flashy spike.

Liquidity, Flows And Early Tells

Catalysts for DOGE usually come in clusters, sometimes loud sometimes sneaky. A small integration headline, a new market maker or a viral meme can nudge flows at the margin but the early tells are consistent. Spot volume should lead not lag during green days, market makers should not blow spreads wide at the first hint of momentum and on-chain engagement should persist beyond one session. When those three conditions line up risk tends to pivot from sideways to up and even cautious desks start to rebuild exposure in measured boring increments.

Where Maxi Doge ($MAXI) Fits In

Maxi Doge ($MAXI) (https://maxidogetoken.com/), ticker MAXI, keeps slipping into the same conversations as traders revisit their Dogecoin price prediction notes and the overlap is not accidental. MAXI leans into familiar dog-coin energy while planning utility hooks that keep the loop active between headline bursts. The goal is simple, maintain community momentum with transparent distribution, budgeted campaigns and incentives that reward patience not reckless churn. If wallet growth holds, listings expand and builders ship visible progress MAXI becomes a nimble sidecar to a DOGE led mood shift not a gimmick that fades after one weekend sprint.

Scenarios For The Next 30 Days

Base case if current conditions persist a patient stair step higher with frequent probes of nearby resistance bands plus annoying fakeouts that punish late chasers. A bullish extension needs a reclaim of a prior weekly supply zone, sustained spot leadership and social velocity that doesn’t fade after the first pop. The bearish path is simpler, lose the higher low structure, see funding turn negative with falling open interest and accept range trading until majors pick a direction. None of these paths require heroics just discipline and the humility to adjust when the tape disagrees.

Trading Plan, Not Hype

Meme coins reward timing and punish stubbornness which is polite code for know your invalidation before you click buy. Decide where the idea breaks, size positions so you can think during drawdowns and avoid stacking leverage (https://www.binance.com/en/academy/articles/what-is-leverage-in-crypto-trading) on top of sentiment because it works until it ruins your week. Practical habits help. Scale partial profits at obvious levels, trail the remainder with a stop that’s not so tight a routine wick knocks you out and remember your average entry matters more than any accidental bottom tick. Investors can simply ladder entries instead of sprinting.

Fundamentals, Narrative, Community

Dogecoin will never read like a suit and tie prospectus and that’s fine because culture carries real weight. The community shows up, merchants experiment and development cycles while uneven deliver enough to keep the engine alive. For MAXI to matter beyond punchlines distribution must be understandable, budgets transparent and incentives aligned with holding rather than dump and run games. People don’t need perfection they need evidence the team is shipping and the next milestone is not a moving target. That’s how projects earn second chances and how buyers justify buying again.

On-Chain Clues And Social Velocity

On-chain clues help separate breathless narratives from durable trends and you don’t need a doctorate to track them. Watch unique wallets interacting with DOGE, average transaction sizes and whether activity persists after price cools for a session. Pair that with social velocity that looks organic rather than botted and the signals carry more weight. If MAXI’s metrics improve in parallel while DOGE holds structure rotation flows can be surprisingly efficient. Traders who combine these checks with patient execution often avoid the worst traps and they earn the right to buy again when momentum returns.

What Could Derail The Setup

Every bullish setup has an obvious villain sometimes two. A sharp drawdown in majors that erases higher lows will pull liquidity from meme names first and you’ll feel it in wider spreads, thinner bids and sloppy gaps between venues. Regulatory headlines can also freeze risk even when fundamentals remain unchanged. Finally if on-chain participation fades while funding stays elevated the market is telling you speculation outran demand. In each case the solution is boring, reduce risk, wait for cleaner signals and stop trying to be a hero while the tape argues with you.

A Practical Toolkit For Readers

Readers don’t need exotic tools to track this. Keep DOGEUSD open on a reliable charting platform for structure, note one or two rolling averages and mark prior weekly supply and demand. Check a neutral data site for circulating metrics and liquidity snapshots across venues then ignore any dashboard that turns curiosity into panic. Track MAXI beside DOGE for relative strength during green sessions it should hold gains better when the mood improves. Most important write the plan before the trade so that confidence comes from preparation rather than a stranger’s conviction at midnight.

Dogecoin Price Prediction, In Plain Words

In plain words if support holds and majors are calm Dogecoin can grind to nearby resistance over the next few weeks while pullbacks screw over impatient hands. That’s the environment for momentum traders who scale into clean retests and investors who prefer laddered entries to chasing. Maxi Doge ($MAXI) (https://maxidogetoken.com/) is close to that path as a rotational beneficiary when meme energy kicks in during late sessions. If the base breaks and liquidity dries up patience wins because range trading kills heroes. Use what you see, size risk to sleep and let the tape decide.

Buchenweg 15, Karlsruhe, Germany

For more information about Maxi Doge (MAXI) visit the links below:

Website: https://maxidogetoken.com/

Whitepaper: https://maxidogetoken.com/assets/documents/whitepaper.pdf?v2

Telegram: https://t.me/maxi_doge

Twitter/X: https://x.com/MaxiDoge_

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.