The main tag of Cryptocurrency News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Dogecoin Price Rally Above $0.74 ATHs In The Works As HTF Trend Holds — TradingView News

Crypto analyst Balo has assured that the Dogecoin price rally to a new all-time high (ATH) above $0.74 is in the works. He explained why this rally may be closer than some may imagine despite the recent bearish price action.

Dogecoin Price Eyes Rally Above $0.74 ATH

In an X post, crypto analyst Balo shared an accompanying chart showing that the Dogecoin price could surpass its current all-time high of $0.74, reaching $0.8 in the process. This came as the analyst opined that a major run was imminent for the foremost meme coin, despite its current downtrend.

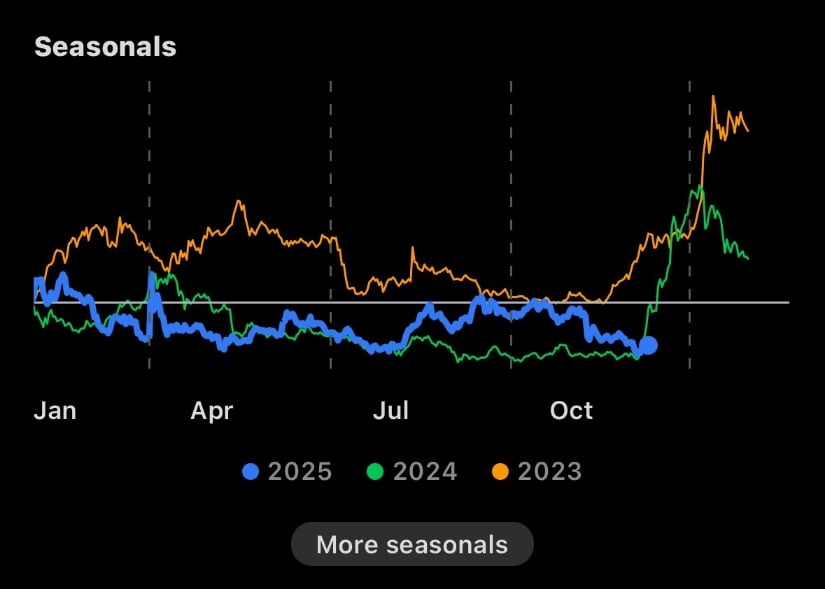

Balo explained that at each local bottom since early 2024, there has always been a “messy” Dogecoin price action that looks designed to shake people out before the real jump. He added that DOGE has made higher lows and maintained the higher-timeframe (HTF) trend, and that the same price pattern appears to be repeating now.

The crypto analyst also admitted that the parabolic surge for the Dogecoin price may feel far away, but that each mini cycle brings DOGE closer to its bull run. He also stated that this gives investors more time to accumulate before the DOGE price rallies to a new all-time high, which he claimed is just a matter of time.

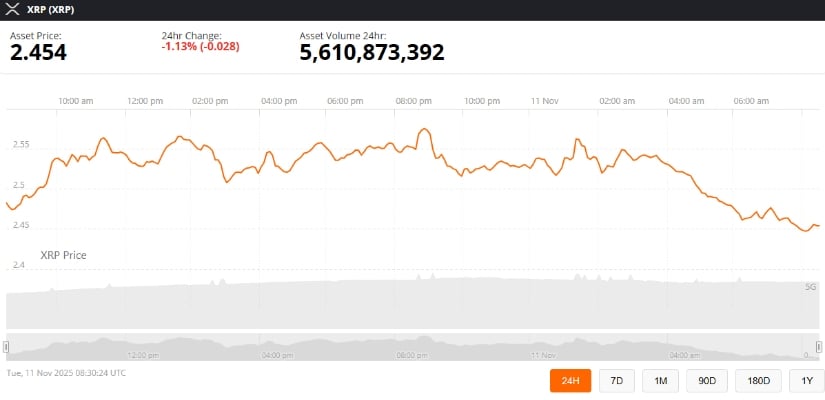

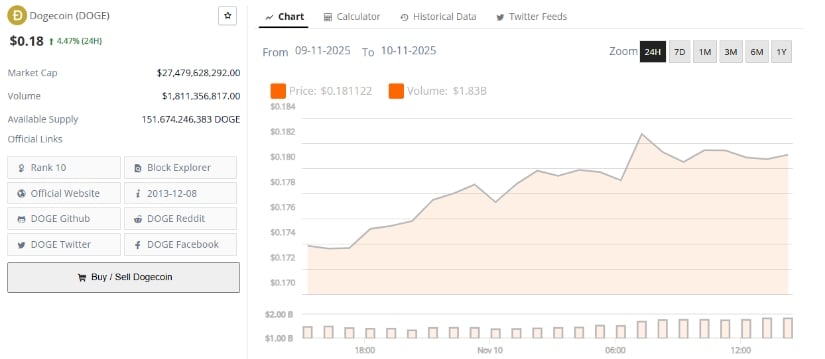

This bullish prediction for the Dogecoin price comes amid its current downtrend, with the meme coin struggling below the psychological $0.2 level. DOGE has continued to mirror Bitcoin’s price action, and with the flagship crypto threatening to drop below $100,000 again, crypto analyst Dogecoin OG predicts that the meme coin could fall to the $0.16 range.

Analyst Predicts Mega Run For DOGE

Crypto analyst Crypto Patel has also provided a bullish outlook for the Dogecoin price, declaring that the meme coin was ready for its next historic mega run. The analyst stated that the breakout and retest are complete and that the structure is locked and loaded for a parabolic explosion.

Furthermore, Crypto Patel revealed that the same pattern that sent the Dogecoin price flying during the 2017 and 2021 bull cycles is repeating again on the monthly timeframe. He added that the move looks even more powerful this time around. As such, he expects DOGE to rally 10x to 33x based on the fractal confluence and macro breakout structure.

Patel stated that targets 1 and 2 are $2 and $5, respectively, both of which mark new ATHs for the meme coin. His accompanying chart showed that the Dogecoin price could reach these targets sometime next year.

At the time of writing, the Dogecoin price is trading at around $0.17, down over 4% in the last 24 hours, according to data from CoinMarketCap.