The main tag of Cryptocurrency News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Polygon (MATIC) Price Forecast: Why Pepenode (PEPENODE)

The crypto market in 2025 is a mix of steady layer‐2 adoption and rapid presale activity. Investors are hunting for the best crypto to buy now and the next crypto to explode, balancing blue‐chip plays like Polygon with high‐upside token launches. Interest in Polygon (MATIC) Price and the broader Polygon price outlook remains strong as developers and wallets expand multi‐chain offerings.

At the same time, crypto presale trends are driving a new wave of retail demand. Projects that combine memecoin energy with real utility are standing out. Examples capturing attention include Maxi Doge (MAXI), Bounce Token (AUCTION), Best Wallet Token (BEST), Aptos (APT), and Pepenode (PEPENODE https://pepenode.io/).

Pepenode has emerged as a standout presale, drawing interest with a $0.0011138 presale price and over $1.9 million raised so far. Its tokenomics and novel mechanics-virtual node mining, NFT upgrades, leaderboard gamification, and token burns tied to upgrades-are creating strong early PEPENODE momentum among speculative and retail buyers.

Staking incentives that once reached very high yields and a rewards mix including tokens like PEPE and FARTCOIN are encouraging early participation while planned reductions in staking rewards create urgency. These design choices are key reasons Pepenode presale activity is accelerating alongside ongoing conversations about MATIC forecast 2025.

This article pairs a Polygon technical and fundamental outlook with an analysis of why Pepenode’s presale mechanics are pulling faster momentum. Readers will get a clear comparison of Polygon (MATIC) Price dynamics and why some investors are shifting a portion of capital toward presales that promise rapid upside.

Polygon (MATIC) Price: market outlook and technical forecast

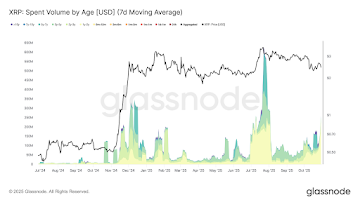

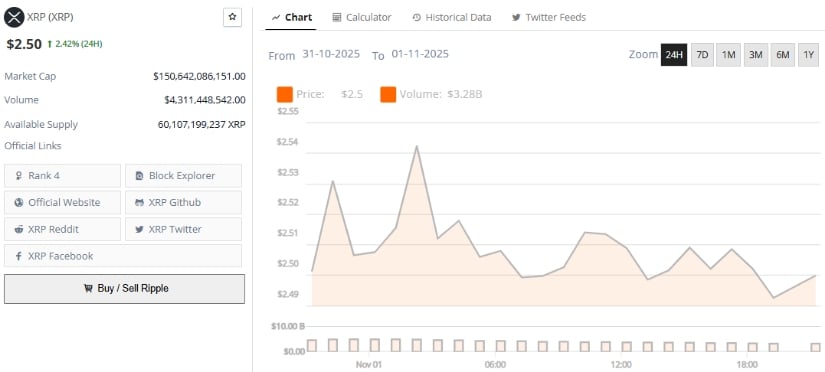

Market momentum for Polygon has shifted with Bitcoin correlation and macro cues driving short-term moves. Traders watch moving averages, RSI, and volume to time entries and exits. A rotating appetite toward presales and momentum tokens can pull capital away from established Layer-2 assets like Polygon, shaping near-term price action.

Recent price performance and key support/resistance levels

Recent swings show MATIC testing critical zones after a period of consolidation. Clear MATIC support resistance bands appear near prior swing lows and moving-average clusters, which traders use to size risk. Volume spikes at those levels signal whether buyers defend the range or sellers push lower.

Fundamental drivers for Polygon’s 2025 outlook

Polygon fundamentals rest on real-world adoption and developer traction. Growing dApp activity, multi-chain integrations, and partnerships can lift demand as Layer-2 demand rises to ease Ethereum congestion. Upgrades and higher onboarding from wallets and projects improve the narrative for longer-term appreciation.

Risk factors and scenario analysis for MATIC

Competition from other Layer-1 and Layer-2 networks poses upside limits for MATIC. Regulatory shifts, exchange delistings, or token unlocking events can increase volatility. Scenario planning should track BTC correlation, on-chain metrics, and macro risk-on signals to model best-case, base-case, and worst-case paths for Polygon (MATIC) Price.

Pepenode (PEPENODE) presale dynamics and why momentum is accelerating

The Pepenode presale https://pepenode.io/ has drawn attention with aggressive early metrics and a layered incentive design. A current PEPENODE price near $0.0011138 and more than $1.9M raised signal strong early demand. High advertised presale staking APY – staged to fall over time – rewards early liquidity and nudges participants to lock funds now rather than later.

Presale metrics and incentives are tuned to drive participation. Early buyers see high yields and token scarcity through upgrade burns tied to virtual node mining and NFT enhancements. Each virtual node upgrade consumes tokens, which reduces circulating supply and supports perceived value growth for holders who join during the presale window.

Gamification and community mechanics boost retention. Leaderboard rewards, NFT upgrade paths, and virtual node mining create daily tasks and milestones for users. Novelty reward tokens such as $PEPE and $FARTCOIN amplify social sharing and meme-driven reach, which can expand the community faster than plain token drops.

These engagement tools work with presale staking APY to encourage longer participation. Staged reward curves make early APY far higher, then reduce rates to slow new inflows. This design raises short-term excitement while signaling scarcity and commitment for those tracking PEPENODE price trends.

Pepenode’s model differs from classic memecoin launches in several ways. Standard memecoin presale mechanics often rely on simple liquidity events and broad viral marketing. Pepenode layers utility around virtual node mining, burn mechanics, and progressive NFT upgrades to create repeat use cases and retention incentives beyond pure hype.

Risks remain visible despite the momentum. Very high APY levels may prove unsustainable, and future token unlocks or vesting cliffs could trigger price pressure after the presale. Community growth and execution must keep pace with promises, or social virality may plateau and slow the PEPENODE price trajectory.

Market context: how other rising projects and presales influence investor attention

The 2025 presale landscape is pulling capital in new directions. Retail buyers chase high APY offers and low entry prices, while institutional desks watch protocols with clear roadmaps. Examples such as the Maxi Doge presale and Best Wallet Token presale show how fast fundraising can reshape short-term flows.

Presale economics often drive retail capital into early-stage tokens. Attractive pricing and staking incentives have drawn millions, and projects with multi-chain plans can siphon attention from established networks. Bounce AUCTION’s recent surge highlights how utility-focused launches can create momentum across the sector.

Presale and altcoin landscape shaping capital flows in 2025

High-yield presales alter liquidity distribution, pushing speculative capital away from large caps. That shift can lift overall market sentiment by boosting retail participation. At the same time, vesting schedules and listing timelines create bursts of trading volume that investors must track.

Developers integrating with Polygon or offering Polygon-compatible wallets increase cross-chain activity. The Best Wallet Token presale, with support for Polygon, is a clear case where wallet integrations could redirect usage back to MATIC-based services.

Cross-impact on Polygon (MATIC) and Pepenode demand

When new presales attract funds, MATIC vs presales becomes a tactical question for traders. Capital that flows into memecoins or utility launches can dampen near-term buying for MATIC. Conversely, projects launching on Polygon or bridging to it can raise protocol utility and steady long-term demand for MATIC.

Pepenode’s presale https://pepenode.io/ competes for the same retail attention. Careful monitoring of on-chain metrics, staking yields, and developer announcements helps gauge whether Pepenode benefits from sector rotation or loses ground to flashier campaigns.

Trading and investment considerations for U.S. investors

U.S. regulatory presales scrutiny matters now more than ever. KYC, AML, and securities-law considerations should be part of pre-investment checks. Investors should review audits, vesting terms, and exchange listing plans before allocating funds.

Position sizing is critical when balancing established tokens like MATIC against high-risk presales. Use watchlist triggers such as major exchange listings, on-chain activity, and developer updates to manage exposure. Track liquidity and vesting cliffs closely to avoid surprise sell pressure after listings.

Conclusion

Polygon (MATIC) Price forecast for 2025 centers on Layer-2 demand, developer adoption, and cross-chain integrations. Technical indicators – moving averages, RSI, and volume trends – alongside liquidity events and macro drivers will shape short- and medium-term moves. For U.S. investors, the MATIC investment takeaway is to watch exchange listings, on-chain activity, and developer updates before adjusting allocations.

Pepenode momentum reflects steep early incentives: a low presale price, sizable funds raised, high staking rewards, token burn mechanics, and gamified NFTs. Those features can spark rapid demand but also amplify crypto presale risks like unsustainable rewards, concentration, and unclear vesting. Treat such presales as high-risk, high-reward opportunities and size positions accordingly.

Actionable steps blend both strategies. Keep a core allocation to established infrastructure plays like Polygon while using small, controlled stakes for presales that show credible tokenomics and audits. Monitor signals – listings, audit reports, staking metrics, and macro shifts – to manage exposure across the 2025 crypto outlook.

Buchenweg 15, Karlsruhe, Germany

For more information about Pepenode (PEPENODE) visit the links below:

Website: https://pepenode.io/

Whitepaper: https://pepenode.io/assets/documents/whitepaper.pdf

Telegram: https://t.me/pepe_node

Twitter/X: https://x.com/pepenode_io

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.