The main tag of Cryptocurrency News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Dogecoin (DOGE) Price Prediction: Dogecoin Holds Key Support as Bulls Eye Explosive $0.50 Breakout

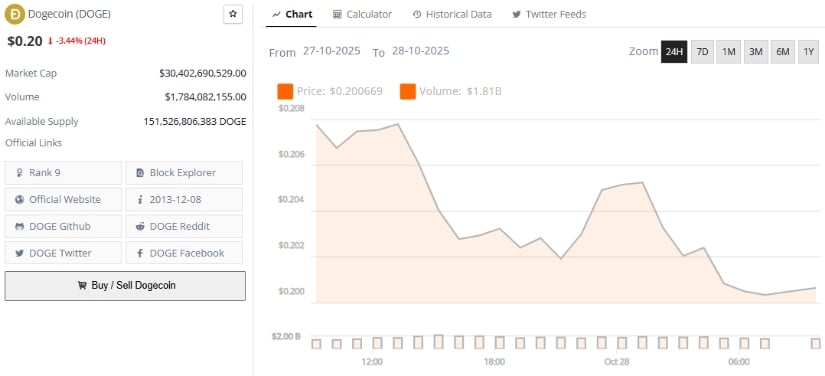

Dogecoin (DOGE) is capturing investor attention again, holding critical support at $0.19 as analysts anticipate a potential breakout that could propel the meme coin toward $0.50.

Despite a quieter crypto market and declining trading volumes, Dogecoin continues to demonstrate resilience. Technical setups, historical patterns, and growing whale accumulation indicate the coin is positioning itself for a bullish surge. Traders are closely monitoring key support and resistance levels to gauge the next major move.

Dogecoin Stability Amid Low Volume

According to a recent analysis by Saad Ullah of The Tradable, Dogecoin has been holding firm around the 0.5 Fibonacci retracement level at $0.19–$0.20. Even as trading volume declines, technical indicators suggest accumulation is ongoing, creating the conditions for a possible breakout.

Analyst Ullah noted, “All it takes is just some volume. Even a modest influx of buying pressure could quickly flip this quiet phase into action.”

On the weekly chart, Dogecoin (DOGE) holds key support at the cycle high VWAP, Ichimoku “Katana,” and 0.5 Fibonacci level, with low volume suggesting a small influx could trigger a quick rebound. Source: Cantonese Cat via X

Dogecoin’s stability in this zone is further reinforced by the Ichimoku “Katana” formation and cycle VWAP indicators, which historically highlight equilibrium points before major price moves. These technical signals collectively point to a growing bullish potential if the $0.19 support continues to hold.

Triangle Patterns Signal Potential Upside

On the weekly chart, Dogecoin is trading within a well-defined triangle pattern, a classic setup that often precedes periods of high volatility. Usman Salis, a market analyst, highlighted that “DOGE has delivered explosive rallies after extended periods of compression, making the current triangle setup particularly interesting for traders.”

Dogecoin’s weekly chart maintains a symmetrical triangle, signaling consolidation with potential for a bullish breakout or bearish reversal depending on key support and resistance levels. Source: Trader Tardigrade via X

Key levels to watch include the lower boundary at $0.19 and the upper triangle resistance near $0.30. A clean breakout above this threshold could propel Dogecoin toward the $0.50 mark and potentially higher. Historical cycles from 2021 and 2024 suggest that similar triangle consolidations preceded sharp upward movements, lending credibility to the pattern’s predictive value.

Accumulation and Whale Activity

Data from October 2025 shows that whales have been actively accumulating Dogecoin. According to Diana Sanchez, $DOGE has surged 43% year-to-date and “is holding strong above $0.20, a key support zone,” despite altcoins underperforming.

Dogecoin (DOGE) has surged 43% this year, holding firm above the $0.20 support zone, with $0.218 as a critical level—breaking it with volume could pave the way toward $0.50. Source: Diana Sanchez

Recent transactions indicate $134 million worth of Dogecoin was purchased by larger holders, flipping previous resistance at $0.21 into support. Analysts argue this accumulation could underpin the next bullish wave, potentially taking the coin to $0.50 if momentum persists.

Short-Term Targets and Outlook

Technical analysis points to immediate resistance levels at $0.25–$0.26, followed by higher targets at $0.33 and $0.50. According to Ali_charts, maintaining support near $0.18–$0.20 could allow DOGE to flip $0.25 into a new support level, enabling a rally toward $0.33 in the short term.

EtherNasyonal, a long-term market analyst, emphasized that “the real wave of expansion hasn’t arrived yet,” noting that Dogecoin is still in the accumulation phase within a lower band of an ascending channel. This mirrors previous bull waves observed in the 2015–2018 period, where DOGE climbed from fractions of a cent to roughly $0.018, marking a cumulative gain of over 5,000%.

Final Thoughts

Dogecoin (DOGE) continues to present an interesting combination of stability and bullish potential. Holding crucial support at approximately $0.19, paired with historical patterns and whale behavior, positions DOGE for an explosive push to $0.50.

Dogecoin was trading at around $0.20, down 3.44% in the last 24 hours at press time. Source: Brave New Coin

Amidst continued uncertainty in the broader crypto market, technical setups suggest the meme coin is coiling for another phase of bullish momentum, with opportunities for traders and long-term holders alike.

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.