The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Solana price holds firm above a key support level near $155, with participants watching closely to see if the market can reclaim momentum or slip into deeper correction.

Despite growing market pressure, Solana price has managed to hold its crucial support zone, keeping participants on edge as the next move could define the short-term trend. SOL’s recent retest near $155.83 showed strong defensive buying, even as technical indicators flashed mixed signals.

Solana’s price structure sits at a decisive make-or-break level as highlighted by the daily chart. The $155.83 support, nearly tagged to the cent in the latest retest, marks the final line of defense for bulls. The 50-day moving average is rolling over, while the 200-day MA has already been breached, showing momentum fatigue.

Solana holds its final support near $155.83, a level that could determine whether the trend recovers or slides into deeper correction. Source: The Wolf of Wall Street via X

A sustained close below this zone could confirm trend deterioration towards the $140 to $145 range, while holding above may invite a rebound back to the mid-$170s. The next sessions will be critical in determining whether Solana price maintains its structural integrity or slips into deeper corrective territory.

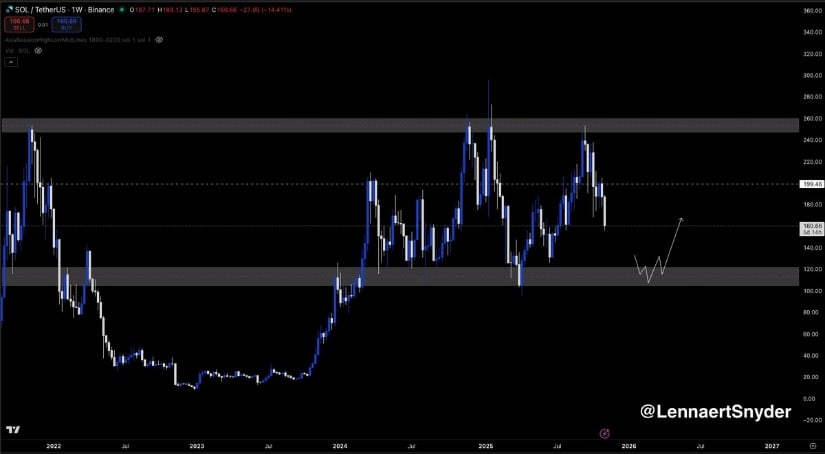

Lennart Snyder’s weekly outlook identifies $122 as the broader range low that could act as the next significant accumulation point for long-term buyers. Current price movement continues to drift lower within the midrange, suggesting the market is pricing in a potential corrective phase before another rally attempt.

Solana’s weekly structure signals a controlled correction, with $122 emerging as the next major accumulation zone for patient buyers. Source: Lennart Snyder via X

For long-term investors, this setup presents a prime zone, where participants may find a favorable risk-reward ratio near $120 to $125. A weekly reclaim above $200 remains the invalidation level for the broader downtrend, as it would mark a structure-breaking higher high. Until then, Solana remains in a controlled correction mode within its long-term channel.

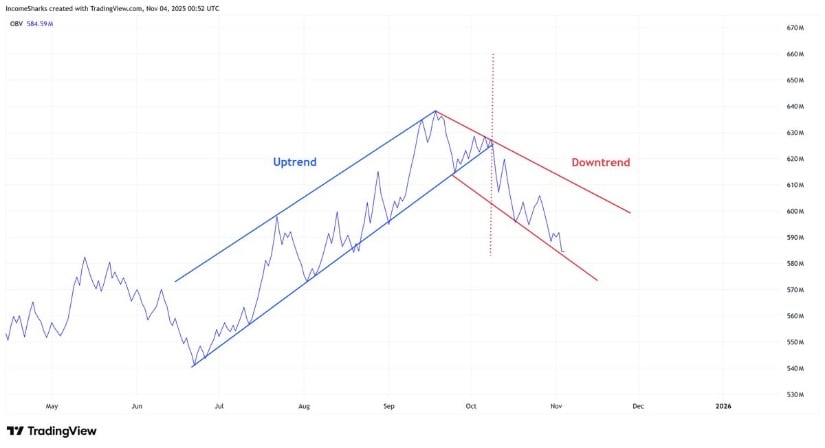

The chart points to a clear directional shift in Solana’s On-Balance Volume (OBV), which has now broken its prior uptrend and is sliding lower alongside price. This decline reflects weakening accumulation and growing sell-side dominance, confirming that buying activity has yet to return in strength.

Solana’s OBV trend breaks lower, signaling fading accumulation and strengthening sell-side pressure in the short term. Source: IncomeSharks via X

The OBV’s failure to stabilize alongside price supports the view that momentum remains bearish until sellers show exhaustion. Only a flattening OBV with rising volume on green candles would suggest that buyers are preparing to step back in, but for now, Solana price appears to be in the distribution leg of its cycle.

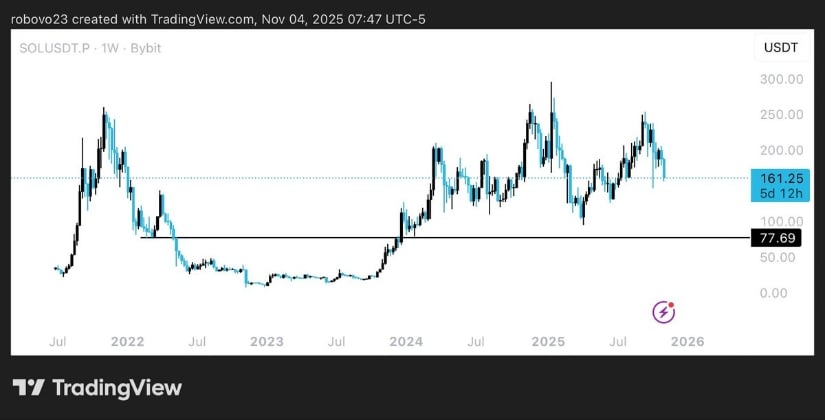

Technical outlook shared by robw00ds paints a bearish continuation setup on the weekly chart, indicating Solana could decline by up to 60% from current levels if the trend fails to stabilize. The chart shows price struggling to maintain higher lows, with a projected downside target towards $80–$85, corresponding to the previous accumulation range from mid-2023.

Solana’s weekly chart hints at a possible 60% correction towards $80–$85 if key supports fail to hold, keeping traders cautious of deeper downside risks. Source: robw00ds via X

This potential retracement would still fit within Solana’s macro cycle, where deep pullbacks have historically preceded large rallies. However, maintaining structure above $150 is essential to prevent broader downside. If buyers fail to defend this threshold, a full correction towards sub-$100 levels becomes increasingly likely for Solana price.

Despite the recent decline in Solana’s price, Solana ETFs recorded $70 million in fresh inflows in a single day, signaling sustained institutional interest. According to SolanaFloor, Bitwise’s BSOL accounted for $66.5 million, even as both Bitcoin and Ethereum ETFs experienced outflows during the same period.

Solana ETFs attract $70 million in a single day, highlighting strong institutional confidence even as broader crypto markets face outflows. Source: SolanaFloor via X

This divergence reinforces Solana’s position as a favored altcoin among institutional allocators, reflecting confidence in its long-term potential despite short-term turbulence. ETF inflows of this scale often precede recovery phases as liquidity returns to the ecosystem, offering a glimmer of optimism for the weeks ahead.

Solana’s technicals currently show a fragile structure but solid fundamental support. The charts warn of downside continuation if $155 fails, yet the ETF inflow data highlights institutional conviction that remains intact.

If Solana price holds the $150 to $155 zone and OBV begins flattening, a gradual recovery towards $175 to $190 could take shape in the short term. Conversely, a breakdown below this threshold would likely accelerate losses towards $120 or lower before the next accumulation phase. Overall, the network’s liquidity strength and ecosystem demand suggest that even amid short-term pressure, the long-term outlook for Solana price prediction remains resilient.

Bitcoin Price News: After $1B BTC Whale Sale, Will Bitcoin Stabilize and Ethereum’s Ecosystem Priorities Boost Confidence?

Bitcoin enters November after posting its first negative October in six years.

The drop has sparked debate among traders about whether the pullback signals a deeper decline or a normal pause before the next move.

According to CoinGecko, the Bitcoin price is down about -4.4% in the past day and trades near $107,000.

That slide has helped pull the broader crypto market lower, with total value down 2.2% to $3.64 trillion.

The retreat triggered more than $1.16Bn in long liquidations on November 3, showing how quickly leverage has unwound across major venues.

(Source: Coinglass)

The weakness came as global markets adjusted to shifting policy signals. Federal Reserve Chair Jerome Powell confirmed the end of quantitative tightening and said rate cuts were coming.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

But later comments cooled hopes for a cut in December, adding uncertainty and weighing on risk assets.

A long-silent Bitcoin wallet has also moved after nearly 14 years. The address transferred 10,000 BTC, first purchased for around $1.54 each, a crypto investor named Ted said.

The holder is believed to have sold the full amount today for roughly $1Bn, marking one of the largest profit-taking events linked to an early Bitcoin address.

On the charts, Bitcoin is now retesting a key support zone after pulling back toward a long-term blue moving-average line on the weekly timeframe.

The analyst noted that every major upswing since March 2023 has originated from this area, with past touches resulting in strong rebounds.

Bitcoin is trading close to $103,000, sitting just above its key moving average band at the same level.

A weekly close below this zone could signal that the rally is losing strength and open the door to a deeper pullback, possibly toward the $40,000 area.

If the trendline holds, the broader uptrend remains in place. In that case, analysts see room for a move toward $150,000 if buyers regain control.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Traders are watching how the market closes this week to get a clearer signal.

Meanwhile, the Ethereum Foundation has introduced a revised grant program designed to take a more proactive approach to ecosystem support.

The group paused new applications in August under its previous ESP framework, saying it needed time to reassess funding priorities.

Risk appetite is seeping back into crypto, and the Dogecoin (https://www.forbes.com/sites/digital-assets/article/what-is-dogecoin/) Price Prediction debate is getting louder for practical reasons, not just memes. Buyers are stepping in earlier on pullbacks, and depth looks less like a puddle and more like a shallow pool that keeps filling during active hours.

Options skew has nudged toward calls on strong sessions, while perp basis flips positive, then cools without collapsing – a healthier rhythm than the manic spikes we saw months ago. In the same breath, Bitcoin Hyper (HYPER) (https://bitcoinhyper.com/) keeps showing up in risk-on conversations as a sidecar trade when capital rotates into high-beta names.

None of this guarantees a moon shot, yet when multiple small tells line up, traders stop doom-scrolling and start planning entries with actual rules.

Three Signals Traders Are Actually Tracking Today

Think less prophecy, more receipts. First, time at highs – if DOGE can sit just under resistance without coughing up gains, that usually hints at patient bids rather than a one-print squeeze.

Second, volume profile – watch whether participation thickens near last week’s ceiling instead of drying up the moment price pokes it. Third, weekend vs weekday depth – sturdy books outside peak hours beat any single candle.

Mix in funding that normalizes after pushes, a gentle rise in open interest without the “everyone long now” alarm, and on-chain activity (https://coinmarketcap.com/academy/article/what-is-on-chain-analysis-how-to-analyze-on-chain-crypto-data) that stays steady while spot ticks up, and you get a Dogecoin Price Prediction path that leans constructive. It is not bulletproof. It is simply behavior you can verify without squinting.

Two Paths From Here – Breakaway or Box

From here, DOGE faces two clean scenarios. Breakaway: hold the mid-range, reclaim the prior day’s value area, and build volume above the most recent distribution.

If spreads remain sane when price retests the local highs, trend models can press into the next liquidity pocket. Box: fail to hold the middle, drift back into the chop band, and favor mean-reversion tactics until majors reset the tempo.

You do not need magic indicators – just track whether buyers add size after the first push or vanish at the first sign of heat. If you see thin prints near intraday peaks and no follow-through on the next session open, treat strength like a rental, not a forever home. Patience beats chasing candles into air.

Where Bitcoin Hyper (HYPER) Fits Beside DOGE

Dogecoin runs on crowd energy and timing, which is fine in a market that rewards attention. Bitcoin Hyper (HYPER) (https://bitcoinhyper.com/) tries to anchor that energy to routine – small actions, predictable costs, and frequent but modest ships that keep people returning without bribes.

Some holders report that this cadence feels practical, and early experiments around simple payments seem aimed at making crypto feel less like homework. If that loop holds, HYPER becomes a useful way to express risk when meme flows heat up, without depending on a single viral moment.

Emissions discipline, transparent trade-offs, and a roadmap that favors near-term delivery over slogans would turn curiosity into traction. None of this competes with DOGE directly – it complements it when rotation favors higher beta and utility gets a little respect.

48-Hour Checklist, Then the Dogecoin Price Prediction Frame

Here is the boring checklist that tends to work. Watch whether DOGE spends more minutes building value above last week’s node than below it, whether call skew strengthens without torching funding, and whether Asia-US handoff keeps depth intact instead of creating a vacuum.

Track if spot leads perps on pushes, not the other way around, and whether realized volatility (https://coinmarketcap.com/academy/glossary/volatility) expands with participation rather than with liquidation spikes.

If these boxes tick, the Dogecoin Price Prediction lens tilts toward breakout continuation with stair-step targets instead of straight lines.

If they do not, keep trading the box – scale into pullbacks, harvest into prior highs, and let majors set the next cue. Either path rewards discipline over drama, which is usually how real gains survive the headlines.

Buchenweg, Karlsruhe, Germany

For more information about Bitcoin Hyper (HYPER) visit the links below:

Website: https://bitcoinhyper.com/

Whitepaper: https://bitcoinhyper.com/assets/documents/whitepaper.pdf

Telegram: https://t.me/btchyperz

Twitter/X: https://x.com/BTC_Hyper2

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.

Analysts project ADA between $3–$12 by the end of 2025, but XRP Tundra’s verified dual-chain model offers structured growth beyond market speculation and sentiment swings.

Cardano’s native token ADA is regaining market attention after reclaiming resistance levels last tested in March. Analysts’ projections vary widely, reflecting optimism tempered by the sector’s inherent volatility. Data from CoinCodex forecasts ADA at $0.86 by late November and $1 by year-end, while independent analyst Sssebi expects $3, and Alex Becker and Investing Broz extend that range to $6–$12, depending on broader market strength.

The Fear & Greed Index sits at 34, signaling caution despite recent gains. ADA has traded positively on just 43% of days in the past month, showing that while momentum exists, conviction is still limited. Against this uneven backdrop, projects built on measurable logic rather than sentiment are drawing attention – and XRP Tundra sits squarely in that category.

Cardano’s recent climb above its March resistance point has encouraged traders looking for a technical breakout. Yet even among optimistic forecasts, there’s acknowledgment that ADA’s recovery depends heavily on sustained liquidity and Bitcoin’s broader trajectory. A single macro shift – such as renewed rate uncertainty – could compress altcoin performance despite improving fundamentals.

This hesitation explains why many investors now favor projects that publish fixed terms, verified audits, and structured emission models. XRP Tundra’s presale, operating transparently across both the XRP Ledger and Solana, fits that preference. Its appeal lies in data that participants can verify, not projections they have to interpret.

As ADA’s potential remains speculative, XRP Tundra operates on defined parameters. The project’s Phase 9 presaleprices TUNDRA-S at $0.147 with an 11% token bonus, paired with a free allocation of TUNDRA-X valued at $0.0735. Listing prices – $2.50 and $1.25 – establish a measurable upside based on published math.

Over $2 million has already been raised, driven by consistent wallet participation rather than momentum trading. The system’s transparency, verified by independent audits, offers a contrast to speculative charts dominating much of the current discussion.

A 2Bit Crypto analysis described Tundra’s approach as a “measurable model” in an industry defined by probabilities, noting that predictable design increasingly appeals to investors seeking yield rather than volatility exposure.

XRP Tundra’s technical advantage lies in its dual-chain design. The XRP Ledger (XRPL) anchors governance, reserves, and settlement integrity, while Solana manages execution and liquidity through the TUNDRA-S utility token. This split prevents the concentration of all functions in a single network and reduces congestion risk while maintaining verifiable performance metrics.

The arrangement allows for yield systems such as Cryo Vaults – Tundra’s audited staking environments – and Arctic Spinner, a transparent bonus feature that rewards participation through immediate token incentives. Both mechanisms reflect the same transparency standards shaping the project’s presale documentation.

Solana provides throughput; the XRP Ledger provides assurance. Together, they give XRP Tundra a base that supports growth without relying on speculation.

Every aspect of the Tundra ecosystem is documented and verifiable. Independent audits by Cyberscope, Solidproof, and FreshCoins confirm the integrity of its contract logic and vault mechanics, while full KYC verification by Vital Block authenticates the development team’s identity.

This documentation gives participants something the market often lacks: verifiable evidence. As capital rotates toward compliant and transparent ecosystems, XRP Tundra’s open-audit structure meets the standards institutional investors increasingly require for DeFi exposure.

Cardano’s bullish forecasts reflect optimism about market direction, but XRP Tundra’s design turns that optimism into measurable structure. While ADA’s 2025 targets depend on price momentum, Tundra’s returns are embedded in its published parameters and verified contracts. The distinction is between speculation and system — and markets under pressure are beginning to favor the latter.

Buy Tundra Now: official XRP Tundra website

How To Buy Tundra: step-by-step guide

Security and Trust: KYC Certificate

Join the Community: Telegram

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.

The current XRP price prediction has sparked optimism as traders anticipate fresh institutional inflows from potential spot ETF approvals.

The current XRP price prediction has sparked optimism as traders anticipate fresh institutional inflows from potential spot ETF approvals. Ripple’s growing clarity in regulatory matters and rising payment volumes are restoring confidence across markets. Meanwhile, investors are also keeping an eye on Remittix, a PayFi project that has already raised over $27.9 million through the sale of more than 683 million tokens, currently priced at $0.1166 each, a sign of growing demand for utility-focused crypto solutions.

Source: BNC XRP Market Data

The latest XRP price prediction points to a cautious but bullish setup. XRP’s current price is $2.24 with a marketcap of $134,611,948,909.00. Its price is -7.32% down in last 24 hours, as traders wait for news of a spot ETF filing. Technical indicators show that XRP is above its 100-day moving average, but it continues to struggle to cross above the $2.70 resistance line reached in late October. Breaking out of this point may provide an entry point into the short term to $3.00 to $3.30 in November.

Nonetheless, the latest XRP price prediction models indicate that spot ETF approval might be a game-changer. The legal clarity that has ensued after the courtroom wins of Ripple has preconditioned more institutional-grade involvement, whereas the advance of regulations has enhanced investor confidence. Market watchers are looking to sustained break above $2.70 to initiate fresh buying by institutional funds – to get exposure before a larger-scale advance in altcoins.

While traders continue to analyze every new XRP price prediction, Remittix continues to build real-world momentum. As a cross-border PayFi network, it bridges crypto and fiat transactions across 30+ countries, positioning itself as a next-generation digital payment hub. The project’s focus on transparency and compliance has helped it attract thousands of new investors.

Here’s what makes Remittix stand out in the current crypto news cycle:

Although the XRP price prediction shows room for growth, market observers believe long-term potential lies in utility-based ecosystems like Remittix. As ETFs bring institutional capital into crypto, investors will likely seek projects that solve real-world payment problems. Combining strong fundamentals, exchange readiness, and verified security, Remittix is rapidly emerging as one of the best crypto projects of 2025, potentially leading the next big altcoin 2025 wave.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.

The Solana (SOL) price is showing reactions at the recent support at $175. Based on forecasts, SOL could touch $131 in 2025 and trade between $619 and $819 by 2030. If it breaks above the previous ATH of $295, the next ATH may reach $418. On the other hand, if it falls below the key support of $94, the price could drop further toward $67 or even test the low around $70.

Within the last 2 years, SOL has been ranging between two key levels, 94.62 and 295.43, and a big move probably happens once the price breaks out of this range.

When SOL interacts with these specific price levels, expect significant price movement, making these areas ideal for short-term, rapid trades (scalping) within the established range.

If SOL breaks the key resistance at 295.43, a new high could form up to 418.

If SOL closes a W1 candle below the key support of 131.18, a deeper drop is possible towards 94.62. Should selling momentum overpower the market, SOL risks dropping back to its two-year low of 70.82.

Solana’s W1 Candle Chart and Its Key Levels.

| Support Key Level | Price |

| S1 | 174.00 |

| S2 | 131.18 |

| S3 | 94.62 |

| Resistance Key Level | Price |

| R1 | 252.00 |

| R2 | 295.43 |

Currently, Solana is trading around $168. In the bullish case, driven by the approval of spot ETFs and continued ecosystem growth, we strongly agree that SOL could reach about $252 in 2025 and trade between $295 and $418, or even $619 and $819 by 2030.

| Year | Price |

| 2025 | Avg ~$200 |

| 2026 | Avg ~$252 |

| 2027 | Avg ~$400 |

| 2028 | Avg ~$600 |

| 2029 | Avg ~$800 |

| 2030 | Avg ~$1000 |

In general, SOL price maintains its status as an asset with high performance and significant upside potential. For short-term traders, focus on the $131.18 support and the $252.00 resistance. For long-term investors, watch the fundamental drivers: network adoption rates, ETF capital inflows, and ongoing network stability/upgrades.

Solana launched onto the scene as a pioneering Layer 1 chain, aggressively tackling the long-standing blockchain scalability trilemma. Anatoly Yakovenko conceptualized this high-throughput vision in his 2017 white paper detailing Proof of History (PoH), the network’s foundational time-stamping innovation.

Moreover, professionals recognize Solana’s hybrid consensus, combining PoH with Proof of Stake (PoS), as a design choice favoring performance and developer adoption. While it has navigated network stability challenges, Solana’s dedication to raw speed and cost efficiency continues to attract significant institutional and retail interest.

Learn more: What is Meteora (MET)? Pioneering Infrastructure for Solana DeFi

Historically, the platform experienced meteoric growth in 2021, with the SOL price surging significantly. However, subsequent years brought sharp price volatility following the FTX collapse, alongside regulatory challenges, notably the SEC’s security classification allegations.

Despite the challenges, Solana has demonstrated resilience: 2025 saw the launch of Solana Spot ETFs, igniting renewed institutional confidence, further supported by critical stability upgrades like the Alpenglow Consensus Upgrade.

Recently, the Solana ecosystem has marked some significant milestones and updates:

Learn more: SOL, LTC, HBAR ETFs Emerge, Redefining Altcoin Investment

Can SOL reach $500 by the end of 2025?

It is possible but not likely. Specifically, some analysts, such as VanEck, project SOL could target as high as $520 by late 2025, driven by institutional flows from ETF approvals and continuous ecosystem development. However, combined with the market condition, the average prediction in this article for 2025 is around ~$200, with an optimistic case of $252.

What Are The Key Support And Resistance Levels For SOL Currently?

The key support levels to watch include $174.00, $131.18, and $94.62. Meanwhile, the key resistance levels include $252.00 and $295.43.

What Is The Average Forecast For SOL Between 2025 And 2030?

Based on the prediction table, the average price is around ~$131 in 2025 and approximately ~$1000 by 2030.

What Would Push SOL Above $300?

Several factors. On the chart, SOL needs to break the critical resistance level of $295.43. Furthermore, it requires a significant and sustained institutional capital inflow following ETF approvals. If the $295.43 level is breached, the next target could be up to $418.

What Is The Biggest Risk For SOL Right Now?

The biggest risks are potential regulatory uncertainty (due to previous SEC comments), network instability (despite recent upgrades), and a loss of the critical support level at $174.00.

What Is The Most Optimistic Forecast For SOL By 2030?

While specific 2030 projections vary, the most bullish case in the document suggests SOL could trade between $619 and $819. Additionally, other analysts predict SOL could reach $1,000 – $1,500 based on its position as a leading high-speed L1 for institutional finance and global payments.

Is SOL a Good Investment?

That depends on your overall outlook on the Solana ecosystem. If you are confident in its high throughput, low fees, and strong institutional interest (ETFs, Western Union), it can be a compelling long-term choice. However, volatility and network stability issues remain factors to consider.

Can SOL Reach $1,000 in the Future?

Yes. In an optimistic scenario driven by widespread adoption, sustained institutional investment from ETFs, and successful scaling upgrades, experts believe SOL could hit $1,000 (the average predicted price for 2030).

Can SOL Flip Ethereum’s Market Cap?

Yes. With its superior transaction speed and lower costs, Solana is often seen as a direct competitor to Ethereum. Especially, if it manages to capture a significantly larger share of the DeFi and NFT markets, it has the potential to challenge Ethereum’s market capitalization.

What is SOL’s All-time High?

SOL’s ATH is approximately $295.00, achieved around late 2021/early 2025.

Should I Buy SOL at the Current Price ($185 – $195)?

Right now, the current price mentioned in the article is around $168. If you believe in Solana’s long-term vision and its ability to capitalize on ETF flows and network upgrades, the current price is considered by some analysts to be in the accumulation zone (if $200 holds). However, you must clearly weigh the risks and your own investment thesis.

At current prices in early November 2025, the cryptocurrency community has no reasons to stay bullish from a technical perspective, the pseudonymous trader @PhilakoneCrypto says. This cycle should already be over by now, and institutional-driven purchases are not mirrored by price moves.

Bull market over: Four reasons by top trader

Despite most people being bullish about the midterm prospects of the crypto market, they all might be terribly wrong. From the perspective of cycle theory, this bull market is over, seasoned crypto trader @PhilakoneCrypto shared with his 178,000 followers in X (formerly Twitter).

The longest bull market after bitcoin halving was 546 days. We’re on day 562.

The longest bull market from the bottom in 2018 to the top in 2021 was 1,047 days.

We’re on day 1,078.

October was green for 6 years straight. We’re red in 2025.

Institutions and governments are buying…

He stressed that the longest bullish market in terms of post-halving days amount to 546 days, and we are on day 562 now.

Also, given the broader perspective, the previous bull run from the 2018 bottom to the 2021 top lasted 1,047 days, and we are now 1,078 days away from the FTX/Alameda collapse.

Bitcoin BTCUSD managed to close October in green for six years in a row before closing the month in red last week.

The overhyped institutional purchases have little-to-no effect on price performance, which is yet another signal of market exhaustion:

Institutions and governments are buying crypto, but we’re not moving. They’re using you as exit liquidity soon and will liquidity hunt you to buy back much cheaper.

As a result, charts and technical data give crypto holders “zero reasons to be bullish” today, the trader points out.

Fundstrat’s Mark Newton disagrees

Historically, the longitude of cryptocurrency cycles increases thanks to the market maturing and becoming more liquid. However, most analysts still point to Q4, 2025, as the potential most likely target for the market peak.

As covered by U.Today previously, some experts are still bullish on crypto in the midterm. Mark Newton, Fundstrat Global Advisors’ Head of Technical Strategy, highlighted that reliable tech analysis indicators only hint at accumulation.

Bitcoin BTCUSD, the largest cryptocurrency, lost the level of $110,000 today. As of press time, it is trading at $108,000, down 2.16% in 24 hours.

Crypto’s market cap lost 2.7% overnight and touched $3.6 trillion, CoinMarketCap data says.

While Dogecoin speculators bet on emotion, XRP Tundra builds on mathematics. The project’s ongoing Phase 9 presale prices its Solana-based utility token, TUNDRA-S, at $0.147 with an 11% bonus, while the companion TUNDRA-X governance token references $0.0735. Both have confirmed listing prices of $2.50 and $1.25, respectively — establishing a verifiable 27× upside when accounting for combined exposure and bonus allocations.

Over $2 million has already been raised through the presale, supported by the project’s dual-chain architecture that connects Solana’s performance layer with the XRP Ledger’s settlement efficiency. The two-token structure separates operational yield (TUNDRA-S) from governance and reserve functions (TUNDRA-X), creating a self-balancing system that scales without inflationary risk.

As HotCuppaCrypto noted in a recent , this separation lets Tundra maintain on-chain transparency while keeping emissions predictable — a combination increasingly favored by institutions seeking measurable DeFi exposure rather than speculative momentum.

Article Summary:

Jakarta, Pintu News – The chances of the ADA/USD price reaching $1 are increasing as November begins. Cardano price predictions for November 2025 are now receiving great attention, as ADA seems to be preparing for a rebound.

Despite its recent weakness around $0.60, increased accumulation by whales, growing technical pressure, and new milestones on the Cardano network indicate that the crypto may soon enter a stronger recovery phase.

After struggling to sustain recovery efforts, Cardano’s price is currently still under pressure, moving near the $0.60 support level. However, on-chain data shows a different picture.

Read also: ASTER Crypto Jumps 30% Today, Changpeng Zhao’s Big Buy Effect?

Whale wallets holding between 1 million and 10 million ADA have accumulated around 50 million tokens in the last 48 hours, according to data from Santiment.

This increased buying activity suggests that the whales see the current price drop as a strong entry opportunity, signaling long-term conviction. Historically, accumulation phases like this are often the start of broader price rallies, reinforcing optimism of a potential market reversal.

From a technical point of view, Cardano’s price chart still shows a consolidation pattern. However, many traders interpret this compression as an accumulation of momentum before a major price movement, which is expected to happen in the next 150 days, based on the analysis of the current market structure.

Market sentiment towards Cardano crypto ahead of November is influenced by several possible scenarios.

The first scenario depicts a base phase, where the price of Cardano in USD is expected to fluctuate in the range of $0.80 to $1.00. This is driven by rising optimism along with Hydra updates and Cardano’s tour of Asia, which could increase the visibility of the ecosystem.

In a more bullish scenario, analysts project that a “bull phase” could push ADA prices to reach between $1.20 to $1.50, fueled by the potential discussion of a Cardano ETF as well as a market rally led by Bitcoin .

Conversely, a bearish (pessimistic) scenario remains possible if macroeconomic conditions worsen. In this situation, ADA could drop to the $0.50-$0.65 range due to BTC’s correction and the lack of positive catalysts from major events.

Read also: Elon Musk Launches X Chat, a Messaging App with Bitcoin-Like Encryption!

Simultaneously, Cardano recorded an important technical achievement that further strengthens its long-term appeal. The network successfully passed its decentralization test through Amazon Web Services (AWS), as reported by Cardano Feed.

This validation shows that Cardano is able to meet decentralization standards by leveraging AWS’s cloud infrastructure.

Network resilience like this boosts investor confidence and supports Cardano’s overall price prediction narrative. More so as decentralized network verification is increasingly becoming a key benchmark for institutional as well as retail trust.

As the month of November progresses, Cardano’s price prediction for November 2025 reflects market conditions that are balancing between technical consolidation, whale confidence, and innovative network advancements. All of these factors suggest that a strong recovery phase may be imminent.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

Solana price sits around $184 as traders weigh short-term pullbacks against strong long-term growth signals. The network’s steady ecosystem expansion continues to strengthen investor confidence, keeping analysts focused on their bullish Solana price prediction targets. While the $200 resistance has held firm, market sentiment and on-chain data still point toward another upward push.

There is a new altcoin called Remittix (RTX) that is gaining the attention of traders. Remittix has secured a BitMart listing after the project raised $20 million, followed by an LBank listing after $22 million, with a third exchange listing currently in preparation.

Solana price recently failed to break the $205 barrier, which has caused a short-term correction that pulled it below $198 and $195. Yet, the bulls have guarded the support extended by the $188–$192 zone, not allowing it to turn further negative. A bearish descending channel has been set on the hourly chart, and resistance is near $200, which remains the key level to reclaim.

According to analysts, this setup reflects a normal cooling phase within a broader bullish structure. The Solana price prediction is still optimistic as long as the buyers retain more than $188. The immediate obstacle will be at $198 and then, $205.

Any confirmed breakout of the levels may see a short-term opening in the $220 or even $225. Although the RSI has not exceeded 50, which is a signal of neutral momentum, the increase in the spot interest and constant inflows in staking indicate that a new wave will soon follow.

While Solana leads this smart-contract layer-1 rally, payments-focused projects like Remittix are showing growth in the real-world utility space. As on-chain adoption accelerates, many traders see Remittix as a strong complement to Solana for diversified crypto portfolios, balancing growth potential with tangible utility.

Remittix has sold over 682 million tokens, raised more than $27.8 million, and its token is priced at $0.1166. The project also features a 15% USDT referral paid daily and a $250,000 giveaway to reward community participation.

Some key reasons Remittix is gaining attention

The next few sessions will likely decide whether Solana can reclaim the $200 mark or retest the $188 floor. Holding the higher range keeps the bullish Solana price prediction alive, especially as ecosystem data and institutional interest continue to rise.

As Solana strengthens its network position and new capital enters, paired with utility projects like Remittix expanding alongside. This Q4 could be where both tokens redefine what sustainable growth looks like in crypto.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.