The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The crypto market in 2025 is a mix of steady layer‐2 adoption and rapid presale activity. Investors are hunting for the best crypto to buy now and the next crypto to explode, balancing blue‐chip plays like Polygon with high‐upside token launches. Interest in Polygon (MATIC) Price and the broader Polygon price outlook remains strong as developers and wallets expand multi‐chain offerings.

At the same time, crypto presale trends are driving a new wave of retail demand. Projects that combine memecoin energy with real utility are standing out. Examples capturing attention include Maxi Doge (MAXI), Bounce Token (AUCTION), Best Wallet Token (BEST), Aptos (APT), and Pepenode (PEPENODE https://pepenode.io/).

Pepenode has emerged as a standout presale, drawing interest with a $0.0011138 presale price and over $1.9 million raised so far. Its tokenomics and novel mechanics-virtual node mining, NFT upgrades, leaderboard gamification, and token burns tied to upgrades-are creating strong early PEPENODE momentum among speculative and retail buyers.

Staking incentives that once reached very high yields and a rewards mix including tokens like PEPE and FARTCOIN are encouraging early participation while planned reductions in staking rewards create urgency. These design choices are key reasons Pepenode presale activity is accelerating alongside ongoing conversations about MATIC forecast 2025.

This article pairs a Polygon technical and fundamental outlook with an analysis of why Pepenode’s presale mechanics are pulling faster momentum. Readers will get a clear comparison of Polygon (MATIC) Price dynamics and why some investors are shifting a portion of capital toward presales that promise rapid upside.

Polygon (MATIC) Price: market outlook and technical forecast

Market momentum for Polygon has shifted with Bitcoin correlation and macro cues driving short-term moves. Traders watch moving averages, RSI, and volume to time entries and exits. A rotating appetite toward presales and momentum tokens can pull capital away from established Layer-2 assets like Polygon, shaping near-term price action.

Recent price performance and key support/resistance levels

Recent swings show MATIC testing critical zones after a period of consolidation. Clear MATIC support resistance bands appear near prior swing lows and moving-average clusters, which traders use to size risk. Volume spikes at those levels signal whether buyers defend the range or sellers push lower.

Fundamental drivers for Polygon’s 2025 outlook

Polygon fundamentals rest on real-world adoption and developer traction. Growing dApp activity, multi-chain integrations, and partnerships can lift demand as Layer-2 demand rises to ease Ethereum congestion. Upgrades and higher onboarding from wallets and projects improve the narrative for longer-term appreciation.

Risk factors and scenario analysis for MATIC

Competition from other Layer-1 and Layer-2 networks poses upside limits for MATIC. Regulatory shifts, exchange delistings, or token unlocking events can increase volatility. Scenario planning should track BTC correlation, on-chain metrics, and macro risk-on signals to model best-case, base-case, and worst-case paths for Polygon (MATIC) Price.

Pepenode (PEPENODE) presale dynamics and why momentum is accelerating

The Pepenode presale https://pepenode.io/ has drawn attention with aggressive early metrics and a layered incentive design. A current PEPENODE price near $0.0011138 and more than $1.9M raised signal strong early demand. High advertised presale staking APY – staged to fall over time – rewards early liquidity and nudges participants to lock funds now rather than later.

Presale metrics and incentives are tuned to drive participation. Early buyers see high yields and token scarcity through upgrade burns tied to virtual node mining and NFT enhancements. Each virtual node upgrade consumes tokens, which reduces circulating supply and supports perceived value growth for holders who join during the presale window.

Gamification and community mechanics boost retention. Leaderboard rewards, NFT upgrade paths, and virtual node mining create daily tasks and milestones for users. Novelty reward tokens such as $PEPE and $FARTCOIN amplify social sharing and meme-driven reach, which can expand the community faster than plain token drops.

These engagement tools work with presale staking APY to encourage longer participation. Staged reward curves make early APY far higher, then reduce rates to slow new inflows. This design raises short-term excitement while signaling scarcity and commitment for those tracking PEPENODE price trends.

Pepenode’s model differs from classic memecoin launches in several ways. Standard memecoin presale mechanics often rely on simple liquidity events and broad viral marketing. Pepenode layers utility around virtual node mining, burn mechanics, and progressive NFT upgrades to create repeat use cases and retention incentives beyond pure hype.

Risks remain visible despite the momentum. Very high APY levels may prove unsustainable, and future token unlocks or vesting cliffs could trigger price pressure after the presale. Community growth and execution must keep pace with promises, or social virality may plateau and slow the PEPENODE price trajectory.

Market context: how other rising projects and presales influence investor attention

The 2025 presale landscape is pulling capital in new directions. Retail buyers chase high APY offers and low entry prices, while institutional desks watch protocols with clear roadmaps. Examples such as the Maxi Doge presale and Best Wallet Token presale show how fast fundraising can reshape short-term flows.

Presale economics often drive retail capital into early-stage tokens. Attractive pricing and staking incentives have drawn millions, and projects with multi-chain plans can siphon attention from established networks. Bounce AUCTION’s recent surge highlights how utility-focused launches can create momentum across the sector.

Presale and altcoin landscape shaping capital flows in 2025

High-yield presales alter liquidity distribution, pushing speculative capital away from large caps. That shift can lift overall market sentiment by boosting retail participation. At the same time, vesting schedules and listing timelines create bursts of trading volume that investors must track.

Developers integrating with Polygon or offering Polygon-compatible wallets increase cross-chain activity. The Best Wallet Token presale, with support for Polygon, is a clear case where wallet integrations could redirect usage back to MATIC-based services.

Cross-impact on Polygon (MATIC) and Pepenode demand

When new presales attract funds, MATIC vs presales becomes a tactical question for traders. Capital that flows into memecoins or utility launches can dampen near-term buying for MATIC. Conversely, projects launching on Polygon or bridging to it can raise protocol utility and steady long-term demand for MATIC.

Pepenode’s presale https://pepenode.io/ competes for the same retail attention. Careful monitoring of on-chain metrics, staking yields, and developer announcements helps gauge whether Pepenode benefits from sector rotation or loses ground to flashier campaigns.

Trading and investment considerations for U.S. investors

U.S. regulatory presales scrutiny matters now more than ever. KYC, AML, and securities-law considerations should be part of pre-investment checks. Investors should review audits, vesting terms, and exchange listing plans before allocating funds.

Position sizing is critical when balancing established tokens like MATIC against high-risk presales. Use watchlist triggers such as major exchange listings, on-chain activity, and developer updates to manage exposure. Track liquidity and vesting cliffs closely to avoid surprise sell pressure after listings.

Conclusion

Polygon (MATIC) Price forecast for 2025 centers on Layer-2 demand, developer adoption, and cross-chain integrations. Technical indicators – moving averages, RSI, and volume trends – alongside liquidity events and macro drivers will shape short- and medium-term moves. For U.S. investors, the MATIC investment takeaway is to watch exchange listings, on-chain activity, and developer updates before adjusting allocations.

Pepenode momentum reflects steep early incentives: a low presale price, sizable funds raised, high staking rewards, token burn mechanics, and gamified NFTs. Those features can spark rapid demand but also amplify crypto presale risks like unsustainable rewards, concentration, and unclear vesting. Treat such presales as high-risk, high-reward opportunities and size positions accordingly.

Actionable steps blend both strategies. Keep a core allocation to established infrastructure plays like Polygon while using small, controlled stakes for presales that show credible tokenomics and audits. Monitor signals – listings, audit reports, staking metrics, and macro shifts – to manage exposure across the 2025 crypto outlook.

Buchenweg 15, Karlsruhe, Germany

For more information about Pepenode (PEPENODE) visit the links below:

Website: https://pepenode.io/

Whitepaper: https://pepenode.io/assets/documents/whitepaper.pdf

Telegram: https://t.me/pepe_node

Twitter/X: https://x.com/pepenode_io

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.

While Dogecoin’s chart may resemble its 2021 setup, analysts argue that now shows even stronger technical potential. Built for global payments, Remittix bridges the gap between crypto and fiat, letting users send digital assets that instantly convert into bank deposits anywhere in the world. It’s a real-world utility project, something Dogecoin still lacks beyond social media hype.

Over $27.7 million raised from early backers

Over 681 million tokens distributed across global wallets

Beta testing for the Remittix Wallet is now live

15% USDT rewards via the referral program, paid daily

The platform already serves freelancers, NGOs, and small businesses needing fast, borderless transactions. With BitMart and LBank listings confirmed and CertiK verification secured, are hard to ignore.

In a departure from meme-focused approaches, Remittix brings together transactional effectiveness, scalability, and compliance readiness. Many industry experts forecast that RTX has the potential to be one of the best-performing assets in 2025 and should achieve sustainable growth, unlike the hype coins, whose growing pains will not appear as promising on the metrics.

While XRP price prediction models suggest modest consolidation toward $2.61 by November, emerging challenger Remittix is reshaping market narratives with its innovative payment solution. XRP price has struggled maintaining momentum despite institutional backing, now trading cautiously near support levels.

Meanwhile, the $0.11 token Remittix leverages CertiK-verified security and real-time fiat conversion across 30+ countries—directly challenging XRP’s cross-border dominance. As Remittix approaches critical milestones with its live wallet beta, analysts increasingly question whether XRP price can compete with projects delivering tangible, everyday payment utility. Here’s all you need to know today to stay in the loop.

The narrative for XRP remains strong: with reports pointing to renewed ETF filings and institutional interest, many believe big money could flood in. According to one recent report, XRP’s price could be propelled by the pending U.S. spot-ETF moves.

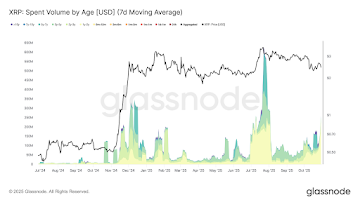

Long-term XRP holders are making moves. As the price slid from $3.3 to $2.4, these folks didn’t just sit back—they ramped up their activity and got people talking again about where XRP’s headed.

Glassnode’s latest numbers show these experienced holders boosted their daily XRP spending by almost 580%, jumping from $38 million to $260 million (based on the 7-day average). That’s a big spike, and it looks like plenty of them are cashing in after the drop.

Even with all this selling, though, XRP’s key support levels are still holding strong. It feels like the price is right on the edge, and XRP price prediction models hint at a major rebound happening soon.

Yet, the competition is heating up. When analysts talk about a $0.11 token that could overshadow XRP’s dominance, it’s clear the payment-vertical narrative is shifting. For XRP, this means: it’s no longer just about regulatory clearance—it’s about defending its real-world utility lead.

Meet the payments ecosystem poised to out-pace the big names—and the one many analysts are quietly touting. While XRP manages regulatory headlines, this project is busy building global infrastructure, bank-linked payouts, and real-world frictionless flows.

Remittix isn’t just a token, it’s a transaction network. What you may not know: the team has already landed key integrations, with the web-app now in full development and user-flow beta is active.

Only a handful of tokens can claim both payment utility and growth momentum; compared to XRP, this one is leaner, fresher and closer to its breakout window. With less hype built in, the upside may be larger.

Compared to XRP that is widely known and priced for expectation, Remittix is still under-valued, still has room, and still gets top attention from smart money. Early data shows rising holder counts, wallet upgrades, and partnerships that hint at scale.

The door is still open, but not for long. This payment-token is already showing 40,000+ holders and 370,000+ giveaway entries, signaling that momentum is well alive. Listings on centralized exchanges are in motion, and the referral program is stacking rewards. You earn 15% of each referral’s purchase back in USDT, claimable every 24 hours via your dashboard.

If you wait until XRP’s ETF headlines flood the news, you might see the token climb, but you’ll also see the cheaper play already soar. Don’t watch the opportunity pass. Choose now whether you’ll participate or observe.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

Solana price prediction discussions are back in focus as investors look for scalable performance, stable fees, and strong developer traction. The 2025 debate now centers on whether upcoming network upgrades and deeper ecosystem engagement can justify a major revaluation.

Alongside that, PayFi keeps drawing attention, with projects like positioning for real-world settlement rather than pure speculation. Analysts framing a Solana prediction to the high hundreds point to sustained usage, cleaner validator performance, and healthier derivatives structure.

The ROI question, however, is not only about blockspace; it is also about payments utility. That is where Remittix’s PayFi push enters the conversation in Q4 roadmaps.

Is Bitcoin price losing steam after Uptober? Jump into the latest Bitcoin and Ethereum price prediction for the first Week of November.

Bitcoin traded near $110,000 on Saturday as sentiment stayed cautious after a slow “Uptober.”

The market attempted to recover from losses incurred during Friday’s Wall Street session, but steady selling persisted throughout the week on US exchanges and in spot Bitcoin exchange-traded funds.

On-chain research firm Glassnode noted that recent ETF outflows point to “rising sell pressure from TradFi investors and renewed weakness in institutional demand.”

Data from UK-based manager Farside Investors showed roughly $191M leaving spot Bitcoin ETFs on Friday, following another $488M withdrawn on Thursday.

(Source: Farside)

Glassnode stated that broader markets showed little reaction to the recent interest-rate cut by the US Federal Reserve.

The firm noted on X that the Fed delivered the expected reduction but kept a hawkish tone for December, which has cooled optimism.

DISCOVER: Top 20 Crypto to Buy in 2025

Bitcoin held near $110,000 in November as analyst Ali Martinez questioned whether the current structure could support a move toward $250,000 by December.

The monthly chart he shared shows Bitcoin still tracking an uptrend that began after its 2022 bottom, with two years of higher highs and higher lows.

Martinez pointed to past drawdowns of about 73% in 2018, 50% in 2019, and 71% between 2021 and 2022.

He said those heavy corrections suggest the worst phase may already be behind the market.

Since then, Bitcoin has reclaimed key macro resistance levels and is now consolidating close to its record range.

The monthly MACD remains positive, though it has begun to flatten. That is an indication of dwindling momentum following a protracted recovery. Tighter candle action is also witnessed by the recent candles, as Bitcoin trades laterally under 120,000.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Ether is staying stagnant within a relatively important support level.

The price recently bounced from the $3,600–$3,750 area after briefly slipping under a short descending trendline, showing that buyers are still protecting this zone.

As per Bitbull, a crypto analyst, a possible bull-flag pattern is taking shape below the $4,100–$4,250 resistance band, which has blocked upside moves since mid-2025.

(Source: X)

Tony Kim

Nov 01, 2025 05:35

MATIC price prediction suggests potential 18-53% upside targeting $0.45-$0.58 resistance levels, though bearish momentum indicators warrant caution for short-term traders.

Polygon’s MATIC token stands at a critical juncture as technical indicators present a mixed picture for the coming weeks. With the current price at $0.38, MATIC sits precisely at its pivot point, creating an ideal setup for a directional breakout that could determine the next significant price movement.

• MATIC short-term target (1 week): $0.42 (+10.5%) – Testing SMA 20 resistance

• Polygon medium-term forecast (1 month): $0.45-$0.58 range – Key resistance cluster zone

• Key level to break for bullish continuation: $0.43 (SMA 20) followed by $0.45 (SMA 50)

• Critical support if bearish: $0.35 immediate support, $0.33 strong support level

Recent analyst predictions show a notable divergence in timeframes and price expectations. Changelly’s conservative MATIC price prediction targets the $0.196-$0.199 range for short-term movements, representing a significant disconnect from current price levels around $0.38. This suggests either outdated analysis or an expectation of substantial downward pressure.

Conversely, medium-term Polygon forecast models from PricePredictions.com and LongForecast.com paint a dramatically different picture. PricePredictions.com projects an average MATIC price target of $0.715326, while LongForecast.com suggests an ambitious $5.263 target. These projections appear overly optimistic given current technical conditions and represent a stark contrast to near-term bearish indicators.

The consensus among recent predictions indicates modest short-term volatility with potential for significant medium-term appreciation, though the wide variance in targets suggests high uncertainty in the current market environment.

Polygon technical analysis reveals a token positioned for a crucial test of overhead resistance levels. The current price at $0.38 sits directly on the pivot point, with MATIC trading below all major moving averages except the 7-day SMA at $0.37.

The RSI reading of 38.00 places MATIC in neutral territory but closer to oversold conditions, suggesting potential for upward movement if buying pressure emerges. However, the MACD histogram at -0.0045 indicates persistent bearish momentum, creating conflicting signals that require careful interpretation.

Bollinger Bands analysis shows MATIC positioned at 0.29 within the bands, closer to the lower band at $0.31 than the upper band at $0.56. This positioning typically suggests oversold conditions and potential for mean reversion toward the middle band (SMA 20) at $0.43.

Volume analysis shows moderate activity at $1,074,371 on Binance spot markets, insufficient to confirm a strong directional bias but adequate for testing nearby resistance levels.

The primary bullish MATIC price target focuses on reclaiming the SMA 20 at $0.43, representing a 13% upside from current levels. Success at this level opens the path to test the SMA 50 at $0.45, which aligns with the lower end of our medium-term Polygon forecast range.

Breaking above $0.45 would target the upper Bollinger Band at $0.56, coinciding with immediate resistance levels. This scenario requires RSI to break above 50 and MACD to flip positive, indicating renewed bullish momentum. The ultimate bullish target remains the immediate resistance zone at $0.58, representing a 53% upside potential.

For the bullish case to materialize, MATIC needs sustained buying pressure above the current pivot point and successful defense of the $0.37 SMA 7 level as new support.

The bearish scenario targets immediate support at $0.35, representing an 8% downside risk from current levels. Failure to hold this level would likely trigger a test of strong support at $0.33, near the 52-week low of $0.37.

A break below $0.33 would invalidate the current consolidation pattern and potentially target the lower Bollinger Band at $0.31. This scenario would be confirmed by RSI dropping below 30 and MACD histogram increasing its negative divergence.

The key risk factor remains the distance from the 52-week high of $1.27, representing a 70% decline that suggests underlying fundamental weakness that technical analysis alone cannot overcome.

The current setup presents a moderate buy opportunity for traders comfortable with near-term volatility. The optimal entry strategy involves accumulating positions between $0.37-$0.38, using the SMA 7 and pivot point as natural support levels.

Conservative investors should wait for a confirmed break above $0.43 (SMA 20) before establishing positions, accepting higher entry prices in exchange for reduced risk. This approach aligns with the “buy or sell MATIC” decision framework that prioritizes confirmation over early entry.

Risk management requires strict stop-loss placement below $0.35, limiting downside exposure to approximately 8-10% from current levels. Position sizing should reflect the mixed technical signals, suggesting moderate allocation rather than aggressive positioning.

Our MATIC price prediction anticipates a 30-day target range of $0.45-$0.58, representing 18-53% upside potential from current levels. The prediction carries medium confidence due to conflicting technical indicators and the significant gap between short-term and medium-term analyst forecasts.

Key confirmation signals include RSI breaking above 45, MACD histogram turning positive, and sustained trading above the $0.43 SMA 20 level. Invalidation would occur on a decisive break below $0.35 immediate support.

The timeline for this Polygon forecast extends through December 2025, with initial resistance tests expected within 7-14 days. Traders should monitor volume expansion and momentum indicator improvements as early confirmation signals for the predicted upward movement.

Image source: Shutterstock

While Dogecoin holds near $0.1855, early investors are pivoting toward , a new meme coin presale that blends storytelling, deflationary supply, and transparent mechanics into a structured ecosystem.

Launched on presale just three days ago, Noomez has already raised $7,572.93, with traction increasing among early-stage investors.

As of Saturday, November 1, the project is set to transition from Stage 1 to Stage 2, with the token price rising from $0.00001 to $0.000012320.

Each presale stage lasts up to seven days or closes early once sold out, with all unsold tokens burned permanently at the end of each stage: a key deflationary feature that strengthens long-term supply dynamics.

Excitement is building around the latest Cardano price prediction as analysts highlight a possible rally toward the $1 mark. While ADA shows technical strength, growing investor attention is also shifting toward Remittix (RTX) https://remittix.io – a fast-rising Ethereum-based payment token that has raised over $27.7 million through the sale of 681 million tokens at $0.1166 each. As ADA consolidates, Remittix’s real-world utility and adoption are turning heads across the crypto market.

Cardano Price Prediction: ADA Targets $1 Amid Rising Bullish Momentum

After gaining 0.5% in the past 24 hours, Cardano (ADA) trades around $0.61, facing resistance near $0.62. The symmetrical triangle pattern on the 12-hour chart indicates consolidation, often preceding strong breakouts. Ali Martinez https://x.com/ali_charts/status/1983307288032293251 expects that if ADA breaks above the $0.80-$0.90 resistance zone, it could accelerate toward $1.10 or even $1.70.

Market analysts emphasized that Cardano needs to hold above the key support at $0.65 to maintain momentum. Similarly, Dan Gambardello https://x.com/cryptorecruitr/status/1984286761800057105 believes the ADA bull market could be starting as accumulation strengthens. Consistent buying near $0.60 shows trader confidence, but ADA must overcome waning trading volume to confirm a breakout. Still, its DeFi expansion and possible Grayscale ETF inclusion continue to support a positive long-term Cardano price prediction.

Remittix: The Ethereum-Based Altcoin Stealing ADA’s Momentum

While Cardano focuses on scalability and staking, Remittix (RTX) is making waves as a payments-driven project with mass appeal. The Ethereum-based PayFi platform allows seamless crypto-to-fiat transfers across 30+ countries, blending the convenience of fintech with the innovation of DeFi. Its wallet beta is already live, offering real-time transactions with low gas fees and transparent conversion rates.

Here’s why investors are increasingly favoring Remittix:

● Wallet beta live, supporting instant crypto-to-bank transfers for users and businesses

● CertiK-audited and team-verified, ensuring investor confidence and platform safety

● Over $27.7M raised, signaling massive global investor interest and trust

● Business API integrations, enabling merchants to accept and settle crypto payments easily

● Daily 15% USDT referral rewards, fostering organic growth and community engagement

As ADA aims for $1, Remittix’s combination of verified security, payment innovation, and strong token demand gives it a practical edge in adoption. Many analysts now list RTX among the best crypto projects of 2025, alongside established players like Cardano and Solana.

Why Remittix Could Outperform ADA in 2025

The current Cardano price prediction suggests growth potential, but Remittix’s surge in volume and exchange listings may set it apart. With real-world payment utility, investor transparency, and a robust community, Remittix embodies the future of blockchain-based finance. As traders anticipate ADA’s next rally, RTX could be the one quietly outperforming it in the months ahead.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by https://btcpresswire.com

This release was published on openPR.

XRP is once again commanding attention across the crypto market as bullish momentum builds following Ripple’s latest escrow unlock, fueling speculation that XRP could be gearing up for a major breakout toward $3.50.

After climbing above the $2.50 mark for the first time in years, traders and analysts are turning increasingly optimistic about XRP’s next move. A combination of strong technical signals, growing institutional interest, and Ripple’s consistent token management has set the stage for what could become one of XRP’s most significant rallies of 2025.

Ripple has released 1 billion XRP—valued at approximately $2.5 billion at the current XRP price—as part of its regular monthly escrow schedule for November 2025. According to Ripple’s established procedure, the release aims to ensure liquidity and support operational needs while maintaining predictability in supply management.

Ripple’s routine release of 1 billion $XRP worth over $2.5 billion adds short-term liquidity, though most tokens typically return to escrow. Source: ZARcryptoTV via X

The company has been following this system since 2017, routinely unlocking 1 billion XRP and relocking 80–90% of the tokens back into escrow. This transparent process helps regulate the XRP market supply and prevents sharp price swings.

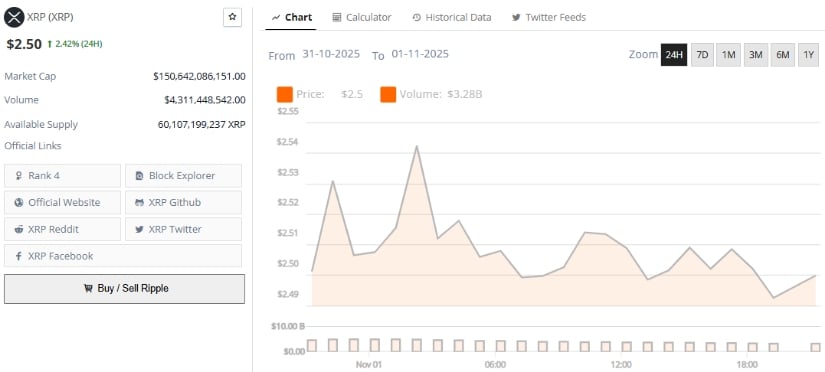

Ripple’s latest escrow movement comes amid renewed optimism in the XRP crypto market, with the XRP price today hovering around $2.50 and showing signs of further bullish activity.

Technical analysts and trading groups have spotted a strong bullish confirmation on lower timeframes for XRPUSDT, signaling an opportunity for a potential swing buy. According to a post by Team Setupsfx, the major upside target for the ongoing move stands at $3.50, though analysts noted the price could “move beyond that region” if momentum continues to build.

Bullish signals on smaller timeframes suggest a swing buy with a $3.50 target. Price could move higher—like and comment your next crypto pair! Source: Setupsfx on TradingView

Independent traders on social media platforms echoed the optimism. Popular crypto analyst @Steph_iscrypto highlighted a bullish expansion signal on the daily XRP/USD chart using EMA ribbons. “The next huge XRP rally is imminent,” the analyst posted on X, projecting a 28–71% rally from current levels.

Sentiment across the XRP market has been strengthening, fueled by growing institutional interest and confidence in Ripple’s ongoing developments. Influencers have noted that larger entities may have accumulated long positions during XRP’s consolidation phase, positioning for potential upside ahead of the next XRP bull run.

This aligns with historical performance data—November has typically been one of XRP’s stronger months, with average gains above 80% in several previous years. Analysts say that if this pattern holds, XRP could test higher resistance zones beyond $3.50, potentially revisiting its all-time high range in future market cycles.

As XRP builds strong bullish momentum, analysts are closely monitoring price action for confirmation of a sustained breakout. The current XRP price near $2.50 has already surpassed key resistance levels, and the $3.50 target represents the next major test for bulls.

XRP was trading at around $2.50, up 2.42% in the last 24 hours at press time. Source: Brave New Coin

While speculative enthusiasm remains high, traders caution that market volatility could intensify if profit-taking occurs around psychological price zones. Still, with increasing institutional participation and Ripple’s ongoing real-world adoption, the XRP price forecast for 2025 appears optimistic.

If momentum continues, XRP could not only hit its $3.50 target but also potentially enter a new expansion phase—reviving discussions about whether XRP could reclaim or surpass its previous all-time highs.

Solana price today sits at $186.51, down 4.51% in the past 24 hours, as traders assess profit-taking pressure after recent strength across Layer-1 assets.

Despite the dip, Solana remains among the top-performing blockchains in 2025, supported by sustained DeFi activity and institutional inflows.

However, while SOL consolidates, Noomez ($NNZ), a presale project now in its second day, is quickly drawing investor attention.

The structured 28-stage sale, combined with transparent burns, audited contracts and stage-based rewards, is helping Noomez emerge as a standout alternative for short-term gains.

Analysts expect Solana (SOL) to continue trading within a strong recovery range through 2025. Current forecasts suggest that:

These levels imply a potential 15.38% annual gain from current prices, signaling moderate but sustainable growth. Solana’s active developer ecosystem and rising DEX volume continue to anchor its long-term value, though short-term volatility remains tied to macro conditions and liquidity trends.

Still, Solana’s 2025 outlook suggests a gradual climb rather than a breakout, as the network matures and competition among Layer-1 protocols intensifies.

Looking ahead, analysts remain bullish on Solana’s 2030 potential, with projected averages around the $210–$215 range and highs near $220.

The consistent gains forecasted for 2026, between 13% and 18% monthly growth across several months, reflect confidence in Solana’s scalability and real-world utility.

However, the pace of returns suggests that while Solana remains stable, new investors may find faster upside opportunities elsewhere, especially in presales like Noomez.

Noomez ($NNZ) is redefining the presale model with built-in fairness and transparency. The live dashboard shows early progress, with over $1,862.29 raised toward a $127,000 stage goal, all displayed in real time. Each of the 28 stages lasts up to seven days or closes early when sold out, with prices starting at $0.0001 and climbing incrementally to $0.028.

Every stage also includes a Stage X Million Airdrop, rewarding one wallet with tokens equal to the stage number in millions (for example, Stage 5 → 5M $NNZ). Anti-bot protection ensures only verified buyers with a minimum $20 entry can participate, while unsold tokens are automatically burned at the end of each stage.

Beyond mechanics, Noomez introduces The Noom Engine; a post-launch feature that rewards holders with partner project tokens automatically. With all contracts audited, liquidity locked, and team wallets vested for up to 12 months, the project is emphasizing trust, transparency, and structure.

The Genesis Horn dashboard, where users can buy Noomez directly, visually tracks funds raised, token burns, and airdrop events as they happen.

While Solana continues to command market confidence through proven infrastructure, Noomez offers a more dynamic growth curve in the short term.

Solana’s steady institutional adoption builds long-term value, but Noomez’s presale structure (combining gamified rewards, deflationary burns, and live transparency) appeals to retail investors seeking faster movement and verifiable fairness.

With early-stage entries still open, and each stage becoming progressively more expensive, Noomez ($NNZ) presents one of the clearest near-term plays for those chasing high upside in a fully-audited, community-driven launch.

Telegram: Join the Noomez Telegram Channel