The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Solana (SOL) is receiving institutional renewal after the introduction of the first U.S. spot Solana ETF that raised more than $56 million in first-day trading volume. With a current price of about $194, SOL has recovered from its lows as analysts believe it can potentially soar to $280 in November due to inflows in ETFs, staking demand, and positive technical indications.

In the meantime, Remittix (RTX) the PayFi app that supports crypto and fiat payments has already passed the $27.7 million threshold in its private funding and is close to the $30 million mark. The high growth crypto is appealing to institutional and retail investors looking to be exposed to utility-driven blockchain expansion.

Institutional momentum is building rapidly beyond ETF products, with major financial firms integrating Solana into their offerings. Fidelity Digital Assets expanded its trading suite to include SOL for both retail and institutional U.S. investors in late October 2025, while Hong Kong approved its first Solana ETF through ChinaAMC.

Solana CME futures open interest surged to an all-time high of $1.49 billion, up sharply from $1 billion in August, underscoring the depth of institutional demand following the ETF launch.

Staking inflows have climbed to $1.72 billion, with products like the REX-Osprey Solana Staking ETF attracting over $12 million in first-day volume

The latest Solana price prediction has the token eyeing a $240-$280 range this November as momentum builds across its ecosystem. On-chain data show strong staking flows and rising TVL, while analysts are beginning to say early buyers are already up and positioning for the next leg.

A breakout above Rs $245 could trigger rapid upside toward Rs $280, according to bullish charts and sentiment. That said, failure to hold Rs $200 range would jeopardize the solana price prediction optimism.

Now let’s shift into an upcoming powerhouse. While SOL grabs headlines, a utility-first project is quietly building infrastructure that investors are calling “the real deal.”

This next-level DeFi project and low gas fee crypto has already surpassed $27.7 Million in funding and gearing up for a mega-announcement near $30 Million. Early buyers are already up and the community is buzzing.

In comparison to many speculative tokens, this cross-chain DeFi project offers real bank-fiat ramp features, mobile wallet arrival in Q3, and listings on major centralized exchanges confirmed. If you’re looking for early stage crypto investment with high-growth crypto potential, this one checks off the boxes where many others simply hype.

Why Remittix Is Gaining Traction

This combination of utility, traction, and scarcity is what top crypto under $1 investors are already watching. Don’t let this slide into “should’ve gotten in” territory.

Here’s the gut-check moment: the $250,000 community giveaway is active, and the referral program now pays 15% of each new buyer’s investment back in USDT, claimable every 24 hours through the dashboard. Early users are sharing links and stacking rewards—some are already talking thousands weekly.

With over 40,000 holders and 370,000 entries on the giveaway gleam page, momentum is stacking fast. Whales are loading in ahead of the wallet reveal. The clock is ticking and this isn’t just “watch” time; it’s “act now or regret later” time.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: The content above is presented for informational purposes as a paid advertisement. The Tribune does not take responsibility for the accuracy, validity, or reliability of the claims, offers, or information provided by the advertiser. Readers are advised to conduct their own independent research and exercise due diligence before making any decisions based on its contents and not go by mode and source of publication. Investments in cryptocurrencies are subject to high market risks and volatility; readers should seek professional advice before investing.

The Dogecoin price prediction is heating up again as traders wonder if DOGE can finally hit $1. Yet, other meme coin projects like Floki, Pengu, and Layer Brett https://layerbrett.com are drawing attention.

A project built on Ethereum Layer 2, LBRETT stands out as with real DeFi use cases. This meme coin offers fast transactions and strong community appeal. While older coins rely on hype, Layer Brett focuses on lasting value and better scalability.

Dogecoin price prediction: Analysts anticipate rebound as DOGE targets $0.29 mark

Analysts expect a mild rebound as Dogecoin price prediction points toward the key $0.25 support zone. After recent market dips, sentiment around DOGE is turning positive again, with traders watching for signs of renewed momentum.

Popular analyst Ali charts, pointed out that holding above its current level https://x.com/ali_charts/status/1981617151803900208 could set the stage for a $0.25 rebound. However, while optimism grows, some investors are seeking fresh opportunities beyond Dogecoin.

New tokens like Layer Brett are gaining attention for their DeFi framework and faster growth potential. As the Dogecoin price prediction continues to spark debate, traders are looking out for more rewarding options.

Floki falls by 2% but meme coin analysts remain optimistic

Floki dropped by 2% this week, but analysts still believe it can recover. Their confidence comes from its mid-October bounce, when a tweet from Elon Musk pushed prices higher.

Now, as Floki slows down again, many traders are keeping an eye on newer meme coins that seem to offer better growth and faster rewards. Layer Brett offers this and stands out for its fast growth and more lasting value.

Pengu sparks optimism among analysts with fresh partnerships

Pengu also saw a mild 2% dip over the past week, yet confidence in the token remains steady. The team recently announced partnerships with Kung Fu Panda https://x.com/pudgypenguins/status/1982120596294029625 and NASCAR, sparking new excitement among investors.

These partnerships aim to grow the project’s visibility and strengthen its brand across multiple platforms. While price action stays calm, analysts believe these moves could drive up the Pengu price.

Traders look towards Layer Brett amid Pengu and Floki retracement

In a market filled with uncertainty, many traders are moving toward Layer Brett https://layerbrett.com for something stronger than hype. The project runs on Ethereum Layer 2, making it fast, cheap, and reliable.

Unlike other meme token projects like Dogecoin, transactions happen in seconds, and gas fees are cut down to pennies. Users can also buy, stake, and earn rewards easily through the platform’s smooth dApp.

What makes LBRETT stand out from tokens like Pengu is its design. It mixes meme culture with working blockchain tools. Holders can stake their tokens and earn high yields. Its no-KYC setup also gives users full control of their wallets and privacy.

Layer Brett offers key features that benefits investors

Aside from its DeFi framework and advanced technology, Layer Brett offers key features that would benefit investors greatly. These include:

● Transparent tokenomics: The LBRETT tokenomics are fully transparent with a max supply of 10 billion tokens

● Cross chain interoperability: Unlike Floki, Layer Brett’s bridging solutions allow assets to move freely across chains.

● High staking rewards: Layer Brett offers users who stake their LBRETT tokens rewards nearing 600% APY.

Conclusion

While the Dogecoin price prediction dominates conversations, Layer Brett offers a more rewarding option. With Dogecoin targeting $1, analysts believe it could spark a meme coin wave, with Pengu and Floki and Layer Brett at the forefront.

Layer Brett’s growing ecosystem and clear roadmap are giving investors renewed confidence. Its early phase presents an opportunity for investors to be a part of a fast-growing meme token with great potential.

Discover more about Layer Brett (LBRETT):

Website: https://layerbrett.com

Telegram: https://t.me/layerbrett

X: https://x.com/LayerBrett

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by https://btcpresswire.com

This release was published on openPR.

Cardano continues to strengthen its ecosystem through network upgrades, enhanced scalability, and expanding DeFi integration. Its consistent innovation and growing institutional interest position ADA as one of the most stable long-term assets entering the 2025 bull cycle.

Meanwhile, Pepenode’s (https://pepenode.io/) emergence as a fast-growing AI-driven project highlights how new altcoins can shift investor focus. As fresh narratives develop, cross-market sentiment from such projects could indirectly fuel renewed interest in Cardano’s long-term valuation.

Cardano Price Prediction: Can ADA Break Past the $1 Resistance Level?

Cardano (ADA) is currently priced around $0.80, showing steady momentum as it approaches the critical $1 resistance level. Traders are closely monitoring volume strength and market sentiment to confirm a sustainable upward breakout.

The recent consolidation reflects mixed investor behavior, with some profit-taking after short rallies. However, on-chain metrics show increasing staking participation and network activity, which signals strong community confidence and long-term potential.

If ADA maintains its current trend and broader market conditions improve, a breakout above $1 could mark the start of a renewed bullish phase. Cardano’s expanding ecosystem continues to reinforce optimism among long-term holders.

Pepenode: Fast Staking and Advanced Ethereum Layer 2 Framework

Pepenode (https://pepenode.io/) is currently priced at around $0.001004 per token in its presale phase, showing strong early investor interest. The project aims to merge gaming elements with staking mechanics for long-term ecosystem engagement.

Positioned between meme culture and utility-driven DeFi, Pepenode introduces virtual mining, token burns, and tiered staking rewards. These features create sustainable demand while incentivizing holders to remain active within the ecosystem.

From a market analysis perspective, Pepenode remains in a high-risk, high-reward stage. Its growth will depend on successful exchange listings, real user adoption, and delivery of its planned Layer 2 framework integration.

In the current crypto landscape, Pepenode holds a promising niche within blockchain gaming and staking-based projects. With consistent marketing, community expansion, and token utility development, it could evolve into one of 2025’s standout performers.

Pepenode Presale Accelerates with Strong Utility, Speed, and Growing Investor Trust

Pepenode (https://pepenode.io/) is currently priced at around $0.0011227( https://www.coingecko.com/en/coins/pepenode) per token in its presale phase, gaining significant traction among early investors. The project combines high-speed staking, gamified mining, and strong community engagement to build momentum.

Its innovative structure blends meme coin appeal with real blockchain functionality, offering users virtual node upgrades, staking rewards, and deflationary token mechanics. This mix of entertainment and utility positions Pepenode as a standout presale in 2025.

With over $2 million raised so far, Pepenode is shaping a strong presence in the Web3 ecosystem. If its roadmap continues as planned, the project could become one of the leading next-generation altcoins.

Buchenweg 15, Karlsruhe, Germany

For more information about Pepenode (PEPENODE) visit the links below:

Website: https://pepenode.io/

Whitepaper: https://pepenode.io/assets/documents/whitepaper.pdf

Telegram: https://t.me/pepe_node

Twitter/X: https://x.com/pepenode_io

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.

XRP has returned to the spotlight. After a few subdued sessions, the token is now holding steady between $2.38 and $2.46 (seen here https://coinmarketcap.com/currencies/xrp/) as renewed ETF speculation draws fresh capital back into the market. With its sizable market cap and well-established role in blockchain-based payments, XRP remains a crucial barometer for assets rooted in real-world utility.

Every sustained move in XRP’s price tends to reignite discussion about retesting multi-year highs-especially when liquidity, capital flows, and market sentiment align. Meanwhile, traders focused on the payments sector are also watching utility-driven projects like Bitcoin Hyper (HYPER) (https://bitcoinhyper.com/) for potential secondary momentum.

What’s Driving XRP Right Now?

ETF expectations remain the primary catalyst behind XRP’s current momentum. Trading desks are adjusting positions in anticipation of potential product approvals, while on-chain data points to renewed whale accumulation and rising spot volumes. The timing of any official decision is still uncertain, keeping the tone optimistic yet cautious.

To shape their outlook, analysts often refer to aggregated forecasts and technical models-such as CoinCodex’s XRP price analysis-which outline key ranges and scenarios traders use to frame their bias as filings and liquidity data evolve.

XRP Price Outlook: Technical Picture

Technically, XRP is showing signs of compression. Overhead resistance sits between $2.50 and $3.00, while buyers continue to defend the $2.20-$2.30 area on dips. A strong daily close above $3.00 could open the path toward $3.35-$4.47, though a failure to break higher may leave the token consolidating within its current range.

Short-term traders tracking volume surges and order book depth often monitor real-time charts-like XRPUSD on TradingView https://www.tradingview.com/symbols/XRPUSD/ – to assess whether a move shows conviction or lacks momentum.

Why This Matters for the Broader Market

An XRP-related ETF would mark a significant step in integrating blockchain settlement tokens into traditional financial markets. Coverage of ETF filings-such as Coinpedia’s report on the first actively managed XRP ETF-tends to boost appetite for exposure across both large-cap and mid-tier digital assets.

While XRP’s size and supply naturally limit the scope for extreme short-term moves, its direction often sets the tone for overall market sentiment and sector rotation toward payment-focused tokens.

Why Traders Are Watching Bitcoin Hyper (HYPER)

When capital flows toward payment and settlement networks, emerging projects built on scalability and performance often gain traction. Bitcoin Hyper (HYPER) (https://bitcoinhyper.com/) is one of those rising names, emphasizing high throughput and low transaction fees over pure hype-driven marketing.

If the market continues rewarding real utility and efficiency, HYPER could benefit from the same shift supporting XRP’s renewed narrative. Both tokens reflect a maturing trend where blockchain payment systems are transitioning from speculative buzz to tangible use cases.

Due diligence remains key-but for traders following utility-based projects, Bitcoin Hyper stands out as a notable contender alongside XRP in the evolving payments landscape.

Buchenweg 15, Karlsruhe, Germany

For more information about Bitcoin Hyper (HYPER) visit the links below:

Website: https://bitcoinhyper.com/

Whitepaper: https://bitcoinhyper.com/assets/documents/whitepaper.pdf

Telegram: https://t.me/btchyperz

Twitter/X: https://x.com/BTC_Hyper2

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.

The comparison to Solana’s $2 entry point reflects how investors view early-stage, high-utility assets in the crypto market today. Remittix, with its verified infrastructure, active funding momentum, and wallet rollout, aligns with the traits that defined early Solana growth.

As Solana traders look toward the next Solana Price Prediction cycle targeting $230–$250, Remittix is carving its place as a low gas fee crypto project with global potential. Both represent different sides of the same narrative: scalable, utility-first ecosystems driving the next wave of digital finance.

Discover the future of PayFi with Remittix by checking out their project here:

Disclaimer : Cryptocurrency investments are risky and highly volatile. This is not financial advice; always do your research. Our editors are not involved, and we do not take responsibility for any losses.

Jakarta, Pintu News – Dogecoin is currently struggling to maintain support at the psychological level of $0.20 amid heavy selling by large investors and the exit of leveraged traders. The Dogecoin (DOGE) price briefly hovered above $0.21 earlier this week, but has now fallen more than 2%, indicating mounting selling pressure in the market.

On-chain data shows that whales have sold more than 500 million Dogecoin (DOGE) tokens in the past week, sparking fears of further declines. These sales coincided with a sharp 61% drop in futures open interest, from $5.03 billion to $1.95 billion, signaling extensive position liquidation and trader fatigue.

Dogecoin’s (DOGE) 24-hour trading volume jumped 17.5% to nearly $2 billion, an indicator that sellers still control the market despite the overall market recovery stalling. This suggests that selling pressure is still very strong and could affect future price movements.

Also Read: Top 3 Crypto’s that are Trending and Stealing Investors’ Attention by the End of 2025!

Technical indicators show a similarly cautious picture. On the daily chart, the Dogecoin (DOGE) price formed a potential “death cross” pattern between the 50-day and 200-day exponential moving averages, a bearish pattern that often precedes further declines.

If the selling continues, analysts warn that the Dogecoin (DOGE) price could fall towards support at $0.166, which is in line with the lower limit of its long-term uptrend line. However, this trendline has historically triggered strong rebounds, with previous retests resulting in nearly 100% price recovery.

Currently, the Dogecoin (DOGE) price is hovering near $0.20 with a market capitalization of $30.3 billion, still holding above the psychologically important zone but struggling to gain upward momentum. Immediate resistance lies between $0.204 and $0.210, while a firm close below $0.19 could accelerate losses towards $0.18-$0.166.

The balance between whale distribution and new buyer demand will determine the next move for Dogecoin (DOGE). If new inflows return and futures activity stabilizes, a recovery towards $0.23-$0.25 is still possible.

Without renewed conviction from large holders, the Dogecoin (DOGE) price risks prolonged consolidation, or a deeper retracement before the next bullish wave begins. Investors and traders are advised to monitor market indicators and current news to make informed investment decisions.

Also Read: Bitcoin (BTC) Breaks $115,000, Fear & Greed Index is Neutral!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

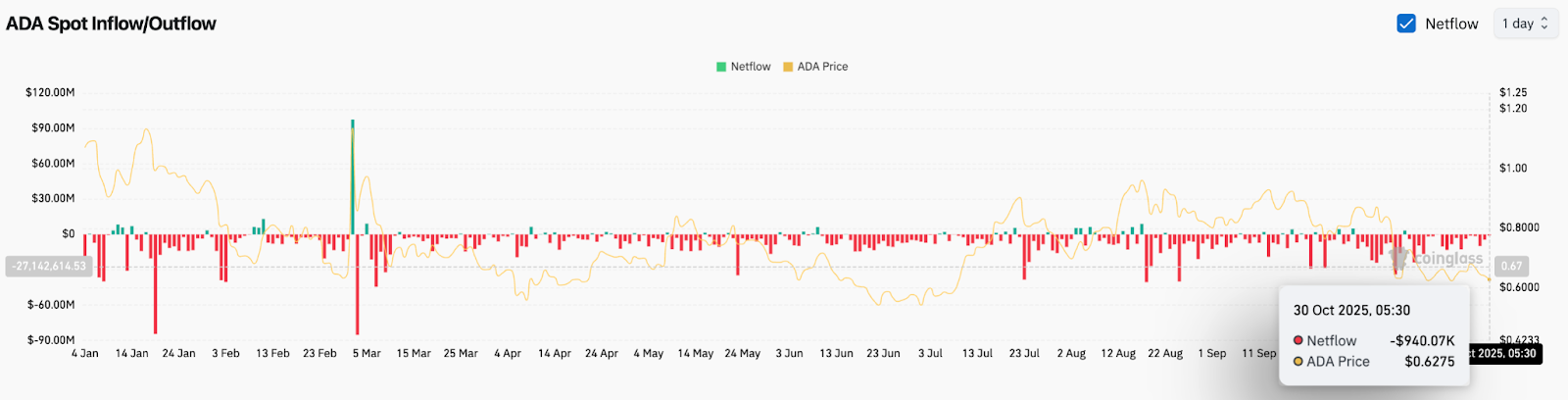

Cardano price today trades near $0.63, holding slightly above support as weakness spreads through the altcoin market. The token’s consolidation inside a tightening triangle signals growing pressure, with sentiment shifting toward caution while institutional flows retreat from risk assets.

CoinShares reported $300,000 in ADA outflows this week, reversing the prior week’s inflows. The rotation follows delays in crypto ETF approvals and a broader pullback in speculative exposure. Traders have shifted focus to Bitcoin and cash-based holdings, leaving ADA exposed to volatility if support fails.

The 4-hour chart shows ADA confined between $0.62 and $0.68 within a symmetrical triangle. The 20-EMA sits near $0.65, the 50-EMA at $0.67, and the 100-EMA near $0.71, all stacked above price and confirming short-term pressure.

A break below $0.62 would complete a bearish continuation setup, targeting $0.59 and $0.56. A move above $0.67 could restore short-term momentum toward $0.71, where the 200-EMA caps upside.

The RSI near 36 shows muted demand and limited buying strength. Repeated rejections near the mid-range underline the absence of conviction. Until ADA reclaims its 50-EMA with stronger volume, sellers maintain control.

Coinglass data confirms continued capital flight. As of October 30, ADA registered $940,000 in net outflows, extending a three-week decline exceeding $25 million. Persistent red readings across spot exchanges point to reduced accumulation and lighter liquidity on rallies.

Analysts link the withdrawals to pre-FOMC caution and reduced risk appetite across altcoins. With U.S. monetary policy under review, traders have trimmed exposure, preferring assets with deeper liquidity and clearer catalysts. The lack of inflow support leaves ADA vulnerable if broader market sentiment weakens further.

Cardano’s technical outlook may look heavy, but development momentum continues. Input Output Global confirmed that Ouroboros Leios, Cardano’s largest consensus upgrade, has entered active engineering.

Leios introduces a split-layer design separating input and endorser blocks, a change expected to lift throughput toward 10,000 transactions per second. The engineering shift marks completion of the design phase and begins benchmarking across live prototypes.

The milestone reinforces long-term fundamentals, though it has yet to attract near-term capital. Market participants acknowledge the progress but remain focused on liquidity and ETF timelines rather than distant network upgrades.

For now, the ADA price outlook remains balanced between cautious optimism and technical fragility. Long-term investors are encouraged by the Leios milestone, which strengthens Cardano’s infrastructure narrative. Yet, in the short term, persistent outflows and RSI weakness suggest the path of least resistance may still lean lower.

If ADA holds above $0.62 and reclaims the 100-EMA near $0.71, sentiment could turn constructive again, paving the way for a measured recovery. Until then, analysts expect the token to remain range-bound with potential for a breakdown if broader market conditions fail to stabilize.

Breadcrumb: Cardano price consolidates near $0.63.

Image caption: ADA compresses inside a tightening triangle as traders weigh ETF delays and Leios upgrade optimism.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

XRP price started a fresh increase above $2.550. The price is now facing hurdles above $2.650 and at risk of another decline in the near term.

XRP Price Holds Support

XRP price formed a short-term top near $2.69 and started a downside correction, like Bitcoin and Ethereum. The price dipped below the $2.65 and $2.62 levels.

There was a move below the 23.6% Fib retracement level of the upward wave from the $2.327 swing low to the $2.697 high. The price even spiked below $2.55 but remained stable above $2.50. Besides, there is a bearish trend line forming with resistance at $2.65 on the hourly chart of the XRP/USD pair.

The price is now trading below $2.60 and the 100-hourly Simple Moving Average. If there is a fresh upward move, the price might face resistance near the $2.620 level. The first major resistance is near the $2.650 level and the trend line, above which the price could rise and test $2.680.

A clear move above the $2.680 resistance might send the price toward the $2.720 resistance. Any more gains might send the price toward the $2.750 resistance. The next major hurdle for the bulls might be near $2.80.

More Losses?

If XRP fails to clear the $2.650 resistance zone, it could start a fresh decline. Initial support on the downside is near the $2.550 level. The next major support is near the $2.5120 level and the 50% Fib retracement level of the upward wave from the $2.327 swing low to the $2.697 high.

If there is a downside break and a close below the $2.5120 level, the price might continue to decline toward $2.468. The next major support sits near the $2.420 zone, below which the price could continue lower toward $2.40.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $2.550 and $2.5120.

Major Resistance Levels – $2.620 and $2.650.

The current Dogecoin price prediction reflects a market holding pattern, with DOGE consolidating near $0.20. Despite the short-term volatility, technical indicators stay balanced.

While long-term models forecast gradual appreciation toward 2030, much of Dogecoin’s movement still depends on retail speculation and social-driven catalysts.

As investors monitor $DOGE, attention is going toward Noomez ($NNZ), a coin built around an automated presale stage, positioning itself as a data-driven alternative in a sector driven by community sentiment, prompting many to ask what is Dogecoin price prediction beyond 2025’s consolidation phase.

Recent data puts Dogecoin (DOGE) around $0.2000, with short-term goals pointing to a small rise to $0.2271 by November 27, 2025, showing a 13.21 % gain.

The token’s sentiment remains bearish, supported by only 18 % bullish indicators and a Fear & Greed Index of 50 (neutral), showing a balanced but cautious outlook.

Over the next few quarters, DOGE’s 50-Day SMA ($0.2324) sits slightly above its 200-Day SMA ($0.2084), suggesting soft recovery potential if trading volume stabilizes.

Analysts note that short-term volatility hovers near 12 %, ranking on the higher end among legacy meme assets.

If consolidation continues at current levels, 2026 averages could hold between $0.21-$0.25, consistent with the most conservative Dogecoin 2025 price prediction and Dogecoin price prediction 5 years models projecting steady accumulation rather than breakout momentum.

Long-term projections for Dogecoin (DOGE) suggest steady appreciation supported by cyclical recovery trends across major altcoins.

Forecast models indicate that between 2027 and 2030, DOGE could trade within a range of $0.21 to $0.61, representing cumulative growth of over 200 % from current 2025 averages.

In 2028, average prices are estimated around $0.32, with high-end targets nearing $0.53, reflecting potential annualized returns exceeding 160 % under favorable liquidity conditions according to the latest price prediction for Dogecoin studies.

By 2030, DOGE’s median forecast levels will stabilize near $0.56, a projection consistent with most verified dogecoin price prediction 2030 reports.

However, analysts caution that sentiment cycles and influencer activity continue to define much of DOGE’s volatility profile, leaving its long-term trajectory dependent on sustained ecosystem engagement rather than fundamentals alone.

Broader sentiment data shows Dogecoin (DOGE) entering a neutral phase marked by lower volume and slower directional shifts.

Analysts point out that DOGE’s price movements are now tracking broader meme-asset cycles rather than isolated speculative surges.

Instead of reacting to single-event catalysts, the market is showing signs of rhythmic accumulation, where buyers accumulate around psychological price zones near $0.20.

Momentum indicators stay stable, but without decisive breakouts, most models project a holding pattern through early 2026. This transition makes a key point, that legacy tokens like DOGE are going into slower, liquidity-based trades.

This shift has also directed trader focus toward Noomez ($NNZ), a structured presale built on verifiable token logic and automated scarcity, appealing to traders seeking measurable mechanics rather than social volatility.

Pro Tip: Keep an eye on DOGE’s $0.18–$0.22 support range, historically, consistent rebounds have formed when price compression holds above that corridor for two consecutive weeks.

As Dogecoin stabilizes within predictable ranges, traders seeking higher structural clarity are turning to Noomez ($NNZ), a presale built on coded scarcity rather than speculative sentiment.

Unlike legacy meme tokens, Noomez defines every stage of its market logic in advance. The project distributes 140 billion $NNZ, representing 50 % of total supply, through a 28-stage presale with fixed, audited smart contracts.

Each stage lasts up to seven days or closes once sold out, and any remaining tokens are burned on-chain. Pricing scales from $0.00001 at launch to $0.0028 by the final round, creating a deterministic curve that eliminates rollover supply.

Every completed stage triggers a permanent update on the Noom Gauge, an on-chain tracker confirming sales data, burns, and vault milestones in real time.

With KYC-verified founders, locked liquidity (15 %), and 6–12 month team vesting, Noomez’s approach contrasts the social volatility that has historically defined the meme sector.

While Dogecoin continues to thrive on community momentum, Noomez brings measurable transparency and verifiable progression, giving traders defined entry logic before listings go live.

For More Information:

Website: Visit the Official Noomez Website

Telegram: Join the Noomez Telegram Channel

Twitter: Follow Noomez ON X (Formerly Twitter)

Solana price is showing renewed strength as whales and institutions align bullishly, with price consolidating near key support ahead of a potential breakout move.

Solana’s recent price action is drawing fresh attention as both whales and institutions start aligning on the bullish side. After weeks of sideways movement, momentum is quietly building again, fueled by large leveraged positions, growing ETF optimism, and consistent on-chain accumulation near key supports.

Fresh data shared by Ash Crypto reveals a prominent whale with a 100% win rate doubling down on bullish exposure, expanding a large BTC long position while simultaneously opening a 10x leverage long on Solana. Such synchronized positioning across Bitcoin and Solana signals a potential bullish rally ahead.

A major whale with a flawless track record opens a 10x long on Solana, signaling rising confidence in its next bullish leg. Source: Ash Crypto via X

With Solana consolidating near key technical supports and Bitcoin showing strong trend continuation, the positioning adds confluence to the bullish thesis forming.

Institutional flows appear to be reinforcing this narrative, as Whale Insider reported that Bitwise clients purchased $69.5 million worth of SOL, a substantial commitment amid growing expectations for a potential ETF approval. These inflows mark one of the largest recent allocations into Solana.

Such consistent institutional buying has been a stabilizing force for Solana’s price action, helping absorb volatility even during broader market pullbacks. With large entities accumulating rather than distributing, liquidity continues to tighten, creating the conditions for a strong upside expansion once momentum returns.

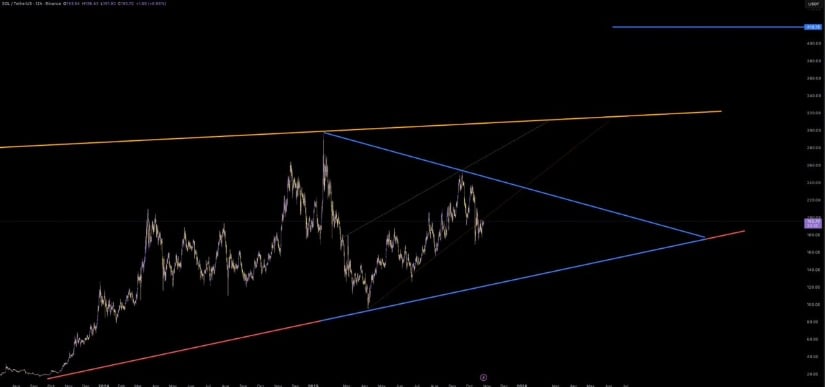

A large symmetrical triangle continues to define Solana’s macro structure, as visualized by Azyra. Price action is compressing between the converging trendlines, with current support holding near $180 to $190 and resistance positioned near $260 to $270. Historically, such macro triangles precede explosive breakouts once momentum converges with liquidity inflows.

Solana’s symmetrical triangle structure hints at a potential breakout, eyeing $400. Source: Azyra via X

If Solana price manages to break above the upper boundary, the measured move projection implies a potential rally towards $400 and beyond, coinciding with the analyst’s forecast. The setup resembles Solana’s 2021 expansion pattern, a long consolidation followed by vertical acceleration once price structure resolves in favor of bulls.

The latest analysis by Kamran Asghar highlights Solana’s clean retest of $195, the previous breakout resistance now acting as support. Maintaining this zone is technically crucial, as it aligns with both horizontal structure and Fib retracement confluence.

Solana successfully retests $195 support, reinforcing breakout strength and setting sights on $207 and $235 targets ahead. Source: Kamran Asghar via X

If SOL Solana price sustains above $195, the next short-term targets lie at $207, followed by $230 to $235, as mapped by the Fibonacci 2.618–3.618 extensions. Each retest within this range strengthens the breakout validity, suggesting that the ongoing consolidation may serve as a preparation phase for the next impulsive advance.

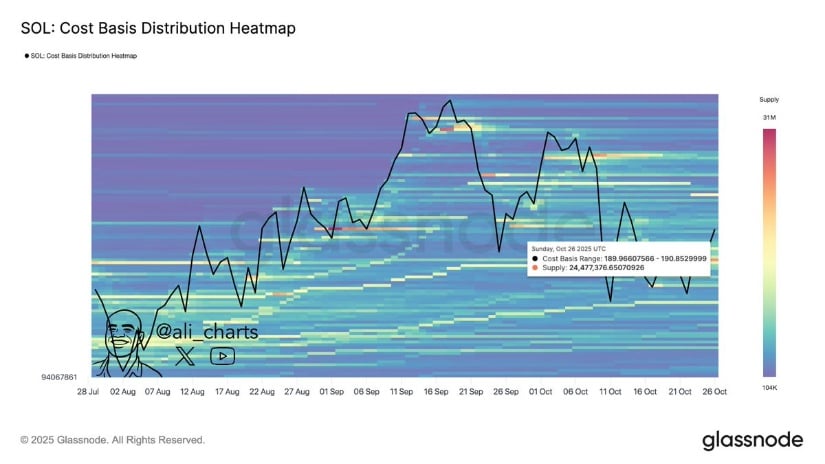

On-chain data from Ali Martinez further validates Solana’s solid support foundation. According to Glassnode’s cost-basis heatmap, over 24.5 million SOL were accumulated between $188 and $190, forming one of the largest buying clusters of the current cycle.

Over 24.5 million SOL were accumulated between $188 and $190. Source: Ali Martinez via X

This accumulation band represents a strong defense zone where long-term holders continue to add to their positions. As long as the Solana price remains above this range, downside risk appears limited, providing the structural backing needed for sustainable upside continuation.

Both on-chain and off-chain data now point towards synchronized confidence in Solana’s trajectory. Institutional inflows, whale positioning, and solid technical structures are combining to create one of the strongest bullish backdrops in months.

Holding above $189 to $195 remains the key condition for continuation, while any breakout beyond $260 could ignite momentum towards $400. With market sentiment stabilizing and liquidity deepening, Solana appears poised to reclaim its leadership role among Layer-1 assets, supported by both price structure and real capital inflow.