The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Dogecoin (DOGE) price surged past the $0.18 resistance level. This followed Donald Trump’s pledge to fund $2,000 dividends using potential tariff proceeds.

Dogecoin (DOGE) recently experienced a significant price surge, breaking past the $0.18 resistance level. This rally followed recent comments from Donald Trump saying he will use money from possible tariffs to fund $2,000 dividends for Americans. The news has sparked speculative interest throughout the crypto market, with meme currencies such as Dogecoin reaching particular heights.

The date of the rally was Monday, November 10, 2025. Trump’s words encouraged a greater appetite for risk among investors. This resulted in a rotation of capital to more speculative assets, such as different meme coins. According to CoinMarketCap, Dogecoin’s price in particular rose by more than 5%, and was able to break through the $0.18 resistance level to reach a high around $0.1826.

The breakout in the price of Dogecoin was backed up by a massive spike in trading volume. The volume of trade was up a whopping 180% which shows that there was a lot of accumulation from institutional as well as retail investors who reacted quickly to the news. This implies that the rally was not a brief knee-jerk but was supported by significant market activity.

Related Reading: DOGE News: Spot Dogecoin ETF Nears Launch as Bitwise Submits 8(a) Filing | Live Bitcoin News

While Trump’s latest dividend idea is linked to general tariff proceeds, it is worth noting a previous concept early in 2025. Discussions previously had connected a “DOGE Dividend” idea, by which savings from government efficiency efforts would be distributed directly with Trump. This previous concept had even been supported by Elon Musk. This pre-existing association probably drove the market’s response to the new dividend pledge, as investors were quick to link the populist sentiment to Dogecoin.

Traders have cited Trump’s populist rhetoric for inflaming hopes of more relaxed fiscal conditions. Historically, periods of perceived monetary or fiscal expansion have been accompanied by growth in speculative interest in digital assets. This economic outlook often encourages investors to take on more risk. As a result, cryptocurrencies are seen as a hedge against inflation and a chance for high growth.

The current market rally for Dogecoin is also taking place with significant developments of ETF (Exchange-Traded Fund). On November 7, Bloomberg ETF analyst Eric Balchunas revealed key information, and he said the Bitwise Dogecoin spot ETF could debut in just 20 days. Meanwhile, this timeline became possible after Bitwise filed an amendment to its registration form with the SEC.

According to the filing, Bitwise particularly deleted the “8(a)” clause. This clause, or the “delaying amendment,” in the past gave the SEC the discretion to delay the launch of ETFs. By dropping this clause, Bitwise has effectively gotten the DOGE ETF on a faster track for potential approval. The amended form strongly implies that if the mandatory 20-day waiting period comes to an end, the DOGE ETF could be listed for approval.

Balchunas gave a clue to the potential launch date of Bitwise’s DOGE ETF between November 26 and November 27. This timeline is, however, conditional on the SEC not taking any further measures to delay the debut. The anticipation of a spot DOGE ETF is driving excitement in the market. Consequently, it would provide a regulated way for institutional and mainstream investors to access Dogecoin. As a result, this could boost demand and potentially increase its price.

In conclusion, there is a strong combination of political rhetoric and imminent regulatory developments behind Dogecoin’s recent breakout above $0.18. Donald Trump’s promise of $2,000 dividends served as an immediate catalyst. On the other hand, the removal of the SEC’s delaying amendment for a Bitwise Dogecoin ETF gives some great underlying bullish sentiment.

Polkadot price predictions are raising eyebrows, Cardano is making headlines in a major way, and Remittix just dropped word of a $30 million mega announcement.

The buzz around top DeFi projects is alive and kicking, and today’s headlines are flashing red-hot for three names: Polkadot (DOT), Cardano (ADA) and the newcomer Remittix.

Better still, the broader crypto market is hinting at renewed momentum for early stage crypto investment and next big altcoin narratives. For anyone who wants to catch the ride and avoid standing on the sidelines, this is the moment.

When analysts call a project the next big altcoin in 2025, you take notice and that’s exactly what’s happening with Polkadot. Some Polkadot price-prediction models see DOT climbing well above current levels by end of year. One forecast puts DOT’s range between $8.42 and a staggering $61.63 in 2025.

Considering DOT is trading near $3.25 at present and up 10.12% in the last week. This implies a potential leap – which fuels the urgency: you either position now, or watch others jump ahead. The underpinning case is strong: Polkadot’s parachain architecture supports a cross-chain DeFi project model, boosting its utility and making it a strong contender in the ‘high growth crypto 2025’ label.

However, not all forecasts agree. Some sources estimate as low as $2.50-$3.20 range for the rest of the year. This means risk is still real. If Polkadot fails to trigger breakout catalysts or the market turns sour, it may languish.

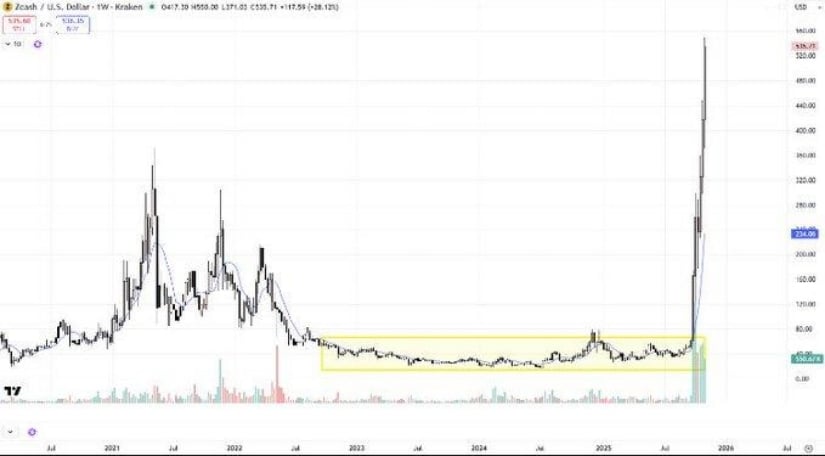

Over at Cardano, the headlines are buzzing. Analysts recently projected a 100-150% rally in the coming weeks, if momentum holds. A golden cross in ADA’s chart and rising volume also jump out.

Meanwhile, update after update: ADA recently surged to near $0.91 after breaking a long-term triangle pattern. The project has solid fundamentals, solid community support, and healthier trading activity. Whale accumulation is being flagged too.

But for investors tuned into top altcoins to invest in, Cardano is flashing warning signs of missing out. If you believe in an undervalued crypto project with serious upside and smart community support, ADA continues to tick boxes.

Enter Remittix. With the market’s eye on traditional DeFi heavyweights, this young contender is carving a niche in real-world utility: crypto to fiat bank account payments in 30+ countries. The $28 million raised in private funding speaks volumes – demand is proven.

Now the $30 million mega announcement looms as a catalyst event. This is not hype for hype’s sake; investors are viewing it as the kind of moment that separates the ‘could have’ from the ‘did’.

While Polkadot and Cardano fight for position in crowded ecosystems, Remittix is operating in payment rails, bridging crypto and fiat – a niche still under-penetrated. Its growth potential is labelled by some as the next 100x crypto.

If you’re chasing the best crypto to buy now and want exposure to the movement before mainstream sees it, Remittix is shouting at volume.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This content has been supplied by a third party contributor. Brave New Coin does not endorse or promote any products or services mentioned herein. Readers are encouraged to conduct independent research before making any financial decisions. The information provided is for informational and educational purposes only and should not be interpreted as investment advice.

The XRP price prediction is once again the talk of the market as traders eye a potential 400% surge. While XRP continues to make headlines, investors are also turning to Remittix https://remittix.io, the PayFi project that has raised over $28 million through the sale of 684 million tokens at $0.1166 each. With exchange listings, wallet testing, and ecosystem rollouts underway, many now see Remittix as the smarter long-term bet.

XRP Price Prediction: Bulls Orchestrate another Huge Upruning

Following a robust 300% increase since November 2024, XRP is currently trading at just around $2.35 https://www.tradingview.com/symbols/XRPUSD/ and remains resilient to profit-taking and market uncertainty. Those who provide their current XRP price prediction anticipate that when the Ripple case concludes and presumed spot XRP ETFs are approved by a more favorable U.S. government, a significant surge to the $8 – $9 value could occur. Analysts https://x.com/ali_charts/status/1987240958765728180 have also confirmed that XRP is flashing a buy signal on its TD sequential.

Presently, the stochastic RSI is close to 30.53, where a potential reversal momentum is observed, and traders are waiting until the breakout of the price above the resistance of $2.37. The next key support sits around $2.10, where whales have been quietly accumulating. https://x.com/ali_charts/status/1987098017409720529 If momentum returns and institutional demand picks up, this XRP price prediction cycle could easily push gains back toward the 400% mark.

Remittix: The PayFi Powerhouse Stealing The Spotlight

While XRP eyes institutional growth, Remittix https://remittix.io continues to build real-world adoption through its expanding ecosystem. The project has confirmed its first two centralized exchange listings, with two more secured for upcoming milestones. The team has already passed KYC verification on CertiK and has secured the top position in the CertiK Skynet Pre-Launch leaderboard – evidence of its transparency and deep investor trust.

Remittix Wallet has been in its beta phase, and users have been able to test real-time payments of crypto-to-fiat. Its upcoming Web App will integrate global fiat support, advancing Remittix’s mission to bridge crypto and traditional finance.

Why investors are bullish on Remittix:

● Supports 30+ fiat currencies and 40+ cryptocurrencies at launch

● Built-in FX engine delivers transparent, real-time conversion rates

● Merchant pilot programs launching in top remittance corridors

● $250,000 community giveaway campaign is active until the next milestone

● Deflationary tokenomics rewards holders and stabilizes supply

Why RTX Might Be The Better Bet

The XRP price prediction shows optimism, but Remittix https://remittix.io is building tangible products and real-world connections. XRP may lead in liquidity, yet RTX leads in innovation, offering a bridge between blockchain and everyday payments. As investors hunt for the next 100x crypto with real utility, Remittix is positioning itself as the clear front-runner for 2025’s DeFi revolution.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by https://btcpresswire.com

This release was published on openPR.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as Ethereum takes back the headlines with big predictions flying. Some say the next surge is just around the corner, while others caution that hidden assumptions and long timelines could make the hype more complicated than it seems.

Fundstrat’s Tom Lee recently made headlines with a bold forecast that Ethereum (ETH) could reach $60,000 in the near future.

The crypto executive cited the migration of real-world assets (RWA) onto the blockchain as the primary catalyst for this shift.

“The total size of global financial markets is 200 trillion, maybe more. How much of that ends up on blockchains? According to Larry Fink, the idea is to move 100% of this onto the blockchain. So we’re talking trillions of dollars of assets moving onto layer one blockchains,” he stated.

Lee shared his perspective during an interview, framing Ethereum as a potential global financial settlement layer.

According to Lee, Ethereum’s market cap of around $440 billion pales in comparison to the $200–300 trillion in global financial assets, including stocks, bonds, and real estate.

Even a fraction of these assets, Lee suggests, 0.5% to 1%, moving on-chain could, in his view, multiply Ethereum’s network value several times. This, in his opinion, justifies his $60,000 target.

He also highlighted Ethereum’s strong validator network, decade-long uptime, and alignment with Wall Street’s growing interest in tokenization as key tailwinds supporting long-term growth.

However, crypto analyst BitWu critiqued Lee’s forecast, describing it as overly reliant on what he calls a “typical RWA narrative.” The analyst cautioned that Lee’s model rests on two hidden assumptions:

That all real-world assets will settle on Ethereum’s mainnet, and,

That Ethereum’s price will directly reflect settlement volume.

While both assumptions are “reasonable,” BitWu argues, they oversimplify the unique mix of macroeconomic factors, regulatory clarity, and infrastructure maturity that will ultimately determine Ethereum’s trajectory.

“ETH at $60,000 USD is no problem [but not this year]. In about three years, I think it’s possible! Why do I say that? The true breakout point for RWA, I believe may be in 2026-2028, depending on the macroeconomic interest rate cycle + regulatory clarity + maturity of on-chain infrastructure (especially L2 and compliant chains),” BitWu explained.

Bitcoin (BTC) price surged

above $106,000 and gold (XAU) jumped nearly 2% today (Monday), November 10,

2025, as the U.S. Senate voted 60-40 to advance legislation ending the longest

government shutdown in American history. The dual rally reflects dollar

weakness and improved risk sentiment as eight Democratic senators agreed to a

GOP funding deal, marking the 15th attempt by Senate Majority Leader John Thune

to secure bipartisan support.

I am looking in this article for an answer to why

Bitcoin and gold are surging today. I also provide a technical analysis of the

BTC/USDT and XAU/USD charts, based on more than ten years of experience as an

analyst and active retail investor.

Bitcoin

rocketed 4.38% to $106,274 in the 24 hours following the Senate breakthrough,

with the cryptocurrency trading at $106,403.31 as of Monday morning,

representing a 1.63% daily gain. The rally extended gains from weekend trading,

pushing Bitcoin decisively above the psychological $100,000 level after

multiple dips below that threshold during the prolonged shutdown.

The political

resolution triggered sharp improvements across crypto markets.

Ethereum surged over 7% to trade above $3,600, while XRP and Solana both

advanced approximately 6%. Total cryptocurrency market capitalization added

$156 billion in 24 hours, climbing to $3.57 trillion as long positions flooded

back into the market. Bitcoin open interest increased by nearly $700 million,

signaling aggressive position-building by traders anticipating further upside.

Markets

reacted swiftly to the temporal correlation between legislative advancement and

price movements. The Senate vote occurred Sunday, November 9, immediately

sparking the crypto rebound after weeks of suppressed sentiment due to

political gridlock and broader macroeconomic uncertainty. Bitcoin had tumbled

into bear market territory last week, falling over 20% from its October record

high of $126,080. The cryptocurrency remains more than 15% below that peak but

has recovered strongly from recent lows near $100,000.

Crypto prices are up today. Source: CoinMarketCapc.om

Joel

Kruger, crypto strategist at LMAX, noted: “The crypto market enters the

week on a solid footing, with Bitcoin closing last week above its 50-week

moving average and reaffirming the broader uptrend that has defined much of

this year. The mid-week dip we discussed proved to be another buying

opportunity rather than the start of any meaningful correction, with price

support at key technical levels attracting renewed demand across digital

assets.”

Gold prices

rallied nearly 2% on Monday, rebounding almost $80 per ounce to reach $4,085 as

the Senate shutdown vote pressured the U.S. dollar. According to my technical

analysis of the gold chart, XAU/USD is capitalizing on support just below the

$4,000 level, additionally reinforced by the 50-day exponential moving average,

and now has room to appreciate toward the historical highs tested in October

around $4,400 per ounce.

The only

scenario that would contradict this bullish outlook would be a breakdown of

current support, which would open the path to deeper correction toward the

$3,400 level where the 200 EMA also runs.

The dual

rally in both Bitcoin and gold represents a rare market phenomenon

where traditional safe havens and risk assets advance simultaneously. This

reflects the unique dynamics of the shutdown resolution, removing political

uncertainty (boosting risk assets) while simultaneously weakening the dollar

(supporting safe havens).

Why gold is going up today? Source: tradingview.com

In my previous gold price analysis, I

forecasted that the metal can jump to over $5,000 in the longer term.

Chris

Turner, ING analyst, observed: “Risk assets have been helped over the

weekend by news that a group of moderate Democrat senators are softening their

stance on the US government shutdown. There is still a long way to go here, but

we should know over the next couple of days whether the current compromise bill

has legs.”

Turner

noted that developments “hint at a path to ending the US government

shutdown,” explaining that “the prospect of massive flight delays

around Thanksgiving and the delay in food aid payments has prompted a group of

moderate Democrats to back a proposed compromise bill in the Senate.”

You may

also like: Bitcoin

Undervalued Compared to Gold, JPMorgan Flags $170K Fair Value

FX markets

responded by pushing the risk-sensitive Australian dollar close to 0.5% higher,

while USD/JPY climbed over 154 as the yen served as funding currency for risk

trades. Turner explained: “While some might argue that the end of the

shutdown could be a risk-on, dollar-negative impulse for the FX markets, its

impact may be more mixed.”

The dollar

weakness stems from the shutdown resolution enabling federal spending

to resume, potentially increasing fiscal concerns that traditionally support

gold. Additionally, political stability allows the Federal Reserve to maintain

its dovish trajectory, with December rate cut probability still above 64%.

Lower rates reduce the opportunity cost of holding non-yielding gold while

typically weakening the dollar—a double benefit for precious metals.

According

to my technical analysis, Bitcoin’s price is rising 1.7% on Monday and testing

session highs at $106,670 on Binance exchange, adding to Sunday’s gains and

producing a 4% advance over the past 24 hours. As visible on the chart, price

is bouncing from the lower boundary of the consolidation drawn continuously

since May, coinciding

with psychological support at $100,000 and the 50% Fibonacci retracement.

Currently,

price is stalling at the resistance zone around 106,000-108,000 dollars,

supported by the 38.2% Fibonacci retracement and 200 EMA. From my analysis,

this zone may determine the future direction within the current consolidation

pattern.

If Bitcoin

breaks above the grid of 50 and 200 EMAs and current resistance, it will open

the path to retesting the October all-time high around $126,000. If it fails to

overcome this resistance, risk increases for a move back below $100,000, falling

ultimately to $74,000. The cryptocurrency is currently trading at

$106,403.31, still below its 50-day moving average of $112,050 but showing

strong recovery momentum.

Bitcoin price technical analysis. Source: Tradingview.com

Joel Kruger

emphasized: “Momentum has since spilled over into Ethereum and the broader

altcoin complex, reinforcing the view that the market remains well-anchored

within a strong medium-term bullish structure. This resilience comes against a

macro backdrop that is once again turning supportive.”

The Senate

bill now moves to a full floor vote in coming days, followed by House

consideration. Market observers assign high probability to passage, with

prediction market Myriad showing over 90% chance the government closure ends

before November 15—up from 37% just 24 hours earlier.

For Bitcoin,

according to my technical analysis, breaking decisively above the

106,000-108,000 resistance zone would open the path toward retesting October’s

$126,000 all-time high. Failure to overcome this resistance increases the risk

of retreat below $100,000, though most analysts view the technical and

fundamental backdrop as supportive.

Gold faces resistance at historical

highs around $4,400 per ounce. According to my analysis, support is holding at

the critical $4,000 level reinforced by the 50 EMA. Dollar weakness from

resumed government spending and Fed dovishness should provide tailwinds for

further precious metals appreciation.

Turner

cautioned: “If last week’s 100.36 high in DXY is to prove significant, it

should not really be making it back above the 99.90/100.00 area now.” This

suggests dollar downside may be limited, potentially capping gold’s immediate

upside while still supporting the broader bullish trend.

The coming

48 hours in Congress will determine whether the shutdown compromise “has

legs,” with markets positioned for positive resolution but prepared for

continued volatility if the deal falters.

Before you leave, I encourage you to also check my earlier analyses and forecasts on gold and Bitcoin:

Bitcoin is

surging 4.38% to $106,274 on Monday, November 10, 2025, primarily due to the

U.S. Senate’s 60-40 vote advancing legislation to end the historic 40-day

government shutdown. The cryptocurrency bounced from support at the

psychological $100,000 level after eight Democratic senators agreed to a GOP

funding deal, removing political uncertainty that had weighed on risk assets.

Gold

rallied nearly 2% on Monday, rebounding almost $80 per ounce to reach $4,085,

as the Senate shutdown vote pressured the U.S. dollar. The precious metal is

benefiting from dollar weakness stemming from expectations that resumed

government spending will increase fiscal concerns, while political stability

allows the Federal Reserve to maintain its dovish trajectory with December rate

cut probability above 64%.

Bitcoin

price forecasts for November 2025 vary significantly across analysts. Changelly

predicts Bitcoin could reach $129,042 by November 13, representing a 26% gain

from current levels. CoinCodex forecasts BTC will rise 4.48% to $127,142 by

November 17 if it reaches upper price targets, with technical indicators

currently showing bearish sentiment despite the recent rally.

Major

institutions forecast gold between $4,200-$5,000 per ounce by late 2026. UBS

projects gold reaching $4,200 as the next baseline target, with an upside

scenario of $4,700 by Q1 2026 if geopolitical risks intensify. Goldman Sachs

forecasts $5,055 by Q4 2026, while Bank of America targets $5,000 (averaging

$4,400 for the full year). ING expects more conservative near-term targets of

$4,000 for Q4 2025 and $4,100 for Q1 2026, with further upside through 2026.

Industry

experts project Bitcoin could reach $180,000-$200,000 during 2025, according to

forecasts compiled by CNBC. Youwei Yang, chief economist at Bit Mining,

predicts Bitcoin’s price will range between $180,000 and $190,000 in 2025,

though he warns of potential corrections to around $80,000 during market

shocks.

For

Bitcoin, primary risks include failure to break above the $106,000-$108,000

resistance zone (which would increase probability of retreat below $100,000),

Federal Reserve speakers signaling slower pace of rate cuts (December cut

probability has dropped to 64%), and potential for corrections to $80,000

during major market shocks according to analyst warnings.

Bitcoin (BTC) price surged

above $106,000 and gold (XAU) jumped nearly 2% today (Monday), November 10,

2025, as the U.S. Senate voted 60-40 to advance legislation ending the longest

government shutdown in American history. The dual rally reflects dollar

weakness and improved risk sentiment as eight Democratic senators agreed to a

GOP funding deal, marking the 15th attempt by Senate Majority Leader John Thune

to secure bipartisan support.

I am looking in this article for an answer to why

Bitcoin and gold are surging today. I also provide a technical analysis of the

BTC/USDT and XAU/USD charts, based on more than ten years of experience as an

analyst and active retail investor.

Bitcoin

rocketed 4.38% to $106,274 in the 24 hours following the Senate breakthrough,

with the cryptocurrency trading at $106,403.31 as of Monday morning,

representing a 1.63% daily gain. The rally extended gains from weekend trading,

pushing Bitcoin decisively above the psychological $100,000 level after

multiple dips below that threshold during the prolonged shutdown.

The political

resolution triggered sharp improvements across crypto markets.

Ethereum surged over 7% to trade above $3,600, while XRP and Solana both

advanced approximately 6%. Total cryptocurrency market capitalization added

$156 billion in 24 hours, climbing to $3.57 trillion as long positions flooded

back into the market. Bitcoin open interest increased by nearly $700 million,

signaling aggressive position-building by traders anticipating further upside.

Markets

reacted swiftly to the temporal correlation between legislative advancement and

price movements. The Senate vote occurred Sunday, November 9, immediately

sparking the crypto rebound after weeks of suppressed sentiment due to

political gridlock and broader macroeconomic uncertainty. Bitcoin had tumbled

into bear market territory last week, falling over 20% from its October record

high of $126,080. The cryptocurrency remains more than 15% below that peak but

has recovered strongly from recent lows near $100,000.

Crypto prices are up today. Source: CoinMarketCapc.om

Joel

Kruger, crypto strategist at LMAX, noted: “The crypto market enters the

week on a solid footing, with Bitcoin closing last week above its 50-week

moving average and reaffirming the broader uptrend that has defined much of

this year. The mid-week dip we discussed proved to be another buying

opportunity rather than the start of any meaningful correction, with price

support at key technical levels attracting renewed demand across digital

assets.”

Gold prices

rallied nearly 2% on Monday, rebounding almost $80 per ounce to reach $4,085 as

the Senate shutdown vote pressured the U.S. dollar. According to my technical

analysis of the gold chart, XAU/USD is capitalizing on support just below the

$4,000 level, additionally reinforced by the 50-day exponential moving average,

and now has room to appreciate toward the historical highs tested in October

around $4,400 per ounce.

The only

scenario that would contradict this bullish outlook would be a breakdown of

current support, which would open the path to deeper correction toward the

$3,400 level where the 200 EMA also runs.

The dual

rally in both Bitcoin and gold represents a rare market phenomenon

where traditional safe havens and risk assets advance simultaneously. This

reflects the unique dynamics of the shutdown resolution, removing political

uncertainty (boosting risk assets) while simultaneously weakening the dollar

(supporting safe havens).

Why gold is going up today? Source: tradingview.com

In my previous gold price analysis, I

forecasted that the metal can jump to over $5,000 in the longer term.

Chris

Turner, ING analyst, observed: “Risk assets have been helped over the

weekend by news that a group of moderate Democrat senators are softening their

stance on the US government shutdown. There is still a long way to go here, but

we should know over the next couple of days whether the current compromise bill

has legs.”

Turner

noted that developments “hint at a path to ending the US government

shutdown,” explaining that “the prospect of massive flight delays

around Thanksgiving and the delay in food aid payments has prompted a group of

moderate Democrats to back a proposed compromise bill in the Senate.”

You may

also like: Bitcoin

Undervalued Compared to Gold, JPMorgan Flags $170K Fair Value

FX markets

responded by pushing the risk-sensitive Australian dollar close to 0.5% higher,

while USD/JPY climbed over 154 as the yen served as funding currency for risk

trades. Turner explained: “While some might argue that the end of the

shutdown could be a risk-on, dollar-negative impulse for the FX markets, its

impact may be more mixed.”

The dollar

weakness stems from the shutdown resolution enabling federal spending

to resume, potentially increasing fiscal concerns that traditionally support

gold. Additionally, political stability allows the Federal Reserve to maintain

its dovish trajectory, with December rate cut probability still above 64%.

Lower rates reduce the opportunity cost of holding non-yielding gold while

typically weakening the dollar—a double benefit for precious metals.

According

to my technical analysis, Bitcoin’s price is rising 1.7% on Monday and testing

session highs at $106,670 on Binance exchange, adding to Sunday’s gains and

producing a 4% advance over the past 24 hours. As visible on the chart, price

is bouncing from the lower boundary of the consolidation drawn continuously

since May, coinciding

with psychological support at $100,000 and the 50% Fibonacci retracement.

Currently,

price is stalling at the resistance zone around 106,000-108,000 dollars,

supported by the 38.2% Fibonacci retracement and 200 EMA. From my analysis,

this zone may determine the future direction within the current consolidation

pattern.

If Bitcoin

breaks above the grid of 50 and 200 EMAs and current resistance, it will open

the path to retesting the October all-time high around $126,000. If it fails to

overcome this resistance, risk increases for a move back below $100,000, falling

ultimately to $74,000. The cryptocurrency is currently trading at

$106,403.31, still below its 50-day moving average of $112,050 but showing

strong recovery momentum.

Bitcoin price technical analysis. Source: Tradingview.com

Joel Kruger

emphasized: “Momentum has since spilled over into Ethereum and the broader

altcoin complex, reinforcing the view that the market remains well-anchored

within a strong medium-term bullish structure. This resilience comes against a

macro backdrop that is once again turning supportive.”

The Senate

bill now moves to a full floor vote in coming days, followed by House

consideration. Market observers assign high probability to passage, with

prediction market Myriad showing over 90% chance the government closure ends

before November 15—up from 37% just 24 hours earlier.

For Bitcoin,

according to my technical analysis, breaking decisively above the

106,000-108,000 resistance zone would open the path toward retesting October’s

$126,000 all-time high. Failure to overcome this resistance increases the risk

of retreat below $100,000, though most analysts view the technical and

fundamental backdrop as supportive.

Gold faces resistance at historical

highs around $4,400 per ounce. According to my analysis, support is holding at

the critical $4,000 level reinforced by the 50 EMA. Dollar weakness from

resumed government spending and Fed dovishness should provide tailwinds for

further precious metals appreciation.

Turner

cautioned: “If last week’s 100.36 high in DXY is to prove significant, it

should not really be making it back above the 99.90/100.00 area now.” This

suggests dollar downside may be limited, potentially capping gold’s immediate

upside while still supporting the broader bullish trend.

The coming

48 hours in Congress will determine whether the shutdown compromise “has

legs,” with markets positioned for positive resolution but prepared for

continued volatility if the deal falters.

Before you leave, I encourage you to also check my earlier analyses and forecasts on gold and Bitcoin:

Bitcoin is

surging 4.38% to $106,274 on Monday, November 10, 2025, primarily due to the

U.S. Senate’s 60-40 vote advancing legislation to end the historic 40-day

government shutdown. The cryptocurrency bounced from support at the

psychological $100,000 level after eight Democratic senators agreed to a GOP

funding deal, removing political uncertainty that had weighed on risk assets.

Gold

rallied nearly 2% on Monday, rebounding almost $80 per ounce to reach $4,085,

as the Senate shutdown vote pressured the U.S. dollar. The precious metal is

benefiting from dollar weakness stemming from expectations that resumed

government spending will increase fiscal concerns, while political stability

allows the Federal Reserve to maintain its dovish trajectory with December rate

cut probability above 64%.

Bitcoin

price forecasts for November 2025 vary significantly across analysts. Changelly

predicts Bitcoin could reach $129,042 by November 13, representing a 26% gain

from current levels. CoinCodex forecasts BTC will rise 4.48% to $127,142 by

November 17 if it reaches upper price targets, with technical indicators

currently showing bearish sentiment despite the recent rally.

Major

institutions forecast gold between $4,200-$5,000 per ounce by late 2026. UBS

projects gold reaching $4,200 as the next baseline target, with an upside

scenario of $4,700 by Q1 2026 if geopolitical risks intensify. Goldman Sachs

forecasts $5,055 by Q4 2026, while Bank of America targets $5,000 (averaging

$4,400 for the full year). ING expects more conservative near-term targets of

$4,000 for Q4 2025 and $4,100 for Q1 2026, with further upside through 2026.

Industry

experts project Bitcoin could reach $180,000-$200,000 during 2025, according to

forecasts compiled by CNBC. Youwei Yang, chief economist at Bit Mining,

predicts Bitcoin’s price will range between $180,000 and $190,000 in 2025,

though he warns of potential corrections to around $80,000 during market

shocks.

For

Bitcoin, primary risks include failure to break above the $106,000-$108,000

resistance zone (which would increase probability of retreat below $100,000),

Federal Reserve speakers signaling slower pace of rate cuts (December cut

probability has dropped to 64%), and potential for corrections to $80,000

during major market shocks according to analyst warnings.

Dogecoin Price Prediction 2025-2030: Will DOGE Finally Reach $1?

Dogecoin has captured the imagination of cryptocurrency investors worldwide, transforming from a meme coin into a serious digital asset. As we look toward 2025-2030, the burning question remains: Will DOGE finally reach the elusive $1 milestone? This comprehensive Dogecoin price prediction analysis examines technical indicators, market trends, and key factors that could propel DOGE to new heights or keep it grounded.

Dogecoin occupies a unique space in the cryptocurrency ecosystem. Originally created as a joke in 2013, DOGE has evolved into one of the most recognized digital currencies. The DOGE cryptocurrency benefits from strong community support and high-profile endorsements, particularly from Elon Musk, who frequently tweets about the coin. Current market analysis shows Dogecoin consistently ranking among the top cryptocurrencies by market capitalization, demonstrating its staying power beyond the meme coin label.

Our Dogecoin price prediction for 2025 considers several key factors that could influence DOGE’s trajectory:

Based on historical patterns and current crypto market analysis, we project DOGE could reach between $0.35 and $0.65 in 2025, depending on broader market conditions and specific catalyst events.

The mid-term outlook for DOGE cryptocurrency presents both opportunities and challenges. Our technical analysis identifies several critical price levels and resistance points that will determine whether Dogecoin can maintain momentum toward the $1 target. Key factors include:

| Year | Conservative Prediction | Moderate Prediction | Optimistic Prediction |

|---|---|---|---|

| 2026 | $0.25 – $0.45 | $0.40 – $0.70 | $0.60 – $0.85 |

| 2027 | $0.30 – $0.55 | $0.50 – $0.80 | $0.75 – $0.95 |

| 2028 | $0.35 – $0.65 | $0.60 – $0.90 | $0.85 – $1.10 |

The Elon Musk Dogecoin connection cannot be overstated when making price predictions. The Tesla and SpaceX CEO’s tweets have repeatedly caused significant price movements in DOGE. This unique relationship creates both volatility and opportunity for investors. The crypto market analysis must account for potential future endorsements or integrations that could dramatically affect Dogecoin’s valuation.

As we assess the meme coin future, Dogecoin stands at a crossroads. While it pioneered the meme coin category, it now faces competition from newer tokens. However, DOGE’s first-mover advantage, established ecosystem, and brand recognition provide significant staying power. The key question for long-term investors is whether Dogecoin can transition from pure meme status to having substantial utility and adoption.

The million-dollar question remains: Will DOGE reach $1? Our analysis suggests several scenarios where this could occur:

Based on current circulating supply and market dynamics, reaching $1 would require Dogecoin’s market capitalization to approach approximately $130 billion – a challenging but not impossible milestone given cryptocurrency’s history of surprising valuations.

What makes Dogecoin different from other cryptocurrencies?

Dogecoin was created as a lighthearted alternative to Bitcoin, featuring faster transaction times and lower fees. Its strong community and celebrity endorsements set it apart.

How does Elon Musk influence Dogecoin’s price?

Elon Musk’s tweets and public statements about Dogecoin have historically caused significant price movements, both positive and negative.

What are the main risks for Dogecoin investors?

Key risks include regulatory uncertainty, competition from other meme coins, reliance on celebrity endorsements, and market volatility common to cryptocurrencies.

Can Dogecoin be used for everyday transactions?

Yes, an increasing number of merchants accept Dogecoin, and its transaction speed makes it suitable for small purchases, though adoption remains limited compared to traditional payment methods.

What technological developments are planned for Dogecoin?

The Dogecoin development community continues working on improvements, though the project maintains its lightweight approach compared to more complex blockchain platforms.

Dogecoin’s path to $1 represents one of the most fascinating narratives in cryptocurrency. While the journey faces significant challenges, including market volatility and regulatory hurdles, DOGE’s strong community support and unique position in the crypto landscape provide compelling reasons for optimism. Our Dogecoin price prediction analysis suggests that reaching $1 by 2030 remains within the realm of possibility, though investors should approach with careful consideration of both the opportunities and risks inherent in meme coin investments.

To learn more about the latest crypto markets trends, explore our article on key developments shaping cryptocurrency institutional adoption and future market liquidity.

This post Dogecoin Price Prediction 2025-2030: Will DOGE Finally Reach $1? first appeared on BitcoinWorld.

Cardano price is showing early signs of revival as bullish technical setups, rising market dominance, and strong on-chain confidence hint at the start of a major uptrend.

Cardano price is once again making headlines after a long stretch of underperformance. A surge in market interest, improving on-chain strength, and bullish technical formations have participants eyeing a potential comeback. With confidence rebuilding across both retail and institutional circles, ADA might be gearing up for its next big move.

A potential macro breakout may be forming on Cardano’s market dominance chart as shown by Wolf of Crypto. The structure highlights two confirmed bottoms, labeled 2025 Bottom 1 and Bottom 2, forming a classic Elliott Wave foundation for the next impulse move. The projected 2026 top mirrors the same five-wave rhythm seen during the 2020–2021 bull cycle, with dominance potentially expanding towards the 3.5%–4% range.

ADA forms a potential double-bottom reversal on the dominance chart, signaling a bullish structural shift ahead of 2026. Source: Wolf of Crypto via X

This setup suggests ADA could reclaim its market presence after years of underperformance. With the trendline resistance now converging near 1.2% dominance, a breakout from this zone could confirm the beginning of a macro uptrend. If history repeats, ADA’s rise may coincide with its strongest accumulation-to-expansion phase since 2020, favoring bulls heading into 2026.

Cardano’s optimism continues to grow, with Lucid asserting that ADA is “about to go parabolic.” His outlook rests on the network’s expanding technological stack, privacy integration, scalable infrastructure, and security advancements. These factors reinforce the belief that ADA is positioning for a major run alongside the next wave of blockchain adoption.

With 2026 potentially being the “privacy-dominant cycle,” a $300 billion market cap projection doesn’t appear far-fetched.

According to Sssebi, Cardano’s short-term chart structure hints at renewed bullish reversal. After a strong Friday push, ADA has been consolidating near the $0.50 to $0.52 zone, forming bottoming tails that indicate dip absorption. The chart shows ADA still trading below its 50-day moving average, leaving room for a continuation rally if buyers sustain momentum.

Cardano price holds steady above key support, with buyers eyeing a breakout toward $0.72 as momentum strengthens. Source: Sssebi via X

Immediate resistance lies near $0.65, a level that coincides with the declining 50DMA and recent liquidity highs. A breakout above this area could trigger a move towards $0.72, confirming the start of a short-term bullish reversal.

Cardano macro view aligns with a larger structural setup that mirrors ADA’s 2020–2021 price expansion. The chart identifies liquidity contraction zones followed by massive upward expansions, with Fibonacci targets projecting a potential surge towards $3.40 to $5.0 during the next market cycle.

Cardano’s price structure mirrors its 2020–2021 expansion phase, with Fibonacci targets hinting at a potential rally toward $3.40–$5.00. Source: Dan Gambardello via X

This model implies ADA’s consolidation from 2022 to 2025 represents reaccumulation before the next breakout. Once the current range between $0.40 and $0.60 resolves, the next Cardano price impulse could match the previous 1.618 Fibonacci extension, suggesting a path towards higher levels.

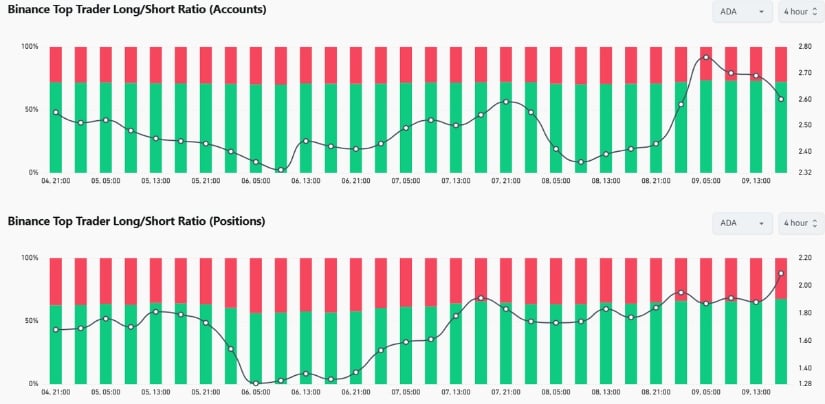

Fresh on-chain and derivatives data support the bullish case. As CW8900 notes, top Binance traders have increased their ADA long positions by 10% in just three days, signaling renewed institutional confidence. This rise in long ratios usually precedes short-covering rallies, especially when coinciding with rising open interest and stable funding rates.

Top Binance traders boost ADA long exposure by 10% in three days, signaling growing institutional confidence. Source: CW8900 via X

The steady uptick in long exposure indicates traders are preparing for directional continuation rather than fading the move. Combined with ADA’s rising spot volume and network stability, this on-chain and derivatives activity aligns perfectly with broader accumulation patterns observed across the charts.

From market dominance projections to on-chain signals, the narrative around Cardano is shifting decisively towards bullish territory. Technicals across multiple analysts point to a maturing base structure, while institutional traders are increasingly positioning for upside.

If Cardano price holds above the $0.50 support and breaks through the $0.65 to $0.70 resistance, confirmation of a broader uptrend could arrive sooner than expected. As historical cycles suggest, ADA’s next move may not just be a rebound, but a full-scale macro expansion phase.

The crypto market is surging once again, and two assets are capturing investor attention for very different reasons — XRP and AlphaPepe (ALPE).

After the U.S. government ended its shutdown, the broader market has gone risk-on. Bitcoin is above $106,000, and XRP has jumped to $2.47, breaking out of months of consolidation. Analysts now believe XRP could climb to $6 in the coming cycle as institutional adoption accelerates and Ripple’s payment network gains further global traction.

Meanwhile, AlphaPepe, a fast-growing BNB Chain presale, is making waves as the most promising meme coin of 2025. With over 3,500 holders, 100+ new participants joining daily, and Binance listing rumors swirling, AlphaPepe is positioning itself as the next big retail phenomenon. Experts even say it could climb from $0.007 to $1 in the months ahead — a move that could transform early investors’ portfolios.

XRP is trading between $2.26 and $2.47 today, continuing a strong upward trend that began after the resolution of the U.S. government shutdown. The token’s recovery is being driven by renewed institutional inflows, Ripple’s expanding network of cross-border payment corridors, and growing investor confidence in the company’s long-term vision.

Ripple’s On-Demand Liquidity (ODL) system is now live in more than 30 markets worldwide, processing hundreds of millions in daily transaction volume. Combined with Ripple’s $40 billion valuation, its global partnerships with banks and fintech firms position XRP as one of the most credible assets bridging traditional finance and blockchain technology.

Technically, XRP’s chart paints a bullish picture. After breaking through key resistance levels near $2, traders now view $3 as the next critical threshold and $6 as the mid-term target if momentum continues.

Analysts attribute the surge to increased liquidity across major altcoins and the growing narrative that XRP may become a foundational layer for global remittances — a role once reserved for SWIFT.

While XRP leads among institutional altcoins, AlphaPepe (ALPE) is taking the retail market by storm. Built on BNB Chain, AlphaPepe is redefining meme-coin investing with real mechanics, instant transparency, and active community engagement.

The presale has raised nearly $400,000 and has now surpassed 3,500 holders, a milestone achieved in record time. Over 100 new participants are joining daily, attracted by the project’s unique blend of meme culture and tangible token utility.

AlphaPepe’s standout features include instant token delivery, giving buyers immediate control over their holdings, and staking rewards, which are already live during the presale. Its USDT reward pool has distributed over $9,000 to early participants, demonstrating that AlphaPepe isn’t just a presale — it’s a working ecosystem before listing.

Security remains a top priority. AlphaPepe’s contract has been audited by BlockSAFU, receiving a 10/10 security rating, and liquidity will be locked at launch to ensure transparency and safety. The team has also introduced NFT rewards for top holders, offering collectible incentives that deepen community loyalty and encourage long-term participation.

This structured, transparent approach is why analysts and traders alike are calling AlphaPepe the “next Shiba Inu.”

At its current presale price of $0.007, AlphaPepe offers one of the most attractive entry points in the meme-coin space. Several analysts believe that after listing and scaling its community further, AlphaPepe could trade anywhere between $0.50 and $1, depending on market sentiment and exchange visibility.

If that scenario plays out, the math is compelling. A $1,000 investment in AlphaPepe right now buys you over 400,000 ALPE tokens. Should AlphaPepe hit even the lower end of analysts’ forecasts, that same position could be worth around $10,000 in a matter of months, excluding staking rewards and NFT incentives.

To put things in perspective, one early investor in PEPE famously turned $1 into $7 million within a year. Analysts suggest AlphaPepe has the right mechanics, timing, and community momentum to deliver the next iteration of that story.

Adding fuel to AlphaPepe’s rapid rise are rumors of a Binance listing. After AlphaPepe was featured on Binance News earlier this month, speculation has grown that it could debut on major exchanges shortly after its presale concludes.

A potential Binance listing would provide immediate liquidity and access to millions of users worldwide, potentially accelerating AlphaPepe’s growth trajectory. With other successful meme coins like Shiba Inu and PEPE following a similar path, this rumor alone has sparked even more presale activity.

If AlphaPepe does list on Binance, analysts believe it could mirror the explosive post-listing momentum of its predecessors — transforming it from a promising presale to a mainstream success.

AlphaPepe isn’t just popular with small investors. Whales and large trading groups have begun accumulating presale tokens as well, viewing AlphaPepe as the perfect high-upside rotation play. On-chain data shows several large wallet inflows in recent days, indicating that experienced investors are positioning early.

For whales, AlphaPepe offers a rare mix of verified credibility and massive upside. For retail investors, it’s an accessible entry point into what could become one of 2026’s biggest meme-coin stories.

As one trader on X put it:

“For traders and whales positioning early, AlphaPepe could be the kind of move that turns strong BTC gains into life-changing ROI.”

This combination of whale confidence and retail energy is exactly what fueled past meme-coin booms — and AlphaPepe appears to be recreating that formula perfectly.

The current rally is defined by balance — institutional and retail energy moving together. XRP represents the institutional side: regulated, integrated, and purpose-driven. AlphaPepe represents the retail side: viral, community-powered, and culture-driven.

Together, they illustrate how different sectors of the crypto market are converging in the 2025 bull cycle. XRP provides the foundation for blockchain’s utility narrative, while AlphaPepe injects vitality, accessibility, and mass participation.

Analysts are recommending a diversified approach — combining XRP’s stability with AlphaPepe’s explosive potential — to maximize growth while balancing exposure across established and emerging narratives.

The post-shutdown rally has reawakened crypto enthusiasm, and XRP’s rise to $2.47 shows that institutional adoption and utility remain powerful market drivers. Analysts now see $6 as a realistic target for XRP as liquidity expands and Ripple’s payment solutions scale globally.

Yet, while XRP dominates the headlines for utility, AlphaPepe (ALPE) is dominating for momentum. With 3,500+ holders, Binance listing rumors, whale participation, and analysts projecting a move from $0.007 to $1, AlphaPepe is positioning itself as the best crypto to buy now — and possibly the next Shiba Inu-style success story.

For investors, this may be the golden window: a chance to combine established players like XRP with emerging stars like AlphaPepe — balancing institutional confidence with early-stage opportunity. Because if AlphaPepe’s trajectory continues, the early investors of today could be the headline-makers of tomorrow.

Website: https://alphapepe.io/

Telegram: https://t.me/alphapepejoin

What is XRP’s current price and target?

XRP is trading around $2.47, with analysts forecasting a potential move toward $6 as Ripple expands its global payment corridors.

What is AlphaPepe (ALPE)?

AlphaPepe is a BNB Chain meme-coin presale featuring instant token delivery, staking rewards, NFT incentives, verified audits, and an expanding community of over 3,500 holders.

How much can investors earn with AlphaPepe?

At $0.007, a $1,000 investment secures over 400,000 ALPE tokens, which could be worth around $10,000 if AlphaPepe reaches $0.05 to $0.10 after listing.

Why are analysts calling AlphaPepe the next Shiba Inu?

Because it mirrors Shiba Inu’s early viral growth but adds structural advantages — staking, NFTs, transparency, and potential Binance listings — that make it more sustainable.Why are whales buying AlphaPepe?

Whales see AlphaPepe as the perfect high-upside trade to convert Bitcoin profits into exponential ROI — a strategy that has made meme coins one of crypto’s most lucrative trends.

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release

Solana Price Prediction: Can SOL Reach $500 by 2025?

Imagine watching your Solana investment potentially multiply as SOL cryptocurrency approaches the $500 milestone. The blockchain technology behind Solana has captured significant attention in the crypto market analysis community, making it one of the most discussed digital assets in recent years. But what does the future truly hold for this high-performance blockchain?

Solana price prediction models rely on multiple factors that influence the value of SOL cryptocurrency. The blockchain technology that powers Solana offers high-speed transactions and low fees, making it attractive for developers and users. When analyzing crypto market analysis trends, experts consider network activity, adoption rates, and technological developments. These digital assets derive their value from both utility and market sentiment.

Several elements contribute to Solana price prediction accuracy. The blockchain technology continues to evolve with regular upgrades and improvements. Market analysts study trading volumes, institutional interest, and competitor performance when evaluating SOL cryptocurrency. The broader crypto market analysis considers macroeconomic factors that affect all digital assets, including regulatory developments and global economic conditions.

| Year | Conservative Prediction | Moderate Prediction | Optimistic Prediction |

|---|---|---|---|

| 2025 | $180-$250 | $250-$350 | $350-$500 |

| 2026 | $220-$300 | $300-$450 | $450-$650 |

| 2030 | $400-$600 | $600-$900 | $900-$1,200 |

The underlying blockchain technology plays a crucial role in Solana price prediction accuracy. Recent upgrades have addressed network stability concerns while maintaining the platform’s signature speed. As developers continue building on Solana, the utility of SOL cryptocurrency increases. This creates a positive feedback loop where improved blockchain technology attracts more users, potentially driving up demand for these digital assets.

Current crypto market analysis positions Solana among the top contenders in the blockchain space. When comparing SOL cryptocurrency to other digital assets, several advantages emerge. The network’s transaction speed and scalability make it suitable for various applications, from DeFi to NFTs. However, investors should consider that all crypto market analysis contains inherent uncertainties, and digital assets remain volatile investments.

Investing in digital assets like SOL cryptocurrency requires careful planning. A solid Solana price prediction should inform but not dictate investment decisions. Consider these points when evaluating SOL as part of your portfolio:

What makes Solana different from other cryptocurrencies?

Solana stands out for its high transaction speed and low fees, powered by its unique proof-of-history consensus mechanism combined with proof-of-stake.

Who founded Solana?

Solana was founded by Anatoly Yakovenko, who previously worked at Qualcomm and Dropbox. The project also received early support from FTX and Alameda Research.

Is Solana environmentally friendly?

Compared to proof-of-work blockchains, Solana’s energy consumption is significantly lower, making it more environmentally sustainable than many older blockchain technologies.

What companies are building on Solana?

Major companies and projects building on Solana include Circle (USDC), Chainlink Labs, and various DeFi and NFT platforms that utilize the network’s capabilities.

The journey toward $500 for SOL cryptocurrency represents more than just price appreciation—it signifies the growing adoption of advanced blockchain technology and the maturation of digital assets as a legitimate asset class. While Solana price prediction models provide valuable insights, remember that the crypto market analysis landscape changes rapidly. The potential for significant growth exists, but so does volatility. Your investment decisions should balance optimistic projections with prudent risk management.

To learn more about the latest crypto markets trends, explore our article on key developments shaping Solana institutional adoption.

This post Solana Price Prediction: Can SOL Reach $500 by 2025? first appeared on BitcoinWorld.

Bitcoin and Ether steadied Sunday as traders weighed a fragile hold above $100,000 for BTC and a rebound in ETH toward the mid-$3,000s amid tentative risk appetite.

Bitcoin and Ether held steady on Sunday as traders balanced on a knife-edge. As per Coingecko data, Bitcoin traded near $102,100, about +2% in 24 hours.

On the other hand, Ethereum hovered around $3,530, about +4% in 24 hours.

The market was shaped by a modest increase in US spot Bitcoin ETF demand late last week, alongside a cautious macroeconomic backdrop that kept crypto prices stuck in a range.

US spot Bitcoin ETFs turned positive again on Thursday, November 7, attracting roughly $240M after six consecutive days of outflows.

(Source: Farside)

Most of the buying came from products offered by BlackRock, Fidelity, and ARK Invest, according to figures from Farside Investors.

Ethereum developers have set December 3 for the Fusaka upgrade, which will introduce PeerDAS.

The feature is meant to expand data capacity for layer-2 networks. It’s an important step for the ecosystem, even as ETH prices remain choppy.

The swing back to ETF inflows followed a rough start to November and arrived alongside calmer weekend trading. It suggests a more stable mood rather than a clear shift in direction.

Earlier in the week, Bitcoin briefly fell below $100,000. The slip came during a broader pullback across crypto and related stocks, with liquidations and position cuts adding pressure.

Bitcoin’s heat map shows thick liquidity sitting between about $110,000 and $125,000. That suggests many resting sell orders above the current price.

The market has been easing since early October, when Bitcoin briefly traded near $123,000. Since then, it has moved lower, marking a pattern of lower highs and lower lows into early November near $100,000.

Liquidity looks heaviest around $115,000 and $120,000, where the yellow-green bands cluster. Areas below show lighter activity, pointing to fewer buyers.

A sharp slide in mid-October left a thin pocket of support, though liquidity has started to form again.

EXPLORE: Best Solana Meme Coins To Buy

Ethereum is also approaching a significant supply zone near $3,700. About 869,000 ETH were bought around this level, creating a strong resistance cap.

Glassnode’s cost-basis data shows many holders sitting near break-even here, so some may sell if prices bounce.

Recent price action tells a similar story. ETH has tried several times to break above the $3,700–$4,200 band but failed, with each attempt followed by sharp pullbacks.