The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Jessie A Ellis

Nov 08, 2025 06:57

MATIC price prediction shows potential recovery to $0.45-$0.58 range within 4-6 weeks, though current bearish momentum suggests caution with $0.35 support critical.

Polygon (MATIC) presents a complex technical picture as we analyze the latest data for our comprehensive MATIC price prediction. Trading at $0.38, the token sits near its 52-week low of $0.37, yet several technical indicators suggest a potential recovery scenario could unfold over the coming weeks.

• MATIC short-term target (1 week): $0.40-$0.42 (+5-11%)

• Polygon medium-term forecast (1 month): $0.45-$0.58 range (+18-53%)

• Key level to break for bullish continuation: $0.43 (SMA 20 resistance)

• Critical support if bearish: $0.35 (immediate support) and $0.33 (strong support)

The latest analyst predictions reveal a significant disconnect between short-term forecasts and current market reality. Recent MATIC price prediction models from Changelly suggest modest targets around $0.19-$0.194, while CoinArbitrageBot’s AI models project higher targets near $0.228. However, these predictions appear outdated given MATIC’s current price of $0.38, suggesting either the models haven’t adjusted to recent price action or there’s potential for significant downside risk.

This disparity highlights the challenge in cryptocurrency forecasting, where rapid price movements can quickly invalidate short-term predictions. The consensus among recent forecasts indicates bullish sentiment, but the actual price action tells a different story, with MATIC experiencing a -0.29% decline in the past 24 hours.

Our Polygon technical analysis reveals several key indicators that shape our MATIC price prediction. The RSI reading of 38.00 places MATIC in neutral territory, avoiding oversold conditions but indicating selling pressure remains present. This positioning suggests room for downward movement before reaching truly oversold levels that might trigger buying interest.

The MACD histogram at -0.0045 confirms bearish momentum in the short term, with the MACD line (-0.0246) below the signal line (-0.0202). This technical configuration typically indicates continued selling pressure, though the relatively shallow negative readings suggest the bearish momentum isn’t extremely strong.

Volume analysis shows $1.07 million in 24-hour trading on Binance, which is relatively modest and indicates lack of strong conviction in either direction. This low volume environment could mean that any significant news or technical breakout might result in amplified price movements.

The bullish scenario for our MATIC price target focuses on the token’s position within the Bollinger Bands. At a %B position of 0.29, MATIC trades closer to the lower band ($0.31) than the upper band ($0.56), suggesting potential mean reversion toward the middle band at $0.43.

For the Polygon forecast to turn bullish, MATIC must first reclaim the SMA 20 level at $0.43. This would represent a 13% gain from current levels and could trigger algorithmic buying from trend-following strategies. A successful break above $0.43 opens the path toward the SMA 50 at $0.45, followed by the upper Bollinger Band near $0.56.

The ultimate bullish MATIC price target sits at the strong resistance level of $0.58, which coincides with both technical resistance and the upper Bollinger Band. Reaching this level would represent a 53% gain from current prices and would likely require positive fundamental catalysts alongside technical momentum.

The bearish scenario cannot be ignored in our comprehensive MATIC price prediction analysis. The immediate support at $0.35 represents just an 8% decline from current levels, making it highly vulnerable if selling pressure intensifies. A break below this level would likely trigger stop-loss orders and automated selling.

The critical support level at $0.33 aligns with the strong support identified in our technical analysis. A breakdown below this level would be particularly concerning, as it would represent a new 52-week low and could trigger capitulation selling. Such a scenario might see MATIC testing the $0.30 level, where the lower Bollinger Band provides some mathematical support.

Based on our Polygon technical analysis, the decision to buy or sell MATIC depends heavily on risk tolerance and time horizon. The current price action suggests waiting for either a clear reversal signal or a deeper correction might be prudent.

For aggressive traders, a position could be initiated near current levels with a tight stop-loss below $0.35. This strategy offers a favorable risk-reward ratio if MATIC can reclaim the $0.43 resistance level. Conservative investors might wait for a successful break above $0.43 with increased volume before establishing positions.

Risk management remains crucial given the bearish momentum indicators. Any position should include stop-loss orders below $0.33 to protect against further downside. Position sizing should be conservative, as the technical picture suggests higher volatility ahead.

Our comprehensive MATIC price prediction suggests a cautiously optimistic outlook for the medium term, despite current technical weakness. The most likely scenario sees MATIC consolidating between $0.35-$0.43 over the next 1-2 weeks before attempting to break higher toward our $0.45-$0.58 price targets.

The Polygon forecast carries medium confidence due to conflicting signals in the technical indicators. While RSI levels suggest room for recovery and Bollinger Band positioning indicates potential mean reversion, the negative MACD momentum and proximity to 52-week lows warrant caution.

Key indicators to watch for confirmation include volume expansion above 2 million daily, RSI moving above 50, and most importantly, a decisive break above the SMA 20 at $0.43. Invalidation of this bullish scenario would occur on a close below $0.33, which would likely lead to further downside testing toward $0.30 or lower.

Timeline expectations suggest any significant move higher would likely develop over 4-6 weeks, requiring patience from investors seeking to capitalize on this potential Polygon recovery scenario.

Image source: Shutterstock

As the crypto market buzzes with activity, Bitcoin (BTC) currently trades at $101,468.15, marking a 2.31% dip from the previous day. With a high of $107,269.85 and a low of $98,892.97, investors are closely watching the movements to gauge its next direction. Could Bitcoin reach the projected price of $142,556 by year-end? Let’s delve into the data and predictions.

Bitcoin’s current price of $101,468.15 sits below its 50-day average of $113,119.94 and its 200-day average of $110,046.36. Despite this downturn, forecasts suggest a potential climb to $142,556 by December. However, longer-term projections indicate a dip to $96,114 within a year. Factors contributing to these targets include historical performance trends, with a notable 1,060.81% increase over the past five years.

A dive into technical indicators reveals mixed signals. The RSI stands at 38.96, indicating near oversold conditions, and the ADX at 25.94 shows a strong trend. However, the MACD suggests bearish momentum, as both the MACD line (-2,486.11) and signal line (-1,688.61) are negative, with a histogram at -797.49. Forecasts can change due to macroeconomic shifts, regulations, or unexpected events affecting the crypto market.

The market sentiment around Bitcoin is cautious yet optimistic. The recent decrease in price by 2.31% could be attributed to profit-taking behavior or broader market corrections. An analysis of volume shows a relative increase with a volume of 110,967,184,773, exceeding the average of 718,412,463, suggesting heightened trading activity. Meyka AI provides an interactive platform for assessing these trends, offering investors valuable insights into market movements.

In conclusion, while Bitcoin’s immediate future shows potential for recovery to $142,556, it’s crucial to remain aware of prevailing market conditions and sentiments. The mixed technical outlook suggests careful monitoring is needed before anticipating significant price shifts. As always, the crypto environment is subject to change from various external influences.

As of now, Bitcoin is priced at $101,468.15, reflecting a 2.31% decrease from its previous closing price of $103,869.00.

BTCUSD

Projections are varied, with some forecasts suggesting Bitcoin could rise to $142,556 by December, subject to market conditions and sentiment shifts.

Important indicators include RSI (38.96, near oversold), MACD indicating bearish pressure, and ADX at 25.94 signaling a strong trend.

Recent declines, like the 2.31% drop, might be from profit-taking or market corrections, reflecting broader market trends and investor strategies.

Increased trading volume can indicate strong market interest or anxiety, leading to price volatility. Bitcoin’s current trading volumes are significantly above averages.

Disclaimer:

Cryptocurrency markets are highly volatile. This content is for informational purposes only.

The Forecast Prediction Model is provided for informational purposes only and should not be considered financial advice.

Meyka AI PTY LTD provides market data and sentiment analysis, not financial advice.

Always do your own research and consider consulting a licensed financial advisor before making investment decisions.

Alvin Lang

Nov 07, 2025 20:09

MATIC price prediction suggests potential 18-32% upside to $0.45-$0.50 if bulls can break $0.42 resistance, with critical $0.35 support holding firm in current consolidation phase.

Polygon’s MATIC token sits at a critical juncture as technical indicators paint a mixed picture for the coming weeks. With the token trading at $0.38 and showing signs of potential reversal, our comprehensive MATIC price prediction analysis reveals key levels that could determine the next major move.

• MATIC short-term target (1 week): $0.42 (+10.5%) – Breaking EMA resistance

• Polygon medium-term forecast (1 month): $0.45-$0.50 range (+18-32% upside)

• Key level to break for bullish continuation: $0.42 (EMA 26 resistance)

• Critical support if bearish: $0.35 (immediate support) and $0.33 (strong support)

The latest analyst predictions for MATIC show a notable divergence in short-term versus medium-term outlooks. Blockchain.News presents the most bullish Polygon forecast, targeting $0.45-$0.70 with potential for a breakout above the critical $0.58 resistance level within 4-6 weeks. This MATIC price target aligns with our technical analysis showing strong resistance at this level.

In contrast, more conservative predictions from CoinLore suggest a near-term MATIC price target of $0.3763, while CoinArbitrageBot’s AI-driven model forecasts a bearish scenario toward $0.19876. The consensus appears split between those expecting continued consolidation and analysts anticipating a medium-term recovery contingent on breaking key technical levels.

The most realistic Polygon forecast appears to be in the $0.45-$0.50 range for the next month, assuming current support levels hold and momentum indicators begin to improve.

Current Polygon technical analysis reveals MATIC is positioned just above critical support levels with several indicators suggesting a potential reversal setup. The RSI at 38.00 indicates the token is approaching oversold territory without being extremely bearish, providing room for upward movement.

The MACD histogram at -0.0045 shows bearish momentum is weakening, though not yet turning positive. More importantly, MATIC’s position within the Bollinger Bands at 0.29 suggests the token is in the lower portion of its recent range, historically a zone where reversals often occur.

Volume analysis shows relatively stable trading at $1.07 million on Binance, indicating sustained interest despite the recent price weakness. The key technical setup revolves around MATIC’s ability to reclaim the EMA 26 at $0.42, which would signal the beginning of a more substantial recovery.

The primary bullish MATIC price prediction hinges on breaking above $0.42 (EMA 26) with conviction. Once this level is cleared, the path opens toward $0.45 (SMA 50), representing our initial MATIC price target. A sustained move above $0.45 could trigger momentum toward $0.50-$0.55, bringing MATIC closer to the critical $0.58 resistance level highlighted by multiple analysts.

For this bullish Polygon forecast to materialize, we need to see RSI climbing above 45, MACD turning positive, and volume increasing on any upward moves. The 52-week high at $1.27 remains a distant target, but breaking $0.58 would represent a significant milestone in MATIC’s recovery.

The bearish scenario for our MATIC price prediction involves a breakdown below the immediate support at $0.35. Such a move would likely trigger selling toward the strong support zone at $0.33, representing the lower Bollinger Band level.

A break below $0.33 would invalidate the current consolidation pattern and could lead to a test of the 52-week low at $0.37. This scenario becomes more likely if Bitcoin experiences significant weakness or if broader market sentiment deteriorates sharply.

Based on current Polygon technical analysis, the question of whether to buy or sell MATIC depends heavily on risk tolerance and timeframe. For conservative investors, waiting for a clear break above $0.42 provides better risk-adjusted entry with a stop-loss at $0.37.

More aggressive traders might consider accumulating between $0.36-$0.38 with a tight stop-loss at $0.34. This strategy offers a favorable risk-reward ratio toward our MATIC price target of $0.45-$0.50.

Position sizing should remain conservative given the mixed technical signals. A maximum 2-3% portfolio allocation seems prudent until clearer directional momentum emerges.

Our comprehensive MATIC price prediction suggests a cautiously optimistic outlook for the next 2-3 weeks, with targets of $0.45-$0.50 representing realistic upside potential. This Polygon forecast carries medium confidence given the current technical setup and analyst consensus around these levels.

Key indicators to watch include RSI breaking above 45, MACD turning positive, and most critically, MATIC sustaining above $0.42. Failure to hold $0.35 support would invalidate this bullish thesis and shift focus to lower targets.

The prediction timeline spans 2-4 weeks for initial targets, with the broader $0.58 resistance test potentially occurring within 6-8 weeks if momentum sustains. Investors should monitor Bitcoin’s price action closely, as broader market sentiment will significantly influence MATIC’s ability to achieve these projected levels.

Image source: Shutterstock

Once born from an internet meme, Dogecoin is again turning heads as bold predictions surface, suggesting a breathtaking rally toward $5.76 powered by an Elliott Wave forecast.

This eye-catching projection, derived from an AI-driven technical model, has reignited excitement among traders hoping DOGE can reclaim its former glory. But behind the hype lies a tough question: can Dogecoin’s price truly sustain such a meteoric rise amid a market struggling for direction and credibility?

At the time of writing, Dogecoin trades near $0.16, meaning it would need to surge more than 36 times to reach the $5.76 mark. Achieving such a move would push its market capitalization to roughly $840 billion, rivaling Ethereum’s—an extraordinary feat given Dogecoin’s unlimited supply of over 146 billion coins. As the crypto market weighs between technical optimism and economic realism, analysts are split on whether this Elliott Wave dream can turn into reality.

The Elliott Wave model argues that market cycles follow recurring psychological patterns, forming five upward waves followed by three corrective ones. In Dogecoin’s case, the AI-generated analysis suggests that the cryptocurrency may be entering wave 3, often the most powerful phase in bull markets. Based on the 1.618 Fibonacci extension, that setup projects DOGE toward $5.76, with a theoretical maximum of $48.55 under perfect bullish conditions.

AI analysis suggests Dogecoin ($DOGE) could reach $5.76 in a strong bull market, though current conditions and market cap constraints make such a surge unlikely in the near term. Source: @MoneyHustl41075 via X

Despite its mathematical allure, skepticism remains high. Elliott Wave theory is widely used but not scientifically validated, with many traders admitting that wave counts can vary drastically between analysts. Some experts caution that Dogecoin’s previous rallies—such as its 12,000% explosion in 2021—were largely driven by social media enthusiasm and celebrity hype, not predictable wave structures. That reality raises doubts about whether pure technical modeling can truly forecast Dogecoin’s next major move.

A broader look at Dogecoin’s chart shows a multi-year symmetrical triangle forming since the 2021 peak. This structure, often seen before large breakouts, suggests DOGE could climb toward $1.20, representing a 650% gain if momentum shifts bullish. Technical studies indicate that such patterns resolve upward nearly 70% of the time in crypto bull cycles, giving long-term holders a glimmer of hope.

Still, the near-term picture remains volatile. DOGE has declined roughly 10% in the past week, hovering near its $0.14 support. Analysts note that Bitcoin’s price trends remain a dominant influence, with Dogecoin historically showing an 80% correlation to Bitcoin’s movements—particularly during halving years. If Bitcoin rallies, Dogecoin could follow, but weak macro conditions or investor fatigue could delay its next breakout.

To reach $5.76, Dogecoin would need massive capital inflows, renewed public enthusiasm, and an unprecedented shift in investor psychology. Its unlimited supply model continues to limit long-term valuation potential, making sustained price growth difficult compared to scarce assets like Bitcoin.

Dogecoin has formed a six-month triangle pattern, with a breakout potentially targeting the $1.20 level. Source: @TATrader_Alan via X

Yet, Dogecoin’s community strength and brand recognition remain undeniable. New developments in AI trading, blockchain integration, and meme-driven marketing could inject renewed energy into the coin. Some analysts believe the next bull cycle might see DOGE revisit or exceed the $1 mark, but few expect the dramatic leap to $5.76 without a transformative market event.

Dogecoin’s Elliott Wave projection to $5.76 is both ambitious and intriguing, symbolizing crypto traders’ constant hunt for the next explosive move. While the model captures the imagination, the practical barriers—valuation limits, supply inflation, and market structure—temper expectations.

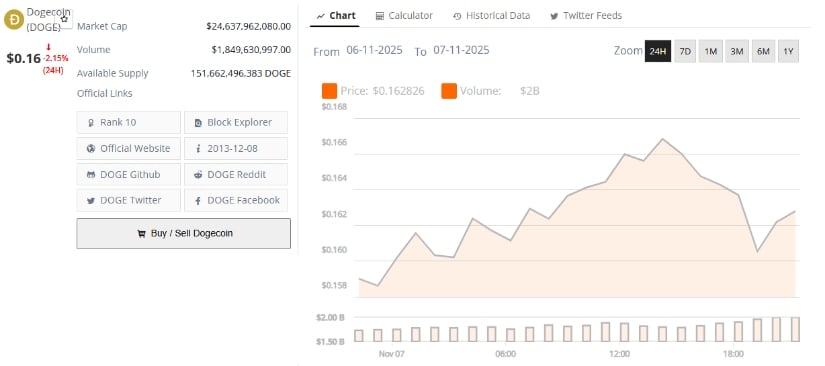

Dogecoin was trading at around $0.16, down 2.15% in the last 24 hours. Source: Brave New Coin

In a realistic scenario, Dogecoin’s next major milestone might lie between $1.00 and $1.20, rather than the multi-thousand-percent rally to $5.76. As the market evolves, Dogecoin’s price prediction will test whether optimism and community power can once again propel the “people’s crypto” beyond its meme roots and into the realm of sustainable growth.

The Cardano price is finally showing signs of life again. Network activity is rising, and more developers are building on the blockchain. ADA price today is still way below $1, but investor confidence is slowly coming back as staking grows and new upgrades approach.

Analysts believe these strong fundamentals could set the stage for a major breakout — with some predicting Cardano could approach the $5 mark this market cycle.

After months of wild swings, Cardano has settled near $0.60. Investors are now doubting whether another significant rally will see ADA price reach $5 during this cycle.

Short-term momentum is hesitant. However, analysts cite consistent on-chain growth, new collaborations, and an increasing developer base as causes to be optimistic about the latest Cardano news.

The ADA price today continues to trade within a narrowing channel. This suggests that Cardano could be nearing a key turning point. The RSI is hovering near neutral, while volume indicators hint at quiet accumulation beneath the surface.

If the Cardano price breaks above $0.75 with convincing volume, analysts believe $1 could quickly follow. Beyond that, long-term models project a potential climb toward $3–$5 by late 2026 — assuming continued expansion in staking activity and decentralized app deployments.

For now, the Cardano price prediction remains cautiously bullish. With strong fundamentals and consistent upgrades, ADA news shows a blockchain that’s still building in silence — one that could surprise the market when momentum returns.

While Cardano news focuses on ecosystem upgrades, Remittix (RTX) is capturing real-world momentum with a working model already transforming cross-border payments. Trading at $0.1166, the project has raised over $28 million and sold 684 million tokens, proving strong investor confidence in its PayFi model.

Remittix combines blockchain technology with banking infrastructure to deliver fast, low-cost global transactions — a solution to the $190 trillion remittance problem.

With BitMart and LBank listings confirmed and beta testing of the Remittix Wallet live, adoption is growing fast. While ADA price prediction discussions center around $5 possibilities, Remittix is already delivering measurable value — not just potential.

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Despite heightened volatility across the cryptocurrency market, XRP continues to showcase remarkable resilience—holding firm near the $2.20 support level while technical patterns hint at a potentially explosive move ahead.

Investors are closely watching the charts, as a confirmed breakout could set the stage for one of XRP’s most significant rallies since early 2021.

The current setup has drawn growing attention from analysts and traders who see XRP’s sustained strength, strong liquidity, and promising technical formations as signs that the asset may be gearing up for a major upward push.

The XRP price has remained relatively stable around the $2.20 level, even as broader cryptocurrency markets experienced renewed volatility this week. Data from CoinGecko shows the current XRP price at approximately $2.21, marking a 4.6% daily decline and a 9% weekly dip. Despite these pullbacks, XRP continues to trade more than 40% above its prior support zone near $1.58—a sign of resilience in an uncertain market.

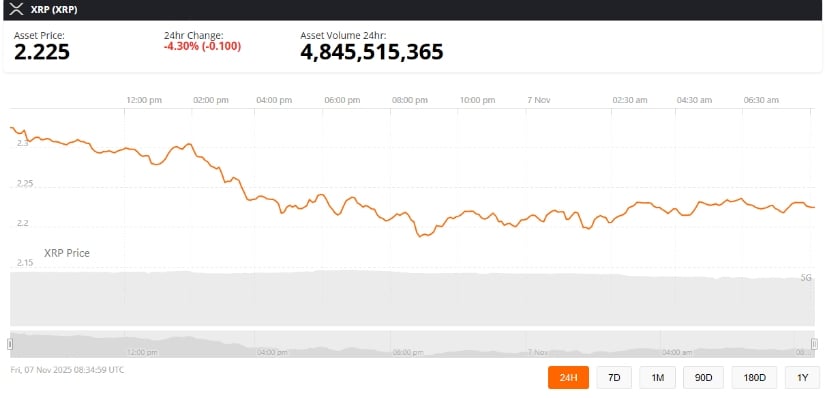

XRP is trading at $2.20, down 4.7% in 24 hours, with a market cap of $132.5 billion and strong daily volume of $4.8 billion, reflecting steady market activity despite volatility. Source: Coingecko

Analysts note that XRP’s liquidity profile remains robust. Over the last 24 hours, trading volume exceeded $5.5 billion, suggesting consistent participation from both institutional and retail investors. This level of activity underscores the asset’s ongoing relevance, especially as discussions around Ripple’s $500 million strategic investment and potential XRP ETF approval continue to shape sentiment.

Market analyst @ChartNerdTA recently highlighted what appears to be a bullish flag pattern forming on XRP’s long-term chart. The setup, often seen as a continuation pattern during uptrends, has historically produced strong follow-throughs once resistance levels are broken.

XRP forms a bullish flag pattern, with a breakout above $2.30 potentially targeting $3.04 and extending to $4.50, supported by strong historical success rates and market momentum. Source: ChartNerd via X

“The pattern began with a sharp rally from $1.90 support, followed by horizontal consolidation around $2.30,” ChartNerd explained. “If resistance at $2.30 to $2.35 breaks, XRP could target $3.04 initially—with an extended move toward $4.50 or higher based on the flag’s height.”

Historically, bullish flag patterns have shown a 64–75% success rate during bull markets, aligning with XRP’s more than 300% yearly gain. Technical analysts argue that a decisive daily close above the $2.94 resistance zone could confirm the start of a new leg higher, potentially positioning XRP among the top-performing altcoins in late 2025.

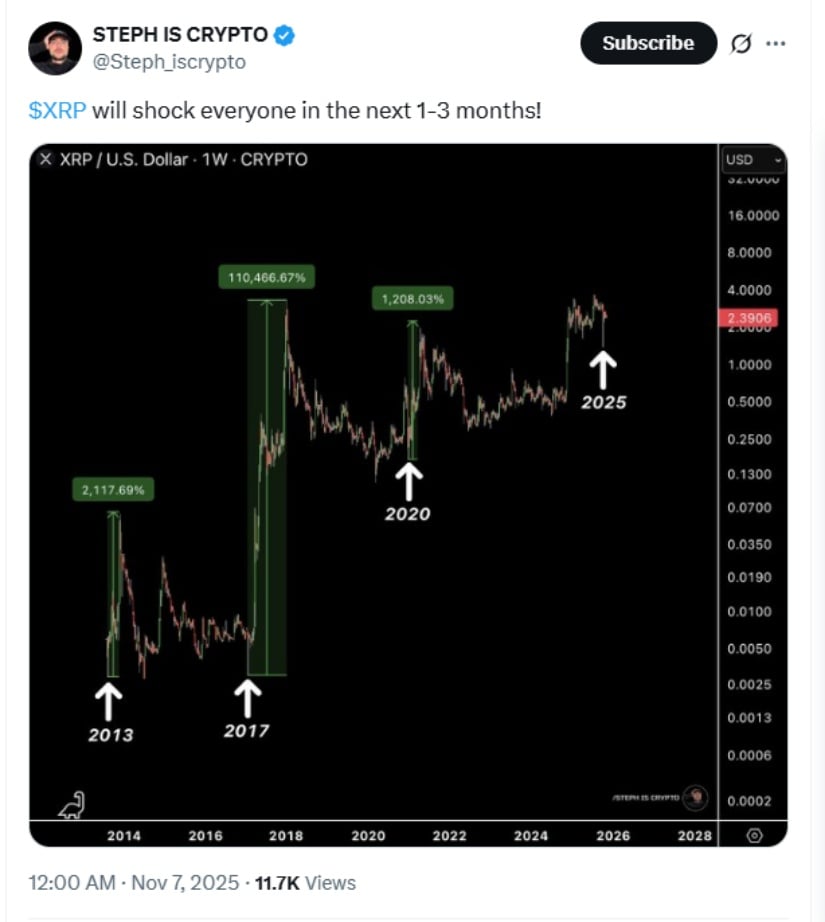

From a historical perspective, XRP has experienced multiple large-scale rallies over the past decade. A viral post by crypto influencer @Steph_iscrypto revisited XRP’s long-term price chart (2013–2028), noting prior surges—including a 2,117% rally in 2020 — to predict another “shock move” within the next one to three months.

XRP may see a “shock” rally in 1–3 months, supported by historical surges and Ripple’s $500M investment, with a rebound likely above $2.35. Source: STEPH IS CRYPTO via X

While some community members remain cautious after several missed short-term predictions, analysts agree that Ripple’s continued network development, regulatory clarity around the XRP SEC lawsuit, and the company’s growing list of institutional partners could serve as catalysts for renewed momentum.

Ripple’s investment initiatives, including expanding cross-border payment corridors and advancing real-world utility on the XRP Ledger, have further bolstered long-term optimism. These developments have helped sustain XRP’s market cap among the top ten global cryptocurrencies despite periods of volatility.

Technical observers suggest that XRP’s ongoing consolidation above $2.20 provides a strong base for a potential upward expansion. Analyst Hov noted that the rebound structure may represent part of a “three-wave micro-pattern,” possibly leading to short-term retracements before the next impulse.

XRP remains strong, 40% above recent lows, with $1.58 support holding and targets near $5.50 if it closes above $2.94. Source: Hov via X

“Even with minor pullbacks, key supports remain intact,” Hov said. “The broader structure continues to favor a bullish continuation if XRP closes above $2.94 on the higher timeframes.”

This stability, coupled with the asset’s high daily volume, indicates sustained liquidity and institutional engagement. The XRP price prediction for the 2025 scenario among many analysts now targets the $4–$5 range, provided the token maintains its current upward trajectory and broader crypto sentiment stabilizes.

Community sentiment around Ripple XRP news remains mixed but generally positive. Social media discussions emphasize the token’s speed, scalability, and cost efficiency—attributes that make it attractive for cross-border payment systems and potential central bank digital currency (CBDC) integrations.

XRP was trading at around 2.22, down 4.30% in the last 24 hours at press time. Source: Brave New Coin

Recent ripple news surrounding its growing partnerships with financial institutions has also supported market confidence. Analysts believe that institutional adoption could drive both Ripple price prediction upgrades and stronger on-chain activity in the coming quarters.

Market watchers continue to monitor Bitcoin’s influence, as BTC’s short-term volatility often impacts XRP’s direction. However, several experts suggest XRP could decouple partially if network adoption continues to expand independently of Bitcoin cycles.

While short-term volatility may persist, XRP’s ability to hold firm above $2.20 amid broader sell-offs signals underlying strength. If the XRP crypto price can break decisively above the $2.94 barrier, analysts see room for acceleration toward $4.50—and potentially beyond—based on historical continuation patterns.

For now, traders remain cautious but optimistic, with attention centered on daily closing levels and liquidity dynamics. Patience will be key, as XRP continues to demonstrate structural strength that often precedes major trend reversals.

Solana (CRYPTO: SOL) price today trades near $154 after losing the critical $170 support zone. The breakdown confirms sellers remain in control while spot outflows and softening open interest reinforce bearish momentum.

The daily chart shows Solana failing to reclaim the 20 day, 50 day, and 100 day EMAs. All three are stacked downward and reinforcing the descending trendline from the October peak. The EMA cluster around $185 to $192 now acts as a heavy o…

Read The Full Article Solana Price Prediction: Sellers Maintain Control As Major Support Breaks On Coin Edition.

Bitcoin’s recent price dip to $101,468.15 has turned heads in the crypto world. Dropping by 2.31% from its previous close, many investors are wondering if this is just a temporary lull or a precursor to a more significant shift. Let’s dig into what this movement means for Bitcoin’s forecast and potential to reach $142,555 by month’s end.

Bitcoin started the day at $106,557.98, only to drop to its current level of $101,468.15. This represents a $2,400.85 decline, further supported by a relative volume of 1.22, indicating above-average trading activity. While the yearly high remains at $126,296, fears of further dips are tempered by positive medium-term forecasts. According to market predictions, Bitcoin could hit a monthly peak of $142,555.95. However, historical volatility indicates sudden market shifts are possible.

Technical analysis shows Bitcoin’s relative strength index (RSI) at 38.96, pointing towards an oversold situation. The average directional index (ADX) reading of 25.94 suggests a strong trend, albeit in a negative direction. The Moving Average Convergence Divergence (MACD) currently signals a bearish trend with -2486.11. However, the Bollinger Bands show potential for volatility, with current prices nearing the lower band at $101,637.25.

Recent news highlights Bitcoin’s potential boost from changing Federal Reserve policies and the growing interest in crypto ETFs. Despite a recent 3.40% loss over the past 24 hours, the one-year growth rate stands at 12.93%. The prospect of institutional adoption and regulatory clarity could act as significant catalysts. Investors are keeping a close eye on these developments, considering Bitcoin’s historical resilience and Meyka AI insights into market behavior.

Overall, Bitcoin’s short-term forecast looks like a roller coaster ride. While current indicators show bearish tendencies, potential macroeconomic factors could influence a positive shift towards the $142,555 target. Forecasts can change due to macroeconomic shifts, regulations, or unexpected events affecting the crypto market. Keeping watch over market sentiment and technical indicators will be crucial for predicting future trends. For further insights, explore the BTCUSD page on Meyka AI.

The current price of BTCUSD is $101,468.15 as of the latest data available today, showing a decrease of 2.31% from the previous close of $103,869.00.

Forecasts suggest Bitcoin could reach $142,555.95 by the end of the month, although there are inherent uncertainties due to market volatility.

Link: BTCUSD.

The RSI for Bitcoin currently stands at 38.96, which generally suggests that it is in an oversold territory. This can potentially lead to a reversal or pivot towards higher prices.

Recent discussions on Federal Reserve policy shifts and increased interest in cryptocurrency ETFs may influence Bitcoin’s market dynamics in the coming weeks.

With a current volume of $110,967,184,773 against an average of $718,412,463, Bitcoin’s trading activity is notably higher, which might suggest increasing market interest or volatility.

Disclaimer:

Cryptocurrency markets are highly volatile. This content is for informational purposes only.

The Forecast Prediction Model is provided for informational purposes only and should not be considered financial advice.

Meyka AI PTY LTD provides market data and sentiment analysis, not financial advice.

Always do your own research and consider consulting a licensed financial advisor before making investment decisions.

Dogecoin won’t go away, and market tone suggests the OG meme coin is coiling for advance. Liquidity across majors has thickened, spreads improved, and volatility looks compressed, not broken. Alongside DOGE, Maxi Doge ($MAXI) keeps sliding onto watchlists as a rotational play if meme momentum returns. When this cocktail appears, traders refresh their Dogecoin price prediction frameworks and ask a question. Can DOGE hold a base long enough for rotation to kick in, or are we stuck chopping until a stronger catalyst? Quiet tells matter, especially order book depth, funding discipline, and steady spot bids.

Market Snapshot And Why It Matters

Markets still orbit Bitcoin and Ethereum (https://coinmarketcap.com/currencies/ethereum/), but leadership often rotates during transition weeks and that’s where DOGE steals time on stage. When BTC prints higher lows while funding is calm risk appetite expands outwards towards higher beta names that the crowd already understands. DOGE fits that bill with an accessible narrative, deep familiarity and enough liquidity to absorb attention without breaking. Look for spot demand leading derivatives on green days, quick absorption of shallow dips and spreads that stay orderly during pushes because those ingredients often mean patient accumulation not tired churn.

Structure, Levels And What Pros Watch

DOGE looks like a compressed spring after weeks of narrowing ranges and cleaner respect for obvious moving averages (https://www.binance.com/en/academy/articles/moving-averages-explained). That doesn’t mean it’s a moonshot it just means the odds of an expansion when liquidity pockets align with momentum. The checklist is simple which is why it works. Do prior resistance zones flip into support after a break, do pullbacks hold above the midpoint of the last impulse and does open interest build without funding racing ahead of price. Traders who care about survival scale into confirmed retests rather than chase every flashy spike.

Liquidity, Flows And Early Tells

Catalysts for DOGE usually come in clusters, sometimes loud sometimes sneaky. A small integration headline, a new market maker or a viral meme can nudge flows at the margin but the early tells are consistent. Spot volume should lead not lag during green days, market makers should not blow spreads wide at the first hint of momentum and on-chain engagement should persist beyond one session. When those three conditions line up risk tends to pivot from sideways to up and even cautious desks start to rebuild exposure in measured boring increments.

Where Maxi Doge ($MAXI) Fits In

Maxi Doge ($MAXI) (https://maxidogetoken.com/), ticker MAXI, keeps slipping into the same conversations as traders revisit their Dogecoin price prediction notes and the overlap is not accidental. MAXI leans into familiar dog-coin energy while planning utility hooks that keep the loop active between headline bursts. The goal is simple, maintain community momentum with transparent distribution, budgeted campaigns and incentives that reward patience not reckless churn. If wallet growth holds, listings expand and builders ship visible progress MAXI becomes a nimble sidecar to a DOGE led mood shift not a gimmick that fades after one weekend sprint.

Scenarios For The Next 30 Days

Base case if current conditions persist a patient stair step higher with frequent probes of nearby resistance bands plus annoying fakeouts that punish late chasers. A bullish extension needs a reclaim of a prior weekly supply zone, sustained spot leadership and social velocity that doesn’t fade after the first pop. The bearish path is simpler, lose the higher low structure, see funding turn negative with falling open interest and accept range trading until majors pick a direction. None of these paths require heroics just discipline and the humility to adjust when the tape disagrees.

Trading Plan, Not Hype

Meme coins reward timing and punish stubbornness which is polite code for know your invalidation before you click buy. Decide where the idea breaks, size positions so you can think during drawdowns and avoid stacking leverage (https://www.binance.com/en/academy/articles/what-is-leverage-in-crypto-trading) on top of sentiment because it works until it ruins your week. Practical habits help. Scale partial profits at obvious levels, trail the remainder with a stop that’s not so tight a routine wick knocks you out and remember your average entry matters more than any accidental bottom tick. Investors can simply ladder entries instead of sprinting.

Fundamentals, Narrative, Community

Dogecoin will never read like a suit and tie prospectus and that’s fine because culture carries real weight. The community shows up, merchants experiment and development cycles while uneven deliver enough to keep the engine alive. For MAXI to matter beyond punchlines distribution must be understandable, budgets transparent and incentives aligned with holding rather than dump and run games. People don’t need perfection they need evidence the team is shipping and the next milestone is not a moving target. That’s how projects earn second chances and how buyers justify buying again.

On-Chain Clues And Social Velocity

On-chain clues help separate breathless narratives from durable trends and you don’t need a doctorate to track them. Watch unique wallets interacting with DOGE, average transaction sizes and whether activity persists after price cools for a session. Pair that with social velocity that looks organic rather than botted and the signals carry more weight. If MAXI’s metrics improve in parallel while DOGE holds structure rotation flows can be surprisingly efficient. Traders who combine these checks with patient execution often avoid the worst traps and they earn the right to buy again when momentum returns.

What Could Derail The Setup

Every bullish setup has an obvious villain sometimes two. A sharp drawdown in majors that erases higher lows will pull liquidity from meme names first and you’ll feel it in wider spreads, thinner bids and sloppy gaps between venues. Regulatory headlines can also freeze risk even when fundamentals remain unchanged. Finally if on-chain participation fades while funding stays elevated the market is telling you speculation outran demand. In each case the solution is boring, reduce risk, wait for cleaner signals and stop trying to be a hero while the tape argues with you.

A Practical Toolkit For Readers

Readers don’t need exotic tools to track this. Keep DOGEUSD open on a reliable charting platform for structure, note one or two rolling averages and mark prior weekly supply and demand. Check a neutral data site for circulating metrics and liquidity snapshots across venues then ignore any dashboard that turns curiosity into panic. Track MAXI beside DOGE for relative strength during green sessions it should hold gains better when the mood improves. Most important write the plan before the trade so that confidence comes from preparation rather than a stranger’s conviction at midnight.

Dogecoin Price Prediction, In Plain Words

In plain words if support holds and majors are calm Dogecoin can grind to nearby resistance over the next few weeks while pullbacks screw over impatient hands. That’s the environment for momentum traders who scale into clean retests and investors who prefer laddered entries to chasing. Maxi Doge ($MAXI) (https://maxidogetoken.com/) is close to that path as a rotational beneficiary when meme energy kicks in during late sessions. If the base breaks and liquidity dries up patience wins because range trading kills heroes. Use what you see, size risk to sleep and let the tape decide.

Buchenweg 15, Karlsruhe, Germany

For more information about Maxi Doge (MAXI) visit the links below:

Website: https://maxidogetoken.com/

Whitepaper: https://maxidogetoken.com/assets/documents/whitepaper.pdf?v2

Telegram: https://t.me/maxi_doge

Twitter/X: https://x.com/MaxiDoge_

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.

The latest Cardano price prediction has sparked excitement across the crypto community, as analysts see ADA retesting a key support that has triggered rebounds multiple times over the past year. With smart contract activity rising and DeFi adoption expanding, experts believe ADA could be on a fast track toward what some call potential “100x” territory in the next cycle.

At the same time, whales are investing in a new PayFi altcoin called Remittix (RTX). The project has been fully verified by CertiK and ranked #1 on CertiK for Pre-Launch Tokens, affording it unmatched credibility among early-stage crypto projects.

Cardano is currently trading around $0.5253, showing a familiar setup that could mark the start of another long-term climb. Analyst Ali Martinez recently highlighted that Cardano is once again testing the lower line of its Parallel Channel, a pattern that has provided reliable support since late 2024.

ADA has approached this level many times, and each time, the Cardano price prediction has appeared bullish. This has led to strong short-term rallies after rebounds. The lower boundary is currently set at $0.52, whereas the resistance levels remain at $0.60 and $0.68. This is an indication of a potential upward push for ADA if buying pressure returns.

A Parallel Channel is one of the clearest patterns in technical analysis, showing price movement between two horizontal lines that represent resistance and support. In Cardano’s case, the asset has stayed within this range for almost a year, maintaining a steady rhythm of accumulation and breakout attempts. If the pattern continues to hold, a move above the upper channel could confirm a bullish breakout. That would open the door to targets at approximately $0.80 and $1.00.

While Cardano builds steady momentum, Remittix (RTX) is emerging as a faster-moving DeFi and PayFi project that could rival ADA’s growth in 2026. Remittix focuses on real-world payments, allowing users to send crypto directly to bank accounts in over 30 countries.

Remittix has already sold over 684 million tokens, raised $28 million, and is currently trading at $0.1166. The project also offers a 15% USDT referral program paid daily via its dashboard, plus a $250,000 giveaway to reward early supporters.

Why analysts call Remittix “the true XRP 2.0”

The current Cardano price prediction indicates a steady climb as ADA continues to hold its key support channel and expand its smart contract capabilities. At the same time, Remittix (RTX) attracts attention as a smaller-cap project that could multiply faster due to its real-world payment utility combined with institutional-grade security.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.