The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Solana Price Prediction 2025-2030: Can SOL Reach $500 in This Explosive Crypto Rally?

As the cryptocurrency market continues to evolve, investors are eagerly watching Solana’s trajectory. Our comprehensive Solana price prediction analysis examines whether SOL can realistically target $500 and beyond in the coming years. With blockchain technology advancing at breakneck speed, understanding where SOL price might head requires careful examination of multiple factors.

Several key elements influence SOL price forecasts. Technical analysis combines historical patterns with current market conditions to project future movements. Fundamental factors include network adoption, developer activity, and competitive positioning within the blockchain technology landscape. Market sentiment and broader cryptocurrency trends also play crucial roles in any cryptocurrency prediction model.

Looking toward Solana 2025 projections, several scenarios emerge based on current growth patterns. The network’s scalability advantages and growing ecosystem could propel SOL toward higher valuations. However, market volatility remains a constant factor in any cryptocurrency prediction.

| Year | Conservative Target | Moderate Target | Bullish Target |

|---|---|---|---|

| 2025 | $180 | $300 | $500 |

| 2026 | $250 | $400 | $650 |

| 2030 | $600 | $900 | $1,200 |

The evolution of blockchain technology directly impacts Solana’s long-term value proposition. As the network continues to optimize its proof-of-history consensus mechanism and improve scalability, these technical advancements could significantly influence our Solana price prediction models. The integration of new features and developer tools creates additional utility for the SOL token.

While optimistic projections capture attention, responsible cryptocurrency prediction must acknowledge potential obstacles. Market volatility, regulatory uncertainty, and technological competition represent significant challenges. Any SOL price forecast should consider these risk factors alongside growth potential.

What makes Solana different from other cryptocurrencies?

Solana’s unique proof-of-history consensus enables high throughput and low transaction costs, positioning it competitively within the blockchain technology space.

How reliable are long-term cryptocurrency predictions?

While technical analysis provides frameworks, cryptocurrency prediction remains inherently uncertain due to market volatility and external factors.

What companies are building on Solana?

Major projects include FTX, Solana Labs, and various DeFi protocols that contribute to ecosystem growth and SOL price potential.

Who founded Solana?

Anatoly Yakovenko founded Solana, bringing expertise from Qualcomm and developing the innovative proof-of-history consensus that drives the network’s blockchain technology.

The journey toward $500 represents both opportunity and challenge for Solana investors. While our Solana price prediction analysis suggests potential for significant growth, market conditions will ultimately determine whether SOL reaches these ambitious targets. The combination of technological innovation, ecosystem development, and broader cryptocurrency adoption creates a compelling case for Solana’s continued relevance in the evolving digital asset landscape.

To learn more about the latest cryptocurrency markets trends, explore our article on key developments shaping Solana blockchain technology institutional adoption.

This post Solana Price Prediction 2025-2030: Can SOL Reach $500 in This Explosive Crypto Rally? first appeared on BitcoinWorld.

Bitcoin (BTCUSD) has been holding steady today at $101,468.15. With no significant changes in price or percentage, the crypto community is abuzz with discussions about Bitcoin’s future potential, particularly the possibility of reaching $142,000. Let’s dive into what the numbers say.

At the moment, Bitcoin’s price stands at $101,468.15, having experienced a day low of $98,892.97 and a high of $107,269.85. Over the past year, it reached as high as $126,296.00 and as low as $74,420.69. Volume spikes to $110,967,184,773 indicate significant trading activity, far above the average volume of $709,449,996.

Looking ahead, Meyka AI forecasts suggest a monthly target of $142,555.95 and a quarterly projection of $141,151.74. However, the yearly outlook is more cautious at $96,114.59. These forecasts could vary dramatically due to potential macroeconomic shifts, regulatory changes, or unexpected events impacting the crypto market.

Delving into technical signals, the Relative Strength Index (RSI) sits at 38.96, indicating that Bitcoin is currently nearing oversold territory. The Moving Average Convergence Divergence (MACD) presents a bearish outlook, with a MACD line of -2486.11 against a signal line of -1688.61.

The Average Directional Index (ADX) is at 25.94, hinting at a strong trend even amidst the downturns. Bollinger Bands reveal current price pressures, with the upper band at $118,648.16 and the lower at $101,637.25, showing Bitcoin is nearing its lower volatility threshold.

The crypto community is largely optimistic about Bitcoin’s long-term growth, even amidst short-term consistency. A 6-month increase of 32.33% highlights ongoing interest and potential upward momentum. However, short-term sentiment shows declines, with a recent 3-month loss of 15.77%.

Current discussions on various forums and platforms, such as those recorded by Meyka AI, indicate a mixture of cautious optimism and speculative anticipation. As Bitcoin’s volume remains elevated, investors seem to be positioning for both potential gains and hedging against risks.

Bitcoin’s current price around $101,468.15 puts it in a position of cautious optimism. With market data suggesting potential peaks and valleys, and the community’s collective eye on $142,000, those involved with BTCUSD are navigating a nuanced landscape. Key risks include regulatory factors and macroeconomic changes that could quickly shift forecasts. BTCUSD remains a focal point for those observing cryptocurrency’s evolving journey.

Current forecasts estimate monthly targets around $142,555.95, with quarterly predictions at $141,151.74. Annually, however, predictions are more conservative at $96,114.59.

Indicators like RSI, MACD, and Bollinger Bands suggest Bitcoin is near oversold territory, with bearish MACD signals but strong trend potential according to ADX.

Market sentiment is a blend of long-term optimism due to a 32.33% gain over 6 months, against short-term declines like the 15.77% drop in 3 months. Macroeconomic factors are pivotal.

Bitcoin’s trading volume is significantly above average, at $110.97 billion compared to $709.45 million, indicating heightened activity and potential repositioning by traders.

While predictions target a potential high around $142,555.95, factors such as market regulations, economic changes, and investor sentiment will significantly influence its trajectory.

Disclaimer:

Cryptocurrency markets are highly volatile. This content is for informational purposes only.

The Forecast Prediction Model is provided for informational purposes only and should not be considered financial advice.

Meyka AI PTY LTD provides market data and sentiment analysis, not financial advice.

Always do your own research and consider consulting a licensed financial advisor before making investment decisions.

Crypto analyst Butterfly has provided a bullish outlook for the Dogecoin price, predicting that it could soon record a massive rally. This comes as the crypto market looks to rebound from its most recent downtrend, with DOGE well below the psychological $0.2 level.

Analyst Declares The Dogecoin Price Is About To Burst

In an X post, Butterfly urged DOGE holders to stay alert as the Dogecoin price could “burst” from its current price level. This came as the analyst noted that the foremost meme coin is facing the lower boundary of the symmetrical triangle on the 3-day chart. Butterfly added that this zone remains a strong floor for price action and that bullish pressure is mounting fast.

The analyst’s accompanying chart showed that the Dogecoin price could bounce off the $0.165 support level and rally to as high as $0.48. Notably, that price level marked a local high for DOGE last year when it rallied from a similar range as its current price level. Meanwhile, the meme coin is expected to hit this price level by year-end or the beginning of next year.

This Dogecoin price prediction comes as the crypto market rebounds from the recent crash, which caused Bitcoin to drop below $100,000, dragging DOGE and other altcoins down. With BTC back above $100,000, the foremost meme coin will look to reclaim the psychological $0.2 level, which could spark a larger rebound.

Crypto analyst Ali Martinez also indicated that the bottom was in for the Dogecoin price following the recent crypto market crash. In an X post, he revealed that the TD Sequential indicator has flashed a buy signal on DOGE, suggesting the local bottom might be in.

DOGE’s Bull Run Could Start Soon

Crypto analyst Chandler indicated that DOGE’s bull run could soon begin. He noted that the biggest bull runs were usually preceded by the TOTAL3/Total rallying to the upside. Then a sharp drop occurs and a clean V-shaped recovery, which is when the Dogecoin price usually peaks. The analyst then revealed that TOTAL3/TOTAL appears to be resuming an uptrend, suggesting the meme coin could soon rally.

Crypto analyst Ether also assured that the bull structure remains intact for Dogecoin’s price despite the recent pullbacks. He noted that every Dogecoin cycle has looked chaotic up close and perfectly structured from a distance. He then asserted that the pattern remains intact. Notably, the analyst had previously predicted that the Dogecoin price would rally to the psychological $1 level, which would mark a new all-time high for the meme coin.

At the time of writing, the Dogecoin price is trading at around $0.16, down in the last 24 hours, according to data from CoinMarketCap.

Bitcoin rose on Thursday, recovering part of its earlier losses as traders took advantage of lower prices. Economic uncertainty and cooling expectations for U.S. rate cuts limited the rebound. The world’s largest cryptocurrency slipped into a bear market earlier this week after falling over 20% from its October highs.

Bitcoin climbed 1.7% to $103,744 by 23:35 ET (04:35 GMT), after briefly dropping below $100,000 earlier in the week, marking its lowest level since June.

World Economic Forum President Borge Brende cautioned about a possible crypto bubble during an event in Brazil. He also warned of similar risks in artificial intelligence and government debt. These warnings fueled market concerns and contributed to this week’s sell-offs, spilling over from equity markets into digital assets.

Bitcoin’s losses in November followed weaker-than-expected performance in October. The crypto lost about 5% last month, breaking seven consecutive years of October gains. Since early October, Bitcoin and other cryptocurrencies have underperformed other risk assets, losing nearly $500 billion in value after a market flash crash.

Robinhood Markets Inc. reported better-than-expected third-quarter earnings driven by higher trading volumes. However, its crypto revenue of $268 million missed Bloomberg estimates. The company’s shares fell 4% in after-hours trading. Robinhood also announced that CFO Jason Warnick will step down in early 2026, with Shiv Verma taking over the role.

Altcoins followed Bitcoin’s modest recovery. Ethereum rose 3.7% to $3,450, while XRP gained 5.1% to $2.35. Solana increased by 3.2% to $162, and Cardano and BNB climbed between 1.5% and 2%. Dogecoin advanced 1.2%, while $TRUMP surged nearly 16% despite no clear catalyst. Uncertainty over the U.S. economy and the ongoing government shutdown continued to weigh on sentiment. Cooling expectations of a December rate cut by the Federal Reserve added to market caution.

Analyst Tim Enneking noted that Bitcoin’s $100,000 level remains a key psychological and technical support. Enneking said this level acts as a magnet, with quick recoveries following every drop below it.

Independent crypto analyst William Noble said Bitcoin must hold between $101,000 and $103,000 to avoid further declines. A fall below $98,000 could push prices toward $95,000, especially if stock markets or banking systems face stress.

Analyst Joe DiPasquale identified $98,000 as a key support zone, with potential downside to $88,000 if it fails. Armando Aguilar noted lower supports at $96,000 and $94,000.

On the upside, resistance levels appear between $105,000 and $112,000, with higher hurdles at $116,000 and $123,000. A sustained move above $115,000 could open the path toward new all-time highs beyond $126,000.

Crypto prices today rose partly due to developments at the U.S. Supreme Court regarding President Trump’s reciprocal tariff policies. A potential ruling against the tariffs could reduce inflation and improve the case for rate cuts.

According to Polymarket data, the odds of Trump winning the case have dropped from 43% to 20%. Lower inflation expectations often support digital asset growth, as rate cuts boost liquidity and investor appetite for risk assets.

Data from CoinGlass showed futures open interest increased 2.13% to $143 billion, signaling improving market participation. However, ETF flows remained mixed. Bitcoin ETFs recorded $137 million in outflows, while Ethereum ETFs saw $118 million in withdrawals, marking their sixth consecutive day of losses. Solana ETFs, meanwhile, logged $9.7 million in inflows.

Ripple Labs received attention after announcing partnerships with Citadel and Fortress Capital, valuing the company at $40 billion. Ripple also teamed up with Mastercard, WebBank, and Gemini to test RLUSD stablecoin settlements on the XRP Ledger. This aims to use blockchain for fiat card payment settlements, showing institutional interest in blockchain adoption.

Crypto prices today show recovery but uncertainty persists. Analysts warn the rebound may be temporary, urging traders to watch the Supreme Court tariff decision, ETF flows, and overall economic trends before making decisions.

1. Why is Bitcoin rising today?

Bitcoin’s rise above $103,000 is linked to optimism around U.S. tariff rulings and potential Federal Reserve rate cuts, both of which could improve liquidity for digital assets.

2. How are Ethereum and altcoins performing?

Ethereum rose 2.29% to $3,423, while altcoins like Solana, XRP, and Cardano gained modestly. The rise reflects stronger investor confidence in blockchain applications and market recovery trends.

The crypto market is in a very volatile phase, Bitcoin […]

The crypto market is in a very volatile phase, Bitcoin price continues to drop, which in turn drags altcoins. The legendary meme coin, DOGE, is also bearing the brunt of the market momentum.

Some market watchers are offering Dogecoin price predictions that the token may soon break out of its bearish rally. This forecast driven of course by Elon Musk’s recurring “DOGE To The Moon” narrative. Questions continue to arise about its feasibility; read on.

Over the past few months, Dogecoin price predictions of $1 have dominated the market; however, it appears the setup may have been invalidated. DOGE lost its $0.20 to yesterday’s pullback, and its steadily recovering trading at $0.17.

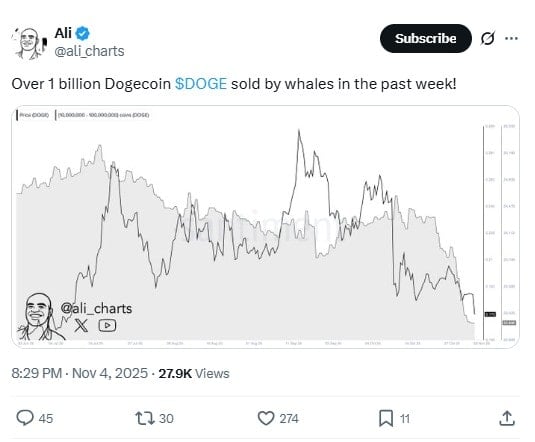

Source: Ali Martinez on X

Earlier, a crypto analyst, Ali Martinez, reported that over 1 billion Dogecoin $DOGE was sold by whales in the past week. This signals profit-taking and capital rotation by the whale investors who are selling off to avoid losses.

While Elon Musk’s “DOGE to the moon” mission has been one of the catalytic factors that have pushed DOGE price since 2021, it seems the momentum has faded away. Recently, Musk has not discussed the token. From all ends, DOGE doesn’t look ready for a bullish rally, hence why the savvy investors are selling off. Also, remember that Dogecoin is a meme coin with no utility offerings, and with the recent diversification into utility-driven projects, the token is experiencing numerous liquidations.

Market observers are recommending utility-driven projects like Remittix (RTX), which has the potential to deliver exponential gains to early buyers

Remittix (RTX) is a PayFi platform built on the Ethereum blockchain, providing seamless cross-border crypto-to-fiat transactions in over 30 countries and supporting more than 40 cryptocurrencies.

It is bridging a $19 trillion payment gap between traditional payment systems and cryptocurrency. It has a business API that freelancers, marketplaces, and SMEs can use to receive payments.

Remittix highlights:

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This content has been supplied by a third party contributor. Brave New Coin does not endorse or promote any products or services mentioned herein. Readers are encouraged to conduct independent research before making any financial decisions. The information provided is for informational and educational purposes only and should not be interpreted as investment advice.

XRP is lower now, yet key support still holds and the long term case remains intact, but Pepeto is shaping up as the high-reward rival with real upside. Its presale traction, staking, audits, and live demo exchange point to more than talk. It is a complete build and ready for exchange listings, which the team says are coming soon.

ETH price has entered a critical phase after sharp ETF outflows and widespread liquidations drove Ethereum into a deeper correction. The asset’s decline of nearly 30% from its yearly peak has put traders on alert, though accumulating whales and on-chain signals suggest potential recovery zones forming ahead.

Major ETH ETF Outflows Add Selling Pressure

Over the past four active ETF days, all nine ETH ETFs have reportedly been responsible for notable capital outflows, which have weighed heavily on sentiment. Per farside, from October 29th to November 3rd, Ethereum ETFs collectively saw continuous withdrawals, with the most latest single-day outflow of $135.7 million recorded on November 3rd. Where BlackRock sold $81.7 million worth of ETH, amplifying selling pressure across institutional desks.

This institutional retreat has coincided with broader crypto market turbulence, leading to $1.33 billion in total liquidations within a single day. Ethereum alone accounted for $324.96 million of those liquidations, a figure that underscores the market’s fragile state. As a result, ETH price today trades around $3,510, down nearly 2.6% intraday.

On the Ethereum price chart, this pullback confirms a technical bear market, with prices now nearly 30% below the 2025 peak of 4USDT,955. Despite this weakness, certain long-term investors appear to be taking advantage of the downturn to accumulate.

BitMine’s Accumulation Highlights Long-Term Optimism

Even as market conditions worsen, large institutional holders have shown confidence in Ethereum’s long-term fundamentals. BitMine, a major ETH holder, has reportedly added $300 million worth of 82,353 ETH to its reserves, raising its total Ethereum holdings to approximately $11.11 billion holding 3.16 million ETH in total.

This accumulation pattern provides a key contrast to recent ETF outflows, suggesting that while some investors are derisking, others view the current ETH price in USD as a discounted accumulation opportunity. Such activity often reflects strategic positioning for future cycles, particularly if ETH crypto continues to expand its role in staking, DeFi, and tokenization.

Technically, Ethereum’s nearest support lies around the $3,300-$3,350 zone. A successful defense of this level could form the base for a reversal, potentially enabling a retest of the 4USDT,955 yearly high if momentum strengthens in November. However, failure to hold support could extend the slide toward $2,890, marking deeper retracement levels.

On-Chain Indicators Show a Potential “Opportunity Zone”

According to on-chain data shared via Santiment insights, Ethereum’s 30-day MVRV ratio has dropped to -10.5%, entering what’s described as an “opportunity zone.” Historically, when this metric falls below -10%, ETH price forecast trends suggest accumulation opportunities, often preceding short-term recoveries.

In addition, whale accumulation and retail capitulation remain crucial for triggering the next leg higher. The pattern seen in past cycles reveals that when retail traders panic-sell and whales accumulate, it often sets the stage for a strong rebound.

Thus, while short-term volatility persists, the combination of technical support, institutional accumulation, and favorable on-chain metrics keeps optimism alive for a potential rebound in ETH price in the near term.

FAQs

What is the ETH price prediction for 2025?

As per our Ethereum price forecast 2025, the ETH price could reach a maximum of $9,428.11.

What will Ethereum be in 5 years?

According to our Ethereum Price Prediction 2030, the ETH coin price could reach a maximum of $71,594.69 by 2030.

Is it better to buy Bitcoin or Ethereum?

While Ethereum is trusted for its stout fundamentals, Bitcoin continues to dominate with its widespread adoption.

How much would the price of Ethereum be in 2040?

As per our Ethereum price prediction 2040, Ethereum could reach a maximum price of 4USDT,128,680.

How much will the ETH coin price be in 2050?

By 2050, a single Ethereum price could go as high as $238,189,500.

Zach Anderson

Nov 05, 2025 06:25

MATIC price prediction suggests recovery to $0.45-$0.52 range over next month as oversold conditions near key support at $0.35, with immediate resistance at $0.58.

• MATIC short-term target (1 week): $0.42 (+10.5%) – reaching EMA 26 resistance

• Polygon medium-term forecast (1 month): $0.45-$0.52 range – testing SMA 20 to upper Bollinger Band

• Key level to break for bullish continuation: $0.58 (strong resistance confluence)

• Critical support if bearish: $0.35 (immediate support) and $0.33 (strong support floor)

The current market environment shows a notable absence of fresh analyst predictions for MATIC over the past three days, suggesting either consolidation in sentiment or analysts waiting for clearer directional signals. This silence often precedes significant moves in cryptocurrency markets, as technical patterns develop without fundamental news interference.

The lack of recent predictions contrasts with MATIC’s current technical setup, which presents clear levels for both bullish and bearish scenarios. This creates an opportunity for independent technical analysis to guide our Polygon forecast without the noise of conflicting analyst opinions.

Polygon technical analysis reveals a cryptocurrency approaching oversold territory with several converging factors that could trigger a reversal. The current RSI reading of 38.00 sits in neutral territory but trending toward oversold conditions, historically a precursor to bounces in MATIC.

The MACD histogram showing -0.0045 indicates bearish momentum, but the relatively small magnitude suggests this selling pressure may be waning. More significantly, MATIC’s position at 0.29 within the Bollinger Bands places it much closer to the lower band ($0.31) than the upper band ($0.56), indicating potential for mean reversion toward the middle band at $0.43.

Current trading volume of $1,074,371 on Binance represents moderate participation, neither confirming strong selling pressure nor indicating accumulation. The narrow 24-hour trading range suggests consolidation, often preceding directional moves once key levels break.

The primary MATIC price target in a bullish scenario targets $0.45-$0.52 over the next 30 days. This range encompasses the SMA 20 ($0.43) and approaches the upper Bollinger Band region, representing a 18-37% upside from current levels.

For this bullish thesis to materialize, MATIC must first reclaim the EMA 26 at $0.42, which would signal short-term momentum shift. A break above $0.45 (SMA 50) would confirm medium-term strength, potentially targeting the strong resistance at $0.58.

The technical setup supports this view as MATIC trades significantly below all major moving averages, creating substantial room for mean reversion. The Stochastic oscillator reading of 25.19 (%K) suggests oversold conditions that often precede bounces.

Conversely, a break below the immediate support at $0.35 would invalidate the bullish MATIC price prediction and target the strong support at $0.33. This represents the 52-week low region ($0.37) and a critical psychological level for MATIC holders.

A sustained break below $0.33 could trigger accelerated selling toward $0.28-$0.30, representing a 20-26% decline from current levels. The bearish momentum, as indicated by the negative MACD histogram, supports this downside risk if support levels fail.

Based on current Polygon technical analysis, a staged entry approach appears most prudent. Consider initial positions near current levels ($0.38) with stop-loss below $0.34 to limit downside risk to approximately 10%.

For more aggressive entries, wait for a break above $0.42 (EMA 26) with increased volume to confirm momentum shift. This would provide better risk-reward dynamics while maintaining the upside targets toward $0.45-$0.52.

Position sizing should remain conservative given the bearish MACD and proximity to support levels. Risk no more than 2-3% of portfolio value until MATIC demonstrates sustained movement above $0.45.

The answer to “buy or sell MATIC” depends on risk tolerance: conservative investors should wait for clearer bullish signals above $0.42, while contrarian traders might consider small positions at current oversold levels.

Our MATIC price prediction anticipates a recovery to the $0.45-$0.52 range within 30 days, representing moderate confidence (6/10) based on current technical indicators. This Polygon forecast relies on the historical tendency for mean reversion when assets trade significantly below moving averages with oversold momentum indicators.

Key levels to monitor include the immediate resistance at $0.42 (EMA 26) for bullish confirmation and support at $0.35 for bearish invalidation. The prediction timeline extends through early December 2025, with interim targets at $0.42 (1 week) and $0.45 (2-3 weeks).

Success of this prediction requires MATIC to hold above $0.35 and demonstrate buying interest as it approaches oversold territory. Failure below this level would shift the focus to downside targets near $0.33 and potentially lower.

Image source: Shutterstock

Risk is back in crypto (https://www.binance.com/en/research/analysis/weekly-market-commentary-2025-09-19), and that means Dogecoin price prediction is back for real reasons. Liquidity is stronger during busy times, spreads are behaving, and price is respecting levels it used to ignore. None of this means fireworks, but it tilts the odds towards trend rather than churn.

When volatility cools but doesn’t die, real buyers test bids and let rallies breathe. In that pocket DOGE can shift from headline driven spikes to a steady climb. For those who layer narratives, Pepenode ($PEPENODE) (https://pepenode.io/) keeps showing up as a complementary, habit-building project, useful when you want engagement to persist between big market moments.

Market Setup – What Actually Changed Since The Last Wobble

The last pullback cleaned out the books and shook out weak positions but didn’t break structure. Depth rebuilt faster than expected, spots often led on green days, and funding cooled instead of snapping to extremes. That rhythm matters because sustainable advances usually start with quiet accumulation, not a one-candle squeeze. If you are refreshing your Dogecoin price prediction (https://coinmarketcap.com/currencies/dogecoin/) center, focus on behavior you can verify: does spot flow into perps, do bids hold through session handoffs, and does weekend liquidity not evaporate? When those answers are yes the path opens up for a climb that frustrates late shorts and cautious longs equally.

Technical Map – Compressed Spring, Clear Checkpoints

Technically DOGE is acting like a coiled spring that won’t snap. Traders anchor to a 20-50 day moving average stack, watch a squeeze in volatility (https://www.binance.com/en/academy/glossary/volatility) bands, and see how long price can “sit” at range highs without bleeding. Time at highs is a quiet tell. If DOGE can sit under resistance while dips get bought, quant models go long, and discretionary desks stop fading every uptick. A daily close above the recent supply shelf with broader participation is the clean trigger most are waiting on. Until then, treat failed breakouts as noise and focus on reclaiming levels with volume, not slogans.

Liquidity And Participation – The Plumbing That Decides Direction

Talk does not equal flow. What turns DOGE from talk into trend is the unglamorous plumbing that keeps spreads tight and books balanced when headlines wobble. Watch weekday vs weekend depth, Asia handoff behavior, and whether large orders can clear without gapping thin venues. Gradually rising open interest alongside spot – not wildly ahead of it – hints at healthier positioning. Funding that oscillates near flat keeps leverage from steering the bus. A credible Dogecoin price prediction rests on these details because they decide if any catalyst can actually stick. Without them, good news evaporates into intraday whipsaws that punish both sides.

Catalysts On Deck – Culture, Tipping, Micro Events

DOGE’s edge is culture and distribution. When momentum turns, a swarm of smaller accounts can move in sync, amplified by creators and casual users. A string of micro catalysts often works better than one big announcement: a tipping feature that actually sees use, a charity push that travels, or a pop brand tie-in that spawns memes worth sharing. Those may sound minor, but they stack quickly and invite repeat engagement. Still, meme coins prefer tailwinds. If Bitcoin and Ethereum print higher lows, DOGE gets the runway it needs. If majors break down, the meme bid tends to thin until the structure stabilizes again.

Where Pepenode ($PEPENODE) Fits – A Balanced Sidecar

Pepenode ($PEPENODE) (https://pepenode.io/) is not trying to be the next DOGE; it plays a different game that can complement a DOGE core. The project leans into small, repeatable actions that build habit – bite-size quests, lightweight bots that cut friction, and simple dashboards that make check-ins fast. Some holders report that this cadence keeps users active when the timeline goes quiet, which is exactly when many tokens fade. In a risk-on tape, that design pairs well with a DOGE position. DOGE captures the culture wave when momentum returns, while Pepenode works to keep engagement steady between larger moves, smoothing the emotional swings that wreck plans.

Scenarios – Base, Bull, And Bear Paths Worth Preparing For

Base case, measured climb: DOGE defends support, wicks get bought, and price grinds higher in steps while participation broadens. It’s not glamorous, but it’s repeatable and kinder to risk budgets. Bull case, expansion with breadth: clean closes through supply with rising spot volume, reasonable funding, and better alt breadth. Here a Dogecoin price prediction that felt optimistic becomes consensus fast, so avoid chasing late and define invalidation. Bear case, range relapse: support breaks on real volume, retest fails and weekend depth thins. That usually means chop inside a wider box while capital hides in majors and a few high-conviction micro caps.

Trade Construction – Structure Over Vibes

Size so three wrong attempts cost less than one right attempt can repair. If you like breakouts, demand fresh volume and a level that gives a clear place to be wrong. If you like pullbacks, buy into the moving average stack with stops below the shelf that just did the work. Time stops help when ranges get noisy – if the idea has not played by your deadline, it probably is not your trade. Split orders across sessions to dodge the loudest hour. And if you pair DOGE with Pepenode keep independent risk buckets. Correlations jump during stress, and sloppy sizing is what turns a dip into damage.

What A “Good” Dogecoin Price Prediction Looks Like This Month

Skip magic numbers. Focus on conditions that let numbers happen. Bulls want BTC and ETH holding higher lows, DOGE spending time near range highs without bleeding, depth that survives off-hours and participation that expands beyond a single venue. Sprinkle in a couple of real-world moments that normal users can touch – tipping that people actually try, a creator campaign that moves beyond crypto Twitter – and you have the bones of a durable advance. The shape is usually a staircase, not a cannon. That’s fine. Health trends beat pace, and trends that annoy everyone often last the longest.

Bottom Line – Plan The Trade, Let The Tape Prove It

DOGE still owns the meme game because culture and reach are hard to replicate. The near term looks like steps, not a line. If the structure holds and the quiet plumbing stays good, the comeback people joke about becomes less of a joke. Use rules that work on Monday and Saturday alike, and pair culture beta with something habit driven like Pepenode ($PEPENODE) (https://pepenode.io/) if you want balance and want to keep your ego out of the sizing. That’s the adult version of a Dogecoin price prediction – a plan you can run next week without excuses.

Buchenweg, Karlsruhe, Germany

For more information about Pepenode (PEPENODE) visit the links below:

Website: https://pepenode.io/

Whitepaper: https://pepenode.io/assets/documents/whitepaper.pdf

Telegram: https://t.me/pepe_node

Twitter/X: https://x.com/pepenode_io

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.

The token currently trades near $0.53 after touching a low of $0.48, while the broader crypto market has also crashed.

Trading volume, on the other hand, surged by 13% to $1.8 billion, a sign that volatility is drawing traders back into the market.

With total market capitalization falling to $3.39 trillion and $1.73 billion in liquidations over the past day, according to CoinGlass, the start of this November has been hard on crypto enthusiasts.

However, even as the bloodbath unfolded, the Cardano Foundation marked founder Charles Hoskinson’s birthday, a reminder of how far the project has come since its inception.

Wishing @IOHK_Charles a very happy birthday. Your pioneering work and vision laid the foundation for Cardano’s global reach today. I hope the year ahead brings new opportunities to reconnect and build on the progress that started it all. pic.twitter.com/Bgdq39XX23

— Frederik Gregaard (@F_Gregaard) November 5, 2025

Despite the chaos, on-chain analyst Ali Martinez highlighted a potentially pivotal moment for ADA.

The TD Sequential indicator has printed a buy signal on the three-day chart, indicating that the recent downtrend could be nearing exhaustion.

TD Sequential prints a buy signal for Cardano $ADA.

Could this mark the reversal? pic.twitter.com/vX7SZxg5N3

— Ali (@ali_charts) November 5, 2025

Historically, this signal has preceded strong upward reversals for ADA, particularly when accompanied by oversold RSI levels.

The weekly chart shows that ADA has broken below its descending triangle support, retesting the $0.50 zone.

The next critical support sits between $0.35 and $0.40. Should ADA confirm a breakout above its descending trendline (near $0.80), it could open the path toward a mid-term target of $1.20.

Source: TradingView

Beyond that, the chart suggests a potential macro move that could drive prices as high as $10, representing a staggering 1,800% gain from current levels.

Historically, extreme fear levels often precede local bottoms as weak hands exit and accumulation resumes.

If Cardano’s buy signal holds and volume sustains, the stage could be set for a significant rebound in the coming weeks.

As Cardano pushes toward a recovery, Best Wallet ($BEST) is quietly gaining momentum in one of crypto’s fastest-growing sectors – non-custodial wallets.

With over $16.8 million raised in its presale so far, Best Wallet is shaping up to be a serious player in the $11 billion wallet market.

Designed for freedom, security, and speed, it’s a multi-chain wallet that puts users fully in control of their assets – no intermediaries needed.

But what sets it apart is access.

$BEST token holders unlock early entry to vetted crypto presales and new projects before they go mainstream.

They also enjoy lower transaction fees across the ecosystem, plus up to 78% staking yields through Best Wallet’s built-in aggregator.

For anyone looking to get in early on the next cycle’s breakout stars, Best Wallet is quickly becoming a go-to tool.

To buy $BEST, visit the official Best Wallet Token website and connect a supported wallet, such as the Best Wallet app itself.

Once done, you can swap existing crypto or use a debit/credit card to complete the transaction.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

A crypto journalist with over 5 years of experience in the industry, Parth has worked with major media outlets in the crypto and finance world, gathering experience and expertise in the space after surviving bear and bull markets over the years. Parth is also an author of 4 self-published books.