The main tag of cryptocurrency price today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The main tag of cryptocurrency price today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The downtrend that pushed ADA lower and lower over October has now been broken, putting bullish Cardano price predictions back on track.

The altcoin has seen renewed participation as broader FUD tied to the U.S. government shutdown clears, with the Senate passing a continuing resolution during late Monday trading.

Though the trendline faces pressure again today, with the initial buy-the-news reaction giving way to sell pressure and a retest around $0.57.

Coinglass futures data also only shows moderate speculative demand despite the technical shift. Open interest has added around $9 million, suggesting traders are not willing to bet on the setup just yet.

Market participants may be awaiting stronger technical signals before taking positions.

While the Cardano price has broken above its month-long downtrend, it’s now facing resistance at a key former demand zone around $0.60.

Bulls have yet to fully seize control, and momentum indicators reflect that hesitation.

The RSI has stalled near 40, while the MACD histogram is flattening with only a narrow lead above the signal line, suggesting the uptrend remains fragile.

A shakeout scenario could see ADA retest its $0.52 launchpad level, aligning with the lower boundary of a year-long descending triangle, potentially forming a stronger double-bottom reversal setup.

For confirmation of a sustained breakout, $0.60 remains the key level to watch. Reclaiming it as support could open the path toward $0.82, the critical breakout threshold for the pattern.

Fully realised, a triangle breakout could see upside extend 300% to could see upside extend to $2.25. However, near-term support levels remain crucial levels to watch.

A fully realized triangle breakout could propel ADA as high as $2.25, a potential 300% move.

For now, however, short-term support levels remain pivotal levels to watch.

As regulation brings real-world utility back to the forefront, platforms like Cardano and SUBBD ($SUBBD) are gaining traction.

Positioned as an AI-powered content platform, SUBBD is redefining the $85 billion subscriber economy by giving creators true ownership and fans genuine access.

By cutting out the middlemen, $SUBDD puts control back in the hands of those who create real value. Creators can monetize directly, while fans gain access to exclusive content, early releases, and meaningful interactions through token-gated perks.

The concept is already gaining traction. $SUBBD has surpassed $1.3 million in presale, as investors back the shift toward a decentralized creator economy.

With SUBBD, both sides of the community win — creators earn more, and fans get closer while embracing the decentralization use cases crypto was built for.

Visit the Official SUBBD Website Here

The post Cardano Price Prediction: 30-Day Downtrend Is Over – Here’s Why Traders Are Suddenly Watching ADA Again appeared first on Cryptonews.

XRP Price Prediction is hot again as liquidity flows into payment focused assets and speculative altcoins. While XRP gets institutional attention, newer projects like Bitcoin Hyper, or HYPER, are trying to attract traders who want higher volatility and early stage upside. Instead of copying Ripple’s model, Bitcoin Hyper (https://bitcoinhyper.com/) positions itself as a fast settlement layer for gaming payments, micro rewards and on chain tipping, giving holders multiple narratives to follow during the next bull run. Traders watch order books, funding, sentiment closely.

As traders refine their XRP Price Prediction strategies, many compare the upside of blue chip payment networks and experimental tokens like Bitcoin Hyper. HYPER’s focus on speed, low fees and potential integrations with gaming ecosystems and rewards programs makes it attractive for users who want utility as well as speculation. If XRP strengthens as a benchmark for cross border settlements, some think niche settlement tokens like Bitcoin Hyper could benefit from increasing interest in real world crypto payments across key exchanges worldwide.

XRP Price Prediction in the Current Market Cycle

When traders talk XRP Price Prediction they usually split scenarios into conservative ranges and breakout extensions. Traders who follow live price feeds on https://coinmarketcap.com/currencies/xrp/ focus on how XRP behaves around key support and resistance while funding rates are balanced across major futures venues. A more aggressive path imagines ETF related headlines, new institutional products or favorable court updates unlocking fresh capital. In both cases payment focused narratives matter because investors compare XRP to emerging settlement tokens like Bitcoin Hyper and other high speed alternatives before rotating their portfolios.

Intraday XRP Price, Trader Sentiment and Key Levels

Short term XRP Price Prediction models start with a simple question: XRP price today and how do you feel about risk. Sentiment tools track if funding is long, if social is overheated, and if spot volume is higher than previous weeks. Many technical strategies focus on clearly defined zones where liquidity clusters near previous highs or lows. Inside those bands scalpers hunt for quick range trades, while swing traders wait for strong trend confirmation, then scale entries carefully and manage position size.

How Bitcoin Hyper (HYPER) Compares to XRP

Bitcoin Hyper (https://bitcoinhyper.com/) wants to sit beside major payment tokens, not compete with them, which is why many traders mention HYPER in any new XRP Price Prediction thread. The project promotes near instant transfers, low fees, and an ecosystem for gaming platforms, reward programs, creator tipping, and digital marketplaces. If XRP continues to show strong cross border utility, some investors expect a halo effect where smaller payment ecosystems benefit from renewed interest, speculative flows, infrastructure upgrades, and expanding settlement rails worldwide through coming cycles.

Unlike large cap assets that already trade on every major exchange, Bitcoin Hyper is still in a discovery phase where liquidity and community growth matter as much as whitepaper promises. Traders who normally watch XRP Price Prediction charts sometimes allocate a small portion of their capital to projects like HYPER as higher beta plays. That way they can express a thesis on payment adoption while keeping blue chip exposure, but it also increases volatility, slippage risk and execution complexity during fast market conditions.

Bitcoin Hyper Tokenomics and Utility Narrative

Any serious look at Bitcoin Hyper starts with tokenomics, because supply schedules and incentive structures can make or break long term performance. The team promotes staking rewards, ecosystem grants and liquidity incentives to bootstrap early usage while avoiding runaway inflation and supply shocks. For traders who normally care about each new XRP Price Prediction update, HYPER offers a complementary narrative around microtransactions, in game rewards and creator tools. If those features attract users, demand could strengthen independent of XRP price action.

Can HYPER Benefit From a Bullish XRP Price Prediction?

A very bullish XRP Price Prediction scenario usually includes increasing interest in payment rails, remittance corridors and compliant infrastructure. In that environment, altcoins that specialize in fast transfers or programmable payments may see correlated inflows as traders look for relative value. Bitcoin Hyper (https://bitcoinhyper.com/) could benefit if exchanges list new trading pairs, liquidity providers add deeper books and marketing campaigns highlight its role as a secondary settlement asset. However correlation is not guaranteed and narratives can decouple quickly after initial speculative bursts.

For conservative traders, a measured approach starts with defining how much portfolio exposure to dedicate to blue chips like XRP versus experimental projects like Bitcoin Hyper. They might anchor their expectations on a base XRP Price Prediction range, then model optimistic and pessimistic paths for HYPER using those assumptions. This framework treats HYPER as a satellite position around a core portfolio, recognizing that thin liquidity, exchange risk and execution delays can amplify drawdowns when sentiment turns against smaller payment tokens.

Risk Factors For XRP And Bitcoin Hyper Traders

Every XRP Price Prediction article that traders actually respect spends time on risk, not just upside scenarios. Regulatory outcomes, ETF decisions, macro shocks and unexpected security incidents can break trend lines. For Bitcoin Hyper, additional risk includes a young team, smart contract bugs, delayed roadmap milestones and limited exchange coverage. Managing position size, using stop levels and diversifying entries across timeframes are essential habits for traders who want to survive multiple market cycles without emotional decision making through changing global crypto markets.

Final Thoughts On XRP Price Prediction And HYPER

In the end, thoughtful traders use XRP Price Prediction as a starting point for broader portfolio construction, not a simple yes or no bet. XRP anchors the payment narrative with deep liquidity and institutional recognition, while Bitcoin Hyper (https://bitcoinhyper.com/) experiments at the edge with gaming, rewards, and community driven use cases. Combining both perspectives encourages disciplined research, scenario planning, and clear exit rules. Whether markets go up, down, or move sideways, that mindset helps traders handle opportunity, stress, and drawdown risk better overall.

For many investors, weaving XRP Price Prediction into a broader thesis on digital payments and scalable altcoin ecosystems makes sense. By pairing established assets like XRP with emerging tokens like Bitcoin Hyper, they can express different risk profiles within one strategy. Actively tracking liquidity, exchange listings, user growth and regulatory signals helps refine that approach over time. Traders who document their decisions and review outcomes regularly are usually better prepared when sharp volatility tests their conviction across market cycles globally.

Buchenweg 15, Karlsruhe, Germany

For more information about Bitcoin Hyper (HYPER) visit the links below:

Website: https://bitcoinhyper.com/

Whitepaper: https://bitcoinhyper.com/assets/documents/whitepaper.pdf

Telegram: https://t.me/btchyperz

Twitter/X: https://x.com/BTC_Hyper2

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.

The latest outlook on Solana (SOL) shows the crypto world watching closely as it attempts a rebound after a broad market slip. SOL is currently trading in the mid-$150 range and is poised near a key resistance zone around $186-$190. The setup: SOL recently pulled back significantly, found support near the $174-$175 range, and is forming a higher low. Indicators such as RSI divergence hint at a possible short-term move upward if it can clear $186-$188. A breakout there could open a path toward $198-$200. That said, the rebound feels fragile.

SOL’s upside looks tied to speculative catalysts and its staking rewards, which some consider less compelling than newer entries.

In contrast, Bitcoin Hyper (https://bitcoinhyper.com/) – though still early and lacking long-term operational proof-is grabbing attention as a rising Layer-2 project built on the Bitcoin ecosystem. Analysts are debating whether Bitcoin Hyper could siphon some of SOL’s momentum in Q4. In short: Solana’s recovery is plausible but not guaranteed. The question now: will it recapture dominance, or will an emerging project like Bitcoin Hyper pull off a surprise and steal the spotlight?

Bitcoin Hyper Emerges as Solana’s Unexpected Challenger

Solana’s recent rebound has drawn cautious optimism after a volatile October, but the spotlight may not stay there for long. Bitcoin Hyper (HYPER) has quietly begun capturing attention among analysts who see it as a new hybrid of meme energy and real infrastructure. Rather than being another speculative asset, Bitcoin Hyper blends the credibility of Bitcoin’s ecosystem with a technical roadmap focused on scalability, community-driven staking, and long-term token utility, giving it a foundation that sets it apart from typical meme projects.

The Core Vision Behind Bitcoin Hyper

At its heart, Bitcoin Hyper (https://bitcoinhyper.com/) aims to extend Bitcoin’s usefulness by introducing faster settlement and dApp capabilities without compromising decentralization. The project’s concept revolves around parallel processing, allowing transactions to confirm in seconds while remaining anchored to Bitcoin’s underlying stability. This approach appeals to investors who believe that innovation within the Bitcoin network could create new market segments. The result is a growing narrative that positions Bitcoin Hyper as both a meme coin and a practical enhancement layer for the broader Bitcoin economy.

Tokenomics and Community Development

Bitcoin Hyper’s tokenomics are deliberately simple yet strategic. The total supply is limited to promote scarcity, while staking pools offer sustainable returns based on network participation instead of unrealistic multipliers. Community incentives include early-buyer benefits, transparent roadmap milestones, and regular development updates that reinforce trust. The project’s Telegram and X activity have surged as traders seek credible alternatives to speculative presales, making Bitcoin Hyper one of the few meme-oriented projects to maintain steady growth in both liquidity and community engagement during a cautious market phase.

Analysts Expect a Q4 Market Rotation

While Solana continues to trade within strong technical zones, several analysts suggest that its Q4 upside could be limited by overextension and slower developer expansion. Bitcoin Hyper, by comparison, benefits from a narrative that blends meme-driven virality with real blockchain scalability. This balance gives it momentum in speculative cycles while preserving a sense of tangible progress. If current presale traction continues and the staking model proves sustainable, Bitcoin Hyper could attract capital rotation from traders seeking fresh exposure beyond established large-cap ecosystems like Solana.

Why Bitcoin Hyper Matters in the Current Market

The broader crypto market has entered a phase where investors favor innovation tied to recognizable ecosystems. Bitcoin Hyper (https://bitcoinhyper.com/) fits this shift perfectly, using Bitcoin’s established network reputation while introducing features designed for modern DeFi participation. Its presale momentum shows that users increasingly want tokens with both entertainment value and infrastructure purpose. As Q4 unfolds, the project’s success will depend on consistent delivery and community strength, but early indicators suggest Bitcoin Hyper could emerge as a defining example of how meme coins evolve toward real-world utility.

Buchenweg, Karlsruhe, Germany

For more information about Bitcoin Hyper (HYPER) visit the links below:

Website: https://bitcoinhyper.com/

Whitepaper: https://bitcoinhyper.com/assets/documents/whitepaper.pdf

Telegram: https://t.me/btchyperz

Twitter/X: https://x.com/BTC_Hyper2

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.

CryptoQuant founder Ki Young Ju released a bull-bear price prediction for Bitcoin BTCUSD. Young Ju highlighted short-term risks from large holders while leaving room for a bullish macro case.

Young Ju’s Bitcoin prediction

The founder of CryptoQuant said large holders, popularly known as whales, have sold Bitcoin worth billions since the coin hit $100,000.

Typically, whale selling creates supply overhang, meaning more BTC hitting the market than buyers can absorb, pushing prices down.

After Bitcoin hit its all-time high (ATH) of $126,025 on Oct. 6, the price has corrected roughly 20-30%. This is partly due to the supply overhang and is a classic sign of distribution in market cycles.

Bitcoin whales have been cashing out billions since $100K.

I said the bull cycle was over early this year, but MSTR and ETF inflows canceled the bear market. If those fade, sellers will dominate again.

There is still heavy selling pressure, but if you think the macro outlook is…

Considering the whale selling, Young Ju had previously suggested that the 2024-2025 bull run had peaked and flipped bearish. However, he pointed out that inflows from Strategy and Bitcoin exchange-traded funds (ETFs) canceled the bear market.

Without this artificial demand, the CryptoQuant founder believes BTC would have entered a multi-year bear market. Hence, he predicted that if Strategy stops or slows down buying BTC and ETF inflows dry up, sellers will dominate again.

Is now good time to buy Bitcoin?

Young Ju went on to emphasize that selling pressure remains heavy. This is confirmed by metrics such as exchange inflows, futures open interest and liquidations.

In a U.Today report, JAN3 CEO Samson Mow attributed the recent sell-off to new buyers. Mow explained that investors who purchased Bitcoin in the last 12-18 months are now taking profits after securing gains of roughly 20%-30%.

His comments further emphasize the concerns of Young Ju about Bitcoin whales disposing of their coins.

On a bullish note, Young Ju later pointed out that the broader economy matters for risk assets like Bitcoin. He, therefore, encouraged investors and traders to buy the dip if they believe the macro outlook will restart inflows and overpower sellers.

As of press time, the Bitcoin price traded at $105,132, down 0.8% over the past 24 hours. However, the trading volume showed a resumption of market activity. The metric jumped by 3.01% to $70.2 billion.

If the momentum continues, combined with inflows into the spot ETF market, BTC could resume an uptrend.

Analysts recently highlighted that the next possible BTC flashpoint is located around $111,700. They claimed the $111,700 range is the threshold that will determine the next move, either upward or downward.

Jakarta, Pintu News – The crypto market is heating up again with a number of significant developments. From the launch of smart contracts on XRP Ledger to Robert Kiyosaki’s fantastic Bitcoin price prediction, as well as the massive sale of Dogecoin by whales.

XRP Ledger is now introducing native Layer-1 smart contract capabilities to developers via AlphaNet. Denis Angell, a software engineer at XRPL Labs and Xahau, announced that XRP Ledger’s Smart Contract features are now available for developers to explore and test.

This is the first milestone to introduce Layer-1 smart contract capabilities natively to the XRP Ledger, combining EVM-style contracts with native XRPL features and transactions. These smart contracts will allow developers to build decentralized applications on XRP Ledger.

The first extension called “Smart Escrows” will allow developers to write custom release conditions to open escrow. The plan is to launch this feature in the first quarter of 2026.

Read More: Bitcoin, Gold, & Silver Price Movements: Increased Correction Potential? Here’s What Analysts Say!

Robert Kiyosaki, author of the book “Rich Dad, Poor Dad”, has again predicted a major crash in the financial markets. However, he sees this as an opportunity to buy, not sell. Kiyosaki has set price targets for 2026 of $27,000 for gold, $250,000 for Bitcoin , $100 for silver, and $60 for Ethereum .

The prediction for Ethereum caused some confusion as Ethereum hasn’t traded in double digits in recent years. Kiyosaki explained that he started buying gold in 1971, when Nixon lifted gold’s backing against the dollar.

More than 3 billion Dogecoin (DOGE), worth around $520 million, have been sold by large holders in just 30 days. On-chain data from Santiment, shared by analyst Ali Martinez, shows that wallets holding between 10 million and 100 million DOGE have sold more than 3 billion coins over the last month.

This happened just as the Dogecoin rally was winding down. After reaching a peak near $0.30 in September, the Dogecoin price dropped to $0.17, erasing almost half of its value. This drop in whale balances is in line with the price drop, suggesting that it’s the big sellers, not the small ones, that are driving the liquidity of the sale.

With the various developments taking place in the crypto market, investors and developers should keep a close eye on the trends and changes taking place. Whether it’s the launch of smart contracts on XRP Ledger, price predictions by well-known personalities, or whale selling activity, these all paint a dynamic and ever-changing picture of the crypto market.

Also Read: Bitcoin Poised to Surge After US Government Shutdown Deal: History Repeats?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

XRP Price Prediction discussions are accelerating again as broader crypto liquidity rotates from mega-caps to large-cap payment and infrastructure plays, with traders reassessing where incremental risk capital will find the best risk-adjusted upside into year-end and early 2026. Derivatives positioning remains sensitive to headlines, while spot flows are shaped by U.S. macro prints and Asia open liquidity. Within that backdrop, analysts are watching catalysts that can move settlement-network assets: throughput upgrades, bank and fintech integrations, and legal clarity around token distribution. A secondary storyline is the rising attention on lean middleware and routing tools in presale phases, with Pepenode (https://pepenode.io/) repeatedly appearing on watchlists as a potential beneficiary of cross-chain demand if alt-liquidity broadens. While none of this guarantees directional moves, the mix of macro, microstructure, and narrative rotation keeps XRP in the conversation for traders seeking asymmetric setups without venturing too far out on the risk curve.

Technical posture and behavior across cycles

From a structural view, XRP tends to oscillate between periods of compressed volatility and swift, news-driven repricings, which complicates any single-point XRP Price Prediction and pushes most analysts toward scenario ranges and conditional triggers. The market continues to respect prior congestion zones and liquidity pockets visible on higher-timeframe charts, especially when open interest builds quickly after macro or regulatory headlines. Traders tracking breadth and dominance metrics often pair these reads with relative strength versus other large-caps to judge whether rotation favors payment rails over smart-contract or meme narratives on a given week. For a neutral, always-on reference, many desks monitor the live data and historical ranges on CoinMarketCap (https://coinmarketcap.com/currencies/xrp/), comparing realized volatility against funding and basis to determine how stretched the market is before positioning for continuation or mean reversion.

On-chain, liquidity, and utility considerations

Utility narratives matter for medium-term XRP Price Prediction because settlement-focused assets typically gain sustained traction when throughput and cost advantages overlap with real usage. Liquidity on ramps and off ramps, regional corridors, and enterprise integrations can become incremental demand drivers, particularly when wrapped liquidity, AMM features, or ledger-level upgrades lower friction for developers. Cross-chain routing has emerged as a complementary theme this cycle: if stablecoin volume or NFT settlement spikes on adjacent networks, liquidity bridges and middleware that reduce slippage can improve execution and expand addressable flows for payment tokens. In this rotating setup, analysts sometimes watch younger infrastructure stories such as Pepenode (https://pepenode.io/) as a sentiment barometer for whether capital is broadening to middleware and tools, a pattern that historically coincides with renewed interest in large-cap settlement tokens.

Regulation, headlines, and the path dependency of price

Regulatory clarity remains a core variable in any XRP Price Prediction. While the market has digested several milestones over recent years, the impact of new guidance, exchange listing standards, and how institutions bucket different digital assets can still change risk budgets abruptly. In practice, traders translate this into headline-sensitivity playbooks: they fade thin moves when liquidity is poor but lean into fully confirmed developments that alter distribution or compliance assumptions. Beyond regulations, network-level enhancements and ecosystem grants can also affect medium-term conviction. For neutral data to contextualize these shifts, some observers keep a tab open on CoinGecko’s XRP overview (https://www.coingecko.com/en/coins/xrp) to compare supply metrics, market cap, and turnover against peer assets, especially during periods when dominance and breadth signal rotation that may either amplify or dampen XRP’s relative performance.

XRP Price Prediction: scenario ranges rather than absolutes

Given the mixture of macro, legal, and microstructure inputs, a scenario-based framework is more informative than a single target. In a conservative “base case,” XRP grinds within established ranges as liquidity alternates between payment and smart-contract narratives, with catalysts required to sustain breakouts; in this path, option sellers focus on income strategies around well-defined levels, and spot-perp basis remains anchored. A constructive “bull case” would involve a clean regulatory impulse, incremental corridor adoption, and risk-on breadth across large-caps; under those conditions, reclaiming prior cycle supply zones and probing psychological round numbers becomes plausible as volatility expands and dips get absorbed faster. The “bear case” hinges on tighter global liquidity, adverse headline surprises, or a failed breakout that traps late longs; here, the market could retest deeper support, with funding flipping negative and realized volatility spiking as risk de-leverages. Across all cases, position sizing and time horizon discipline matter more than point estimates.

Rotation watch: where Pepenode fits into the narrative stack

For traders comparing opportunity sets, rotation signals can refine an XRP Price Prediction by showing whether capital is staying concentrated in mega-caps or widening toward infrastructure betas. When middleware, cross-chain routing, and developer-tooling names start to catch bids, it often precedes or accompanies renewed accumulation in established settlement networks, as builders and liquidity providers align on throughput and cost efficiencies across stacks. In this sense, Pepenode (https://pepenode.io/) has featured in rotation screens as a proxy for alt-beta appetite tied to practical routing and execution improvements. If sentiment around such tooling strengthens-alongside healthy breadth and steady funding-XRP historically benefits from the spillover, especially when on-chain activity validates that lower friction is translating into more usage and deeper liquidity, a combination that can tighten spreads and make trend continuation more durable.

What to watch into the next leg

Near term, the quality of any XRP Price Prediction will depend on how three elements line up: macro prints that steer dollar liquidity and risk parity, regulatory or integration headlines that shift institutional comfort levels, and market microstructure (funding, basis, liquidity around key levels) that determines whether moves stick. Traders will also track Asia and Europe session handoffs for sustained follow-through, since gaps between regional flows often mark the difference between fleeting spikes and genuine trend formation. If breadth continues improving and rotation favors settlement and routing narratives, the probability-weighted path leans constructive; if breadth narrows and liquidity hides in a handful of mega-caps, range trading could persist. Either way, the most robust approaches have paired scenario planning with clear invalidation points and an eye on narrative-sensitive flow proxies so that positioning adapts as conditions evolve rather than anchoring to a single rigid forecast.

Buchenweg 15, Karlsruhe, Germany

For more information about Pepenode (PEPENODE) visit the links below:

Website: https://pepenode.io/

Whitepaper: https://pepenode.io/assets/documents/whitepaper.pdf

Telegram: https://t.me/pepe_node

Twitter/X: https://x.com/pepenode_io

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.

Solana has strong support around 150, with a potential to recover to 200 as network actions and technical indicators continue to gather force.

Solana (SOL) has established a firm ground in the range of approximately $150, and this is an indication of strength following the current fluctuations in the market.

The cryptocurrency is trading around $163, indicating stable recovery and new purchasing interest that will precondition an eventual breakout up to $200 and further.

The $150 mark has taken root as a key support area. SOL price action shows a consolidation between 144 -165, and its perspective is increasing buying pressure and the reestablishment of momentum after falling above 190.

Technical indicators, including the TD Sequential buy signal on daily charts, are short-term indicators that underpin the significance of keeping this threshold to continue bearing bullish momentum.

Source – X

On-chain data includes stable network activity, and there are more than 10 billion in total value locked (TVL) and steady trading volumes on decentralized exchanges (DEXs) of over 3.5 billion in the 24 hours.

Moreover, SOL staking is currently up by almost 3 million tokens, which has tightened supply and maintained price stability.

This stage of interaction with the ecosystem highlights the strength of the $150 support and trust of the market in the principles of Solana.

There is a market momentum favoring a big spurt. Recently, the cryptocurrency has seen its price increase by 5%, driven by flows into Solana-related crypto ETFs, which raised $137 million last week.

This institutional interest is a driver towards the upswing trend towards critical resistance levels of about $180 and $200.

Technical indicators indicate increasing purchasing power; the Relative Strength Index (RSI) is out of oversold states, and the MACD indicators are headed towards bullish crosses.

The analysts note that a move above the 200 mark would affirm a bigger change of direction, which would allow SOL to venture into the more profitable price territory of above 300 in subsequent sessions.

Nevertheless, maintaining support of more than $150 is very important to keep this momentum going. These projections are supported by the Liquidity and stable on-chain metrics, which consist of a history of consistency.

Notably, the activity of the decentralized finance (DeFi) of the Solana ecosystem is dynamic, which implies that investors are still active, regardless of the fluctuations on the market.

This stable network throughput reinforces the argument of a managed yet gradual reclaiming of the market share of the SOL.

PRESS RELEASE

Published November 10, 2025

Market sentiment around Cardano has brightened again, with traders positioning for a potential push toward the region if momentum continues through Q4. The latest Cardano Price Prediction discussions suggest that investors are slowly rotating back into projects with visible development progress rather than purely speculative hype.

At the same time, interest in Remittix (RTX), a PayFi-focused DeFi project, is growing for its real-world payment utility and ongoing platform updates. Both ADA and RTX now sit in a narrative that rewards active ecosystems rather than dormant roadmaps.

Cardano has shown clear signs of recovery this week. ADA is trading around $0.575, up more than 2.9% in 24 hours. For market analysts, this change in momentum is a result of revived developer activity, renewed staking confidence, and Cardano’s core role in decentralized finance.

If ADA maintains its current trajectory and broader market sentiment does not deteriorate, analysts say a move toward $0.73-$0.87 remains realistic in the near term, with the $1.20-$1.50 region back on the table during stronger market conditions. A convincing Q4 would make the target a legitimate conversation heading into 2025.

While the ADA rides the ecosystem’s growth, Remittix is gaining recognition for solving a major real-world challenge: sending crypto directly to bank accounts across 30+ countries with low FX spreads and compliance-ready systems.

With Remittix, users can effortlessly transfer crypto that settles as fiat to the receiver’s accounts in different parts of the world. This process is hitch-free and has very low gas fees. Such a value offer is unmatched even by more established projects like XRP and Stellar.

Key traction points so far:

This positioning places Remittix in the emerging PayFi category, where decentralized finance meets global financial infrastructure.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

COMTEX_470164057/2909/2025-11-10T16:20:30

PRESS RELEASE

Published November 10, 2025

I’m watching the Solargy crypto presale at solargy.io as a tactical, early-stage opportunity that fits a clean-energy narrative. I believe this presale offers asymmetric upside at controlled sizing while diversifying a longer-term digital-asset allocation.

My xrp price prediction blends macro signals, technicals, and adoption data. Right now, the XRP to USD quote sits near $2.32, with 50% green days in the last 30 days and ~6.5% volatility. Sentiment reads bearish at 91% and the Fear & Greed Index shows 27 (Fear).

I write for U.S. investors who want a first-principles approach to allocation. I will weigh institutional paths, ETF catalysts, lawsuit developments, and payment utility, then add scenario ranges and practical portfolio actions.

Throughout, I’ll reference live metrics like market cap (~$139.7B) and circulating supply (~60.1B) so my analysis stays verifiable. I’ll close with a clear action plan and why I see Solargy as a compelling presale complement to a core XRP position.

A measured allocation to Solargy’s presale gives me exposure to early upside in the clean-energy crypto space. I treat this as a tactical sleeve that can complement a core position in xrp rather than replace it.

Presale crypto often offers earlier entry points and thematic upside that blue-chip assets lack. I size these positions smaller to capture growth potential while keeping overall risk controlled.

Solargy pairs a renewables narrative with a clear roadmap and visible team signals. The presale structure aligns incentives and can attract narrative-driven flows from investors who value sustainability.

Liquidity contrasts matter: while xrp trades on deep markets, an upcoming crypto presale can offer a different risk/reward profile. For me, Solargy is a best crypto presale candidate to add tactical upside to a long-term strategy.

My short-form thesis ties monetary easing and institutional flow dynamics to a multi-year outlook for digital assets. Easier policy and large cash pools can push risk appetite higher and widen market participation.

The Fed trimmed its key rate by 0.25% on September 17 and two more cuts are expected this year. Falling yields make cash less attractive and can rotate funds into the crypto market.

Money market funds hold roughly $7.6T in cash. When yields compress, that idle capital becomes potential fuel for risk assets and altcoins.

Institutional adoption is a multiyear trend. Better custody, accounting clarity, and clearer risk frameworks make it easier for institutions to allocate to digital assets over time.

Overall, these trends underpin my forward-looking predictions and shape how I size entries. I prefer to build on consolidations while watching liquidity signals and institutional cues for the year ahead.

I open with a concise market snapshot to orient my tactical and strategic calls.

Live context: the token trades near the $2-$2.6 band, roughly $2.32 today. Sentiment reads Fear at 27 on the Fear & Greed Index, which often brings value-seeking activity from patient buyers.

Shorter timeframes show bearish momentum: four-hour and daily charts have falling 50-day moving averages. The weekly chart is supportive, with a rising 200-day MA that preserves a longer-term uptrend.

Fifteen of the last 30 sessions were green and realized volatility sits near 6.5%. That mix implies two-sided trading and consolidation rather than a decisive breakout or collapse.

“Mixed timeframes and a Fear reading suggest range-bound trading with upside if resistance breaks on volume.”

I’ll track price action into key levels in the technical section to define risk and potential upside, and use this snapshot to inform my near-term trading and longer-term prediction path.

My near-term trading hinges on a few clear horizontal levels and a tightening pattern that has formed since mid-year. I use these levels to size entries, set invalidation points, and keep risk tight.

$2.70 is my first-line support. I place partial adds there with tight invalidation just below that mark.

$2.20 is the major guardrail where I would reassess exposure if a sustained break occurs.

The top of the near-term range sits at $3.30 and $3.55. Clearing these levels with expanding volume would confirm a trend expansion and validate higher targets.

The chart shows a contracting triangle since mid-year on muted volume — a classic coiled structure. Prior analogs often produce 50-70% moves when breakouts come with participation.

I watch the daily 50-day MA slope and the 200-day trend. A turning 50-day alongside a reclaim of the 200-day would signal improving momentum.

“Volatility compression often precedes expansion; I require clear volume to trust a move and protect value while the market resolves.”

Practical fundamentals like settlement speed and burn mechanics shape my long-term view. I focus on how on-ledger finality and predictable issuance affect adoption by banks and payment providers.

The ledger settles in seconds with near-zero transaction costs, while SWIFT only passes messages between banks. That means true on-chain finality can cut settlement time and operational friction for international payments.

Low-cost, fast settlement appeals to financial institutions that need predictable liquidity flows and tight reconciliation windows. These features support remittances and on-chain FX corridors beyond simple transfers.

The network started with a pre-mined supply of 100 billion tokens. About 55 billion sits in escrow with scheduled releases up to 1 billion per month; unused amounts return to escrow to smooth issuance.

Every transaction pays a tiny base fee (~0.000001 unit) that is burned. Over time, higher activity creates subtle deflationary pressure that can support network value as usage scales.

“Utility and institutional integration are central to my multi-year framework; fundamentals don’t dictate short-term swings but they support durable value creation.”

| Feature | Legacy Rail | On-Ledger Network | Investor Implication |

|---|---|---|---|

| Settlement Time | Hours-days (SWIFT) | Seconds | Reduces counterparty risk |

| Fees | Fixed bank fees | Micro-fees burned per tx | Scales with volume; subtle deflation |

| Supply Control | N/A | 100 billion pre-mined; 55B escrow | Predictable issuance, lower surprise dilution |

| Onboarding | High reserve/account friction | Reserve = 1 unit (reduced) | Better accessibility; aids adoption |

Regulatory clarity could be the single biggest catalyst that shifts broad institutional demand into higher gear. The SEC lawsuit overhang has constrained many firms’ mandates and slowed direct allocations.

I view a favorable legal outcome and spot ETF approvals as two distinct but complementary unlocks. A resolved sec lawsuit removes custodial and compliance hurdles for institutions.

A spot ETF would provide a regulated wrapper that advisors and large managers can use. That structure often brings predictable, large-scale flows and supports faster institutional adoption.

Positive rulings can compress risk premia and enable multiple expansion without immediate fundamental change. Adverse outcomes would likely extend consolidation, but the ledger’s long-term utility still supports my broader investment thesis.

“Regulatory clarity is pivotal to any re-rate and must be part of scenario planning rather than a single bet.”

I map three clear case paths so investors can follow triggers, invalidations, and execution rules into the end of 2025.

Range: $2.40-$2.80 by mid-late 2025.

This requires breadth across exchanges and rising on-chain volume. Whale buys accompanied by higher daily volume will confirm strength.

Execution: I increase exposure in tranches as the band holds and volume expands. I tighten stops below the guardrail to protect gains.

Condition: institutional inflows, ETF approvals, and large custody flows.

If regulators clear the path and ETFs attract steady net inflows, an ATH retest into the $3.40s can lead toward ~ $5.05 by year-end in a stretch scenario.

Execution: I add on confirmed breakouts with expanding volume and trim into headline-driven spikes to lock value.

Trigger: sustained break below $2.10-$2.20 with weak volume.

That would likely extend range-bound trading and elevate volatility. Whales selling into weakness usually precede longer pullbacks.

Execution: I hedge or reduce position size, and consider value-accumulation only if fundamentals remain intact.

“I frame each scenario by volume behavior and whale activity — those signals have historically led durable trend shifts.”

Combining cross-desk research gives a clearer, investable band rather than a single-point target.

My working 2030 band centers on $17-$26.50. This reflects two independent desk ranges and the institutional narrative that utility and ETF adoption will drive medium-term flows.

One model averages near $21.99 with a spread roughly $21.23-$25.58. Another desk presents a $17-$26.50 range that overlaps cleanly with that average.

I treat higher outliers as conditional. They need accelerated adoption, broad ETF penetration, and wider use by financial institutions in cross-border flows.

“My plan anchors to a band with multi-source support and revises only with real adoption data, not headlines.”

| Source | Working Band | Model Avg / Spread | Key Driver |

|---|---|---|---|

| Desk A | $17-$26.50 | — | ETF adoption & custody |

| Desk B | $18-$25 | $21.99 (21.23-25.58) | Payments share & volume |

| Institutional View | Higher tail cases | Wide variance | Exceptional adoption curve |

| My Framework | $17-$26.50 | Anchored to cross-desk avg | Regulatory clarity + adoption |

I will keep allocation disciplined. I size exposure to trend strength and real on-chain adoption. That approach preserves optionality while grounding strategy in a multi-source band.

I break 2026-2030 into actionable bands tied to partnerships, on-chain volume, and institutional flows. This helps me convert broad forecasts into specific triggers for sizing and rebalancing.

Research desks converge on a $6-$16 range for 2026-2028 if adoption expands. I expect 2026 in the mid-single digits, rising toward high single or low double digits by 2027-2028.

Drivers: expanding partnerships, corridor liquidity improvements, and stablecoin integrations such as RLUSD. I treat these as execution milestones, not hype.

For 2029-2030, desks outline a $12-$26.50 stretch zone. That band depends on sustained ETF flows and larger institutional allocations.

“My allocations rise with evidence–partnership execution and institutional flows, not headlines, guide durable growth.”

I focus on a tight set of live indicators to validate trend continuations or early reversals. Clear, timely signals help me size entries and protect capital as market dynamics shift.

Primary on-chain and flow signals I watch include rising whale transfers (>$1M) and exchange outflows that often precede sustained rallies. Volume trendline breaks on spot and derivatives markets usually confirm genuine participation.

“When signals diverge from price, I treat that as an early warning and adjust my stance.”

These inputs form the basis for my ongoing prediction updates and tactical execution for U.S. investors watching institutional adoption and broader trends.

I map the main downside scenarios so I can act fast when markets shift.

Volatility can amplify gains and losses. I size positions with downside stress tests and clear invalidation levels to protect capital.

Policy shifts and regulatory news are event risks. I set pre-defined responses for rate moves and SEC updates so I don’t react emotionally to headlines.

Adoption friction–technical setbacks, slower bank integrations, or competing rails–can slow value accrual. I treat these as execution risks and watch integration milestones.

I keep cash buffers to buy on capitulation instead of chasing rallies. I also stagger entries across time to reduce timing risk around major announcements.

“I enforce objective invalidation levels and reassess exposure when new data contradicts my thesis.”

| Risk | Recent Driver | Mitigation | What I Watch |

|---|---|---|---|

| Volatility | Geopolitical shocks | Position sizing + stress tests | Spreads, slippage, realized vol |

| Policy & Regulatory | SEC delays | Pre-set event plans; reduce exposure before rulings | Fed guidance, regulatory news |

| Adoption Friction | Slow bank integrations | Milestone-based adds; partner verification | On-chain volume, integrations |

I review these risks continuously and adjust allocations so my long-term investment thesis keeps pace with real-world trends.

I favor a barbell approach: steady core exposure and a capped basket of speculative presale bets. This lets me hold institutional-grade assets for stability while seeking asymmetric upside from curated presale crypto names.

Core allocation: I keep a meaningful xrp stake to capture adoption and macro-driven flows. That core absorbs much of the portfolio’s volatility and anchors long-term investment goals.

Growth sleeve: I allocate a small percentage to the best crypto presale candidates. These positions are size-limited so one failed new crypto presale won’t derail the plan.

My checklist is simple and practical: credible team, clear problem-solution fit, aligned tokenomics, and a realistic roadmap. I prefer projects with external audits, early partnerships, and transparent communication.

“Risk-adjusted value creation matters more than chasing every upcoming crypto presale.”

| Component | Role | Sizing Guideline | Trigger to Add |

|---|---|---|---|

| Core xrp | Stability / adoption exposure | Primary sleeve (largest) | Trend confirmation / on-chain adoption |

| Presale crypto basket | Higher growth potential | Small, capped per project | Milestones: audits, partnerships |

| Cash reserve | Opportunity & risk control | Buffer for rebalancing | Capitulation or quality entry |

I align exposure with my liquidity needs and risk tolerance so other investors can adapt the approach. My goal is disciplined, tactical allocation that balances core stability with selective presale upside.

Solargy’s presale fits a specific niche I want exposure to: renewable infrastructure tied to token incentives. The narrative aligns with mainstream demand for sustainability, which can attract retail and institutional interest as green finance gains traction.

Narrative fit: linking incentives to energy projects creates a relatable story for investors and for partners pursuing decarbonization goals.

Team signals: I value consistent updates, transparent timelines, and early ecosystem engagement. Those behaviors reduce execution risk and build confidence before listing.

Potential utility: integrating token rewards with real-world energy programs could drive measurable usage if implemented well. That utility supports longer-term growth beyond speculative flows.

Solargy’s earlier-stage profile offers asymmetrical upside while I hold a core xrp position through institutional adoption phases. The new crypto presale can deliver growth during the multi-year adoption arc that my broader prediction contemplates.

“I’ll monitor execution closely after listing and adjust exposure as the project meets its targets.”

| Role | Core Benefit | My Action |

|---|---|---|

| Solargy (presale) | Early growth / thematic exposure | Milestone-based adds; tight sizing |

| xrp (core) | Institutional adoption runway | Hold & rebalance with trend |

| Cash | Opportunity buffer | Reserve for quality entries |

I explain how I will distribute core keywords, presale terms, and editorial signals to support news-focused visibility and user intent.

Primary anchor: I keep the exact-match H1 and header placement for “xrp price prediction 2030” to anchor topical relevance in search and news aggregators.

I then map secondary phrases–like best cryptocurrency to invest in, presale crypto, and best crypto presale–across the intro, portfolio, and Solargy sections. That helps semantic coverage without stuffing.

I balance density to meet Google News style and avoid over-optimization. Meta title and description will mention Solargy and the main anchor to match searcher intent.

“Keyword placement should inform readers first and search engines second–clarity wins in the long run.”

| Element | Action | Example target |

|---|---|---|

| H1 / Section 9 | Exact match anchor | “xrp price prediction 2030” |

| Intro & meta | Presale terms + narrative | best crypto presale, presale crypto |

| Internal links | Related pages | 2025 predictions, market trends |

Below I lay out the exact levels and triggers I’ll use to build exposure while protecting capital. This is a practical, time-aware plan that investors can adapt to their risk tolerance.

I plan gradual accumulation near $2.70 with an invalidation just below $2.60. I treat a tested second tier near $2.20 as a tighter risk add if fundamentals hold.

Breakout adds occur above $3.30 and only on rising volume. That confirms the triangle setup and the potential 50-70% move I expect when participation expands.

Re-entry triggers after shakeouts are simple: an impulsive reclaim of lost levels with expanding volume and constructive funding resets. Those signals indicate renewed buyer commitment.

Profit-taking bands sit into $3.30-$3.55 initially. I trail stops on breakout gains and reassess targets if momentum supports an extended trend expansion.

“I rely on clear levels, volume confirmation, and macro timing rather than emotion to manage trades and long-term investment decisions.”

Conclusion

In closing, I distill the analysis into a short set of clear actions I will follow. I will watch volume, whale flows, institutional filings, and execution milestones for the presale project before scaling exposure.

My approach balances a core holding with a small, milestone-driven presale sleeve. I add on evidence, trim into headline-driven spikes, and tighten invalidation levels to protect capital.

This plan is practical and repeatable: evidence first, size second, and discipline always. I will update the framework as new on-chain and regulatory data arrive.

I present a multi-year view that blends macro liquidity, market structure, and likely catalysts. I highlight how a current presale opportunity can sit alongside a long-term holding thesis, and I map realistic ranges through 2025 and into the decade depending on adoption and regulatory outcomes.

I see presales as a way to diversify upside while keeping capital exposure limited. Solargy at solargy.io fits my checklist for early-stage projects: clear narrative, functional roadmap, and potential network utility that can complement holdings in established settlement-focused tokens.

A presale can offer asymmetric upside with small allocation while established assets provide relative stability and liquidity. Together they balance growth potential and capital preservation across potential market cycles.

I expect central-bank liquidity trends and a rate-cut cycle to shape risk appetite. If inflation moderates and cuts arrive, risk assets should find a more constructive backdrop, aiding broad adoption and institutional allocation into digital settlement networks.

Extremely important. Institutional flows, custody infrastructure, and any ETF approvals would materially increase market depth and credibility, accelerating on-ramps for corporate and treasury use cases.

I see mixed timeframes with price hovering in a consolidation band, market sentiment skewed toward caution, and volatility that can produce sharp intraday moves. I monitor macro cues and retail/institutional flow data for timing decisions.

I use clear downside guardrails and upside thresholds for trend confirmation. I also watch moving-average crossovers and pattern development to validate momentum shifts for sizing my trades.

Real-world utility — especially cross-border settlement speed and cost — tokenomics, fee mechanisms that subtly reduce circulating supply, and steady adoption by payment processors and financial institutions.

Legal clarity and any court outcomes or regulatory decisions can trigger re-rating events. Positive rulings and clearer ETF frameworks would reduce uncertainty and likely draw new capital into the space.

I present base, bull, and bear cases tied to volume trends and institutional flow. The base expects consolidation with gradual volume improvement, the bull requires renewed inflows and macro tailwinds, and the bear follows a loss of key support and extended sideways action.

I lay out structured ranges informed by institutional research and adoption curves, showing progressive traction in the mid-term and wider stretch targets if network effects and ETFs materialize.

Trading volume, large-wallet activity, custody inflows, and institutional order flow. These metrics give early warning of shifting supply-demand dynamics and help inform rebalancing decisions.

High volatility, adverse policy moves, regulatory setbacks, and slower-than-expected adoption by payment networks. I plan position sizing and stop rules to manage those risks.

I allocate core holdings to established protocols for liquidity and market access, while assigning a smaller tranche to high-potential presales for upside. I avoid concentration and set strict size limits per deal.

The project shows narrative fit, an active development team, and potential on-chain utility that aligns with my timeline. I view it as a speculative complement rather than a replacement for core settlement-focused holdings.

I place primary phrases in titles and headers while using related search terms naturally in body copy. I prioritize readability, factual accuracy, and context-driven keywords to support discoverability without over-optimizing.

I define accumulation zones, clear invalidation levels, and re-entry triggers tied to volume and volatility cues. I update these rules as macro headlines and regulatory events unfold.

Website: https://solargy.io/

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

COMTEX_470162390/2909/2025-11-10T13:52:55

Solana price is regaining momentum as ETF inflows surge, signaling renewed institutional confidence and a potential push towards the $200 mark.

Despite recent volatility across the crypto market, Solana has quietly regained attention as institutional investors pile in through spot ETFs. The latest $137 million inflow, led by Bitwise’s $BSOL, signals growing confidence that Solana could be entering its next major expansion phase.

Institutional interest in Solana continues to strengthen as SolanaFloor reports that Solana spot ETFs were the only crypto ETFs to record positive inflows last week, adding over $137 million. The majority came from Bitwise’s $BSOL, which led with $127 million in inflows. Meanwhile, Bitcoin and Ethereum ETFs faced outflows, underscoring Solana’s growing dominance in institutional portfolios.

Solana outshines Bitcoin and Ethereum as the only crypto ETF posting positive inflows last week. Source: SolanaFloor via X

These persistent inflows signal rising investor confidence, suggesting that smart money is positioning for Solana’s next expansion phase. With capital consistently rotating into staking-enabled products, Solana appears to be consolidating as the preferred high-performance blockchain among fund managers.

A sharp technical rebound is unfolding as robo’s chart highlights Solana’s clean recovery from last week’s flush. Solana price is forming higher lows within a well-defined ascending channel, while Bollinger Bands are beginning to expand again, often a precursor to volatility resumption.

Solana forms higher lows as Bollinger Bands expand, hinting at a potential bullish breakout. Source: robo via X

If the SOL price holds above $166, the setup opens room for a push towards $175 or even $180, marking the upper channel resistance. The combination of structural recovery and increasing volatility suggests bulls are regaining control, potentially setting the tone for a renewed uptrend.

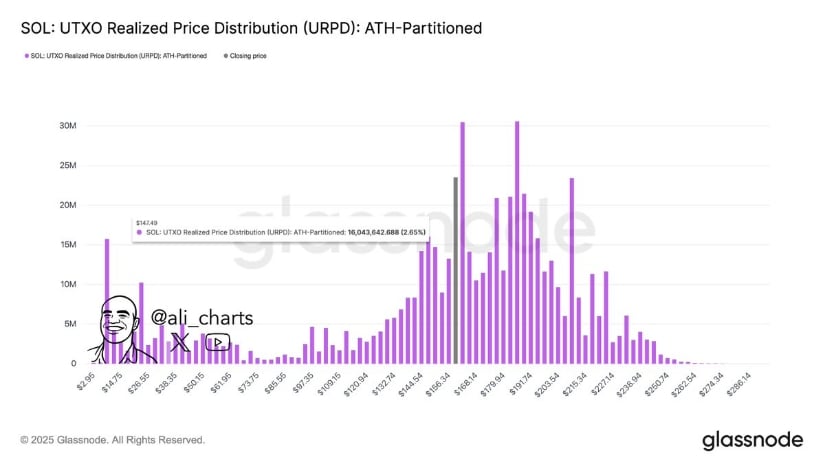

On-chain distribution data shared by Ali Martinez points to $147.49 as Solana’s most critical support level. Glassnode’s realized price distribution reveals a heavy concentration of long-term holders within this range, indicating that it’s a strong base of demand.

$147.49 emerges as Solana’s key on-chain support, backed by strong holder accumulation and limited downside risk. Source: Ali Martinez via X

Historically, Solana price has seen strong rebounds from similar high-density accumulation zones. As long as this level holds, downside risk remains limited, further strengthening the bullish case built by ETF inflows and improving technicals.

Adding to this structure, TraderSZ’s latest chart shows Solana price holding above short-term demand around $163 to $166, with resistance clusters forming between $195 and $227. A breakout above this mid-range could set up an eventual push towards the $243–$260 region.

Solana holds firm above key demand at $163–$166, with upside targets stretching towards the $243–$260 zone. Source: TraderSZ via X

The recent SOL bounce appears to mirror a broader shift in sentiment, as price consolidates near the higher end of its multi-week range. Sustaining momentum above $166 could validate this bullish structure, keeping the broader trend intact.

Solana’s market outlook is beginning to align across technical, on-chain, and institutional fronts. ETF inflows have reignited confidence, technical structures show steady recovery, and on-chain data underscores strong foundational demand.

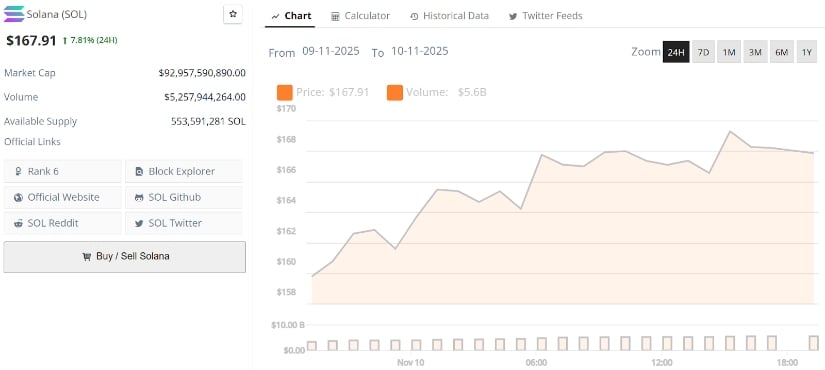

Solana current price is $167.91, up 7.81% in the last 24 hours. Source: Brave New Coin

If Solana price continues to hold above the $160 zone and ETF inflows remain steady, it could reclaim $200 in the coming days, reaffirming SOL’s strong position.