The main tag of cryptocurrency price today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The main tag of cryptocurrency price today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Cardano price is showing renewed strength as rising search trends and technical breakouts hint at a potential bullish reversal.

Cardano’s momentum is picking up again as participants and community members grow increasingly optimistic. After weeks of quiet consolidation, new interest across social platforms and Google trends suggests fresh energy is building behind ADA.

Interest around Cardano is picking up speed again, as TapTools highlights a surge in Google searches for phrases like “will Cardano go up” and “Cardano news now.” This growing curiosity often precedes periods of renewed volatility and upside activity, showing that retail sentiment is shifting towards optimism. The stronger the community narrative becomes, the more it reinforces confidence among long-term holders, often leading to increased inflows and liquidity around key support zones.

Cardano price sees a sharp rise in global search activity, signaling renewed retail interest and growing bullish sentiment across the community. Source: TapTools via X

Historically, such spikes in search volume have coincided with early phases of accumulation before broader rallies take shape. If momentum continues building across social channels and market sentiment remains positive.

Cardano price has just reclaimed one of its most crucial resistance levels at $0.58, a zone that has repeatedly rejected upward attempts in recent months. This breakout, as Alts King points out, represents a strong structural shift from distribution to accumulation.

Cardano’s breakout above $0.58 signals a major technical shift, with bulls eyeing $1.20 to $2.00 as the next key upside targets. Source: Alts King via X

With weekly momentum now turning upward, the next logical targets emerge around $1.20 and $2.00, aligning with key Fibonacci extensions from the previous cycle’s retracement. The chart also shows consistent volume expansion during this reclaim, suggesting active participation.

The latest update from Jack paints a constructive picture for ADA’s short-term outlook. While whales recently distributed around 4 million ADA, the data indicates that retail accumulation and rising taker buy dominance are offsetting that pressure. Cardano Price structure shows a potential recovery leg towards the $1 mark, with notable support levels forming at $0.51 and $0.44.

Retail accumulation strengthens as buying pressure builds, hinting at a potential recovery leg towards the $1 mark for ADA. Source: Jack via X

Momentum indicators are also aligning with this rebound scenario. RSI is trending upwards from oversold levels, and open interest is expanding alongside bullish funding rates. If Cardano price maintains its footing above $0.55, it could trigger a swift continuation towards the $0.85 to $1.00 range.

ADA’s longer-term technical landscape remains favorable for the bulls. As Kamran Asghar highlights, the asset is currently back-testing a multi-year support zone between $0.38 and $0.44, a region that has repeatedly acted as a launchpad during past market cycles. The ongoing defense of this level strengthens the narrative that a new macro cycle could be forming beneath the surface.

Cardano continues to defend its multi-year support zone, hinting at the early stages of a new macro bullish cycle. Source: Kamran Asghar via X

Price compression within this range also mirrors historical bottoming patterns, where extended consolidation preceded impulsive rallies. With resistance trendlines gradually flattening and weekly candle closes tightening, any decisive breakout above $0.60 could confirm the start of ADA’s next bullish expansion phase, potentially setting the stage for a return towards $1.20+ in the coming quarters.

Cardano’s broader landscape continues to improve across both technical and social dimensions. Rising search interest, strengthening community engagement, and consistent support defense all point towards growing confidence. The combination of retail accumulation and expanding network fundamentals provides a strong foundation for a potential sustained recovery.

If Cardano price holds above the $0.50 to $0.55 region and confirms further momentum beyond $0.60, the probability of revisiting $0.85 to $1.20 in the near term increases sharply. From sentiment to structure, the setup is evolving in favor of the bulls, signaling that Cardano price prediction may finally be preparing for its next major breakout phase.

Bitcoin, currently priced at $101,468.15, shows signs of a volatile journey. As it dips by 3.40% over the day and experiences a year-to-date drop of 15.48%, market watchers are eager to know where it stands next. Is it set to climb toward its projected forecast of $142,555.95, or are there hurdles? Let’s dive into the data-driven analysis.

Bitcoin’s recent price movement shows a modest increase of 0.18% today, with highs and lows showcasing its volatile nature ($107,269.85 high to $98,892.97 low). Compared to its year high of $126,296, recent forecasts suggest a bullish outlook. Analysts project a monthly target of $142,555.95. Despite a 15.48% YTD decrease, there’s potential for upward movement. Forecasts, however, remain susceptible to macroeconomic shifts, regulations, or unforeseen events in the crypto world.

Diving into technical indicators, Bitcoin’s RSI stands at 40.72, indicating it’s nearing an oversold territory. Meanwhile, the MACD reflects bearish momentum with a -2912.91 value. With an ADX of 27.80, the trend remains strong. Lower Bollinger Bands at $100,996.52 align closely with the current price, suggesting support levels are being tested. While the Average True Range (ATR) at 4670.44 indicates high volatility, prices could soon sway upward.

Market sentiment swings between caution and optimism. Bitcoin’s volume today at $110,967,184,773 surpasses the average of $780,514,552, hinting at increased trading activities. The On-Balance Volume (OBV) showcases negative market pressure, reflecting bearish behavior. Meyka AI highlights the oscillating investor sentiment due to rapid changes in trading patterns, hinting at cautious optimism tempered by recent performance dips. Despite recent losses, five-year forecasts remain strong at $161,345.54.

In essence, Bitcoin is riding a wave of volatility with potential highs targeted at $142,555.95. Datapoints suggest support at current levels, but risk factors include macroeconomic elements, regulatory changes, and unexpected market shifts. Traders should consider these variables as they interpret the latest forecasts.

Currently, BTCUSD is priced at $101,468.15, reflecting volatile movements throughout the day between $98,892.97 and $107,269.85. Check live prices on platforms like BTCUSD.

Analysts forecast that BTCUSD might reach around $142,555.95 in the coming month, although predictions depend heavily on market conditions and external factors.

Recent data indicates a high volatility with an ATR of 4670.44 and a significant trading volume. Market volatility is further influenced by economic conditions and crypto-specific events.

Key indicators like RSI at 40.72 and MACD at -2912.91 suggest bearish movement with potential support at current prices. Strong ADX implies trend stability, requiring watchful analysis of market shifts.

Bitcoin has strong potential to reach the forecast of $161,345.54 in five years, supported by historical growth trends and current market dynamics. Yet, this path is speculative and subject to change based on various influential factors.

Disclaimer:

Cryptocurrency markets are highly volatile. This content is for informational purposes only.

The Forecast Prediction Model is provided for informational purposes only and should not be considered financial advice.

Meyka AI PTY LTD provides market data and sentiment analysis, not financial advice.

Always do your own research and consider consulting a licensed financial advisor before making investment decisions.

PRESS RELEASE

Published November 8, 2025

Cardano (ADA) remains locked in a long-running fight to reclaim the symbolic $1 level, a price zone that hasn’t been seen since early 2022. As of today, ADA trades near $0.58, showing steady but restrained progress while investors weigh whether the network’s fundamentals can finally translate into decisive price action.

The broader market context looks promising. Bitcoin is consolidating above $100K, Ethereum has regained strength near $3,800, and liquidity is clearly seeping back into altcoins. Still, ADA’s movement has been measured — leading many traders to look for faster-moving opportunities. One project standing out amid this shifting sentiment is AlphaPepe (ALPE), a BNB Chain presale that’s channeling meme-coin enthusiasm through a more structured and transparent ecosystem.

As Cardano works to regain momentum, AlphaPepe is emerging as the face of a new generation of retail-driven projects — combining humor, community energy, and real on-chain mechanics.

Cardano’s technical setup reflects cautious optimism. Trading at roughly $0.58, ADA is still down from its year-to-date highs near $0.82 but comfortably above the mid-$0.50 support zone that’s been in place since September. The $0.60-$0.62 range has acted as local resistance; a break above it could invite momentum toward $0.70, while a sustained move above $0.80 would open the conversation around a return to $1.

On-chain metrics show resilience: nearly 63% of ADA’s circulating supply remains staked across thousands of pools, proof of the network’s strong holder base. Developer activity remains high thanks to Cardano’s Plutus smart-contract platform and ongoing improvements to Hydra, its Layer-2 scaling solution.

However, the market wants proof that Cardano’s ambitious roadmap can deliver traction comparable to Ethereum’s Layer-2 ecosystem or Solana’s resurgence. Until that adoption narrative becomes more visible, ADA may continue to oscillate between consolidation and cautious rallies.

The $1 mark carries both psychological and structural weight for Cardano. Psychologically, it represents a return to parity with pre-bear-market valuations — a symbol that the network has moved beyond consolidation into renewed growth. Structurally, it would re-establish Cardano in the top tier of large-cap performers, restoring confidence among retail investors who have been sidelined since 2022.

Reaching $1 from current levels would require roughly a 70% price increase, or a total market capitalization near $36 billion. While that’s achievable in a bullish environment, it demands both fresh liquidity and sustained media attention. The good news: historical cycles show ADA has often lagged the early-phase Bitcoin run before catching up later in altseason, suggesting time — not structure — may be the missing ingredient.

Cardano’s core fundamentals remain some of the strongest in the sector. The Fusaka upgrade (targeted for early 2026) promises better interoperability and cross-chain functionality. Meanwhile, Midnight, its privacy-focused sidechain, is entering advanced testing, signaling progress toward broader enterprise and government applications.

Partnerships continue to expand in education, identity verification, and real-world asset tokenization — particularly in Africa and emerging markets. Cardano’s slow-and-steady approach, often criticized for its deliberate pace, may actually position it well for the regulatory clarity expected in 2026 and beyond.

Still, for retail traders seeking fast returns, these steady fundamentals often lack the excitement that drives price parabolas. That’s where projects like AlphaPepe (ALPE) enter the picture.

While ADA’s growth remains measured, AlphaPepe has become one of the most explosive new narratives of late 2025. Built on BNB Chain, AlphaPepe is a meme-coin presale combining viral branding with real tokenomics — the same formula that made Dogecoin and Shiba Inu household names but with modern mechanics that solve their biggest weaknesses.

The AlphaPepe presale is approaching $400,000 raised, with more than 3,300 holders already participating and over 100 new wallets joining daily. Early investors receive instant token delivery, allowing immediate ownership, while staking rewards are live during presale — meaning holders can earn yield before the token even lists.

The project also runs a USDT reward pool, which has distributed over $9,000 in earlier rounds and continues to reward participants. AlphaPepe’s contract has been audited (10/10 score) and liquidity will be locked at launch, ensuring transparency.

To keep its community engaged, AlphaPepe introduced NFT rewards for top holders, granting exclusive collectibles and additional bonuses to early adopters. This layer of gamified ownership has helped foster loyalty while expanding the project’s reach across social media platforms.

Market analysts who called PEPE’s legendary rally are now watching AlphaPepe closely, suggesting it could follow a similar trajectory — but with stronger fundamentals. The argument is simple: AlphaPepe could be the next early-stage meme success story, and entering during the presale could replicate those asymmetric gains.

A presale investment, analysts say, could reasonably target upon listing if AlphaPepe hits its projected early-exchange valuations. While speculative, it’s exactly this kind of optionality that attracts investors during altcoin season.

Cardano and AlphaPepe represent two sides of today’s crypto landscape. ADA is the builder’s asset — methodical, battle-tested, and focused on long-term adoption. Its investors are patient, betting on steady progress and future institutional integration.

AlphaPepe, on the other hand, is the opportunist’s token — built for immediate engagement, community energy, and meme-driven culture but underpinned by legitimate mechanics like staking, NFT rewards, and audits.

In many ways, AlphaPepe captures the energy of early Dogecoin or Shiba Inu, but in a market that now demands functionality, not just memes. Its success reflects a generational shift: investors want both excitement and accountability — something AlphaPepe appears to balance effectively.

Looking ahead, most analysts place Cardano’s fair range between $0.70 and $1.10 for 2025, assuming continued development milestones and a stable macro environment. If Bitcoin holds above $100K and the altcoin season strengthens, ADA could test $0.80 within months and challenge $1 again in early 2026.

The bearish scenario sees Cardano consolidating between $0.50 and $0.65 for longer if momentum stalls. Either way, ADA remains structurally sound — but its growth curve depends on liquidity rotation and investor patience.

Cardano’s slow-burn journey toward $1 underscores its role as a long-term cornerstone of blockchain infrastructure. With deep staking participation, active development, and a maturing sidechain ecosystem, ADA continues to justify its top-ten status.

But as altcoin season accelerates and meme-coin culture resurfaces, the market is also rewarding early-stage innovation and community-driven projects. AlphaPepe (ALPE) has become the clear standout of that wave — a meme-coin presale with verifiable mechanics, NFT perks, and analyst attention reminiscent of PEPE’s early days.

For investors, the contrast is clear: Cardano offers stability and structure; AlphaPepe offers speed and asymmetry. Both have roles to play — but as 2025’s altcoin cycle deepens, AlphaPepe is seizing the moment that ADA, for now, is still waiting for.

Website: https://alphapepe.io/

Telegram: https://t.me/alphapepejoin

What is Cardano’s current price?

ADA trades around $0.58, with support near $0.55 and resistance around $0.62.

Why is the $1 mark so important for ADA?

It’s a major psychological milestone that signals recovery from bear-market lows and renewed investor confidence.

What are Cardano’s current development highlights?

Ongoing work on Hydra scaling, the privacy-focused Midnight sidechain, and enterprise partnerships in Africa and beyond.

What is AlphaPepe (ALPE)?

A BNB Chain meme-coin presale featuring instant token delivery, staking rewards, NFT bonuses for top holders, and an audited smart contract.

Why are analysts comparing AlphaPepe to PEPE?

Because it carries the same viral potential but adds real mechanics and transparency — making it the next meme-coin candidate for breakout success.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

This publication is strictly informational and does not promote or solicit investment in any digital asset

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

COMTEX_470124596/2909/2025-11-08T10:42:04

XRP (XRP) is facing a crucial moment in its 2025 rally. The cryptocurrency, native to the Ripple ecosystem, is trading around $2.26–$2.36 USD, testing key support levels.

Market watchers are debating whether XRP will stabilize above $2 or suffer a deeper correction before resuming its upward trend.

After rallying from lows near $0.60 earlier this year, XRP has seen significant gains, climbing above $2.30. On-chain data indicate strong accumulation, including over 21,000 new wallets created in the last 48 hours, signaling growing investor interest. However, the cryptocurrency faces resistance around $2.55–$2.70, where overbought conditions could trigger short-term pullbacks.

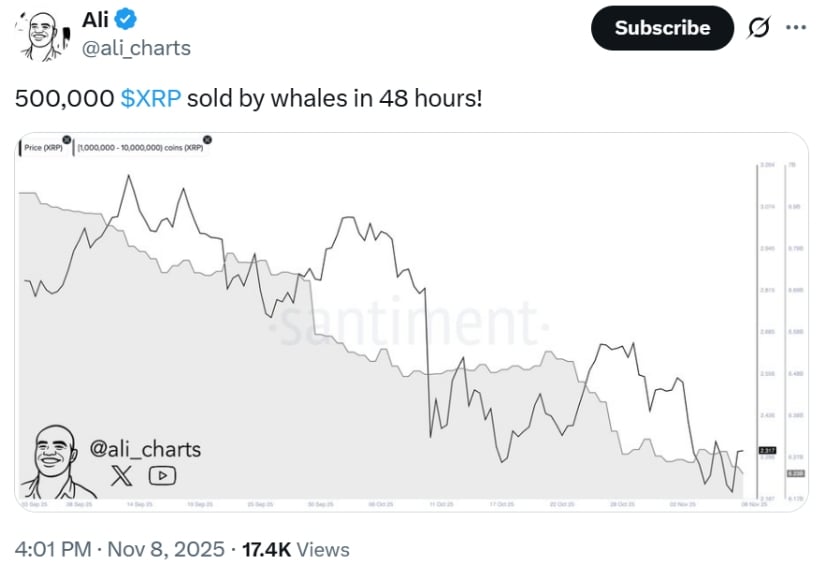

The $1.90–$2 range is a key support level for XRP, drawing price stability and possible upward moves. Source: @ali_charts via X

Crypto analyst Ali (@ali_charts) notes, “$1.90–$2 looks like a magnet for XRP. This zone has repeatedly acted as support and could hold during the current pullback.” On the flip side, a breach below $2 could expose XRP to $1.80–$1.90 levels amid broader market weakness.

Recent on-chain data show whales distributed 500,000 XRP (~$1.1 million) over 48 hours, coinciding with a temporary 13% drop from $2.7. While some community members dismiss this as minor, it reflects heightened short-term volatility. Despite this, the overall circulating supply remains stable, suggesting potential stabilization above $2.10.

Could XRP Price Hit a New All-Time High (ATH) Before the End of the Month? Source: @amonbuy via X

Amonyx (@amonbuy) highlighted the upside potential, posting, “If XRP maintains momentum, a new all-time high above $3.65 could be achievable by November 30.” Analysts warn, though, that resistance at $2.55 and RSI overbought levels could create a 20–30% pullback risk before any major breakout.

Institutional interest remains a key catalyst for XRP. Ripple’s recent strategic moves, including a $500M funding round at a $40B valuation, bolster confidence in the token’s utility for stablecoin custody and payment services. Meanwhile, ETF filings and Ripple-backed initiatives continue to support XRP’s adoption.

Whales Sell 500,000 XRP in 48 Hours, Impacting XRP Price and Market Sentiment. Source: @ali_charts via X

However, regulatory outcomes—particularly in the ongoing SEC vs. Ripple case—remain a major uncertainty. A favorable ruling or positive developments could act as a bullish trigger, while setbacks may increase downside pressure.

If XRP maintains support and benefits from ongoing institutional momentum, analysts suggest it could test $2.80–$3.00+ by year-end. Conversely, a breakdown below key support might see XRP revisiting sub-$2 territory, potentially dropping to $1.70–$1.80.

Traders should watch volume trends, whale activity, and ETF-related announcements closely. Market dynamics over the next few days could decide whether XRP crashes below $2 or soars toward a new all-time high.

Support: $2.10–$2.20—crucial accumulation zone

Resistance: $2.50–$2.70—key technical band with EMA convergence

Bearish risk: A drop below $2.10 could target $1.80–$1.90

Bullish trigger: Sustained move above $2.75–$2.80 could open the path to $3+

For XRP investors, the current market action represents a critical make-or-break moment. The $2.10–$2.20 support zone is key to maintaining bullish momentum, as holding this level could prevent a deeper correction. Traders are closely monitoring XRP price today, XRP chart trends, and whale activity, all of which influence short-term market sentiment. With Ripple’s expanding ecosystem and ongoing institutional interest, XRP continues to be one of the most closely watched altcoins in 2025.

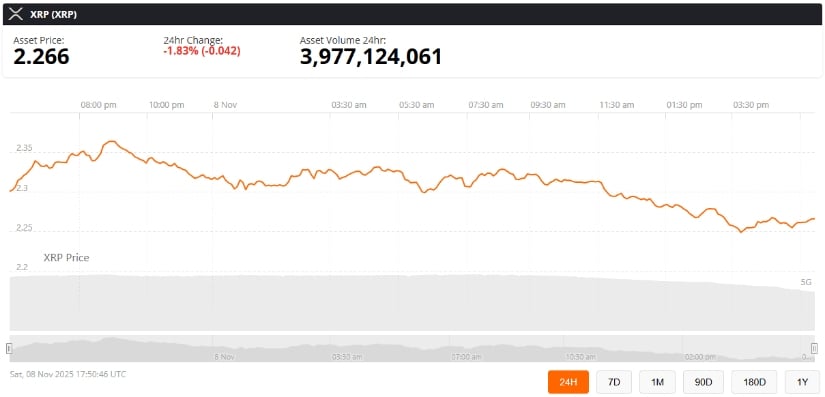

XRP was trading at around $2.26, down 1.83% in the last 24 hours at press time. Source: XRP price via Brave New Coin

Clearing resistance near $2.75–$2.80 could reignite the ongoing rally, paving the way for a potential push toward XRP’s next highs. Analysts note that regulatory updates, ETF filings, and on-chain accumulation will play a crucial role in determining XRP’s trajectory. For those tracking XRP crypto news, the combination of technical support, institutional adoption, and market momentum makes this a pivotal period for forecasting whether XRP will soar to a new all-time high or face further downside.

Bitcoin is currently valued at $101,468.15, showing a modest increase of 0.18% today. With a fluctuating day range, Bitcoin enthusiasts are questioning if BTCUSD could climb to $142K this month. Let’s dig into the numbers and sentiment driving these projections.

Bitcoin’s current journey involves navigating a price range from today’s low of $98,892.97 to a high of $107,269.85. Though the year high of $126,296 remains a distant peak, the monthly forecast of $142,555.95 sparks interest. These projections account for Bitcoin’s inherent volatility.

The recent price changes include a monthly gain of 1.56%, but a three-month decline of 15.77%. This dynamic suggests a cautious yet hopeful market, adjusting strategies amid price swings.

Analyzing Bitcoin’s market signals reveals critical insights:

The Bollinger Bands display a broad range with the lower band at $100,996.52, indicating potential volatility. Forecasts can change due to macroeconomic shifts, regulations, or unexpected events affecting the crypto market.

The market sentiment for Bitcoin remains cautiously optimistic. Despite recent downward trends, long-term believers see potential, as illustrated by the five-year forecast of $161,345.54.

⚈ Volume Metrics: With a substantial daily volume of 110,967,184,773, compared to an average of 780,514,552, increased trading activity reflects a vibrant market.

⚈ Sentiment Trends: Meyka AI highlights that investor sentiment is a blend of cautious watching and hopeful investment, guided by performance trends and future technology expectations.

Bitcoin’s path to reaching $142K this month involves navigating intricate market movements, sentiment, and technical interpretations. While predictions show promise, potential risks from regulatory changes and macroeconomic factors cannot be overlooked.

The current price of BTCUSD is $101,468.15, with slight positive movement seen today at 0.18% increase. For detailed fluctuations, visit our BTCUSD page.

The ADX at 27.8 indicates a strong trend, and although RSI is neutral, it suggests a potential for reevaluation into oversold territory. Such metrics reflect underlying trends that may support upward momentum.

Regulatory shifts, macroeconomic changes, or unexpected events in the crypto market could alter forecasts, emphasizing the importance of monitoring global economic events.

Trading activity is robust with a daily volume of 110,967,184,773, which is significantly higher than the average daily volume, indicating active market participation.

Long-term forecasts suggest Bitcoin reaching $161,345.54 in five years and $205,008.82 in seven years, driven by technological advancements and market maturity.

Disclaimer:

Cryptocurrency markets are highly volatile. This content is for informational purposes only.

The Forecast Prediction Model is provided for informational purposes only and should not be considered financial advice.

Meyka AI PTY LTD provides market data and sentiment analysis, not financial advice.

Always do your own research and consider consulting a licensed financial advisor before making investment decisions.

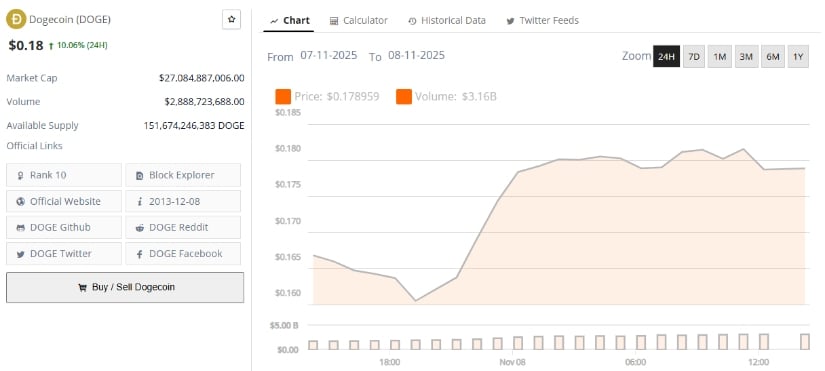

Dogecoin (DOGE) is roaring back with a 9.4% daily jump to $0.178 on November 8, 2025, as Bitcoin’s rally past $70,000 sparks renewed enthusiasm across the meme coin market.

A post from the Dogecoin news account @dogegod highlighted the recent momentum, labeling the coin as “back in action,” and projecting a bold $2.40 target. While this would require over 13x growth from current levels, historical patterns suggest such gains are feasible during extended bull cycles, as evidenced by Dogecoin’s 2021 surge of nearly 10,000%.

Analysts, however, caution that the path to $2.40 remains challenging due to high volatility and the coin’s reliance on social sentiment and hype-driven buying. Dogecoin price prediction 2025 models emphasize that short-term fluctuations are likely, even amid strong technical setups.

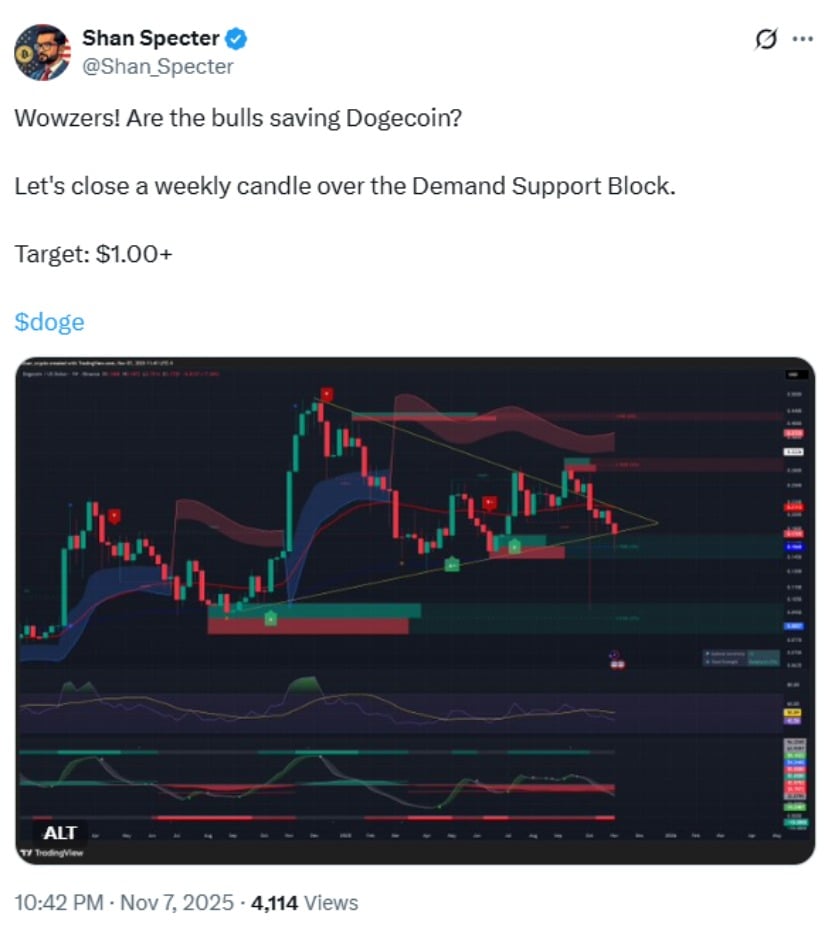

A weekly Dogecoin chart shows the price hovering near a $0.37 demand support block, indicating a critical level for potential bullish continuation. Analysts note that a candle close above this support, combined with green volume spikes and upward momentum indicators, could trigger a breakout toward $1+ in the near term.

Dogecoin (DOGE) has resumed upward momentum, targeting a potential price of $2.40. Source: @_dogegod_ via X

Recent social media discussions on X highlight hidden bullish divergences on the Stochastic RSI and the formation of a falling wedge pattern, setups historically associated with rallies exceeding 200%, as seen in 2021. These technical patterns suggest that Dogecoin may have the foundation for a substantial rebound if market conditions remain favorable.

On November 7, 2025, Dogecoin climbed 11.66% to close around $0.167, outperforming many top cryptocurrencies despite lagging slightly behind projected chart levels. The recent gains reflect renewed buying pressure and a shift in trader sentiment, with investors showing interest in accumulating DOGE near key support zones.

Dogecoin (DOGE) bulls aim to close a weekly candle above the demand support block, targeting a potential price above $1.00. Source: @Shan_Specter via X

Despite these gains, Dogecoin remains approximately 85% below its all-time high of $0.74 from 2021, underscoring the significant upside required to reach the $2.40 target. Market experts suggest that Dogecoin price analysis should account for both historical volatility and the coin’s sensitivity to broader crypto trends.

While technical setups and recent momentum indicate potential for a strong rally, analysts stress caution. Achieving a $2.40 price of Dogecoin would require sustained buying pressure, supportive market conditions, and continued hype among retail traders.

Historical data show that Dogecoin rallies often depend heavily on social media-driven sentiment, including tweets from influential figures and community-driven campaigns. As such, short-term corrections and choppy price movements are possible, even if the overall trend remains bullish.

Dogecoin’s recent rebound highlights growing optimism within the Dogecoin ecosystem, supported by strong technical setups and market recovery. If DOGE holds its current support levels and breaks decisively above key resistance, the coin could see a meaningful upward trajectory, with $1 and beyond becoming realistic milestones.

Dogecoin was trading at around $0.18, up 10.06% in the last 24 hours. Source: Brave New Coin

Ultimately, whether Dogecoin can achieve the long-term $2.40 target depends on a combination of technical confirmation, broader crypto market trends, and sustained community engagement. For now, traders and investors are closely watching DOGE’s price action, where every candle could define the next phase of this meme coin’s evolving story.

Cardano chatter is heating up again as liquidity rotates across the majors and headlines pile in. On-chain data confirms the mainnet has surpassed 115 million transactions, underscoring that network activity remains strong even during quieter price phases. Weekly market digests continue to note how buyers consistently defend key support zones, keeping ADA’s rebound setups firmly in play. Some portfolio strategists are now pairing ADA with community-driven projects like PepeNode (https://pepenode.io/) to balance narrative exposure and utility potential. For real-time insight into structure and flows, check live price dashboards at CoinMarketCap (https://coinmarketcap.com/currencies/cardano/).

Cardano Crosses 115 Million Transactions as Market Eyes Key Zones

When analyzing Cardano’s next move, usage tells the real story. Surpassing 115 million transactions shows demand hasn’t flinched through different market moods. Chart watchers keep circling familiar levels – $0.64 as the line bulls defend, and the $0.77 pocket where sellers tend to reappear.

Since mid-October, excess leverage has been flushed out, clearing the field of crowded longs. That kind of reset often stabilizes funding rates and opens the door for spot-led accumulation. For a clean look at the setup, pull up ADAUSD on TradingView (https://www.tradingview.com/symbols/ADAUSD/).

Watching ADA’s Technical Map Into Year-End

The structure stays simple. Hold above $0.64, grind through $0.68-$0.70, and bulls can aim for $0.74-$0.77, where earlier rallies stalled. A confirmed close above $0.77 flips the short-term bias bullish and brings $0.85 back into focus for traders tracking continuation patterns. If price loses $0.64, a fade toward $0.59 becomes likely before another wave of dip buyers emerges. Momentum confirmation will depend more on expanding volume than single candle spikes – consistency over drama.

Layered Growth: Smart Contracts Meet Utility Chains

Cardano’s vision remains steady – a slow, structured build toward a scalable smart-contract economy. Alongside that, PepeNode (https://pepenode.io/) is shaping its identity around networked participation and creator-driven utility rather than payments alone. The pairing makes sense for investors who want contrast: ADA as the infrastructure backbone, and PepeNode as a social-utility experiment that blends community, staking, and cultural traction. When market cycles turn volatile, exposure across these different lanes can smooth out swings while keeping upside tied to real activity.

Cardano’s Hidden Upside and PepeNode’s Expanding Reach

If Cardano can defend $0.64 and reclaim $0.70 with conviction, the path toward $0.77 opens up once again. Sustained strength above that level could push momentum toward $0.85, while a failure to hold support risks keeping ADA trapped in a sideways range until fresh liquidity enters. For investors seeking a complementary angle, PepeNode (https://pepenode.io/) offers a community-driven and utility-rich ecosystem that contrasts ADA’s technical focus. Track ADA’s market structure and confirmation signals on TradingView for timing clarity.

Buchenweg, Karlsruhe, Germany

For more information about Pepenode (PEPENODE) visit the links below:

Website: https://pepenode.io/

Whitepaper: https://pepenode.io/assets/documents/whitepaper.pdf

Telegram: https://t.me/pepe_node

Twitter/X: https://x.com/pepenode_io

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.

XRP is drawing attention again after a stretch of calm trading. The token has held firm between $2.38 and $2.46, with renewed ETF chatter bringing sidelined capital back into play. Thanks to its sizable market cap and entrenched role in blockchain payments, XRP remains one of the clearest gauges of sentiment around real-world crypto utility. When XRP starts to move, speculation about testing old highs usually follows. These shifts often coincide with rising liquidity and stronger narratives across the payments sector. Alongside XRP, traders keeping an eye on utility-driven plays are also watching projects like Bitcoin Hyper (HYPER) (https://bitcoinhyper.com/), which could benefit from any broader rotation toward functional, payment-focused tokens.

What’s Powering XRP’s Momentum Right Now

XRP is back on traders’ radar as ETF speculation heats up. The token’s steady climb between $2.38 and $2.46 reflects a cautious accumulation phase rather than pure hype. The main catalyst remains ETF expectations, with market desks gradually adjusting exposure in anticipation of potential product approvals. On-chain data adds weight to the story – large wallet activity has picked up, and spot trading volumes have increased across major exchanges, signaling renewed institutional interest. While timing for any formal ETF decision remains unclear, sentiment around XRP has shifted from passive optimism to quiet confidence.

The market now treats Ripple’s token less like a speculative trade and more like a bellwether for blockchain-based payment adoption. Analysts often look to aggregated projections and technical models such as CoinCodex’s XRP forecast to shape their positioning, mapping out likely ranges as filings progress and liquidity deepens.

XRP Price Outlook: Technical Setup and Market Structure

Technically, XRP’s chart looks coiled for a larger move. Overhead resistance remains strong between $2.50 and $3.00 – a zone that has repeatedly capped rallies over recent months. On the downside, buyers continue to step in between $2.20 and $2.30, keeping the structure intact. A clean daily close above $3.00 would likely trigger momentum algos and open a path toward the $3.35 to $4.47 region. Failure to clear that ceiling, however, could keep XRP locked in consolidation until new catalysts arrive. Short-term traders are watching liquidity spikes and volume expansion closely.

Tools like XRPUSD charts on TradingView (https://www.tradingview.com/symbols/XRPUSD/) provide real-time insight into whether a breakout has genuine buying pressure behind it or if it’s just noise before another reset. The next few sessions will likely determine whether XRP enters a sustained uptrend or continues oscillating within its current range.

Why This ETF Narrative Matters for Crypto Markets

An XRP-linked ETF approval would mark a watershed moment for digital payments infrastructure. It would bring Ripple’s settlement technology closer to traditional finance rails, boosting credibility not just for XRP but for utility-driven assets in general. Reports such as Coinpedia’s coverage of the first actively managed XRP ETF filing show how institutional coverage is expanding, pulling new capital into both large-cap and mid-tier assets. Even though XRP’s massive circulating supply can limit short-term volatility, its direction tends to anchor broader market sentiment. When XRP moves, it often signals how traders view blockchain’s integration into real-world finance. A confident, orderly rise in XRP typically draws liquidity toward payment-oriented projects, setting off secondary rallies in networks that share similar fundamentals.

Bitcoin Hyper: A Utility Play Gaining Traction

As capital rotates toward functional, high-performance networks, emerging projects like Bitcoin Hyper (HYPER) (https://bitcoinhyper.com/) are drawing increased attention. Unlike meme-based tokens chasing viral cycles, HYPER focuses on throughput, stability, and practical payment utility. Its architecture is designed to handle rapid settlement with minimal transaction costs, aligning neatly with the same themes driving interest in XRP. If investors continue to favor networks that solve real adoption problems rather than those built purely on narrative, HYPER could benefit from that rotation.

Both XRP and Bitcoin Hyper represent a shift in market maturity – a pivot away from speculative froth toward sustainable infrastructure that can actually power on-chain economies.

While each carries its own risks, together they frame the next phase of blockchain evolution: a cycle where speed, interoperability, and usability dictate value more than meme momentum ever could. For traders tracking the utility narrative, keeping XRP and HYPER on the same screen isn’t just smart – it’s strategic.

Buchenweg, Karlsruhe, Germany

For more information about Bitcoin Hyper (HYPER) visit the links below:

Website: https://bitcoinhyper.com

Whitepaper: https://bitcoinhyper.com/assets/documents/whitepaper.pdf

Telegram: https://t.me/btchyperz

Twitter/X: https://x.com/BTC_Hyper2

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.

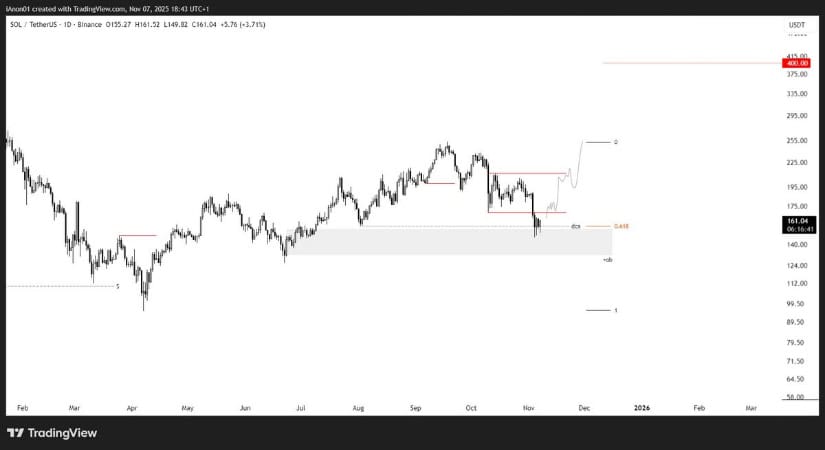

Solana price is hovering near a key demand zone, with participants eyeing whether the recent selloff marks a final shakeout before a major bullish reversal.

Volatility remains high across Solana, but history suggests the current drop may be setting up something bigger. SOL has built a reputation for sharp recoveries after fear-driven selloffs, and this time appears no different. With prices hovering near key demand zones and traders split between caution and anticipation, the market seems to be preparing for its next major move.

Solana current price is $162.15, up 3.55% in the last 24 hours. Source: Brave New Coin

The current Solana weekly chart highlights a classic setup where bearish candles often precede sharp reversals. The price has been repeatedly showing this pattern, deep red closes followed by multi-week recoveries. Historical data support this view, with similar formations around $120, $150, and $175 leading to strong upside reversals. This time, the pattern looks nearly identical, but traders are cautious that it could still be a manipulative sweep before a breakout.

Solana’s weekly structure mirrors previous recovery phases, where deep red candles often preceded major rallies. Source: Batman via X

Famous crypto analyst Batman suggests that such candle structures typically act as liquidity traps, luring late shorts before trend expansion resumes. With wicks extending towards the $140 zone and demand forming above $145 to $150, the market seems to be preparing for volatility compression. If the reaction mirrors past phases, the coming weeks could see a rebound towards $185 to $200, confirming another bear trap in Solana’s historical cycle.

According to Trader Koala, a critical range is forming between $155 to $160, where Solana price is showing its first signs of stabilization since the breakdown. Price is currently basing near this zone, testing previous imbalance support while reclaiming the short-term EMA cluster on the 4H chart. Volume behavior shows clear absorption, and RSI divergence hints that sellers may be losing momentum.

Solana price is stabilizing between $155 and $160 as early bullish signals reappear across lower timeframes. Source: Trader Koala via X

A weekly close above $160 would mark the confirmation point for a rally towards $185 to $190, filling the previous inefficiency visible on the chart. If Solana price manages to sustain that level, market structure would shift bullishly for the first time since September, signaling the beginning of a recovery leg within a broader corrective cycle.

Macro structure remains encouraging, even after months of pullback. Solana continues to respect the 0.618 Fibonacci retracement, bouncing sharply from $150. The overall higher-timeframe picture shows a series of higher lows, reflecting steady accumulation through each correction phase.

Solana maintains its long-term bullish structure, with analysts eyeing a potential continuation towards the $375–$400 zone. Source: iWantCoinNews via X

As iWantCoinNews outlines, if this base holds and Solana price continues reclaiming $185 and $255, the broader path towards $375 to $400 remains valid. This projection fits the same cyclical expansion patterns observed in prior market phases, making the current retracement a potential reaccumulation period before the next macro impulse wave.

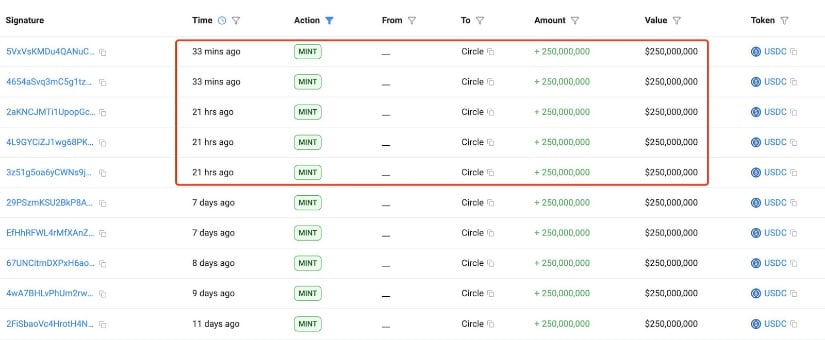

A major on-chain event further supports Solana’s strong fundamentals. Lookonchain reported that Circle minted 1.25 billion USDC on the Solana blockchain within just 24 hours, one of the largest single-day injections of stablecoin liquidity on any network this quarter.

Circle’s 1.25 billion USDC mint on Solana marks one of the largest liquidity injections this quarter, signaling renewed network strength. Source: Lookonchain via X

This minting spree effectively increases liquidity depth, indirectly benefiting SOL’s price dynamics. Historically, similar events have coincided with transaction surges and fee revenue spikes, reinforcing Solana’s position as a leading smart contract platform.

Solana’s structure continues to show signs of underlying resilience despite recent volatility. Price is consolidating above $150 to $155, setting the stage for a potential bullish reversal as long as it maintains momentum above this key base. The repeated historical pattern of bearish-to-bullish weekly candles further strengthens the case for near-term recovery.

If Solana price reclaims $160 to $165, upside continuation towards $190 and later $350 to $400 becomes highly plausible. Combined with liquidity expansion from USDC minting and solid technical confluence, the market appears poised for a steady rebound phase, supported by both price structure and fundamentals.

Bitcoin (BTCUSD) is currently trading at $101,468.15, experiencing a slight uptick of 0.18% today. With a recent day low of $98,892.97 and a high of $107,269.85, Bitcoin’s price action continues to draw the market’s attention. What does this mean for the future, especially with forecasts touching the $142,555 mark? Let’s dive into the numbers.

Bitcoin’s current market dynamics suggest intriguing potential. The price averages—$112,816 over 50 days and $110,126 over 200 days—indicate a pullback. However, short-term forecasts from Meyka AI predict a monthly target of $142,555.95, alongside a quarterly forecast of $141,151.74. Despite a yearly forecast dip to $96,114.59, the long-term outlook remains bullish, projecting $161,345 in five years. Such targets indicate potential growth, but always consider that forecasts can change due to macroeconomic shifts and other factors.

Technical analysis shows a mix of strengths and weaknesses. The Relative Strength Index (RSI) at 40.72 signifies that Bitcoin is not in overbought territory yet, while the Average Directional Index (ADX) of 27.80 suggests a strong trend existing. However, bearish signals like a negative MACD of -2912.91 and Awesome Oscillator at -8953.15 might concern some traders. Nevertheless, the Bollinger Bands show the price currently trading near its lower band, suggesting a potential upward correction.

Market sentiment is a blend of caution and optimism. With a market cap of approximately $2 trillion and a rising trading volume surpassing average levels (1.21 relative volume), investor interest appears robust. News about Bitcoin’s widespread adoption and evolving regulatory landscape continues to impact sentiment positively. Still, with a Money Flow Index (MFI) at 37.54, investors are advised to monitor liquidity flows closely. Past fluctuations, such as a 15.77% decline over three months, underscore the market’s volatility.

In summary, while Bitcoin’s path to $142,500 or beyond is filled with both challenges and potential, market indicators and sentiments reflect a complex yet optimistic scenario. Investors should remain vigilant as forecasts can change due to various factors. For detailed price history and real-time updates, visit the BTCUSD page on Meyka AI.

Bitcoin is currently priced at $101,468.15, with a slight increase noted today of 0.18% from the previous close of $101,290.5. It has a daily range between $98,892.97 and $107,269.85.

Short-term forecasts show potential highs with a monthly target of $142,555.95 and quarterly forecast of $141,151.74. However, a yearly dip to $96,114.59 is expected, with a bullish long-term five-year forecast of $161,345.

Bitcoin’s technical indicators present mixed signals. While RSI is at a balanced 40.72, showing it’s not overbought, MACD and Awesome Oscillator reflect bearish sentiment. ADX shows a strong ongoing trend at 27.80.

Despite recent price drops, market sentiment is moderately positive, reflected in a market cap around $2 trillion and strong trading volumes exceeding averages.

For comprehensive market updates and forecasts on BTCUSD, you can visit the BTCUSD page on Meyka AI, which provides real-time insights.

Disclaimer:

Cryptocurrency markets are highly volatile. This content is for informational purposes only.

The Forecast Prediction Model is provided for informational purposes only and should not be considered financial advice.

Meyka AI PTY LTD provides market data and sentiment analysis, not financial advice.

Always do your own research and consider consulting a licensed financial advisor before making investment decisions.