The main tag of cryptocurrency price today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The main tag of cryptocurrency price today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The latest Cardano price prediction has sparked excitement across the crypto community, as analysts see ADA retesting a key support that has triggered rebounds multiple times over the past year. With smart contract activity rising and DeFi adoption expanding, experts believe ADA could be on a fast track toward what some call potential “100x” territory in the next cycle.

At the same time, whales are investing in a new PayFi altcoin called Remittix (RTX). The project has been fully verified by CertiK and ranked #1 on CertiK for Pre-Launch Tokens, affording it unmatched credibility among early-stage crypto projects.

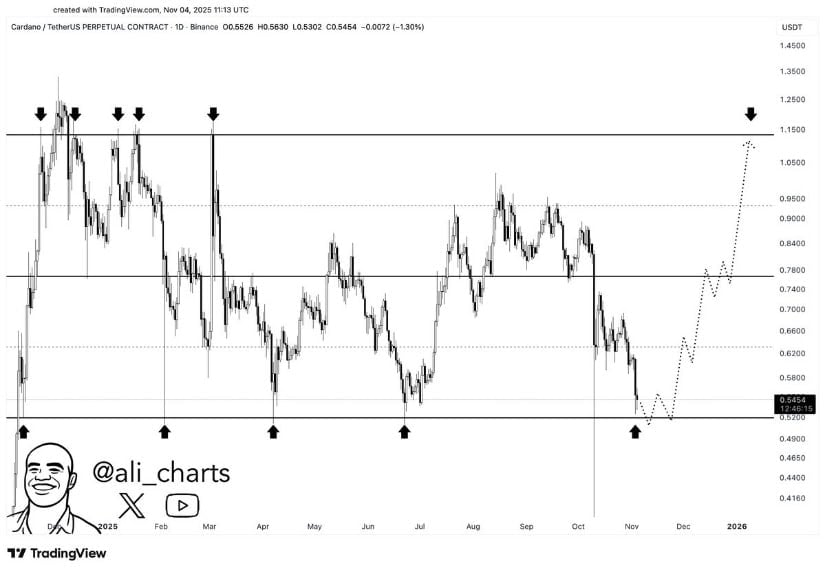

Cardano is currently trading around $0.5253, showing a familiar setup that could mark the start of another long-term climb. Analyst Ali Martinez recently highlighted that Cardano is once again testing the lower line of its Parallel Channel, a pattern that has provided reliable support since late 2024.

ADA has approached this level many times, and each time, the Cardano price prediction has appeared bullish. This has led to strong short-term rallies after rebounds. The lower boundary is currently set at $0.52, whereas the resistance levels remain at $0.60 and $0.68. This is an indication of a potential upward push for ADA if buying pressure returns.

A Parallel Channel is one of the clearest patterns in technical analysis, showing price movement between two horizontal lines that represent resistance and support. In Cardano’s case, the asset has stayed within this range for almost a year, maintaining a steady rhythm of accumulation and breakout attempts. If the pattern continues to hold, a move above the upper channel could confirm a bullish breakout. That would open the door to targets at approximately $0.80 and $1.00.

While Cardano builds steady momentum, Remittix (RTX) is emerging as a faster-moving DeFi and PayFi project that could rival ADA’s growth in 2026. Remittix focuses on real-world payments, allowing users to send crypto directly to bank accounts in over 30 countries.

Remittix has already sold over 684 million tokens, raised $28 million, and is currently trading at $0.1166. The project also offers a 15% USDT referral program paid daily via its dashboard, plus a $250,000 giveaway to reward early supporters.

Why analysts call Remittix “the true XRP 2.0”

The current Cardano price prediction indicates a steady climb as ADA continues to hold its key support channel and expand its smart contract capabilities. At the same time, Remittix (RTX) attracts attention as a smaller-cap project that could multiply faster due to its real-world payment utility combined with institutional-grade security.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

XRP is back in the spotlight and, crucially for our readers, it is sharing that spotlight with Bitcoin Hyper (https://bitcoinhyper.com/), a utility-first sidecar that traders keep on their watchlists when payments and settlement narratives start to lead. The tone in crypto shifted from panic to practical, books filled faster after dips, and ETF headlines pulled cautious money off the sidelines. None of that guarantees a one way rally, but it does change how risk is priced and how the tape gets read.

A real XRP price prediction starts with this context and with the simple observation that, if liquidity keeps improving and ETF talk keeps adding fuel, XRP can trade with a sturdier floor and a cleaner ceiling test while Bitcoin Hyper benefits from second-order flows that reward speed, low fees and straightforward execution. That is the story under the noise, a market that finally feels tradable again instead of chaotic.

Market Setup For XRP Right Now

The last few days have given us a practical tell. Spreads tightened during busier hours, depth came back faster after small selloffs, and spot flows led on most green days instead of leverage painting the tape. That’s not euphoria, that’s a market that will hold bids and let momentum breathe for more than a few minutes. Traders who watch the book instead of social feeds noticed that reactive offers were getting absorbed in logical places, which reduces the chances of those wicks that used to erase two hours of progress in twenty seconds. In short, you can plan around levels again, and plans that respect levels tend to keep you out of trouble.

ETF Speculation As Catalyst

ETF speculation is not a thesis on its own, but it’s a powerful accelerant for a token like XRP that already lives in the payments lane (https://www.binance.com/en/academy/articles/what-is-ripple). Even a hint of regulatory progress can change the audience from purely crypto-native to allocators who prefer regulated wrappers and internal compliance green lights. That matters because it broadens the pool of potential demand without forcing retail to carry every rally. The catch, of course, is timing. Decisions can slide, language can get revised, and markets can overread a footnote. Smart traders treat each incremental update as a probability nudge, not a promise, and they size positions so that a slow timeline doesn’t blow a hole in the boat.

XRP Price Prediction – Levels, Triggers, And What Validates A Move

Price has respected a defined range for weeks and ranges are not the enemy. They are the staging ground. Buyers have defended the lower band often enough to make it meaningful, while sellers continue to lean on familiar overhead zones that coincide with prior breakdown levels and psychological round numbers. A valid breakout is less about a single intraday poke and more about a daily close that sticks, followed by a pullback that holds above the area that used to be resistance. If you get that close-retest-continue pattern with volume that doesn’t vanish, odds tilt toward continuation. Fail that retest and you’re back inside the box waiting for the next clean attempt.

Scenarios To Plan For

Base case, XRP spends more time inside the range while the ETF narrative drips forward, delivering a stair-step path that annoys impatient traders but rewards those who scale in near support and lighten up near resistance. Bull case, a sequence of higher daily closes clears the cap, the retest holds and momentum carries into the next cluster of supply where profit taking becomes rational again. Bear case, funding overheats, spot lags and a sharp shakeout flushes weak hands back to the bottom of the range. None of these require fortune telling, just prep. Decide ahead of time what confirms strength for you and what tells you the move is fading, then act like you meant it.

Why XRP Still Guides The Payments Narrative

Every cycle tries to rebrand itself, yet payment and settlement tokens keep anchoring the “real world” part of the story. XRP’s claim is straightforward, which is why non-crypto folks can understand it without a sermon. If adaptable ETF products appear and distribution expands, even in modest size at first, that signals more than hype. It signals an on-ramp that conservative money can actually use. The knock-on effect tends to show up in two places. First, confidence rises across projects that pitch speed, reliability and integration with existing rails. Second, rotations into this theme often last longer than a viral meme burst because the buyers are not purely momentum tourists. They want exposure to a function they can explain to a boss.

What That Means For Portfolios

If you manage risk instead of rolling dice, XRP is a good barometer. When it leads on spot with controlled volatility, breadth improves and many charts look less fragile. When it stalls exactly where everyone expects it to stall, that’s usually not the day to double risk elsewhere. Positioning around XRP can be simple. Keep a liquid core position you can hold through noise, then use tactical adds only when the market confirms your levels. This approach beats swinging from all-in to all-out because a headline felt exciting on the timeline.

Bitcoin Hyper As A Utility Sidecar

Whenever capital rotates toward payment networks and settlement rails, sidecar bets with a utility angle tend to catch a bid. Bitcoin Hyper (https://bitcoinhyper.com/) sits in that lane, framed by a pitch that favors speed, low transaction costs and familiar developer tooling over catchphrases. The appeal is not in pretending it rivals XRP’s footprint, it’s in the possibility that second-order flows reward projects that move value quickly and keep user actions inexpensive. In other words, if the market starts paying for throughput and practicality, not just a mascot or a meme, Bitcoin Hyper can ride the same current.

How It Fits Next To XRP

Think of a simple barbell. On one side, a liquid anchor like XRP that reflects the sector’s health. On the other, a higher-beta utility play that can respond faster when risk appetite improves. The pairing works only if you respect asymmetry. Smaller caps can outpace to the upside, and they can punish sloppy sizing just as fast. Do your homework on contracts, unlock schedules and venue depth. If you cannot exit without moving the market, you do not have a trade, you have a hope. Treat Bitcoin Hyper as a satellite, not the whole portfolio, and let XRP carry the heavier load.

Risk Controls That Actually Matter

Three checks keep you honest. First, watch whether spot leads futures on green days. If it doesn’t, you are probably staring at leverage games that can unwind before lunch. Second, pay attention to how quickly order books (https://www.binance.com/en/academy/articles/what-is-an-order-book-and-how-does-it-work) refill after a red candle. Healthy markets rebuild depth instead of gapping lower in silence. Third, stay skeptical about calendar claims until the regulator publishes something you can point to. The fastest way to torch a good month is to trade a rumor as if it were a filing.

Macro And Micro Can Clash

Crypto is not a bubble anymore, yet it is not immune to dollar squeezes, rates jitters or liquidity drains tied to events that have nothing to do with blockchains. There will be days when your beautiful setup gets steamrolled by a headline that belongs on the business page, not the tech page. That’s fine. Good risk management assumes you will be wrong sometimes. Small losses are tuition, oversized losses are ego.

Bottom Line – A Practical XRP Price Prediction For The Weeks Ahead

A grounded XRP price prediction is slightly bullish while the ingredients remain in place. The market respects support more often than not, resistance tests are getting cleaner and the ETF thread provides a steady breeze even if no single headline delivers the knockout. The path that makes the most sense is a patient range with an upward bias, punctuated by breakout attempts that either earn validation with a proper retest or get faded back into the channel where disciplined traders reload.

If approvals or concrete milestones arrive, expect a burst, a pullback to the breakout level and then a verdict on whether the move has real sponsorship. If timelines slip, plan for more back-and-forth, which is not failure so much as an extended setup. Keep XRP as the anchor, keep Bitcoin Hyper (https://bitcoinhyper.com/) on the secondary screen if you want utility-tilted beta and keep your risk small enough that you can survive to trade the next headline. That’s how you stay sharp in a market that finally feels like it wants to reward patience again.

Buchenweg 15, Karlsruhe, Germany

For more information about Bitcoin Hyper (HYPER) visit the links below:

Website: https://bitcoinhyper.com/

Whitepaper: https://bitcoinhyper.com/assets/documents/whitepaper.pdf

Telegram: https://t.me/btchyperz

Twitter/X: https://x.com/BTC_Hyper2

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.

Bitcoin’s price recently dipped to $101,468.15, marking a 2.31% decrease. With a year-high of $126,296, investors are questioning if the projected target of $142,555 is achievable in the coming months.

Bitcoin’s current price stands at $101,468.15 after falling by $2,400.85. Over the past month, BTCUSD saw a modest increase of 1.56%, yet it has dropped 15.77% over the last three months. Despite these fluctuations, Meyka AI’s insights suggest a potential reaching of $142,555 monthly. This forecast is based on a favorable market outlook over the next five years, aiming for $161,345 and even $205,008 in seven years. However, yearly forecasts appear conservative at $96,114, highlighting ongoing market volatility.

Bitcoin shows mixed signals with a Relative Strength Index (RSI) of 38.96, signaling an oversold condition. The Moving Average Convergence Divergence (MACD) indicator demonstrates a bearish trend, with a histogram value of -797.49. Furthermore, the Average Directional Index (ADX) of 25.94 signifies a strong trend. Bollinger Bands currently suggest consolidation, with the price nearing the lower band at $101,637.25.

Public sentiment continues to fluctuate as Bitcoin remains impacted by policy shifts and institutional movements. Recent discussions highlight the potential for cryptocurrency ETFs which could influence price stability and growth. While speculative behavior prevails, the crypto community keenly watches regulatory changes and their possible impacts.

In summary, while Bitcoin’s current price faces downward pressure, market forecasts remain optimistic with potential highs of $205,008 within seven years. However, sentiment can shift swiftly due to macroeconomic factors and regulatory changes, warranting a cautious approach to market predictions.

As of the latest data, Bitcoin’s price is $101,468.15, marking a 2.31% decrease recently, with a day low of $98,892.97 and a high of $107,269.85. For more details, check the full BTCUSD page.

The RSI indicates an oversold condition, while the MACD shows a bearish trend. The ADX suggests a strong trend, pointing to potential price movements.

Monthly and quarterly forecasts predict a rise to $142,555 and $141,151 respectively. Long-term projections anticipate prices reaching $161,345 in five years and $205,008 in seven years.

Price movements can be influenced by economic policy changes, regulatory developments, and macroeconomic shifts, as well as unforeseen events affecting the crypto market.

Investor sentiment is crucial as it can drive price volatility, especially with speculative trading and reactions to news about regulations or institutional interest.

Disclaimer:

Cryptocurrency markets are highly volatile. This content is for informational purposes only.

The Forecast Prediction Model is provided for informational purposes only and should not be considered financial advice.

Meyka AI PTY LTD provides market data and sentiment analysis, not financial advice.

Always do your own research and consider consulting a licensed financial advisor before making investment decisions.

Dogecoin price remains under intense pressure today, November 7, even as hopes of another DOGE ETF listing rise. DOGE was trading at $0.1610, down nearly 50% from its September high.

There is a high chance that the Securities and Exchange Commission (SEC) will approve another spot DOGE ETF soon. This is after Bitwise filed an 8(a) filing on Thursday.

Form 8(a) is usually one of the last filings that companies launching their ETFs file with the SEC. As a result, according to Bloomberg’s Eric Balchunas, the fund may start trading within the next 20 days, barring any major setbacks.

Bitwise has already successfully launched its staking Solana ETF, which has attracted over $500 million in assets. It recently filed for its spot XRP ETF and now hopes the DOGE fund will be approved.

The Bitwise DOGE ETF will be the second spot fund tracking the biggest meme coin in the industry. The REX-Osprey Dogecoin ETF (DOJE) was launched recently, and its main difference is that it is registered under the Investment Company Act of 1933.

READ MORE: XRP Price Prediction After the Top Ripple News Events This Week

DOJE started well, with its daily volume and inflows rising, which signaled that the other Act. 40 ETFs will be as popular. Recently, however, inflows of funds have dried up, and its assets have fallen from over $35 million to $27 million today.

In contrast, other recently launched crypto ETFs have had robust inflows, with Solana and Hedera having $293 million and $70 million, respectively.

The daily timeframe chart shows that the DOGE price has dropped from a high of $0.3053 in September to the current $0.1690. It has moved below the ascending trendline that connects the lowest swings since June 24.

The token has also formed a death cross pattern, while the Relative Strength Index (RSI) and the Stochastic Oscillator have both moved downward and are nearing oversold levels.

Dogecoin price is now hovering at an important support level, which was reached on October 11. Moving below this level will point to more downside in the near term, potentially to $0.1. On the flip side, a move above the $0.20 resistance will invalidate the bearish outlook.

READ MORE: RWA News: What We Know About the $1.2 Billion Securitize Nasdaq Listing

Cardano price has rebounded from the key $0.50 support, showing renewed strength as participants anticipate whether this bounce could trigger a broader recovery towards the $0.85 resistance zone.

After weeks of steady declines, Cardano price is finally showing signs of strength as price rebounds sharply from the $0.50 zone. This renewed strength comes amid growing optimism in the ADA community, with participants eyeing whether this bounce can evolve into a full-fledged recovery towards the $0.70 to $0.85 range.

Cardano price is showing its resilience again as price bounces from the $0.50 psychological level, a region that has acted as a major support multiple times this year. The current rebound follows a clean defense of horizontal structure and wick rejections that indicate strong dip absorption by buyers. The chart also suggests a descending channel with the lower boundary now being tested, hinting that ADA Cardano price may be forming a potential bottoming pattern.

Cardano price rebounds from the $0.50 support level, signaling renewed buying interest and potential base formation. Source: Rand via X

For participants, reclaiming $0.56 to $0.58 would be the first structural confirmation of recovery, with upside continuation likely towards $0.70 if volume expands. On the downside, losing $0.50 could reintroduce pressure towards $0.44, but for now, momentum favors cautious accumulation as long as support holds firm.

Ali Martinez’s chart highlights how $0.52 remains a historically reliable level that has triggered multiple rebounds since late 2024. This horizontal zone coincides with the lower range of ADA’s macro consolidation channel, making it a critical pivot point for trend direction.

Cardano continues to defend the $0.52 support zone, with bullish momentum building toward the $0.85 resistance ranges. Source: Ali Martinez via X

From a technical perspective, Cardano price continues to trade between $0.52 support and $0.85 resistance, forming a potential accumulation range. If buyers maintain control, the next rally could aim for $0.74–$0.85, aligning with the midpoint of the broader range. A break above this threshold would confirm a trend reversal structure, potentially opening the door for a retest of $1.00 resistance.

Beyond technicals, Cardano’s fundamentals continue to build momentum. A recent update shared by TapTools cites The Motley Fool’s report, which deems $1 ADA “very plausible” given Cardano’s integration of the new x402 transaction standard developed by Masumi. This standard allows AI agents to transact and pay per request using crypto.

Cardano’s integration of the x402 AI transaction standard boosts its long-term utility and adoption potential. Source: TapTools via X

Such developments position Cardano as one of the few networks bridging blockchain with emerging AI infrastructure. As this adoption narrative strengthens, investor confidence may return faster than expected, especially as Cardano price nears historically undervalued levels.

On the technical front, Cardano’s momentum indicators are painting a textbook setup for a short-term relief rally. The daily RSI hovers around 30, signaling oversold conditions comparable to earlier reversal phases. CryptoCeek highlights that a push above $0.62 could flip sentiment bullish again, particularly if short positions start unwinding.

Cardano’s RSI nears oversold territory, hinting at a possible short-covering bounce if $0.62 resistance breaks. Source: CryptoCeek via X

Cardano price structure shows $0.50 acting as near-term demand, while a clean break above the descending trendline could unlock targets towards $0.74. Conversely, a breakdown below $0.50 exposes $0.40, though that remains a less likely scenario unless broader market weakness accelerates.

Cardano price is approaching an inflection point. With strong technical support at $0.50 to $0.52, oversold RSI readings, and renewed confidence from both participants and fundamental analysts, the probability of a rebound is rising.

If price reclaims $0.62 to $0.65, ADA Cardano price could enter a new short-term bullish phase targeting $0.74 and $1.00, supported by improving on-chain innovation and the AI-driven x402 transaction narrative. Overall, Cardano looks primed for a stabilization phase that could evolve into a stronger recovery if buyers sustain this critical support zone.

After months of uncertainty and sideways trading, XRP is once again drawing attention as renewed optimism, bullish technical setups, and Ripple’s bold 2026 roadmap ignite market excitement.

With the crypto market showing signs of recovery, traders are closely watching XRP’s price structure near the $2 support zone, which could determine whether the token is gearing up for its next major breakout or facing another round of consolidation.

XRP price today is showing fresh signs of strength after weeks of consolidation, with Ripple’s native token regaining momentum around the $2.30–$2.35 range. Following a 3.5% daily gain, XRP’s market cap rose by nearly $4.5 billion, driven by renewed investor confidence after Ripple unveiled its ambitious 2026 strategic roadmap during the recent Swell 2025 event.

Brad Garlinghouse, Ripple’s CEO, lightheartedly endorsed saying “on XRP” instead of “on XRPL” during a Ripple Swell 2025 discussion about casual phrasing for XRP Ledger activities. Source: Brad Garlinghouse via X

At the conference, Ripple CEO Brad Garlinghouse highlighted major developments that have positioned the company for long-term growth. These include a $500 million funding round at a $40 billion valuation, several acquisitions, and new product launches aimed at improving crypto liquidity and institutional access.

“We’re doubling down on infrastructure and global regulation clarity,” Garlinghouse said, emphasizing Ripple’s commitment to advancing enterprise-grade crypto solutions and advocating for transparent oversight.

Technically, XRP has been trading within a downward channel for months, forming lower highs and lower lows—a typical pattern in a bearish cycle. However, analysts say the structure is now nearing a critical support confluence between $1.75 and $2.00, where strong buying pressure has historically emerged.

XRP is currently trading at its most favorable buy zone in months, presenting a potential opportunity for investors. Source: 𝐊𝐚𝐦𝐫𝐚𝐧 𝐀𝐬𝐠𝐡𝐚𝐫 via X

Crypto trader Kamran Asghar (@Karman 1s) noted that XRP is at its “best buy zone in months,” pointing to neutral RSI readings around 40 that indicate the potential for a rebound. He suggested that if the current support zone holds, XRP could see a short-term bullish correction toward $2.50.

“This setup offers a clean risk-to-reward opportunity if bulls manage to defend the zone and regain momentum,” Asghar explained.

On social platform X, Web3 analyst @X Four iv celebrated what he described as the start of XRP’s next breakout phase, writing, “The multi-month consolidation is done. Full send mode initiated.”

XRP has broken out of its multi-month consolidation, signaling the start of strong upward momentum. Source: FOUR | Crypto Spaces via X

His analysis shows XRP testing the upper end of its consolidation range around $2.45–$2.55, a zone closely aligned with its 50-day and 200-day exponential moving averages (EMAs). Clearing this area could pave the way for a decisive move toward $2.50 resistance and potentially higher if momentum persists.

While optimism grows, analysts warn of volatility ahead. A short-term sell wall near $2.55 could temporarily stall the rally, especially if broader crypto sentiment weakens.

Ripple’s newly revealed 2026 roadmap has also boosted investor sentiment across the Ripple XRP ecosystem. The company plans to focus on crypto infrastructure, custody services, and prime brokerage solutions, steering away from launching its own exchange.

Garlinghouse reaffirmed that XRP remains the core of Ripple’s ecosystem, emphasizing its growing utility in global payments and liquidity management. He also hinted that institutional demand could surge once the Crypto Market Structure Bill is passed and an XRP ETF approval becomes reality—something many in the community expect in the coming months.

“Once institutional products like an XRP spot ETF launch, we could see inflows similar to what Ethereum experienced after its ETF approval,” Garlinghouse added.

XRP currently trades between $2.29 and $2.35, with analysts split on which direction the action will take in the near future. Although bulls expect a bounce toward $2.50–$2.55, others think a break below $1.75 support might expose XRP to deeper losses before any meaningful rebound.

XRP was trading at around 2.30, up 2.52% in the last 24 hours at press time. Source: Brave New Coin

Still, the combination of fundamental growth, strong on-chain liquidity, and renewed institutional interest supports a constructive long-term outlook. Many experts view the price of XRP as undervalued relative to Ripple’s progress in enterprise blockchain adoption.

If the bullish momentum sustains, XRP’s next target will be the $2.50-$2.70 zone, with more gains possible into 2026 as regulatory clarity and product expansion strengthen investor confidence.

With Ripple’s roadmap for 2026 strengthening its market narrative and XRP finding firm support near $2, momentum appears to be building toward a potential breakout. Technical traders are watching the $2.50 level closely, as a confirmed close above that resistance could validate a new bullish phase for Ripple XRP.

As XRP price predictions for 2025 and beyond continue to evolve, the token’s next moves could be shaped by ETF developments, institutional adoption, and ongoing market sentiment surrounding the broader crypto economy.

Solana price has entered a key demand zone between $150 and $160, with participants watching closely for signs of a potential bullish reversal after weeks of consolidation.

After fading momentum, Solana is finally showing a bullish perspective ahead. Solana price has dipped into a familiar demand zone where past rallies have often begun, sparking renewed optimism among participants.

After an extended consolidation phase, Solana has now dipped into a major demand zone between $150 and $160, a region that has repeatedly acted as a springboard in previous cycles. BitGuru’s structure indicates that buyers are beginning to re-accumulate, with early signs of a potential reversal visible in the intraday chart.

Solana’s price tests a key demand zone between $150 and $160, where early reversal signs hint at renewed buyer strength. Source: BitGuru via X

If this base continues to hold, a short-term rebound towards $175 to $185 appears likely, matching prior resistance clusters. The presence of bullish divergence on lower timeframes adds further weight to the possibility that Solana price may be entering a bottoming accumulation stage following weeks of corrective pressure.

CryptoBusy’s latest SOL chart showcases a developing double-bottom formation near the $146 to $150 range, a pattern often signaling trend exhaustion and reversal. The neckline for confirmation sits around $170, and a breakout above this could trigger the next impulse wave.

Solana forms a potential double-bottom pattern near $146 to $150, signaling possible trend reversal ahead. Source: CryptoBusy via X

This setup gains credibility as volume has shown mild expansion on recent upticks, while RSI is stabilizing near oversold territory. As long as Solana price maintains structural integrity above $145, the risk-reward remains favorable for an eventual breakout attempt.

A latest statement from Bitwise CIO has emerged in which its believed that Solana price could 5× its market share in the coming cycles. This view reinforces the broader thesis that current price levels significantly undervalue Solana’s network strength and scalability.

Institutional optimism aligns with on-chain growth and increasing adoption. Despite short-term volatility, long-term fundamentals position Solana as one of the most promising large-cap networks heading into 2026.

Solana’s break below $180 has pushed it towards a key weekly demand block between $120 and $130, a region that historically triggered large reversals. Despite recent weakness, SOL’s broader higher-timeframe structure remains bullish as long as this block holds firm.

Solana tests its weekly demand block between $120 and $130, with buyers aiming to defend the zone for a potential rebound. Source: ShangoTrades via X

ShangoTrades believes that if SOL buyers can defend this range, a relief bounce towards $180–$200 becomes the likely scenario. A clean weekly close below $120, however, would invalidate the mid-term bullish bias and expose deeper retracement levels near $100. Until that point, the Solana price still represents a higher-low formation zone within the macro uptrend.

Robo’s analysis on the Solana weekly chart reveals a large ascending triangle pattern that has been forming since early 2023. The support trendline has held firm through multiple tests, while resistance near $280 to $300 continues to compress price action into a tightening apex.

Solana’s long-term structure forms a massive ascending triangle, hinting at a breakout target toward $320. Source: Robo via X

The measured move from this structure suggests a breakout target around $320, which would align with Solana’s next major Fibonacci extension zone. Momentum indicators also remain constructive, with MACD flattening and long-term EMAs aligning for a potential crossover. As Robo puts it, “good things take time”, and the weekly outlook indeed signals brewing strength beneath the surface.

Solana’s multi-timeframe picture paints a story of gradual recovery after deep corrective pressure. From the $150 to $160 demand zone to the potential double-bottom and ascending-triangle formation, technical confluence continues to build in favor of accumulation.

Institutional support, led by comments from Bitwise and sustained network activity, reinforces Solana’s standing as a top contender for the next market expansion phase. If short-term supports hold and $180 is reclaimed, the stage could be set for a steady climb towards $250 to $320 in the coming months.

In essence, while volatility persists, Solana’s structural resilience and growing ecosystem point to renewed upside potential as 2025 unfolds.

PRESS RELEASE

Published November 6, 2025

Dogecoin DOGE the cryptocurrency that sparked the memecoin revolution is trading around 016 holding firm despite a volatile start to November After Elon Musk hinted at potential DOGE integration into X formerly Twitters payment system community optimism has ticked up and whale transactions have risen slightly signaling quiet accumulation

Yet as DOGE steadies many investors are looking beyond the veteran meme coin to find the next wave of opportunity The project leading that charge is AlphaPepe ALPE a presale token on BNB Chain thats capturing massive attention for its reward model community momentum and structured growth With the presale now nearing 400000 raised AlphaPepe has evolved from a viral meme concept into one of the most talked about early stage crypto projects of 2025

At around $0.16, Dogecoin continues to demonstrate staying power in a cautious market. The asset’s wide adoption, simple transaction system, and deep community roots have kept it a top-10 crypto by market cap. However, its massive circulating supply and slower network development make explosive growth less likely in the near term.

DOGE’s recent recovery has been driven largely by renewed enthusiasm from Musk’s ecosystem influence and strong retail sentiment, not by new tokenomics or on-chain innovation. For many long-term holders, the strategy has shifted from “moonshot” speculation to treating DOGE as a blue-chip meme coin — steady, liquid, and here to stay, but no longer the source of early-crypto-style gains.

That reality has sent investors searching for the next generation of meme coins — those with community appeal and functional mechanics. Enter AlphaPepe.

AlphaPepe (ALPE) is shaping up to be the evolution of the meme-coin model — combining humor and community energy with a real, structured financial system. Built on BNB Chain, AlphaPepe’s presale has drawn widespread attention for its transparent pricing system, active rewards, and strong organic growth.

The project’s USDT pool is nearing $3,000, with earlier rounds paying out over $9,000 to holders — proof that the reward mechanics are live and functioning. More than 100 new holders are joining daily, reflecting consistent growth even during the market’s choppy phases.

AlphaPepe’s visibility exploded after being featured on News, sparking rumors of a potential listing after launch. At the same time, the team announced a $100,000 giveaway that has further boosted engagement across Telegram, X (Twitter), and presale communities.

And with the presale now approaching $400,000 raised, AlphaPepe’s early momentum is beginning to mirror the viral trajectory that once defined Shiba Inu and PEPE.

AlphaPepe is rewriting the meme-coin playbook by replacing randomness with rhythm. Its structured presale model introduces weekly price increases that reward early conviction and create a compounding effect for early buyers. Tokens are delivered instantly upon purchase, giving holders immediate verification and participation rights — a rarity in early-stage crypto sales.

Staking rewards are already live, meaning investors earn passive income during the presale. The project’s smart contract was audited by BlockSAFU and scored a perfect 10/10 rating, while liquidity will be locked at launch to protect long-term holders and ensure a transparent listing event.

But what truly separates AlphaPepe from most meme tokens is its community-first approach. Instead of flooding social media with influencer promotions, the project’s growth has been largely organic — built through grassroots enthusiasm and ongoing engagement incentives like reward pools and giveaways.

Analysts have already dubbed it “the next PEPE with real utility and payouts,” and note that AlphaPepe’s early adoption metrics are outpacing those of both PEPE and Shiba Inu during their presale phases.

Dogecoin represents the foundation — the original meme coin that brought humor, community, and accessibility to crypto. It remains the “safe haven” of the meme-coin world, backed by history and cultural relevance.

AlphaPepe, on the other hand, represents the future — a new era of meme coins that combine the same community excitement with structure, yield, and verified transparency. Where DOGE’s story is about legacy, AlphaPepe’s is about evolution.

Many DOGE holders see AlphaPepe not as competition, but as a complementary investment — the next logical step in meme-coin innovation. Just as early DOGE adopters captured lightning in a bottle, AlphaPepe’s early supporters are aligning themselves with the next cycle’s cultural and financial phenomenon.

Dogecoin remains a staple of crypto culture — a symbol of community power and longevity, now trading steadily around $0.16. But while DOGE continues to anchor the meme-coin market, AlphaPepe is capturing the imagination of a new generation of investors.

With a presale nearing $400,000 raised, 100+ new holders joining daily, a USDT pool nearing $3,000, previous payouts exceeding $9,000, and a $100,000 giveaway boosting community engagement, AlphaPepe has become the standout meme coin of 2025. Its News mention has added legitimacy and fueled speculation that it could soon join the ranks of exchange-listed tokens.

In short: DOGE built the meme-coin movement — but AlphaPepe is redefining it.

Website: https://alphapepe.io/

Telegram: https://t.me/alphapepejoin

What is Dogecoin (DOGE)?

Dogecoin is the original meme cryptocurrency launched in 2013. It’s known for its strong community, fast transactions, and lighthearted branding.

What is AlphaPepe (ALPE)?

AlphaPepe is a presale meme coin on BNB Chain that blends humor and community culture with real functionality — instant token delivery, staking rewards, and structured presale growth.

How much has AlphaPepe raised so far?

The AlphaPepe presale is nearing $400,000 raised, reflecting fast-growing investor interest even amid market consolidation.

What is the USDT reward pool?

AlphaPepe’s USDT pool is close to $3,000, with earlier rounds paying over $9,000 to holders — demonstrating active reward distribution.

Why are investors comparing AlphaPepe to Dogecoin?

Because AlphaPepe captures DOGE’s community energy but enhances it with real mechanics, verified rewards, and sustainable growth — the next evolution of the meme-coin model.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

All market analysis and token data are for informational purposes only and do not constitute financial advice. Readers should conduct independent research and consult licensed advisors before investing.

Crypto Press Release Distribution by BTCPressWire.com

COMTEX_470069170/2909/2025-11-06T11:09:33

Cardano price prediction analysts are positioning for a dramatic recovery as ADA bounces from its lows near $0.52 on November 5, 2025, eyeing a potential climb toward $1.20 by year-end; a 130% upside that would validate months of institutional accumulation at depressed prices.

Yet while Cardano price prediction models debate technical targets and regulatory catalysts, there is a new high growth crypto https://remittix.io coin taking the Defi world by storm with its relentless ICO accumulation and more than 40,000 holders. Analysts are asking if this Defi coin can generate exchange liquidity events that dwarf Cardano’s year-long recovery narrative. Let’s dive in.

Cardano Price Prediction: Why Cardano’s $1.20 Target Is Gaining Steam

Cardano’s momentum is building in subtle ways. Market reports show large-scale wallets accumulating over 200 million ADA in recent weeks, even while price lagged demonstrating classic accumulation ahead of a breakout.

Technical charts show ADA forming tightening patterns: one analysis flagged a triangle breakout zone near $0.98-$1.00 as pivotal. Meanwhile, ADA derivatives open interest surged past $600 million https://www.coinglass.com/currencies/ADA/futures, showing growing speculative confidence.

While Cardano price prediction models show bullish targets of $0.87 by December 2025, on-chain data reveals the real story: whale accumulation has accelerated sharply during this 60% crash from October highs, with institutional buyers positioning for the Grayscale ADA ETF approval expected imminently.

Technical analysis suggests Cardano price prediction could easily trigger a 122% rally to $1.12 if it holds the $0.54 support zone, with November historically marking ADA’s second-best performing month, offering compelling risk-reward for early repositioners.

Where ADA Stands Right Now

ADA benefits from upcoming ecosystem developments: governance upgrades, scalability improvements, and growing DeFi infrastructure. Analysts recently noted that renewed ETF speculation and on-chain strength could be the catalyst ADA needs.

Putting this together, a scenario where ADA revisits $1.20 by year-end is plausible, especially if key resistance breaks and flows accelerate.

But, as always: no guarantees. If ADA fails to clear resistance, you might be back in the accumulation zone, watching others grab the move with this new altcoin https://remittix.io making it risky to wait too long.

Remittix: The Payments-First Token That Could Outpace ADA

While ADA aims to reclaim $1.20 and beyond, there’s a payments-centric https://remittix.io token quietly building out global rails and real-world utility. Remittix, unlike broader platforms, focuses on crypto-to-bank conversions, global remittances and mobile wallet adoption.

Where Cardano is a smart contract platform, Remittix is a lean, targeted low gas fee crypto variant designed for mainstream flows. What makes the top Defi project stand out? It’s not just “another altcoin”: instead, Remittix is positioned as the next big altcoin in 2025 for those early enough.

Why Remittix is gaining traction:

● Global Reach: Send crypto directly to bank accounts in 30+ countries

● Real-World Utility: Built for actual use-not just trading hype

● Security First: Audited by CertiK, one of the top blockchain-security firms

● Mobile-first experience with real-time FX conversion

● Deflationary Token Model: Long-term holder value baked in

The build-up toward Cardano breaking $1.20 is happening while many remain on the sidelines. If you wait for a perfect setup, chances are half the move may already be gone.

With over 370,000 entries on the Remittix giveaway registry and several centralized exchanges lined up, investors are pouring massive liquidity in now and top ICO traders say the cost of hesitation might be the biggest regret for retail traders this year.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, including total loss of capital. Readers should conduct independent research and consult licensed advisors before making any financial decisions.

Crypto Press Release Distribution by https://btcpresswire.com

This release was published on openPR.

XRP is back in the spotlight in early November 2025 as XRP ETF speculation brings renewed liquidity and institutional interest. Traders and desks at firms like Goldman Sachs and Fidelity are watching on-chain signals for whale accumulation and rising spot activity that will shape the XRP market. Short-term trading ranges are tight. Recent reports have XRP trading between $2.38 and $2.46 due to ETF flows, while earlier in the month some snapshots had XRP at $0.58-$0.60 as momentum built. Those different levels reflect different timeframes as markets price in a potential Ripple November 2025 breakout.

Technical resistance clusters matter: analysts point to $2.50-$3.00 with targets of $3.35 and $4.47 and earlier resistance at $0.58-$0.60 with a near term target of $0.65 if buyers hold. CoinCodex and liquidity models are being used to map out scenarios ahead of ETF approval. The renewed focus on payment focused digital assets has put tokens that blend utility with momentum in the spotlight. Pepenode (PEPENODE) (https://pepenode.io/) and the Pepenode token are on the watchlist as traders wonder if mid-cap payment or meme-utility projects can follow Ripple’s lead in a broader rotation.

XRP Price For November 2025

XRP is back in focus this month as volume picks up and technicals are neutral to improving. Market participants note creeping momentum without overbought conditions so short term moves are being watched closely. Traders looking at price feeds on https://coinmarketcap.com/currencies/xrp/ will see different snapshots. Some reports have XRP price today in a tight range of $2.38-$2.46 during ETF speculation. Other reports had XRP earlier in the month at $0.58-$0.60, showing short interval swings and consolidation. This volatility keeps traders alert and encourages careful position sizing.

XRP Price Today And Market Sentiment

Current sentiment is cautious optimistic. Analysts are watching RSI and volume to see if momentum can hold gains without quick reversals. Reports on XRP market sentiment November 2025 say ETF speculation is the main driver. That driver is getting attention from retail traders while institutional desks are testing exposure quietly. For traders looking at risk, the XRP price today and the XRP trading range help define stop levels and target zones. Market flow in the coming sessions will determine if consolidation turns into a trend.

Key Drivers Behind XRP’s Breakout

Recent market talk is centered around several drivers that could shape XRP’s near term outlook. ETF speculation is at the top of most trader watchlists, while on chain data and derivatives positioning add crucial context to price action. These narrative threads overlap with liquidity shifts and broader macro signals, creating a complex setup for anyone watching Ripple news and regulatory headlines. For now, sentiment remains cautiously optimistic, but the balance between hype and hard data will decide how the next leg plays out.

Ripple Updates And Broader Market Trends

Public filings and commentary about an XRP ETF have brought institutional interest back in. ETF talk tends to pull custodians and fund managers back into spot markets, improving market liquidity and prompting portfolio reallocation across digital assets. On-chain metrics show steady whale accumulation and rising spot volumes. Large transfers to cold wallets and rising exchange inflows suggest strategic buys from institutions and private funds, a pattern that often precedes big moves. Analysts are pointing to a tight technical range. $2.20-$3.00 is the range of interest as support and resistance. A break above $3.00 could trigger new momentum while a rejection would likely prolong consolidation.

What Is Pepenode (PEPENODE)?

Pepenode (https://pepenode.io/) is a new project that markets itself as an AI oriented altcoin for cross-chain utility and fast transaction finality. The team highlights Pepenode interoperability as a key feature, aiming to link Ethereum, Solana and other chains to reduce fragmented liquidity and streamline transfers. Early technical notes mention machine learning primitives for on-chain decisioning and low latency confirmations for real world payments and microtransactions. The Pepenode presale got attention after stages of expansion brought the token into wider investor view. Reports had the PEPENODE token trading at $0.0042 during one presale window, a level some traders called an entry point before exchange listings.

Why Traders Are Talking About It In November 2025

Market talk around Pepenode picked up as traders looked for utility driven projects after renewed interest in payment focused tokens like XRP. The AI oriented altcoin angle provides a narrative that resonates with investors looking for protocol level innovation beyond simple token supply plays. Analysts are comparing Pepenode’s early adoption story to past growth paths seen with Ethereum and Solana while cautioning to watch execution milestones and listing cadence. Interest in the Pepenode presale mirrors growing community engagement and speculative flows into interoperable solutions. If the project can demonstrate Pepenode interoperability with established chains and meet scheduled releases it may stay in the radar of traders who like practical use cases.

Can Pepenode (PEPENODE) Follow XRP’s Move?

XRP’s momentum this November has traders looking for altcoins that can ride the same wave. Market observers point to liquidity shifting towards payment focused and utility projects as a setup that can lift well positioned tokens. Pepenode’s (https://pepenode.io/) AI and interoperability narrative puts it in that group but correlation is not automatic. Three clear paths outline how Pepenode might behave if XRP gains traction. In the optimistic path a Ripple driven rotation into payments and utility assets sends fresh capital into altcoins. If Pepenode gets tier 1 listings and scales community engagement the token could see strong appreciation.

The conservative path assumes limited market liquidity and stalled presale interest, producing modest gains. The bearish path is centered on regulatory setbacks or execution failures that erase momentum and trigger steep declines. Analysts are flagging key execution items as make-or-break catalysts. Successful exchange listings, steady presale milestones, and visible product progress such as AI integrations and interoperability proofs are crucial signals. Those achievements would materially increase the odds of Pepenode moving in closer correlation with XRP during the next broader market upswing.

Price Prediction And Risks Ahead

Short term technicals have XRP trading between clearly defined resistance and support levels on most major exchanges. If XRP breaks above 3.00 dollars with strong volume, upside targets near 3.35 and 4.47 become realistic for momentum traders. Failure to clear resistance could keep price action pinned in the 2.20 to 2.30 support band or send it back toward earlier ranges around 0.58 to 0.60 on higher timeframes. Traders following XRP price closely should monitor TradingView order flow and aggregated forecasts for volume confirmation.

Fundamentals will matter as much as charts for XRP and Pepenode in this phase of the cycle. Regulatory clarity and the timing of any ETF approvals are key variables that can accelerate or crush momentum, so policy headlines remain part of the XRP price equation. Pepenode looks attractive if listings, roadmap milestones, and marketing execute on schedule. Presale momentum and a growing community create upside, but execution risk and thin liquidity mean early stage tokens can see sudden shifts in demand and sentiment.

Conclusion

XRP’s November 2025 outlook is tied to ETF speculation, institutional repositioning and steady on chain accumulation across major wallets. Technicals show volatility compression that can lead to a large move if volume rises and regulatory signals from courts and agencies remain positive. For traders eyeing Pepenode (PEPENODE) (https://pepenode.io/) as a high beta meme coin, this XRP price conclusion suggests a breakout is possible but not guaranteed, so watching TradingView volume, funding rates and on chain whale activity is especially important in the coming weeks.

Buchenweg 15, Karlsruhe, Germany

For more information about Pepenode (PEPENODE) visit the links below:

Website: https://pepenode.io/

Whitepaper: https://pepenode.io/assets/documents/whitepaper.pdf

Telegram: https://t.me/pepe_node

Twitter/X: https://x.com/pepenode_io

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.