The main tag of Crypto News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Solana Price Prediction: SOL Eyes Recovery as Viral DeFi Altcoin is Named the Next Big Crypto

While Solana (SOL) is struggling to again muster support to help it break through on a bull run after a series of reversals, market onlookers are eagerly awaiting to see if this fast L1 blockchain is finally on the cusp of a break-through on a bull run. Also, while Solana (SOL) is struggling to slow down its downturn and turn its fortunes around, market interest is gradually shifting to a new viral DeFi darling that has been billed as hot on its heels to be the next big crypto in the market economy. Mutuum Finance (MUTM), a new presale darling, has quickly become one of the most talked-about projects of its kind and a potential best crypto for early-stage investors.

With the presale now entering its 6th round and costing only $0.035, almost entirely sold, MUTM has made it a point that it gives the investor a scarcity-based entry that clearly differs significantly in the rate of recovery, not just in the altcoin market, but particularly in a large market cap, such as that of Solana. With its two-way DeFi operating system, including peer-to-peer, as well as peer-to-contract lending, not to mention the yielding of mtTokens, MUTM gives investors more than just hype—it is shaping up to be the next big crypto with real utility. As the investor continues to select highly-performing blockchains over high-growth options, Mutuum Finance is already emerging as one of the most optimal means available to those seeking the best crypto opportunities in DeFi.

Solana Price Prediction

There are signs of a bullish market around the long-term support levels. SOL also displays encouraging signs of a stabilization process during the testing of a strong support level that market participants have been observing for close to two years. Following an orderly correction in the late 2025 period, today SOL finds itself in a sideways trend, with lower highs nearing a support level, although the selling momentum has relented substantially. With every bear test of the support level, there is substantial buying momentum observed in SOL, indicating a strong level of demand within this region.

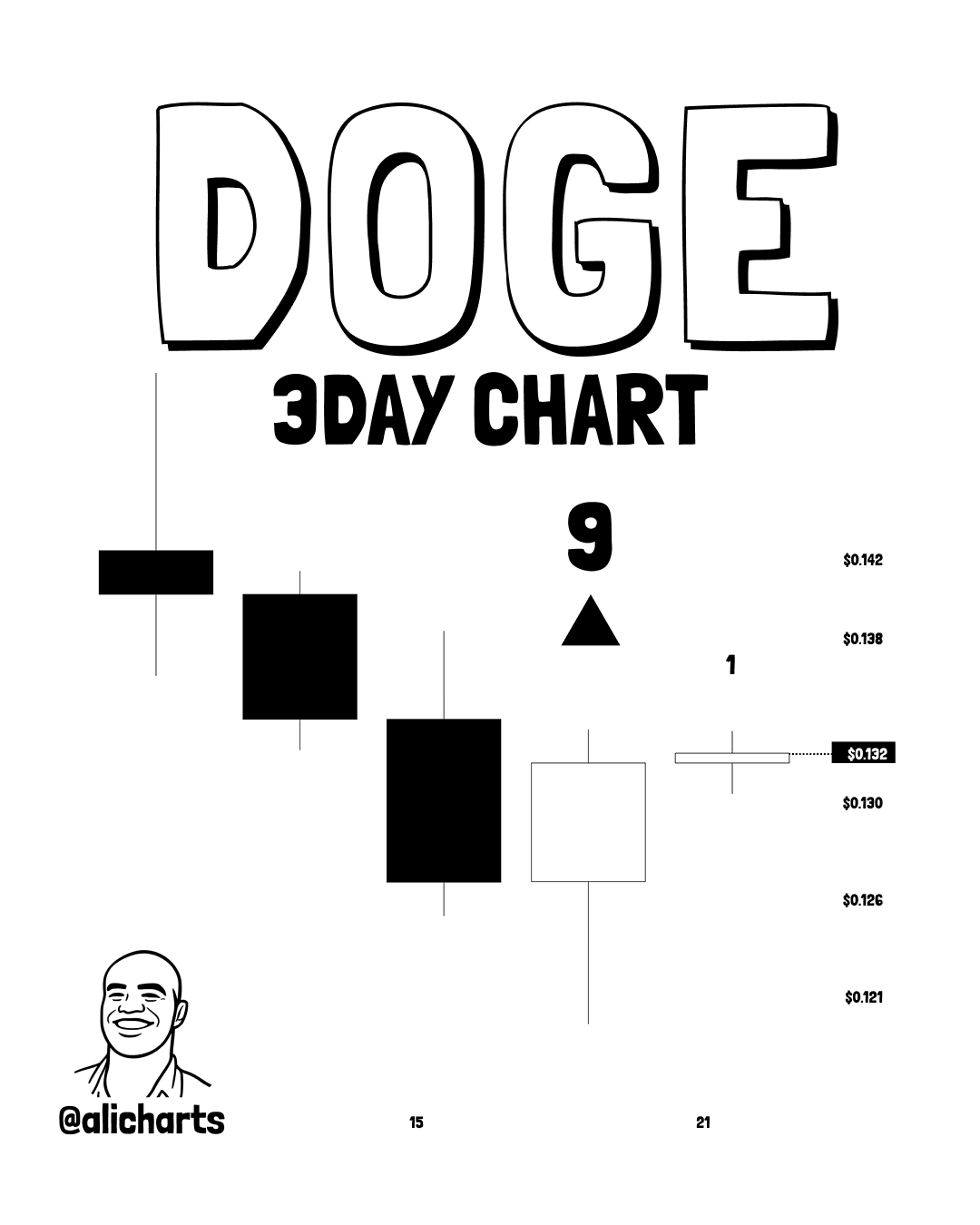

There is a strong bullish divergence within the three-day chart of the SOL/USDT, indicating the creation of progressively higher lows as the markets are near strong support levels, a strongly positive indication of the sort seen in the pattern preceding the March significant bottoming out process. That the market is at this critical intersection point, while also noting the new and rapidly emerging crypto initiatives of Mutuum Finance, strongly indicates that the market participants are reviewing strong growth potentials alongside established successful Layer 1 blockchains. Indeed, MUTM is being regarded by many as the next big crypto ready to rival established networks.

MUTM Presale Analysis

Mutuum Finance (MUTM) is becoming the very best investment choice available within the DeFi market as Phase 6 of its presale stage nears completion. Priced at $0.035 at the moment, this is the last chance for investors who wish to have their hands on this new token before entering Phase 7, where the token price will increase by 20%. Going past 18,560 investor accounts and exceeding a cumulative investment of $19.5 million, it is a massive success for the presale stage, bringing out the utility of MUTM within the realm of DeFi and establishing itself as one of the very best crypto investments for newcomers.

Halborn Audit

Security is one of the primary focuses of the business model of Mutuum Finance. The smart contracts used for lending and borrowing on the Mutuum Finance platform are currently being audited by Halborn Security, which is one of the most famous auditors of blockchain technology. It is due to rigorous checks on the platform that it has been ensured that every smart contract on the platform is working as required and that every bit of investment made on the platform by users has always been safe. After completion of this process, the launch of Sepolia Testnet will take place.

Mutuum Finance is also involved in community engagement and incentive prizes. Members who join early in the token sale presale will be able to share a token prize of $100,000, where ten winners will walk away with $10,000 in MUTM tokens. By incorporating functionality and incentive prizes, MUTM ensures it is a desirable functional token with immense growth potential and a candidate for the best crypto to watch in 2026.

Though Solana (SOL) is on the cusp of a possible turnaround, the tides of investment are clearly shifting towards Mutuum Finance (MUTM), which is nearing full subscription in the current Phase, with more than 18,560 investors raising over $19.5 million, leaving a small pool of investment before the price hike to $0.04 in Phase 7. With the facility of multiple lending options and real-time interest rates through mtTokens that will soon be Halborn audited for testnet, MUTM is not only a fascinating DeFi platform but a likely leader among the next big cryptos that will take the investment scene by storm next year.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance