The main tag of Crypto News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

ADA’s Recovery Hinges on Competing With Emerging Utility Solutions

Cardano Price Prediction discussions are becoming more heated as market participants focus on which networks can hold relevance in a utility-driven cycle. ADA remains a widely followed asset, yet recent market behavior shows traders weighing long-term potential against near-term execution.

This shift has placed pressure on platforms that move slowly while attention grows toward projects delivering usable products.

Within this broader reassessment, smaller utility-focused platforms are gaining quiet interest. One example is Remittix, a PayFi-centered project now trading at $0.119 per token, which is attracting notice as capital rotates toward crypto with real utility.

Cardano Price Prediction Faces Pressure at Key Trading Zones

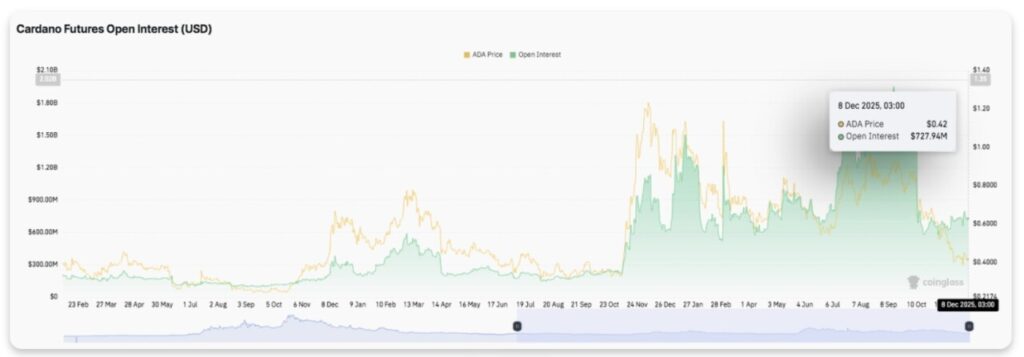

Cardano is currently trading at $0.4130 following a significant drop of about 3.75% in the past 24 hours, with a market cap of about $14.87 billion.

Recent technical commentary points to resistance between 0.4386 and 0.4416, where the price previously rejected after returning to a former value range. Volume behavior in this zone suggests distribution is still active.

According to a recent ADA community analysis shared on CoinMarketCap, traders remain focused on these levels as decision points for short-term direction

Utility Competition Shapes the Current Cardano Price Prediction

The Cardano Price Prediction narrative now sits alongside rising competition from projects built around immediate use cases.

While Cardano continues work across research-driven development, traders are tracking whether usage growth can match newer platforms entering the payments and settlement space. Market flow data suggests capital rotation has already begun.

This transition does not remove Cardano’s relevance, but it raises the benchmark. Investors are placing greater weight on ecosystems that deliver visible tools, transaction flow, and network activity. In this environment, ADA’s recovery path hinges on proving it can compete as crypto solving real-world problems becomes a core filtering factor.

Remittix Gains Attention as Utility Becomes the Deciding Factor

Remittix has moved into focus as a Remittix DeFi project centered on practical payments rather than speculative design. The project recently launched its wallet live on the Apple App Store, marking the first phase of its PayFi rollout. The wallet allows users to store, send, and manage crypto assets in a clean and stable interface.

The Remittix wallet beta is now expanding to more community members, with iOS users invited weekly through an active testing program. Remittix has raised over $28.5 million from private funding and has sold more than 693.1 million tokens, reflecting sustained interest in its payment-focused direction.

The team is also verified by CertiK and is currently ranked #1 on CertiK for pre-launch tokens, adding a layer of accountability.

Key Remittix progress points include:

- Live iOS wallet with active community testing

- Crypto to fiat payments in development

- CertiK verified team and top industry ranking

- Upcoming centralized exchange listings revealed

- Ongoing $250,000 Remittix giveaway for community growth

Where the ADA Outlook Sits Going Forward

The Cardano Price Prediction path remains tied to execution rather than expectation. ADA still holds long-term positioning within the Layer 1 category, yet near-term sentiment reflects a market that rewards delivery speed and product readiness. Traders continue monitoring how demand reacts around established support and resistance zones.

At the same time, the presence of projects like Remittix shows how investor focus is broadening beyond legacy names. With its token priced at $0.119, live wallet infrastructure, and expanding PayFi roadmap, Remittix illustrates the type of utility-driven model now shaping capital decisions.

As this trend continues, ADA’s recovery depends on proving that development progress converts into visible usage.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

FAQ

What is influencing the current Cardano Price Prediction?

The Cardano Price Prediction is shaped by weak short-term momentum, key resistance zones, and growing competition from utility-focused crypto projects.

Which price levels matter most for ADA right now?

Market attention remains on the 0.4386 to 0.4416 resistance area, where prior rejection and volume distribution were observed.

Why are traders comparing ADA with newer utility tokens?

Investors are prioritizing crypto with real utility, especially platforms delivering live products rather than long-term roadmaps.

What makes Remittix relevant in this discussion?

Remittix offers a PayFi-focused ecosystem with a live wallet, CertiK verification, and over $28.5 million raised through private funding, all at a $0.119 token price.

Does Cardano still have long-term potential?

Cardano remains a major network, but its recovery depends on whether usage and adoption accelerate alongside newer utility-focused competitors.