The main tag of Crypto News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Cardano Price Prediction: Indicators Align as ADA Tests Multi-Year Compression Structure Near $0.45

Cardano price is approaching a key structural turning point, with momentum indicators hinting at early signs of a potential market recovery.

Cardano price is entering a pivotal moment in early December as price holds around $0.45, with a cluster of higher-timeframe signals suggesting that the asset may be preparing for a structural shift. While ADA remains far below its former highs, a combination of multi-year wedge compression, fresh momentum signals, and improving short-term liquidity trends has revived discussion around whether a larger recovery phase could take form.

Despite the encouraging signals, analysts emphasize that the ADA Cardano price remains in a macro downtrend and that any recovery scenario depends on whether buyers can sustain renewed momentum through key resistance zones.

Higher-Timeframe Structure Shows Multi-Year Compression

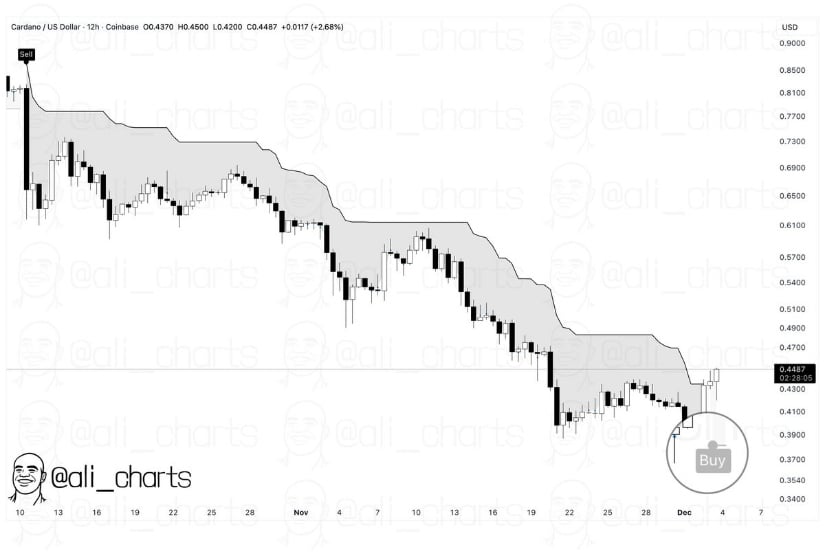

AltcoinPiooners’s long-term chart points to an increasingly important structural moment for ADA. A multi-year descending wedge has been developing since 2021, with repeated lower highs slowly converging towards a major support line around $0.40–$0.42. Price is now pressing back into the upper boundary near $0.48 to $0.50, an area historically associated with strong multi-quarter rejections.

ADA’s multi-year wedge is nearing a decisive point as price compresses towards major resistance, setting the stage for a volatility breakout. Source: AltcoinPiooners via X

This compression mirrors earlier ADA cycles where extended basing phases lasted 12–18 months before a breakout attempt formed. Analysts who track multi-cycle structures, not social-media calls, note that wedge formations do not predict direction on their own but often precede periods of higher volatility when tested at major boundaries.

Cardano Price Enters a Potential Macro Turning Point

Momentum conditions have begun to turn more constructive after a multi-week slide. The most notable development came from the SuperTrend indicator, which recently printed a buy signal on ADA’s higher-timeframe chart, its first in months. The indicator tends to perform better in trending markets rather than range markets, but its appearance near historical support is a sign that sellers may be losing momentum.

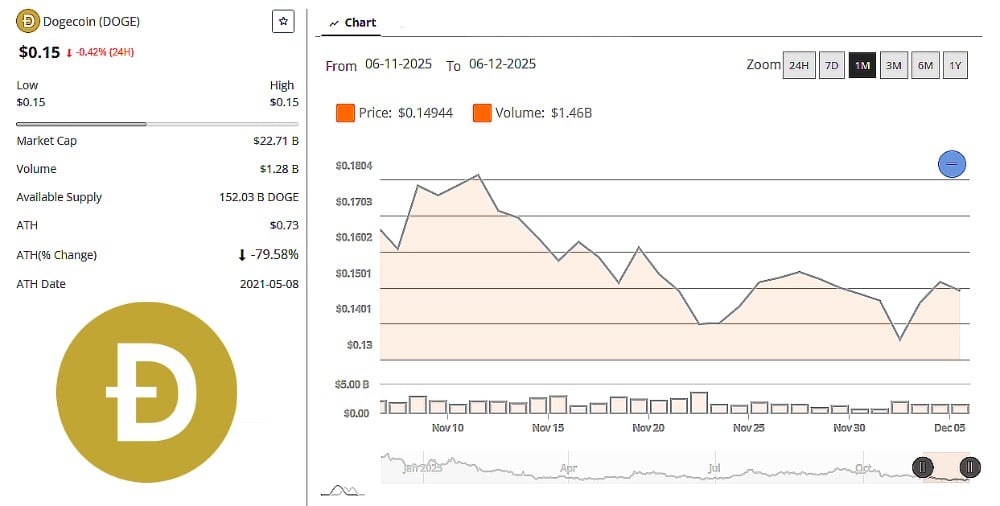

Cardano is flashing its first major SuperTrend buy signal in months, hinting that downward momentum may finally be fading. Source: Ali Martinez via X

A second confirmation comes from RSI behavior. In Sssebi’s chart, ADA’s daily RSI shows a clean breakout from a falling resistance line, the same structure that capped prior relief rallies. Momentum breakouts of this type often precede attempts to reclaim mid-range levels, provided volume follows through.

ADA’s RSI has broken its falling resistance, signaling a momentum shift that could support an attempt towards mid-range recovery levels. Source: Sssebi via X

These signals do not guarantee upside continuation, but they show that ADA is at least responding to the oversold conditions that dominated early Q4.

Short-Term Market Conditions Improve

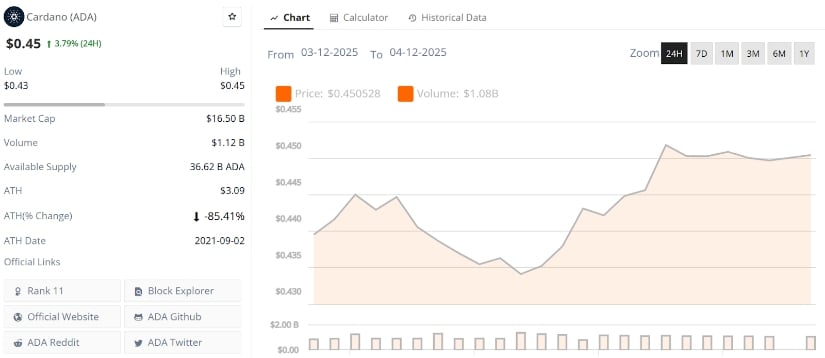

Cardano’s latest market data shows moderate recovery from recent lows, supported by improving short-term liquidity. Trading volume rose above $1.1B over the last day, suggesting that dip-buyers are testing the current range.

Cardano price is trading around $0.44, up 3.79% in the last 24 hours. Source: Brave New Coin

However, ADA’s position below key moving averages, including the 50-day and 200-day, keeps the short-term outlook cautious. Compression phases often trigger sharp but temporary rallies before trend confirmation arrives, meaning ADA’s early reaction still requires validation.

The near-term resistance around $0.50 remains the first major test. Multiple analysts have noted this zone as a “reaction ceiling,” where ADA often experiences supply-driven pullbacks.

Momentum Indicators Suggest Early Reversal Attempts

Lower-timeframe behavior adds another layer to the broader picture. According to DevilsReach, ADA’s RSI has recently broken above a descending boundary for the first time in months. These momentum-break patterns do not guarantee continuation but often serve as the first spark in recovery phases, especially when occurring at multi-cycle support.

Cardano’s RSI finally breaks its downtrend as volume stabilizes, signaling early signs of momentum recovery. Source: DevilsReach via X

Volume profile data also hints at a rebalancing phase rather than capitulation. While selling pressure remains visible, the depth is far shallower compared to earlier drawdowns, suggesting that forced liquidations have cooled.

Final Thoughts: Conditional Scenarios Based on Market Structure

Price models built around liquidity, wedge dynamics, and long-term cycle behavior suggest that ADA may be entering a stabilization phase with asymmetric outcomes depending on whether compression resolves upward or downward.

If support around $0.43 to $0.45 holds, the broader structure allows room for a medium-term move towards the $0.60 to $0.75 corridor. This range aligns with historical reaction levels, mid-wedge resistance, and overhead liquidity pockets formed during the 2023–2024 cycles. A reclaim of this zone would represent ADA’s first meaningful macro higher-high in over a year.

A more ambitious expansion, dependent on improving liquidity and a cooperative macro environment, places later-cycle targets in the $1.00 to $1.20 region. These projections come directly from wedge-measured-move calculations and previous cycle analogs, not speculative community targets.

If ADA loses $0.43, structural vulnerability increases significantly, opening room towards the $0.32 to $0.40 demand shelf. This scenario remains possible given ADA’s sensitivity to BTC volatility and macro liquidity shifts.