The main tag of Crypto News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

XRP Holds Above $2 as ETF Inflows Surge and Vanguard Opens the Door (December 3, 2025)

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investing is highly risky; never invest money you cannot afford to lose.

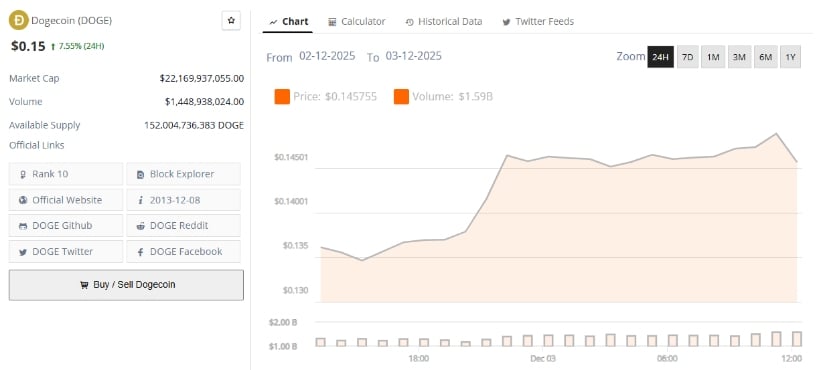

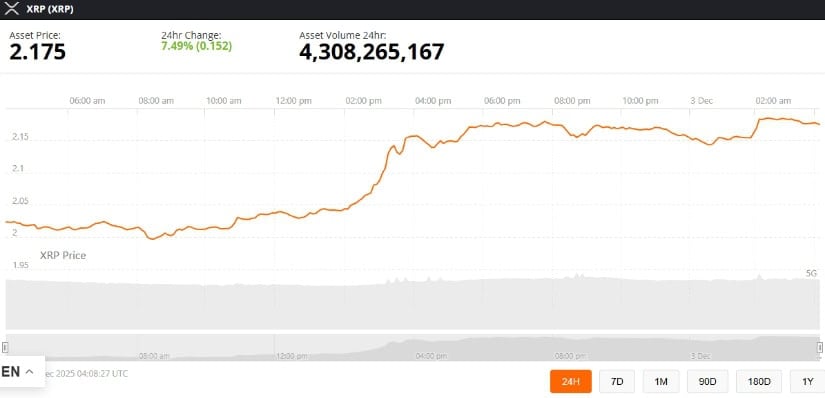

XRP Price Today – Snapshot on December 3, 2025

As of December 3, 2025, XRP is trading around $2.18. Data from Investing.com shows today’s spot price near $2.19, with an intraday range of roughly $2.14–$2.22, and a gain of about 1.6% on the day. [1]

Market data from Crypto.news puts XRP at roughly $2.16, with a 24‑hour low/high of about $2.06–$2.21, 24‑hour volume near $4.8 billion, and a market capitalization around $130 billion, keeping XRP firmly in the large‑cap tier (currently ranked fourth by market cap). [2]

Despite a ~18% drop in November, which saw XRP break below an ascending channel and test key support levels, technical pressure has eased in early December as the token stabilizes above $2.00. [3]

Today’s price action sits at the intersection of three major stories:

- Record spot XRP ETF inflows,

- Vanguard’s shock U‑turn on crypto ETFs, and

- A fresh regulatory win for Ripple in Singapore, alongside a 1 billion XRP escrow unlock that the market appears to have digested without panic. TechStock²+2Ripple+2

Let’s unpack what’s moving XRP right now – and what today’s analysts are saying about where the XRP price might go next.

ETFs Steal the Show: XRP Becomes 2025’s Breakout ETF Trade

Record XRP ETF Inflows

Several of today’s most‑read pieces focus on one big fact: spot XRP ETFs are pulling in huge amounts of capital.

- A CryptoSlate analysis reports that newly launched U.S. spot XRP ETFs have attracted around $756 million in net inflows over just eleven consecutive trading sessions since mid‑November, even as many Bitcoin and Ethereum products saw net redemptions. [4]

- CoinMarketCap’s research team similarly highlights $756 million of cumulative inflows, equivalent to nearly 330 million XRP absorbed by ETF issuers. [5]

- Crypto.news cites about $824 million in combined spot XRP ETF inflows, suggesting the complex is closing in on the symbolic $1 billion milestone. [6]

Even more striking, CryptoSlate notes that XRP ETFs now hold about 0.6% of the token’s total market capitalization, and that while Bitcoin ETFs lost more than $2 billion and Ethereum products nearly $1 billion over the same period, XRP funds continued to print steady inflows. [7]

Vanguard’s U‑Turn: 50 Million Investors Just Got Access to XRP ETFs

The ETF narrative kicked into a new gear this week with Vanguard’s long‑awaited pivot into crypto:

- Barron’s reports that Vanguard has lifted its ban on crypto ETFs and mutual funds, allowing its 50‑million‑strong client base to trade third‑party products tied to Bitcoin, Ethereum, XRP and Solana via its brokerage platform. [8]

- MarketWatch and InvestmentNews confirm that trading in these ETFs begins this week, describing the move as Vanguard “dipping a toe” into crypto while still refusing to launch its own in‑house products. [9]

- CryptoSlate characterizes the decision as Vanguard “caving on crypto to retain clients,” opening a $9.3 trillion platform to spot Bitcoin, Ethereum, XRP and Solana ETFs. [10]

For XRP specifically, multiple reports note that major issuers such as Bitwise, Franklin Templeton and Grayscale now see their XRP products listed on Vanguard’s platform, significantly broadening potential institutional and retail access. [11]

In short: even if today’s XRP price sits near $2.18, the flow data tells a different story – large investors are steadily allocating via regulated wrappers.

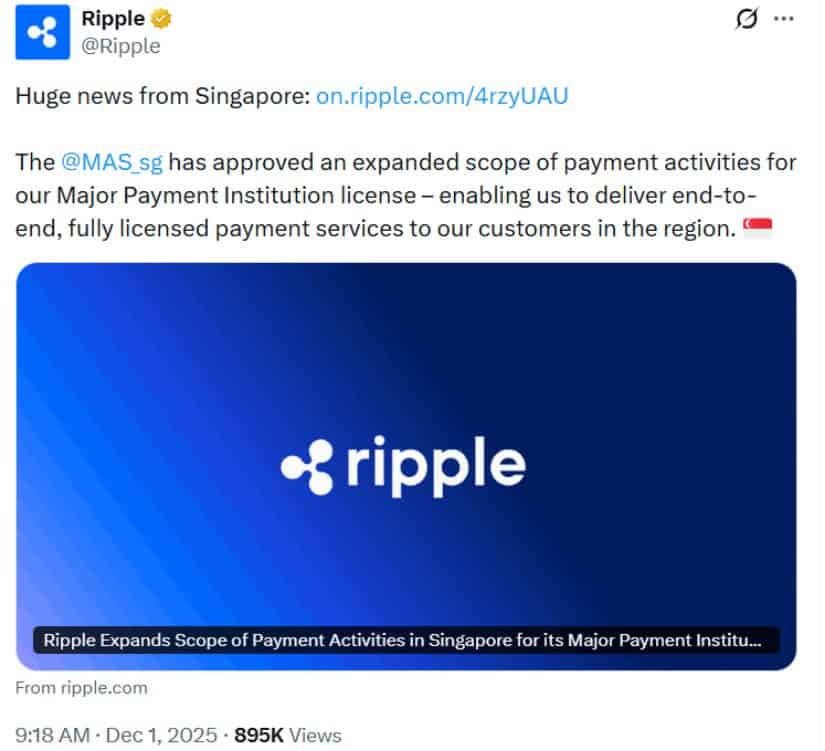

Ripple’s Singapore License: Real‑World Payments Tailwind

On December 1, Ripple announced that the Monetary Authority of Singapore (MAS) had approved an expanded scope of payment activities under the Major Payment Institution (MPI) license held by its Singapore subsidiary, Ripple Markets APAC. [12]

According to Ripple’s press release:

- Ripple can now broaden its regulated payment offerings in Singapore.

- Ripple Payments uses digital payment tokens such as XRP and RLUSD (Ripple’s USD‑pegged stablecoin) to support near‑instant cross‑border settlements for banks, fintechs and crypto firms. [13]

Commentary from payments and fintech outlets emphasizes a few key implications:

- Singapore is a regional hub for on‑chain activity, with Asia‑Pacific leading the world in real digital asset usage. [14]

- Expanded licensing strengthens the case for enterprise‑grade XRP use in payments, which could incrementally support transactional demand over time – even if the short‑term price impact is hard to quantify. [15]

For price‑focused traders, today’s takeaway is that regulatory clarity in a major financial center is now a tailwind rather than a risk – a narrative that often matters as much as raw transaction volumes.

1 Billion XRP Unlocks – and the Market Barely Flinches

In a headline that dropped this morning, U.Today reports that Ripple completed its usual monthly escrow unlock of 1,000,000,000 XRP – a release worth over $2.19 billion at current prices. [16]

Key details from that article:

- Ripple continues its long‑running pattern: 1 billion XRP is released from escrow, then a large chunk (recently around 600 million XRP) is relocked, with the rest hitting circulating supply. [17]

- Ripple still holds roughly 34.5 billion XRP in reserves, meaning this monthly process is far from over. [18]

- Despite fears of a supply shock, the price reaction was muted: XRP dipped about 1.5% in the hours after the unlock alert, then pushed to new intraday highs, leaving analysts to argue that the market had largely priced in the event. [19]

Technically, U.Today notes that if XRP can sustain its recent gains, the next visible resistance lies near $2.33, aligned with the upper Bollinger Band on the daily chart, about 6–7% above current levels. [20]

The message from today’s coverage: supply overhang from escrow remains a long‑term structural issue, but the market is increasingly desensitized to routine unlocks, focusing more on ETF flows and macro risk.

Technical Picture: Key XRP Levels Traders Are Watching

Today’s December 3 analyses paint a nuanced technical backdrop.

Short‑Term Bullish Patterns

A widely circulated Crypto.news piece argues that XRP could rally about 40% in December, with a target around $3.00: [21]

- On the three‑day chart, XRP has repeatedly defended a key support near $1.85, forming a falling wedge – a pattern often viewed as bullish when it breaks upward.

- The token has moved above the 50% Fibonacci retracement of its prior move and printed a “morning star” and emerging inverse head‑and‑shoulders pattern, both classic reversal signals.

- Crypto.news puts the next “psychological” target at $3, roughly 40% above the current $2.16–$2.18 zone, while warning that a drop below $1.85 would invalidate the bullish setup and open the door to $1.56. [22]

U.Today and The Crypto Basic add granular daily‑chart color, highlighting: TechStock²+1

- Immediate resistance in the $2.17–$2.28 band.

- A cluster of Fibonacci supports around $2.10, $2.05, $1.99, and deeper levels around $1.91–$1.81.

- A bullish MACD cross on the daily timeframe suggesting early upside momentum, contingent on a sustained break above the $2.17–$2.28 “ceiling.”

Bearish Overhang and $2 Support Under Attack

Not everyone is convinced. A December 1 technical deep‑dive from CCN underscores that XRP dropped roughly 18% in November, breaking below an ascending channel and flipping key indicators bearish: [23]

- The Supertrend indicator has turned red and now sits above price, indicating short‑term bearish control.

- The Bull‑Bear Power and Awesome Oscillator have slipped into negative territory, confirming weakening momentum.

- On‑chain, daily active addresses (DAA) divergence remains negative, hinting that network demand is not yet matching price.

- CCN warns that losing the $2 support could expose XRP to the $1.77 region, while a clean breakout above the descending channel could open a path toward $2.65.

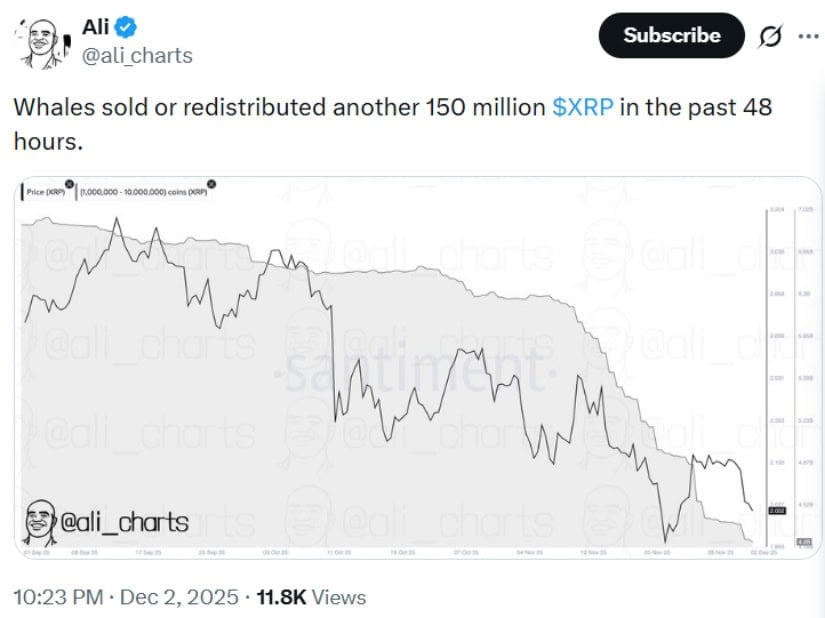

Centralization & Whale Dynamics

CryptoSlate’s ETF‑focused analysis raises a different kind of risk: ownership concentration. Santiment data cited in the report shows that the number of “whale” and “shark” wallets holding at least 100 million XRP has fallen by about 20.6% in the last eight weeks, even as ETFs accumulate supply. [24]

Interpretations vary:

- Some analysts call this “consolidation into strong hands.”

- Others caution that with nearly half of circulating supply held by a shrinking cohort of large entities, XRP’s liquidity profile becomes more fragile: any coordinated selling could trigger sharp downside spikes despite robust ETF demand. [25]

Taken together, today’s technical coverage portrays an asset at a crossroads: structurally supported near $2, facing a dense overhead band between $2.17 and $2.60, and heavily influenced by a mix of ETF flows, on‑chain concentration, and macro risk appetite.

Today’s XRP Price Forecasts: From $2.60 to $5.60 – and Beyond

Near‑Term Targets (Days to Weeks)

Across December 3 articles and fresh research published over the past 24 hours, several short‑term levels appear repeatedly:

- $2.33 – U.Today’s next resistance, aligned with the daily upper Bollinger Band. [26]

- $2.60–$2.65 – Cited by both CCN and other technicians as an upper target if the descending channel breaks to the upside. [27]

- $3.00 – Crypto.news’ approximate upside target based on wedge and inverse head‑and‑shoulders patterns (about 40% above current price). [28]

A separate note from 24/7 Wall St. earlier this week argued that XRP is clinging to a crucial $1.90 floor, with a technical TD Sequential buy signal hinting at the possibility of a rebound toward $2.30–$2.45 in the near term – though they stressed that failure to hold the $1.90 area could quickly flip the signal into a false start. [29]

TipRanks, drawing on ETF data and a bullish TD Sequential signal on the weekly chart, suggests that if the pattern plays out as in past instances, XRP could rally as much as 174% from current levels, potentially reaching around $5.60, provided it can first clear the $2.20–$2.50 resistance zone. [30]

Medium‑Term Forecasts (Into Late 2025–2028)

Today’s more medium‑range outlooks are varied – and sometimes contradictory:

- In an analysis highlighted by InvestX, Standard Chartered reportedly maintains a bullish but measured view, projecting XRP at around $5.50 by the end of 2025 and extending to roughly $12.50 by 2028, based on expectations of banking adoption and regulatory clarity following wins like the Singapore MPI license. [31]

- Brave New Coin (in a fresh but slightly forward‑dated article) discusses a long‑term Elliott Wave structure in which XRP could potentially reach $10 by mid‑2026, assuming a bullish “Wave V” unfolds after the current consolidation around $2.15. Analysts emphasize these projections as conditional and speculative, not time‑locked promises. [32]

At the same time, CryptoSlate and CCN both remind readers that XRP’s weekly trend has been technically fragile for weeks, with price still below key structural reversal levels around $2.31–$2.62, meaning any medium‑term bullish scenarios depend on a decisive weekly close above those zones. [33]

Long‑Term Predictions (2030 and Beyond)

Longer‑horizon forecasts published or updated today range from “optimistic” to “borderline science fiction.”

A new Changelly “XRP Price Prediction 2025–2030” article (dated December 3, 2025) aggregates several algorithmic and expert models: [34]

- 2026: Expected average price around $2.16, with a tight range near $2.13–$2.15.

- 2028: Average price near $6.88, with a projected band of $6.64–$7.86.

- 2030: Average around $15.09, with a range of roughly $14.68–$16.68.

- 2032–2034: Models grow extremely bullish, with averages in the $30–$66 range and maximums approaching $77.75 by 2034.

- 2040–2050: Ultra‑long‑term extrapolations point to four‑digit prices (over $1,300 by 2040 and nearly $1,900 by 2050), which would imply XRP rivaling or surpassing the market capitalization of today’s largest global asset classes.

Meanwhile:

- Popular XRP analyst EGRAG has floated scenarios in which XRP could eventually reach $33 under aggressive conditions, according to coverage highlighted in several news roundups. [35]

- An InvestX feature published today catalogs social‑media‑driven “moonshot” targets between $1,500 and $2,000 per XRP, often based on claims of gold backing or complete replacement of the SWIFT system – targets the article itself describes as economically implausible in the foreseeable future because they would imply market capitalizations larger than the global money supply. [36]

The takeaway: credible long‑term models already span an enormous range (from low single‑digits to double‑digits by 2030), while social‑media narratives reach far beyond what most analysts consider realistic. None of these projections are guarantees; they are best‑guess scenarios built on assumptions that could easily prove wrong.

Key Risks to the XRP Price Highlighted Today

Amid the excitement, today’s coverage repeatedly flags several risks that could derail bullish XRP price forecasts:

- Ownership Concentration & Liquidity Shocks

- Fewer very large wallets are holding a bigger share of XRP. A sharp change in positioning by this small cohort could overwhelm ETF demand in the short term. [37]

- Macro Environment

- Crypto.news notes that expectations of future Federal Reserve rate cuts are part of the bullish thesis, but a surprise re‑tightening or growth shock could hurt all risk assets, including XRP, regardless of ETF inflows. [38]

- Technical Breakdown Below $2

- CCN’s analysis emphasizes that $2 remains a “line in the sand.” Sustained trading below that level could expose XRP to $1.77 or even deeper support, undermining the current bullish wedge and inverse head‑and‑shoulders narratives. [39]

- Ongoing Supply Overhang from Escrow

- Monthly 1 billion XRP unlocks mean new supply will continue to drip‑feed into the market for years, even if a large share is relocked each month. [40]

- Regulatory and Competitive Pressure

- While Ripple’s Singapore win is positive, regulatory regimes elsewhere can still shift unfavorably. Competing networks and alternative payment rails continue to evolve, challenging XRP’s “global settlement layer” thesis. [41]

For Google News and Discover readers, the message is clear: today’s bullish headlines are counterbalanced by serious structural and macro risks.

What to Watch Next for XRP

Based on today’s December 3 news, traders and long‑term holders alike are watching several key signposts:

- Can XRP hold above $2.00?

A weekly close comfortably above this level would reinforce the idea of a durable floor; a breakdown would validate more bearish December scenarios. - Do ETF inflows hit – and sustain – $1 billion+?

Crossing the $1 billion mark in spot XRP ETF assets could cement XRP’s status as the leading altcoin ETF trade, but a sharp slowdown in flows would challenge that narrative. [42] - How much volume actually comes from Vanguard’s platform?

The announcement of access is one thing; sustained allocations from retirement accounts and traditional portfolios are another. Vanguard’s internal messaging remains cautious. [43] - Real‑world payment traction in Singapore and beyond

Evidence that Ripple’s expanded MPI license is driving measurable payment volumes using XRP/RLUSD would strengthen the “utility” leg of the bull case. [44] - Resolution of the centralization debate

Additional on‑chain data showing whether whale concentration is stabilizing, worsening, or dispersing will matter for long‑term confidence. [45]

Final Thoughts

On December 3, 2025, XRP is more than just a $2‑plus token with a volatile chart:

- It is the hottest altcoin in the ETF arena, with hundreds of millions of dollars in inflows.

- It just gained another regulatory foothold in Singapore.

- It shrugged off a billion‑token escrow unlock that would once have terrified the market.

At the same time, the price remains tightly boxed in between a vulnerable $2 support and sticky resistance in the $2.30–$2.60 region – with analysts split between cautious optimism and warnings of further downside.

Whether XRP’s current consolidation becomes a springboard toward $3–$5+ or a precursor to another leg lower will depend on what happens next with ETF flows, whale behavior, macro conditions, and real‑world payment usage.

For now, the only certainty is volatility — and the need for disciplined risk management for anyone exposed to XRP.

References

1. www.investing.com, 2. crypto.news, 3. www.ccn.com, 4. cryptoslate.com, 5. coinmarketcap.com, 6. crypto.news, 7. cryptoslate.com, 8. www.barrons.com, 9. www.marketwatch.com, 10. cryptoslate.com, 11. www.fxleaders.com, 12. ripple.com, 13. ripple.com, 14. ripple.com, 15. bravenewcoin.com, 16. u.today, 17. u.today, 18. u.today, 19. u.today, 20. u.today, 21. crypto.news, 22. crypto.news, 23. www.ccn.com, 24. cryptoslate.com, 25. cryptoslate.com, 26. u.today, 27. www.ccn.com, 28. crypto.news, 29. 247wallst.com, 30. www.tipranks.com, 31. investx.fr, 32. bravenewcoin.com, 33. bravenewcoin.com, 34. changelly.com, 35. thecryptobasic.com, 36. investx.fr, 37. cryptoslate.com, 38. crypto.news, 39. www.ccn.com, 40. u.today, 41. ripple.com, 42. cryptoslate.com, 43. www.barrons.com, 44. ripple.com, 45. cryptoslate.com