The main tag of Crypto News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Dogecoin Price Predictions for 2025, 2026, and 2030: Can DOGE Break $1?

Jakarta, Pintu News – Dogecoin (DOGE), the first meme coin to become a phenomenon, has now cemented its place as a legend in the crypto world. Known for its viral appeal and fiercely loyal community, Dogecoin continues to attract media and investor attention.

Following Donald Trump’s election victory, speculation arose that a Dogecoin ETF might be on the horizon, which then sparked a surge of optimism in the market.

Now, the speculation has become a reality. On September 18, the REX-Osprey DOGE ETF was officially launched, trading under the symbol DOJE and carrying a management fee of 1.5%.

The launch paves the way for institutional investors to access Dogecoin, while making it the first Dogecoin spot ETF listed in the United States. It also increases the likelihood of similar ETF approvals from major firms like Bitwise and Grayscale before the end of the year.

With increased optimism and wider adoption, the market began to change. Traders began to ask: “Will the Dogecoin price rise again?” and “Could DOGE reach $1?”. In this article, we will discuss technical analysis and long-term Dogecoin price predictions for 2025 to 2030.

Dogecoin (DOGE) Price Analysis in 2025

The Dogecoin price continues to be in the spotlight of investors, mainly due to its track record of delivering spectacular returns. One of the most notable price spikes occurred in November 2024, after Donald Trump won the presidential election.

Read also: Dogecoin Price Prediction: Will DOGE Rise from the Selling Pressure?

That moment pushed the price of DOGE to a peak of $0.4846 by the end of the year. However, profit-taking around that peak created a supply zone, which then triggered a downward trend in prices.

In January 2025, optimistic market participants (bulls) sought to maintain the gains achieved in the fourth quarter of 2024. Unfortunately, DOGE faced a major roadblock at the high-volume resistance level of $0.39, which eventually sent the price plummeting to $0.130 in early April.

Interestingly, the April low is close to the demand zone in the $0.130 – $0.150 range, which was the starting point of DOGE’s parabolic rally. In this area, the bulls appear to be active again. Over the past few months, this level has been tested many times and proved difficult to break by selling pressure (bearish).

Moreover, in the last week of the first half of 2025, DOGE tested this support level again after an overall market rebound, triggered by the announcement of a ceasefire in the conflict between the United States, Israel and Iran.

Dogecoin (DOGE) Price Prediction in 2025

Currently, optimism is growing regarding the potential approval of more Dogecoin ETF products. These approvals are expected to significantly boost DOGE adoption before the end of the year.

If institutional demand manages to push the price of DOGE through the resistance at $0.39, then the next target is the previous high of $0.484. If the rally continues and is able to surpass that level, then the $1.00 psychological mark is not impossible to reach.

However, if the price is again rejected at the $0.39 resistance level by the end of 2025, there is a possibility that DOGE will correct and return to the $0.13 demand zone.

The remainder of 2025 will be a crucial moment for Dogecoin, as its price movement is highly dependent on how the market – especially institutional investors – responds to these key support and resistance levels.

Dogecoin (DOGE) Price Prediction for 2026 – 2030

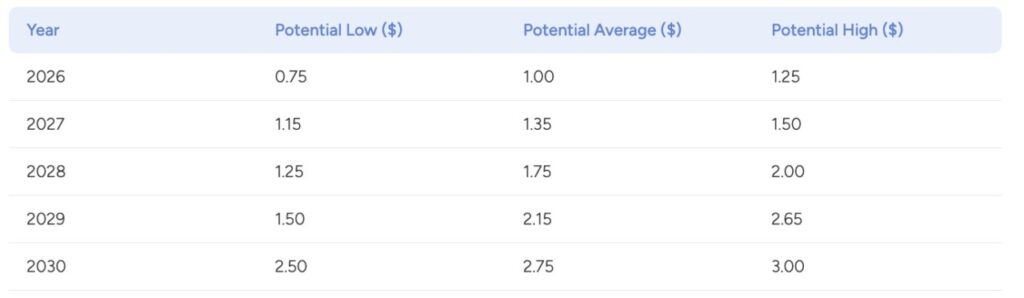

The following prediction table, which is based on historical movements and projected gradual market capitalization growth each year, shows that the price of DOGE could potentially reach $3 by 2030.

Read also: 3 Potential Altcoins Targeted by Crypto Whale amid Black Friday 2025 Discounts!

This table serves as a frame of reference to understand the potential direction of DOGE price movements in the future.

However, it should be noted that the actual price will be heavily influenced by various factors – including market dynamics, investor behavior, as well as other external factors that make up the crypto ecosystem as a whole.

Can DOGE Break the $1 Barrier?

Given Dogecoin’s success so far-largely driven by hype, albeit accompanied by some technical advancements-reaching a price of $1 by 2025 is still a realistic possibility.

If media enthusiasm continues on a massive scale, coupled with more cooperation or support from well-known personalities and brands, bullish momentum could be maintained.

In addition, increased adoption of Dogecoin by merchants as a means of payment will also strengthen confidence in the long-term sustainability of its value.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference: