The main tag of Crypto News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Solana Price Prediction 2025

Solana trades at $127.45, down 31% last 30 days, as fresh volatility shakes the altcoin market. Yet behind that pullback, institutional demand tells a different story. Six new spot Solana ETFs have gone live, each offering unique exposure models. This sharp split between price action and capital flow has turned SOL into one of the most-watched tokens in late 2025. Traders now ask one thing: can these inflows trigger a trend reversal?

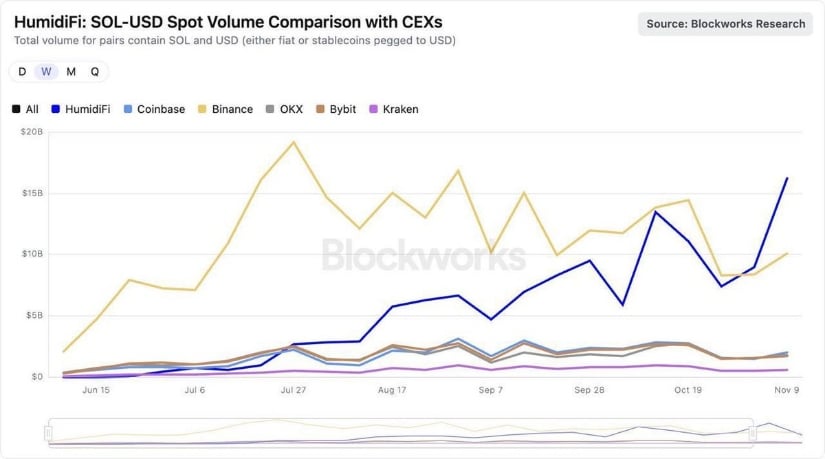

ETF Momentum Fuels Institutional Exposure

Solana-based ETFs are expanding fast. 21Shares’ new spot ETF goes live, following its Cboe approval and a competitive 0.21% management fee. Fidelity entered the market with FSOL on NYSE Arca. It includes a staking component and quickly positioned Fidelity as the largest traditional manager offering a SOL product.

VanEck, Canary Capital, Bitwise, and Grayscale now round out the ETF lineup. Combined, SOL ETFs already hold more than $2 billion. That number grows even as SOL’s price falls. Interesting, right? ETF inflows reached $26.2 million on November 18, marking the 15th straight positive day.

When ETFs absorb capital during sell-offs, it often signals long-term conviction. It makes you wonder: are institutions preparing for a deeper move next year?

Bullet points worth noting:

-

SIX U.S. spot SOL ETFs now trade

-

Staking-enabled ETFs attract yield-driven participants

-

Zero-fee launhes from some issuers heighten competition

-

ETF inflows outpace those of BTC and ETH this week

This dynamic signals belief in Solana’s throughput, cost efficiency, and maturing ecosystem.

Why SOL Attracts Institutions

A few themes drive this pivot:

-

Solana’s fast confirmation speeds

-

High-stakes yield appeal

-

A real ecosystem of DeFi, NFTs, and consumer apps

-

Strong developer retention

Institutions love efficiency. Solana offers that. Even with price weakness, institutions keep allocating. They view SOL as a high-conviction play heading into 2026.

Technical Analysis

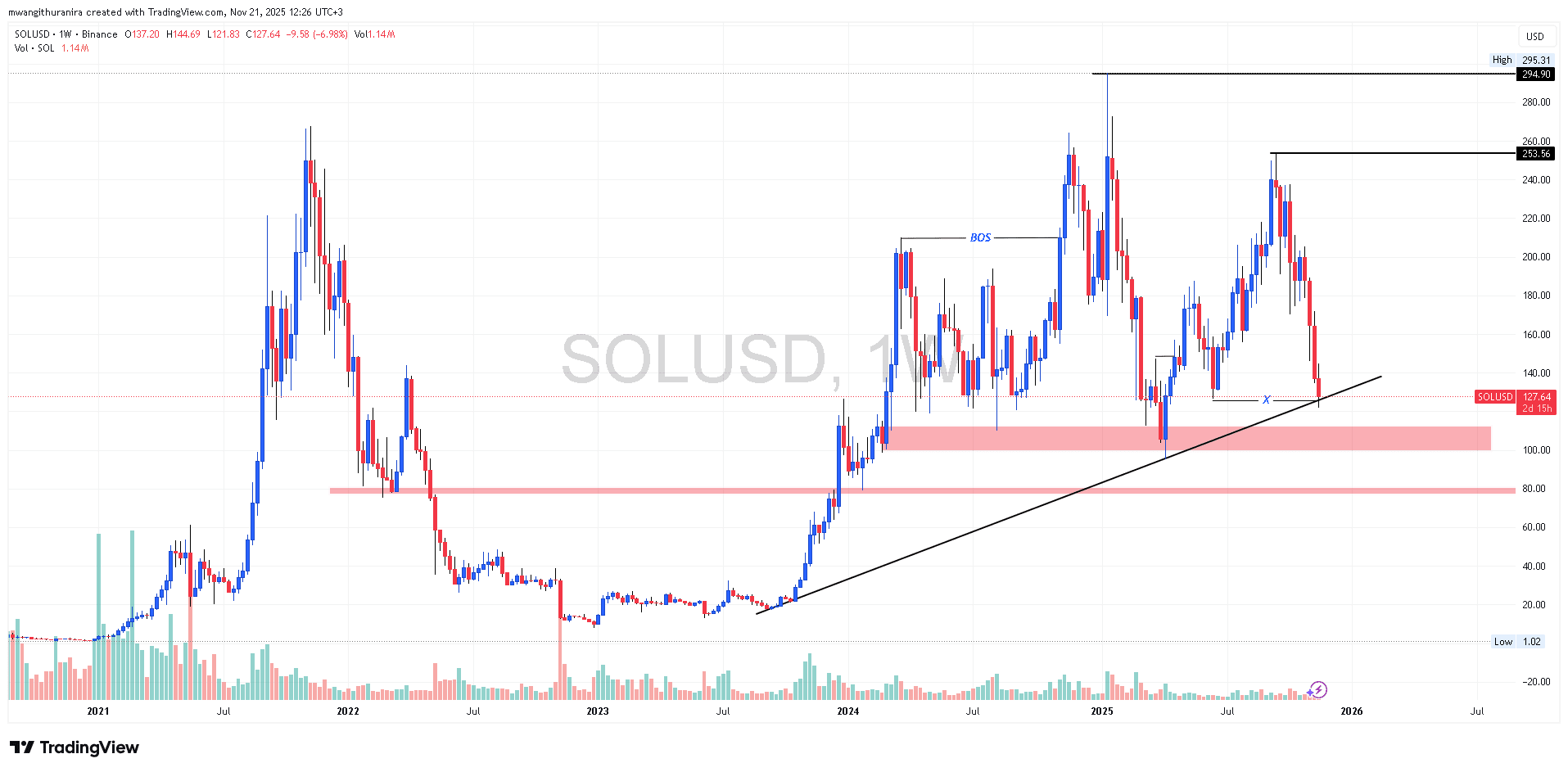

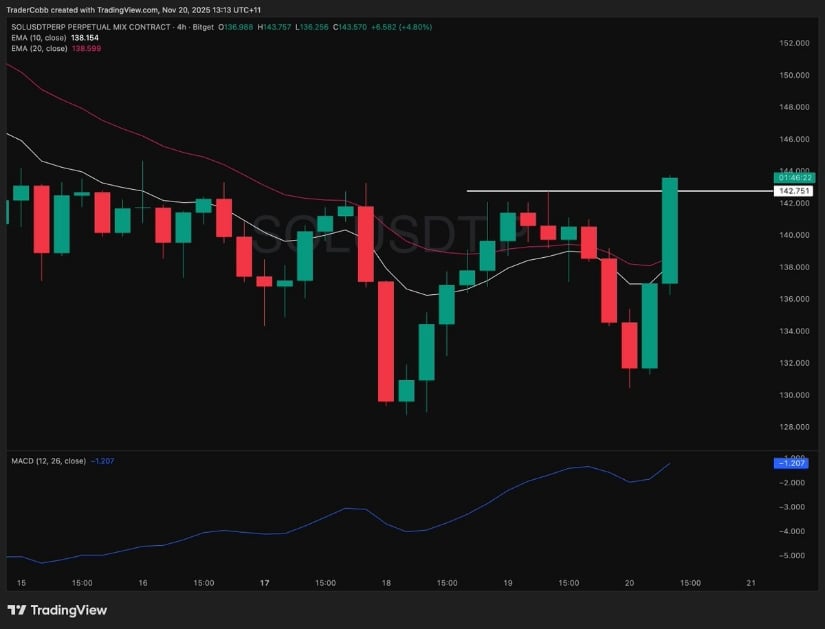

SOL sits on a strong ascending-trendline support. This support has been held many times this year and the current retest comes after liquidity grabs near $127, which often mark local swing points.

Source: X

If support holds:

-

First target: $253

-

Second target: $295

-

Breaks above these confirm new highs in 2026

If support fails:

-

Demand zone: $110–$100

-

Failure of that zone: drop toward $80

Clear levels. Clear reactions. This is why traders eye this zone so closely.

Prediction Table (2025)

| Nov 2025 | $115 | $130 | $150 |

| Dec 2025 | $118 | $138 | $165 |

| 2025 Full Year | $110 | $190 | $295 |

Open Interest Collapse

Source: X

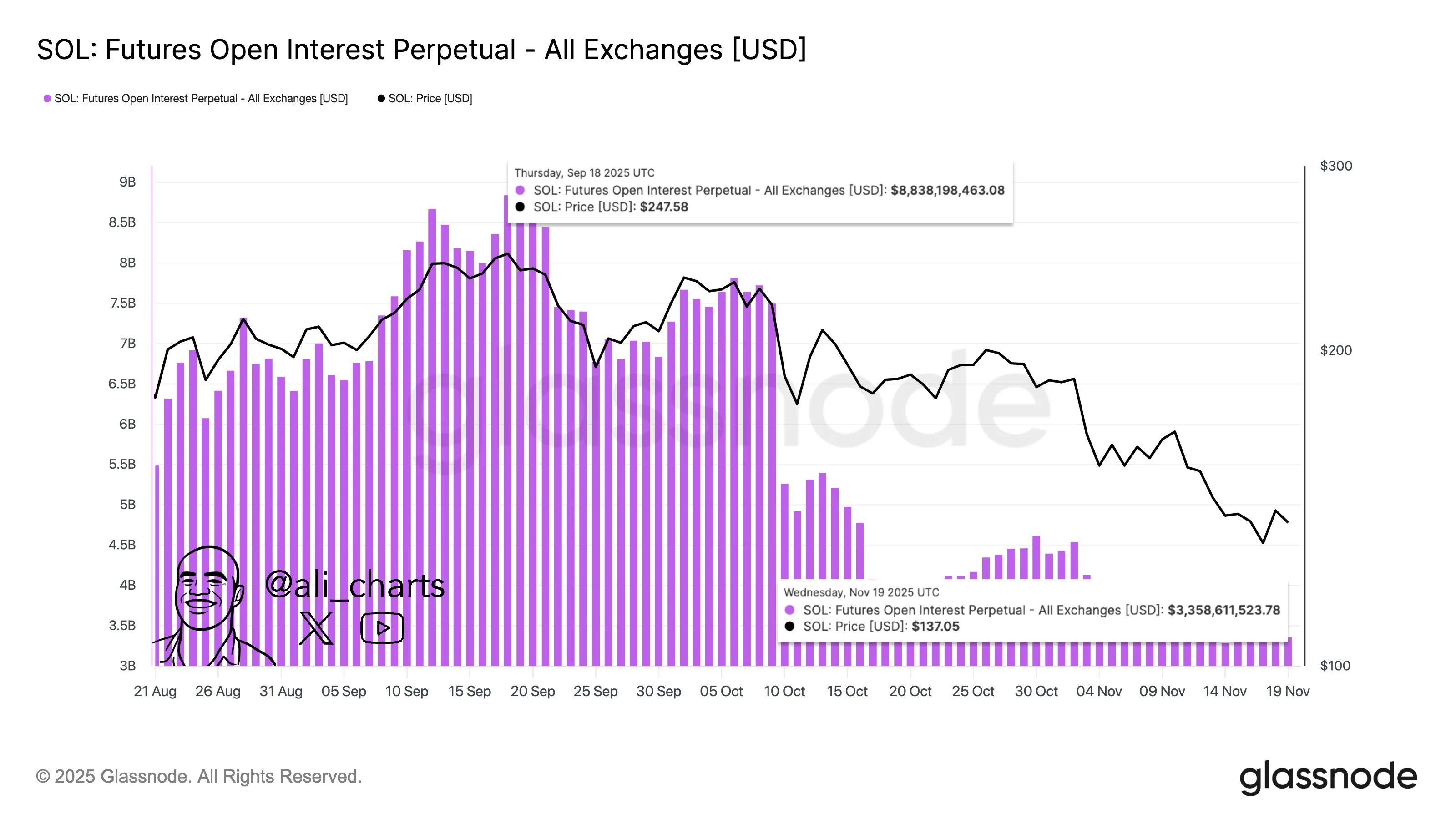

Open interest dropped from $8.84B to $3.36B over three months as stated in X by Ali Charts. That’s huge. But what does it mean?

-

Less speculation

-

Reduced leveraged positions

-

More spot-driven movement

-

Potential for sharp volatility bursts

OI resets often precede trend reversals. When price holds support during OI collapses, strong rallies can follow. But if both collapse together, deeper selling can unfold. Therefore, monitor how OI behaves near $127 support.

Market Context and 2025 Outlook

The launch of multiple ETFs in a single week creates a strong setup for Solana’s next cycle. Inflows show that institutions believe SOL can mirror Bitcoin’s ETF-driven breakout from 2024. The symmetrical-triangle structure that has formed over the past year still holds. A bounce at current support keeps the pattern intact and sets the stage for a higher-timeframe reversal.

The question everyone asks: can SOL replicate a similar 10x ETF rally? The answer depends on the strength of this support zone, ETF inflow consistency, and macro sentiment into Q1 2026.

Solana’s ecosystem growth, staking appeal, and real demand make it one of the strongest altcoins heading into next year. For now, traders watch the chart. Institutions watch inflows. The next move likely comes from whichever group acts first.