The main tag of Forex News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

ISM beats previous, can NFP drive break above 150?

- USD/JPY holds near 149 after ISM PMI improved from 48.0 to 48.7. Can NFP push the pair through 150 or trigger a pullback?

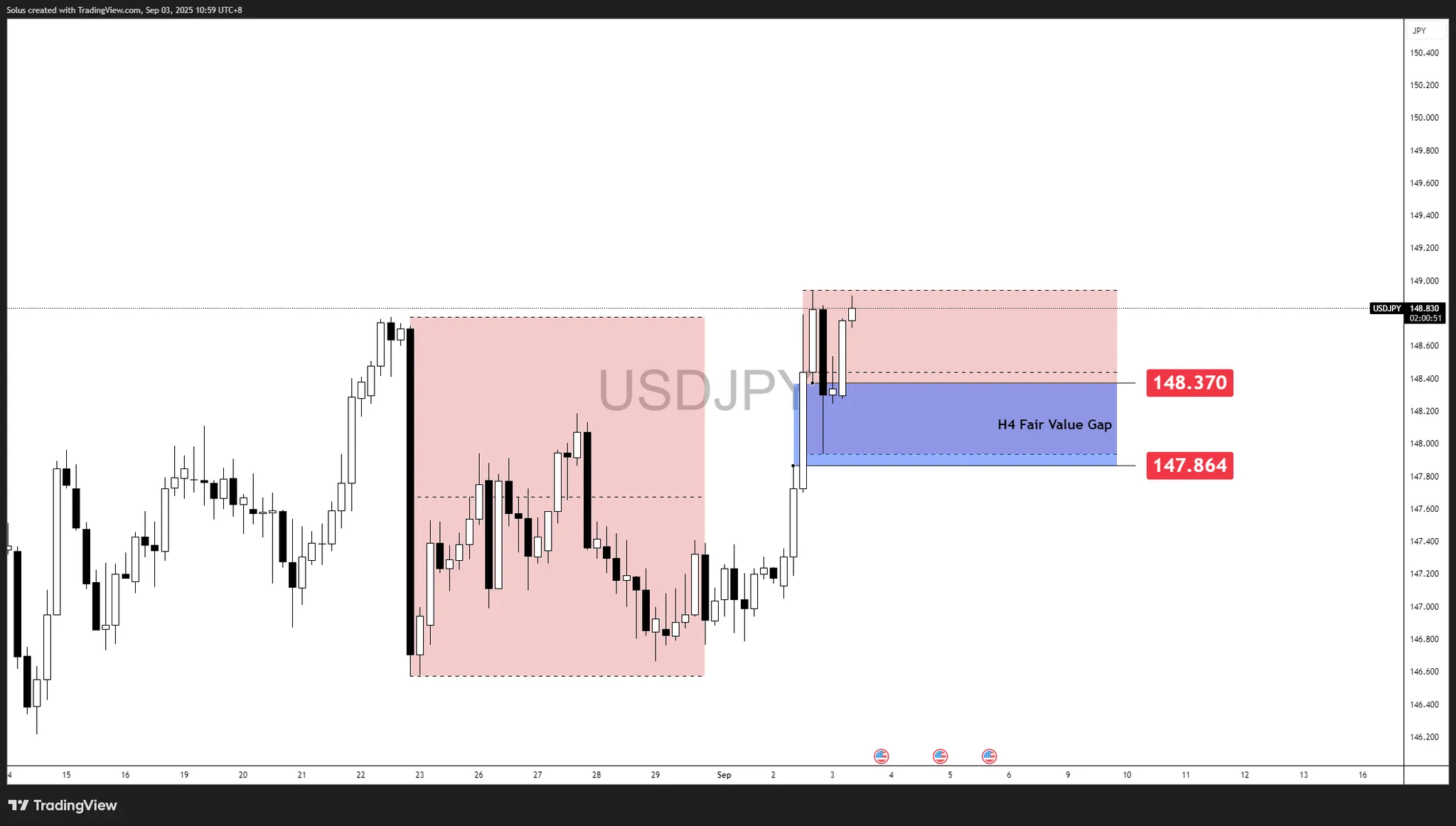

- USD/JPY extends higher after bouncing off the H4 Fair Value Gap (147.864–148.370) and is retesting the 149.00 resistance with 150.00 back in sight.

- BoJ’s cautious stance keeps the yield gap wide while U.S. data shows incremental improvement, sustaining dollar demand.

- A clean break above 149.00 unlocks a run toward 150.00–151.20; a firm rejection at 149.00 risks a dip back into 148.37–147.86 before NFP.

Why USD/JPY stays bid

Dollar-yen is trading heavy-on-the-upside: U.S. yields remain comparatively firm and the BoJ continues to signal patience on policy normalization, reinforcing the positive carry in favor of USD.

BoJ’s cautious stance: Policy divergence widens (concise)

The BoJ remains deliberately cautious, emphasizing the need for sustained wage-led inflation before meaningful tightening. With JGB 10-year yields near ~1% versus much higher U.S. Treasury yields, the carry incentive favors holding dollars over yen. That yield differential is a persistent structural tailwind for USD/JPY, keeping dips shallow and making pullbacks into demand zones (like your H4 FVG) buyable until the BoJ signals a firmer path to normalization.

ISM PMI: Missed forecast, but trend improved (why USD popped)

ISM Manufacturing PMI (Aug) printed 48.7, a touch below 49.0 forecast – but above the previous 48.0. Markets read that as stabilization rather than deterioration, and the USD caught a bid despite the “contractionary” label. This is a good reminder that direction of change often beats the absolute level.

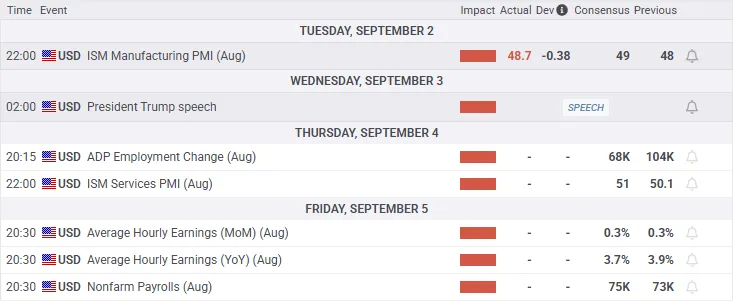

Red-folder watch (this week)

- JOLTs Job Openings (Wed)

- ISM Services PMI (Thu)

- Nonfarm Payrolls + Unemployment Rate (Fri)

Technical outlook: H4 FVG bounce → 149 retest

USD/JPY has bounced off the H4 FVG (147.864–148.370) decisively and pressing back into 148.80–149.00, where supply capped prior attempts. That reaction confirms active demand inside the gap and keeps the bullish structure intact into Friday’s data.

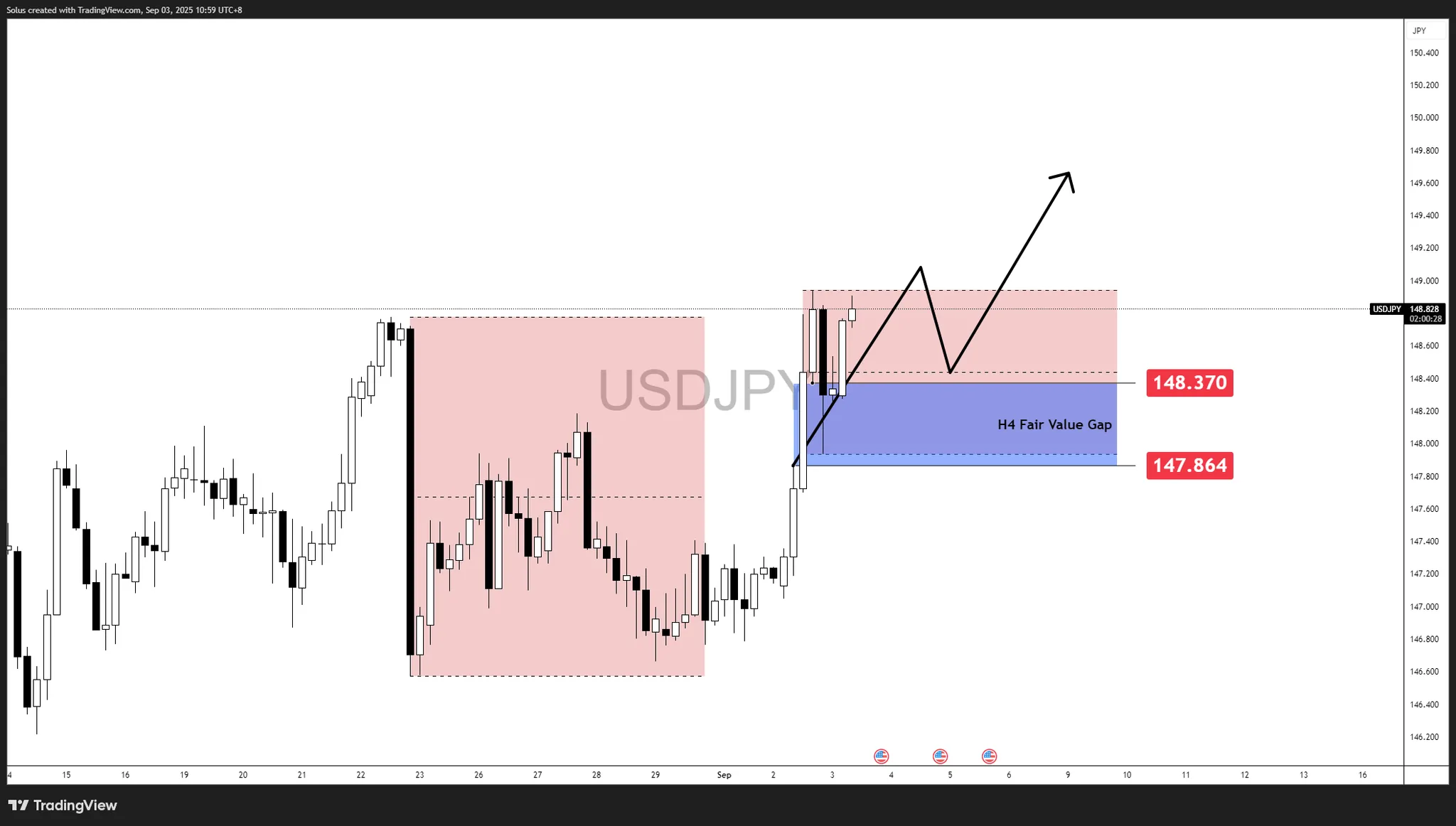

Bullish scenario: FVG demand holds, breakout above 149 in play

On the chart, price reacted cleanly from the H4 Fair Value Gap (147.864–148.370), confirming it as a demand zone. That bounce carried USD/JPY back into the 148.80–149.00 resistance band, where sellers capped momentum previously. If bulls can force a breakout above this zone, the path toward the psychological 150.00 handle opens up.

- A sustained close above 149.00 signals continuation.

- Next liquidity rests at 149.50 before the round 150.00.

- Break of 150 unlocks extension targets at 150.70–151.20.

- FVG remains the defense line; pullbacks into 148.37–148.20 can act as continuation setups.

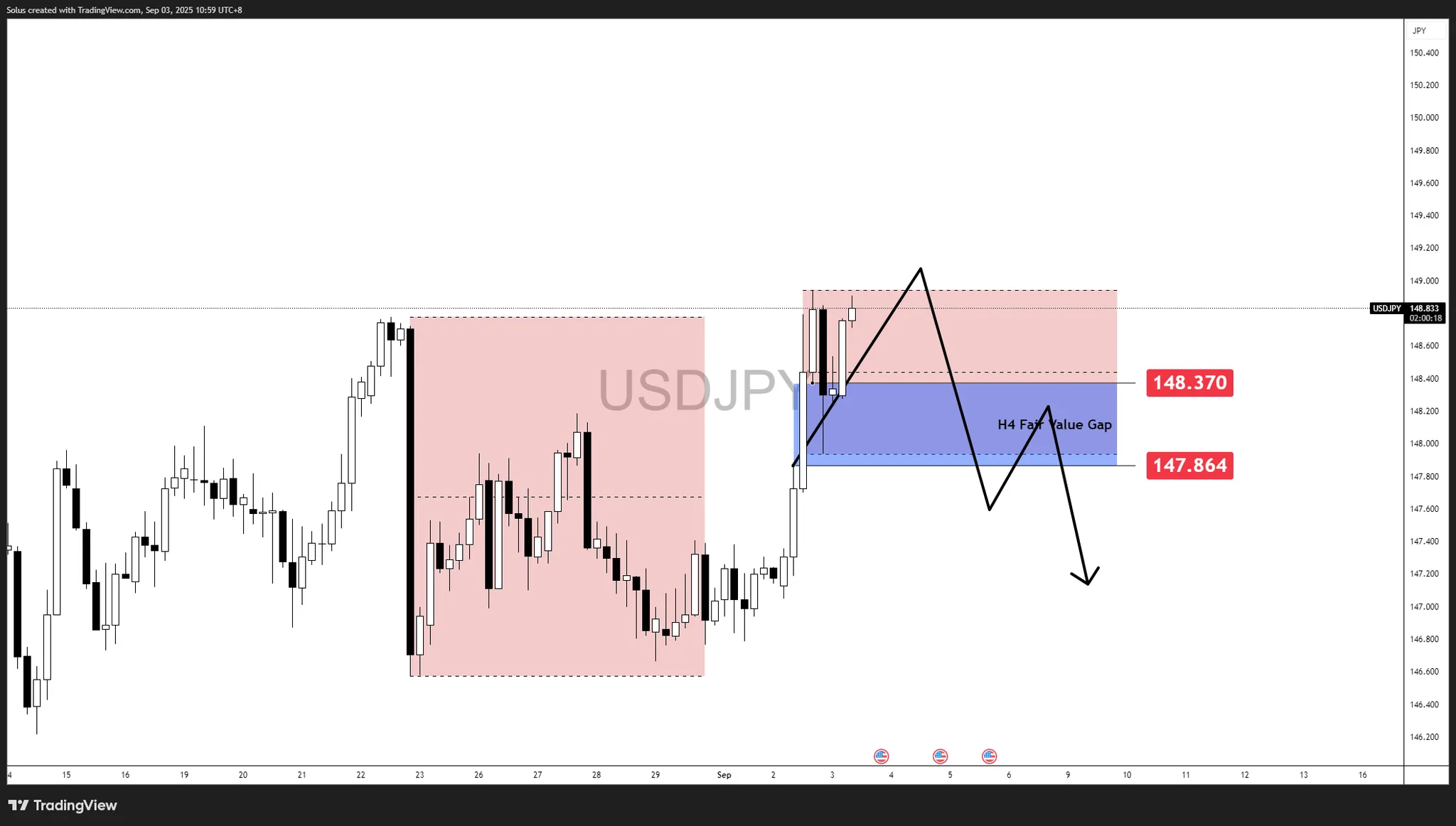

Bearish scenario: Rejection at 149, back into the gap

The same chart also highlights the risk: 149.00 is still acting as firm resistance. If price fails to clear this zone and prints rejection wicks or bearish engulfing patterns, sellers may regain control. That would likely send USD/JPY back into the H4 FVG (147.864–148.370) to test demand again.

- Failure at 149.00 brings downside back to the FVG mid-point (~148.20).

- Break below 147.864 signals demand exhaustion.

- If that occurs, price risks a deeper move to 147.20 → 146.80–146.20.

- Such a shift would frame the August rebound as distribution at premium pricing.

NFP game plan: Jobs data as the decider

Friday’s Nonfarm Payrolls (NFP) and Unemployment Rate will likely act as the catalyst that decides whether USD/JPY breaks cleanly above 149.00 or falls back into the H4 Fair Value Gap (147.864–148.370).

Bullish NFP outcome (supports breakout above 149)

If headline NFP beats expectations (>75K) and unemployment holds steady or drops:

- Markets will interpret it as labor resilience.

- Yields stay firm, reinforcing the dollar’s edge over the yen.

- USD/JPY would likely break above 149.00 quickly, targeting 149.50 → 150.00 into early next week.

- Strong upside surprise could even accelerate toward 150.70–151.20 liquidity zones.

Bearish NFP outcome (triggers rejection at 149)

If NFP misses (<75K) and unemployment ticks up (>4.3%):

- Dollar sentiment weakens, and yields soften.

- USD/JPY would likely reject 149.00, slipping back into the FVG for retests.

- Break below 147.864 exposes 147.20 → 146.80–146.20 downside liquidity.

- Weak data could reframe the recent rally as distribution at premium levels.