The main tag of Forex News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Weekly Forex Forecast For DXY, EURUSD, GBPUSD, USDJPY, And XAUUSD (June 23-27, 2025)

Can the US dollar finally carve out a significant bottom next week? The signs are there, but buyers have work to do.

Watch today’s Weekly Forex Forecast to see how I’m trading the DXY, EURUSD, GBPUSD, USDJPY, and XAUUSD!

US Dollar Index (DXY) Forecast

The DXY is attempting a significant breakout this week. I have discussed the February trend line in recent videos, combined with the massive confluence of support at 97.70.

So far, the USD index has bounced at 97.70, but buyers are struggling to break above the 99.00 mark. That isn’t surprising, given the significance of the 2025 trend line.

As mentioned in recent videos, step one for the DXY to confirm a bottom occurred with Tuesday’s 98.30 breakout. Step two is to break 99.00, which has yet to happen.

There is an intraday imbalance just below 98.30 that could come into play soon. I would like to see the DXY clean up the 98.29 single print before looking for USD longs next week. While there’s no guarantee, it would be ideal from a liquidity standpoint.

Key support for DXY is 98.30, with resistance at 99.00 and 100.20.

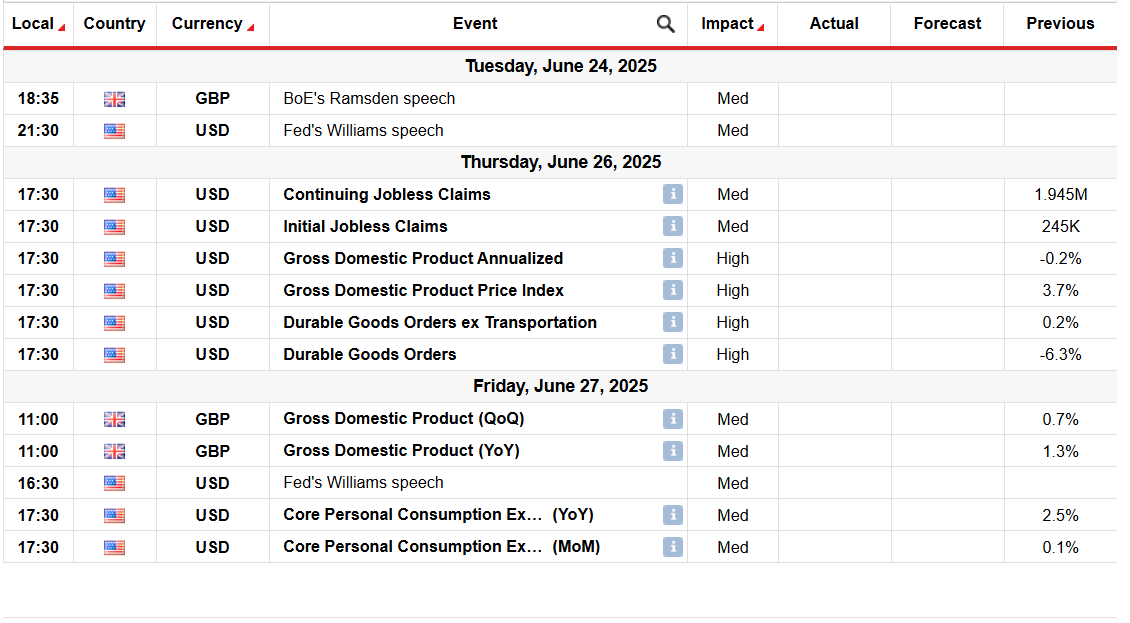

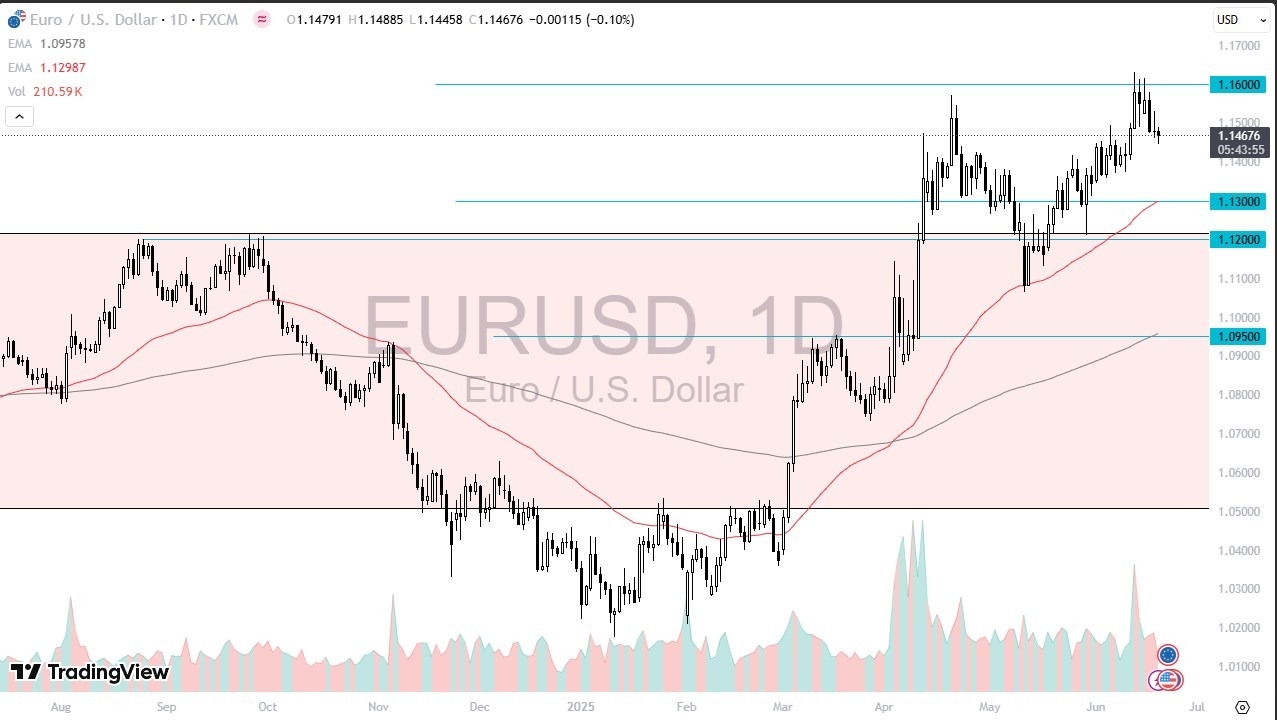

EURUSD Forecast

EURUSD has an important decision to make. The pair failed to hold the 1.1530 breakout during Tuesday’s session, pointing to a potential euro top.

However, EURUSD bulls saved the uptrend with Thursday’s bounce from 1.1440. That leaves the pair in a stalemate between 1.1530 and 1.1440.

There is a buy-side single print at 1.1540 that could come into play next week. How the EURUSD reacts to that (if tested) could determine the next big move for the euro.

I remain short the EURUSD from 1.1522. Any sustained break above 1.1530 on the high time frames would invalidate the idea.

GBPUSD Forecast

GBPUSD is at a similar crossroads to its euro counterpart. The pair broke its rising wedge on Tuesday, but buyers stepped in at 1.3430 support on Thursday.

For now, GBPUSD remains locked between 1.3430 support and 1.3630 resistance. However, Tuesday’s breakdown left a buy-side imbalance near 1.3540, which is also key resistance.

If the pound is going to reverse lower, the 1.3540 resistance area needs to hold next week. Additionally, GBPUSD will need to fall convincingly below 1.3430 to secure a significant top for the pound.

Remember that the DXY also needs to break its 2025 trend line resistance convincingly to confirm a dollar bottom.

USDJPY Forecast

USDJPY is breaking above the 145.40 key level I’ve discussed in recent videos. That was one factor needed to confirm a high probability long setup.

The second factor is the DXY breaking its trend line resistance, which it’s close to achieving. And the third factor is the Yen Basket failing to hold its 2020 trend line.

We are incredibly close to the perfect storm for yen shorts. The only thing left is to see the Yen Basket close a week below its 2020 trend line and the DXY clear its 99.00 trend line.

Of course, there are no guarantees. If these scenarios don’t pan out

XAUUSD (Gold) Forecast

XAUUSD struggled this week after closing below $3,388. That was the bearish scenario for gold that I outlined in the last Weekly Forex Forecast.

However, despite the US dollar starting to look more bullish, I’m not interested in gold shorts. The metal has trended higher for years, and I don’t see a clear opportunity to get short.

At the same time, buying XAUUSD is a challenge while below all-time highs.

A pullback into $3,250 could be interesting for a long. However, given how strong gold has been lately, I’m not convinced we’ll see the yellow metal get that low.

Alternatively, a sustained break above $3,430 on the high time frames would open up $3,500.