June 16, 2025 – Written by David Woodsmith

STORY LINK Pound-to-Euro Week Ahead Forecast: BoE Cuts to Weaken GBP Sterling

Foreign exchange strategists at RBC Capital Markets (RBC) see scope for the GBP/EUR exchange rate to strengthen to at least 1.20 over the next 2-3 months, provided risk conditions remain benign.

It does, however, forecast that the GBP to EUR rate will slide to 1.11 at the end of 2026.

In contrast, Scotiabank forecasts that the Pound Sterling can hold just above 1.20 against the Euro by the end of 2025

GBP/EUR dipped to 7-week lows during the week as evidence of a weaker labour market and GDP disappointment undermined the Pound. There was little net impact from the government spending review, although underlying reservations continued.

RBC sees a notable divergence between the short and medium-term views.

On a short-term view it commented; “As we head into the summer, GBP could stand to gain a bit more if markets settle into carry-hunting mode.”

The bank remains very cautious over the medium-term outlook; “As a long-term c/a deficit country, the UK runs a 280bn negative net international investment position with the rest of the world. It does not have the large stock of foreign assets invested in the US that the Euro area or Japan have.

RBC added; “It is also exposed to global trade wars as a small open economy and fiscally constrained in its ability to support growth through deficit spending.”

The Pound will inevitably be more vulnerable if the economy deteriorates.

The latest labour-market release suggested that there had been significant deterioration with a slide in payrolls, while unemployment hit a 4-year high and wages growth slowed more than expected.

GDP also contracted 0.3% for April after a 0.2% expansion the previous month.

HSBC commented; “our forecast is for a small fall back in Q2. That said, we should not over interpret. A negative GDP print in Q2 would not necessarily suggest recession risks, but payback from an artificially strong Q1.”

There are strong expectations that the Bank of England will hold interest rates at 4.25% in the week ahead. There is, however, speculation over more dovish guidance.

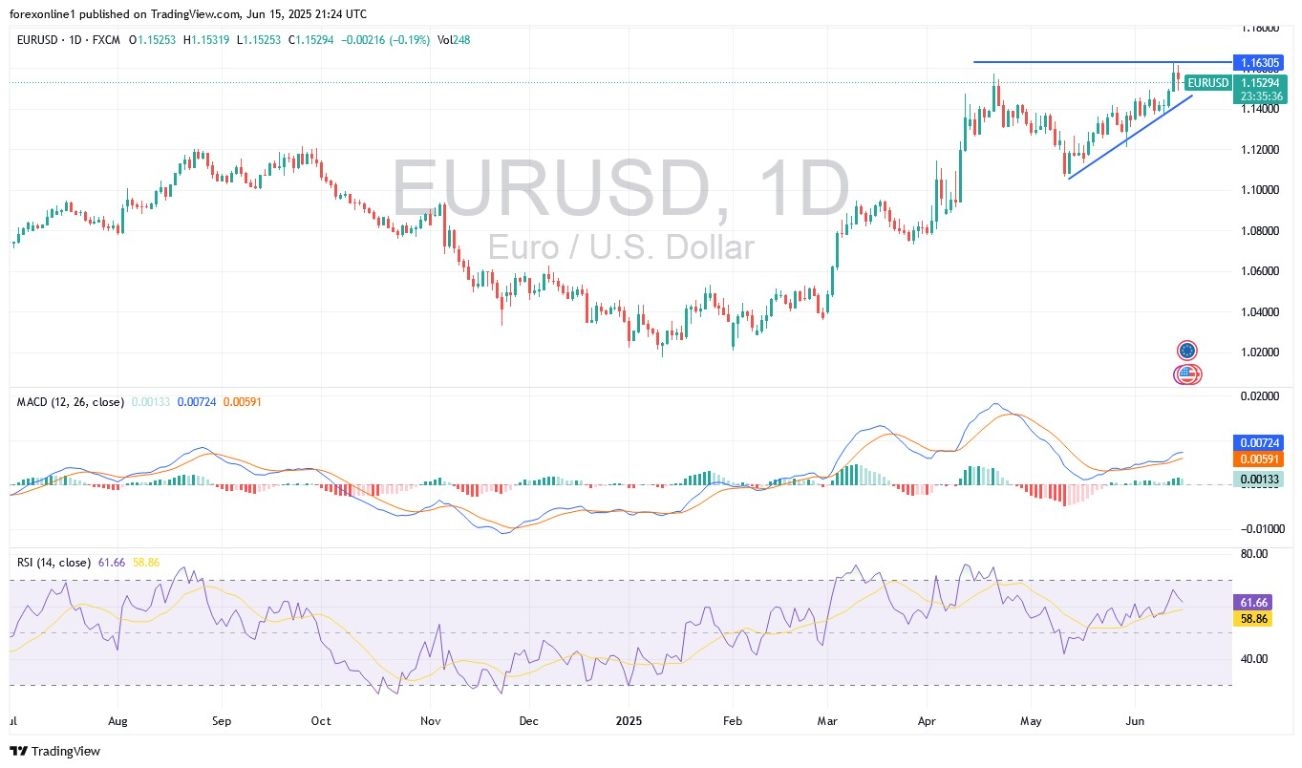

According to Danske Bank; “While markets have increasingly converged to our view of two further rate cuts from the BoE this year, we see risks further skewed to the downside. With slower activity and the scope for more aggressive BoE easing, we see this supporting our view a move higher in EUR/GBP, which we target at 0.87 in 6-12 months.” (GBP/EUR losses to just below 1.1500.)

According to Goldman Sachs; “We expect the labour market to loosen further in the coming months. A looser labour market is in turn likely to further reduce pay pressures.”

Commerzbank commented; “the market is now pricing in significantly more interest rate cuts by the Bank of England this year than at the beginning of the year. As we have emphasised several times, the path towards a stronger pound remains narrow, even if we do not want to overinterpret a single data release.”

Credit Agricole notes fundamentals reservations, but sees scope for Pound resilience; “Yet, as long as the UK economy continues to at least fare as well as the Eurozone, the GBP may still be able to eke out marginal gains over the EUR, especially as it retains a more compelling rate appeal.”

HSBC expects fundamentals will support the Euro; “Not only has the Eurozone growth narrative turned more positive following Germany’s large infrastructure and defence fiscal package, but the ECB has also returned the policy interest rate to the estimated neutral rate.

It added; “In contrast, the BoE has kept policy restrictive, some way above the estimated neutral rate. If UK data remain weak and CPI slows, markets may price more BoE rate cuts, which would likely weaken GBP against the EUR.”

Like this piece? Please share with your friends and colleagues:

International Money Transfer? Ask our resident FX expert a money transfer question or try John’s new, free, no-obligation personal service! ,where he helps every step of the way,

ensuring you get the best exchange rates on your currency requirements.

TAGS: Pound Euro Forecasts