The main tag of Forex News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

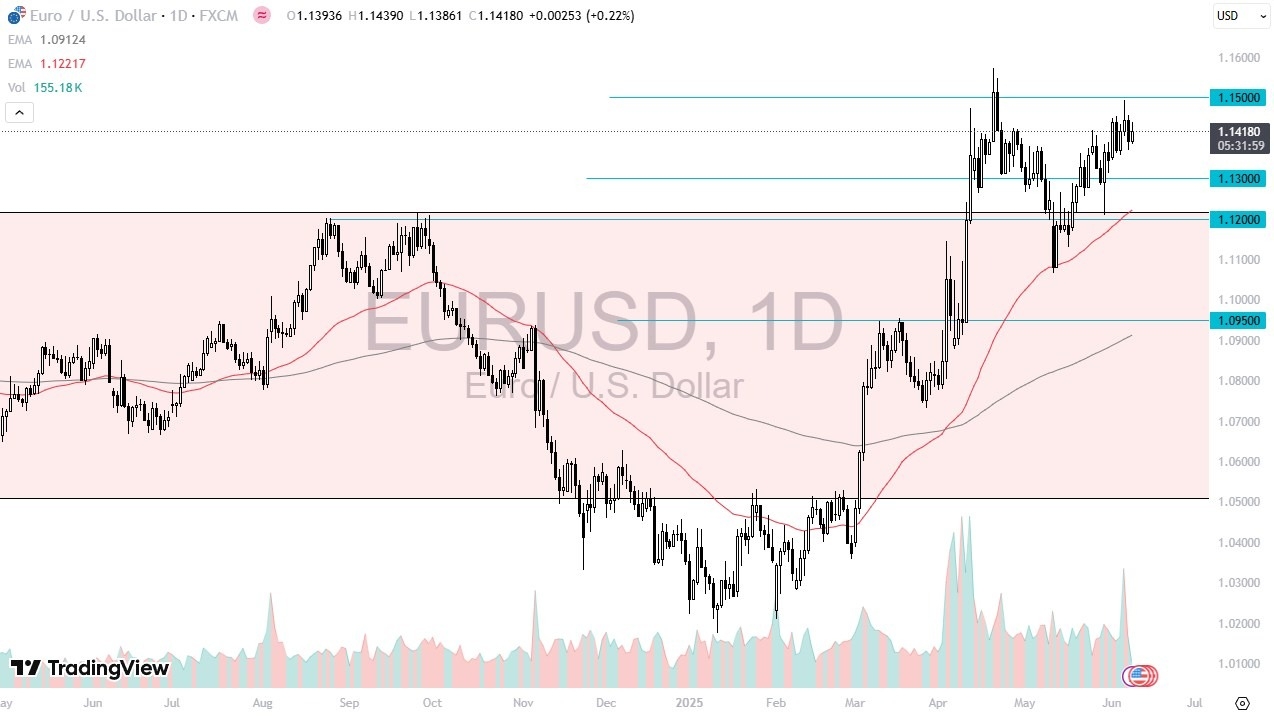

EUR/USD Analysis Today 11/6 Cautious Stability Ahead (Chart)

EUR/USD Analysis Summary Today

- Overall Trend: Bullish

- Today’s EUR/USD Support Levels: 1.1370 – 1.1300 – 1.1220

- Today’s EUR/USD Resistance Levels: 1.1470 – 1.1520 – 1.1600

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1340 with a target of 1.1420 and a stop-loss at 1.1300.

- Sell EUR/USD from the resistance level of 1.1480 with a target of 1.1200 and a stop-loss at 1.1540.

EUR/USD Technical Analysis Today:

As anticipated, the EUR/USD pair remains within its current range, showing bullish momentum as markets and investors await the release of US inflation figures later today. These figures, due at 3:30 PM Egypt time, will significantly impact market expectations for the future monetary policies of the US Federal Reserve. Yesterday, the EUR/USD price jumped to the 1.1447 resistance level, close to its three-year high of 1.1572 recorded in April, as traders closely monitored developments in ongoing US-China trade talks.

Trading Advice:

We still recommend selling the EUR/USD on any upward bounce and avoiding risk, regardless of the strength of the trading opportunities.

Meanwhile, investors are assessing comments from European Central Bank (ECB) officials for clues on the bank’s next policy moves. Governing Council member François Villeroy de Galhau indicated that the ECB can still act quickly to adjust interest rates, even after its eighth consecutive cut, which he stated “returned to normal” in monetary policy. Last week, the ECB cut interest rates as expected, but Governor Christine Lagarde suggested that the monetary easing cycle might be nearing its end. The deposit facility rate is now 2%, while Eurozone inflation fell to 1.9% in May 2025. Concurrently, the bloc’s economy grew by 0.6% in the first quarter of 2025, its fastest growth rate since Q3 2022.

Technical Outlook for EUR/USD Today:

Based on the daily timeframe chart, the EUR/USD currency pair remains on a bullish trajectory, supported by the stability of currency bulls around and above the 1.1400 resistance. This stability is pushing the 14-day RSI (Relative Strength Index) near the 60 reading, which reinforces bull dominance and anticipates stronger gains before the indicator reaches overbought territory. Simultaneously, the MACD (Moving Average Convergence Divergence) indicator confirms the upward path. The bulls’ next key targets are the resistance levels of 1.1520 and 1.1600, with signs of overbought conditions likely to begin around the latter level. Conversely, over the same period, the support levels of 1.1220 and 1.1165 remain crucial for bears to break the current bullish trend of the currency pair.

Goldman Sachs Raises EUR/USD Price Forecast

Goldman Sachs has raised its forecasts for the EUR/USD pair, citing relatively weaker equity performance for Euro-based investors, declining foreign appetite for US assets, and a confirmed slowdown in US economic activity. On another note, according to performance across stock trading platforms, US equities may appear stable in USD value, but they have fallen by 8% year-to-date for Euro investors, making EU stocks relatively more attractive. Overall, the less appealing US investment climate is prompting global investors to diversify their investments away from the US dollar and USD-denominated assets.

Recently, recent macroeconomic indicators support the narrative of slowing US economic activity, reinforcing the argument for continued USD depreciation.

Consequently, Goldman Sachs has raised its EUR/USD targets to:1.17 over 3 months

1.20 over 6 months

1.25 over 12 months

These targets are higher than the previous 1.12, 1.15, and 1.20 set after the “Liberation Day” policy announcement. In general, Goldman Sachs maintains its structurally bearish outlook on the US dollar, driven by macroeconomic divergence and global capital reallocation. From their perspective, the EUR/USD trend remains bullish, with 1.25 now being the 12-month target.

Ready to trade our EUR/USD analysis and predictions? Here are the best European brokers to choose from.