The main tag of Forex News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

EUR/USD Analysis Today 02/06: Selling Pressure (Chart)

EUR/USD Analysis Summary Today

- Overall Trend: Upward.

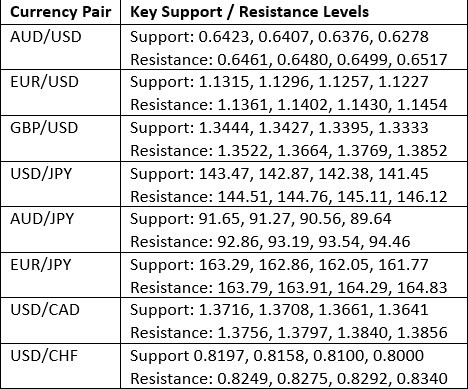

- Today’s Euro-Dollar Support Levels: 1.1300 – 1.1220 – 1.1170.

- Today’s Euro-Dollar Resistance Levels: 1.1385 – 1.1460 – 1.1530.

EUR/USD Trading Signals:

- Buy Euro-Dollar from the 1.1240 support level with a target of 1.1420 and a stop-loss of 1.1150.

- Sell Euro-Dollar from the 1.1430 resistance level with a target of 1.1100 and a stop-loss of 1.1510.

EUR/USD Technical Analysis Today:

we expect the EUR/USD price to move within narrow ranges around last week’s closing levels, awaiting market and investor reactions to this week’s significant economic events and data. These include the European Central Bank’s monetary policy decisions and US jobs figures. The Euro-Dollar is currently in a neutral position with a greater upward bias, led by bulls pushing towards the 1.1400 resistance level.

Technically, this resistance is sufficient to push the 14-day Relative Strength Index (RSI) away from the midline and also lift the MACD indicator lines higher. Today’s Euro-Dollar trading will be influenced by the release of the Manufacturing Purchasing Managers’ Index (PMI) for European economies. This will start with the Spanish reading at 10:15 AM EEST, followed by the French, Italian, and German readings, respectively. The US reading will be later on the same day at 5:00 PM EEST. Three hours later, there will be new statements from Federal Reserve Governor Jerome Powell.

US-European Trade Dispute and Its Impact on Exchange Rates

There will be important repercussions for trade negotiations between the European Union and the United States. For example, trade talks between the EU and the US will see a reduction in the urgency to make concessions. According to forex trading experts, the influence of Trump administration trade representatives in their negotiations with trade partners has certainly diminished. Consequently, the selling of the US dollar was one of the largest “tariff deals,” and thus, with tariffs now threatened, this position is expected to unravel. However, for now, the Euro’s losses against the dollar have been minimal.

In another context, analysts pointed out that the Federal Reserve’s May monetary policy meeting minutes were relatively hawkish, with comments indicating that almost all committee participants noted the risk of inflation persisting longer than expected. Overall, financial markets believe that the probability of a US interest rate cut by the Federal Reserve in July does not exceed 20%.

Uncertainty surrounding the economy as a whole will be renewed, and there will also be an impact on budget revenues.

Forecasts for ECB Decisions This Week:

The European Central Bank will hold its latest monetary policy meeting this week, with financial markets confident of an additional 25 basis point cut in the deposit rate to 2.00%. RBC Capital Markets expects a difficult meeting, stating: “We believe there are sharp divisions on the board, and we would be very surprised if the decision was unanimous.” There is also much less conviction about the outlook. According to ING: “Unless trade tensions escalate strongly, we believe the ECB will prefer to take a wait-and-see approach over the summer.”

According to the results from the economic calendar data, German retail sales data was weaker than expected, falling by 1.1% for April. Therefore, Wells Fargo does not expect sustained support for the Euro, stating: “In our view, the European currency will continue to face the reality of weak sentiment and confidence surveys, and disappointing growth performance.”

Credit Agricole is also cautious about the Euro’s outlook, as the Eurozone remains in a dilemma, with the latest estimates pointing to stagnant economic activity and a significant slowdown in inflation. In this context, the ECB is likely to lower its growth and inflation forecasts, along with cutting interest rates for the seventh consecutive time.

European Stock Market Performance and Future Gains

According to trading on stock brokerage platforms, both the Euro Stoxx 50 and Stoxx 600 indices closed near flat last Friday but achieved gains exceeding 3.5% in May, marking their strongest monthly performance since January. The oil and natural gas, healthcare, and utilities sectors led this rally. Investors were digesting new inflation data from the Eurozone’s largest economies, with consumer price index figures showing a decline in inflation in Germany, Italy, and Spain, which could give the European Central Bank more room to cut borrowing costs at its upcoming meeting this week.

Meanwhile, increasing uncertainty regarding the ongoing US trade dispute prevented further gains. A federal appeals court temporarily reinstated President Donald Trump’s tariffs, just one day after a trade court ruled that he had exceeded his authority. In the interim, US Treasury Secretary Scott Bessent stated that trade talks with China are “a bit stalled.” Among individual stocks, SAP (+1.2%), Siemens (+1.6%), and L’Oréal (+1.7%) were among the best performers, while Sanofi lagged the most, falling by 4.4%.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.