Donald Trump, the former U.S. President, has sparked considerable attention in the Web3 community with his deepening involvement in the cryptocurrency market.

In recent years, “Trump crypto” has evolved from a trending search term into a broader phenomenon – reshaping how the public perceives the intersection between politics and blockchain technology.

The Trump crypto narrative can be divided into two key areas: tokens and NFTs. This article provides a comprehensive look into both, exploring everything from NFT launches and policy stances to notable statistics and the potential long-term impact should Trump return to the presidency.

The Launch of TRUMP Coin: Donald Trump’s Foray into Solana and Political Branding

On January 17, 2025 – just three days before his second presidential inauguration, Donald Trump officially launched his namesake cryptocurrency token, TRUMP coin, on the Solana blockchain. The announcement was confirmed via his verified social media accounts, including Truth Social and X.

Presented as a cultural symbol rather than an investment vehicle or campaign fundraising tool, the TRUMP coin token quickly garnered widespread attention. Within hours of its debut, trading volume surged into the millions of dollars, driven largely by FOMO across the crypto community.

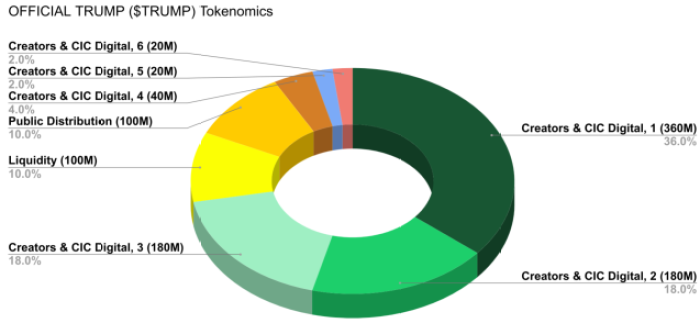

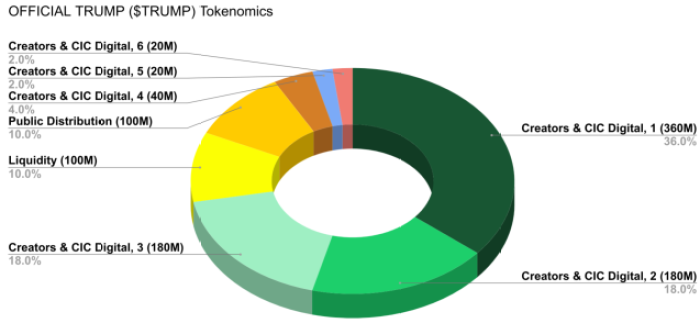

Key details of the TRUMP token include:

- Blockchain: Solana

- Total supply: 1 billion tokens

- Token distribution: 20% went to the public, while 80% is held by Trump-linked firms CIC Digital and Fight Fight Fight.

- Fully diluted valuation: Estimated to have reached as high as $27 billion during its initial trading days

Despite the excitement, the token has faced its share of criticism. Crypto analysts and community members have raised concerns about its utility, arguing that $TRUMP lacks intrinsic value beyond branding.

Holding 80% of the supply in Trump-linked firms raised concerns about manipulation and centralization.

Trump hinted at a Mar-a-Lago event for $TRUMP holders, open only to wallets meeting a token threshold.

Some critics argue the project strays from Web3 ideals and exploits Trump’s fame for speculation.

In addition to TRUMP, several unofficial “meme tokens” such as $MAGA and $DJT have also circulated in the market. These tokens, however, have not received any official endorsement from Trump or his team.

$DJT briefly stirred controversy after being wrongly linked to Trump, but no evidence confirmed the connection.

The $TRUMP launch marks a shift in Trump’s Web3 strategy, blending politics with digital assets.

Trump’s token launch shows how public figures use crypto to build and profit from their brand.

Trump in Crypto Space

Donald Trump’s first NFT collection, titled Trump Digital Trading Cards, debuted on December 15, 2022, via the Polygon blockchain. Each NFT was priced at $99 and depicted the former president in various dramatic personas, including superhero, cowboy, and astronaut.

Despite widespread mockery and skepticism, the collection sold out within 12 hours, generating approximately $4.4 million in initial revenue.

Read more: Trump NFT Collections: The Highs, Lows, and Controversies

According to data from Dune and other aggregators as of May 2025:

- The total secondary market trading volume for Trump NFTs has surpassed $10 million.

- The first collection comprised 45,000 NFTs, distributed among more than 14,000 unique owners.

- At launch, Polygon saw a temporary surge in trading volume, increasing by nearly 200%, driven largely by the Trump NFT frenzy.

Source: Dune

In 2023, Trump released a second collection – Trump Digital Cards Series 2, with 47,000 NFTs, maintaining the $99 price point. Later that year, in December, he unveiled a special “Mugshot Edition” featuring 100,000 NFTs inspired by his widely circulated booking photo taken at Fulton County Jail following his criminal indictment.

This edition also sold out in under 24 hours. Notably, buyers who purchased 47 or more NFTs were rewarded with a physical trading card embedded with fabric from the suit Trump wore in the mugshot, along with an exclusive invitation to a gala at Mar-a-Lago.

For Trump, NFTs have proven to be more than just collectibles or memes. A portion of the proceeds from each NFT drop has reportedly been used to fund his presidential campaign, illustrating how NFTs can serve as a creative, legitimate fundraising tool in the Web3 era.

His ability to monetize digital assets in support of political goals has set a precedent for how blockchain-based fundraising might evolve in future election cycles.

Trump’s Crypto Policy and Market Impact

In a stark reversal from his earlier stance – where he once referred to Bitcoin as a “scam” – Donald Trump has, by 2024–2025, embraced cryptocurrency as a core pillar of national financial sovereignty. Framing Bitcoin as a “hedge against authoritarian government,” Trump has made several public commitments that signal a pro-crypto shift in policy:

- Opposing the launch of a central bank digital currency (CBDC) by the Federal Reserve

- Restricting the regulatory authority of the SEC over the crypto market

- Supporting Bitcoin mining operations within U.S. borders

The Web3 community — especially miners — has responded warmly to these declarations. Following Trump’s speech in Texas in May 2025, the share prices of major Bitcoin mining firms – including Riot Platforms, CleanSpark, and Marathon Digital, surged between 10–25%.

Trump Digital Trading Cards: NFT Price Movements

- December 2022: The initial Trump Digital Trading Cards launched at $99 each and sold out within 12 hours, generating approximately $4.4 million in primary sales.

- July 2024: Following a news cycle involving Trump, the floor price of Series 1 NFTs jumped from roughly $228 to over $500, while Series 2 saw a ~20% increase.

- January 2025: Just before Trump’s second inauguration, Series 1 floor prices spiked from 0.059 ETH to 0.27 ETH in a single day, with daily trading volume reaching 746 ETH.

- Cumulative volume: As of early 2025, total trading volume across all Trump NFT collections exceeded 19,736 ETH (over $65 million USD).

Source: MagicEden

Price Volatility of the TRUMP Coin

- November 2024: Following Trump’s presidential election victory, TRUMP pumped over 300% within 24 hours, then dropped nearly 45% in the following two days as early holders took profits.

- January 2025: TRUMP reached its all-time high of nearly $75 on January 19, just days before the inauguration.

- April 2025: The announcement of an exclusive Mar-a-Lago dinner for the top 220 holders triggered a 58% rally, pushing the price to $14.32.

- May 2025: After the campaign concluded, TRUMP retraced to around $11.04, marking a nearly 15% drop from its recent local high.

- Market cap: As of June 2025, TRUMP has a market capitalization of approximately $2.2 billion, placing it among the top five memecoins on CoinMarketCap.

These figures highlight how both the Trump NFT collections and the TRUMP coin remain highly sensitive to political developments and media cycles tied to Trump’s personal brand. Whether through digital collectibles or memecoins, Donald Trump’s presence continues to move markets, blurring the lines between politics, culture, and decentralized finance.

Source: CoinGecko

Trump’s Long-Term Vision: Crypto as a Pillar of Financial Freedom and Political Power

Donald Trump’s engagement with cryptocurrency goes beyond mere marketing or monetization. In public remarks and policy statements since late 2024, Trump has increasingly framed digital assets as tools for preserving financial sovereignty in the face of what he calls “globalist overreach” and “centralized tyranny.”

By aligning himself with the crypto movement, Trump positions blockchain technology as a means for American citizens to reclaim control over their money and identity.

regulatory environment that encourages blockchain innovation within U.S. borders. His campaign has signaled that under a second Trump administration, America would become a safe haven for digital asset entrepreneurs and developers.

Ultimately, Trump’s adoption of crypto aligns closely with his broader political identity: anti-establishment, nationalist, and disruptive. In this context, the TRUMP coin is not just a meme asset – it’s a symbol of how political influence and blockchain technology may increasingly intertwine in the years ahead.

Conclusion

While not a pioneer of the crypto movement, Donald Trump is effectively leveraging the Web3 ecosystem to build political, financial, and cultural influence.

From multi-million-dollar NFT collections to vocal policy commitments supporting digital property rights, Trump has made cryptocurrency a strategic pillar of his 2025 presidential campaign.

“Trump crypto” is no longer a passing trend – it may well become a defining case study in the convergence of blockchain technology and political power. Should Trump return to the White House, he would be in a position to enact pro-crypto policies that could reshape the regulatory landscape in the United States and catalyze a new era for the global digital asset economy.