The main tag of NFT News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Leading DeFi Tokens By Market Activity Today – Hedera, Aave, Raydium, Jupiter

Join Our Telegram channel to stay up to date on breaking news coverage

As the DeFi space thrives, market activity is crucial to a project’s growth and potential. With the rapid evolution of decentralized finance, these platforms are reshaping how we think about traditional finance, offering decentralized alternatives for lending, borrowing, trading, and more. In this dynamic landscape, specific tokens stand out, not just for their technological innovations but also for their consistent performance in the market.

This article explores some of the leading DeFi tokens, including Hedera Hashgraph (HBAR), Aave (AAVE), Raydium (RAY), and Jupiter (JUP). With impressive growth in market price and user engagement, these tokens are shaping the future of decentralized finance. Let’s look at their recent performance and how they contribute to the evolving DeFi ecosystem.

Biggest DeFi Token By Market Activity Today – Top List

Hedera Hashgraph is a decentralized platform for building fast, secure, scalable applications. Aave Protocol is a decentralized lending platform built on Ethereum. It enables users to lend, borrow, and earn interest on digital assets. Raydium is an automated market maker (AMM) platform built on the Solana blockchain. Jupiter is one of the largest DeFi protocols on the Solana network, reaching impressive transaction volumes. Let’s dive deeply into why these tokens are some of the leading DeFi tokens by market activity today.

1. Hedera (HBAR)

Hedera Hashgraph is a decentralized platform for building fast, secure, scalable applications. Unlike traditional blockchains, it uses a unique technology called Hashgraph, which enables high transaction throughput and low fees. The network is governed by a global council of leading organizations, ensuring transparency and long-term stability.

Its native token, HBAR, powers the ecosystem by fueling transactions, smart contracts, and network services. HBAR is also interested in helping maintain network security and integrity. As adoption grows, HBAR continues to play a key role in supporting Hedera’s performance-driven DLT infrastructure.

Hedera is trading at $0.2132, reflecting a 3.09% increase in the last 24 hours. Over the past week, it has surged by 20.59% and experienced a solid 26.47% rise over the past 30 days. With a price range of $0.2018 to $0.2137, Hedera shows positive performance, signaling growing investor confidence in its potential.

gm and hello future. It’s a new era for Hedera.

The Hedera ecosystem just leveled up with a fresh identity, strategic upgrades, and new leadership designed to bring alignment across the board. 🧵 pic.twitter.com/fWY2O6KUIk

— Hedera (@hedera) May 8, 2025

Hedera has entered a new era with a fresh identity and strategic upgrades, including a shift from the HBAR Foundation to the Hedera Foundation, focusing on ecosystem and retail growth. The leadership transition includes Sylvester as President and Mance Harmon as Chair-Elect, reinforcing Hedera’s commitment to governance and enterprise adoption. The Hedera network remains the backbone of the digital economy, focusing on transparency, decentralization, and real-world utility.

This evolution positions Hedera for greater growth and efficiency, attracting more enterprise adoption and decentralized applications. Investors can expect stronger governance and a sharper focus on innovation, ensuring that Hedera remains a leading layer of trust in the digital economy.

2. Aave (AAVE)

Aave Protocol is a decentralized lending platform built on Ethereum. It enables users to lend, borrow, and earn interest on digital assets. By depositing cryptocurrencies into liquidity pools, users contribute to the protocol’s funds, which can then be lent to other users. Aave offers two types of tokens: aTokens, given to lenders to accumulate interest, and AAVE tokens, which represent the platform’s native currency.

The AAVE token plays a crucial role in the governance of the Aave ecosystem, allowing holders to propose and vote on protocol changes. Additionally, a portion of the platform’s fees is used to buy back AAVE tokens, reducing the token’s supply and increasing its scarcity over time.

Aave is priced at $224.62, a 2.55% increase in the last 24 hours. The token has performed exceptionally well over the past week, rising by 26.61%, and has surged by 64.57% over the previous 30 days. Aave shows strong momentum with a price range between $214.73 and $225.54, reflecting positive market sentiment and investor confidence.

Horizon by Aave Labs has partnered with AntChain to create a custom Real-World Asset (RWA) market on Ethereum. This collaboration will enable qualified users to borrow stablecoins using tokenized RWAs as collateral, marking a significant step toward integrating real-world assets with decentralized finance.

This partnership enhances the DeFi ecosystem by bridging traditional assets with blockchain technology, providing greater liquidity and access to borrowing. This development allows investors to diversify collateral options and engage with tokenized real-world assets, unlocking new possibilities for the DeFi space.

3. SUBBD Token (SUBBD)

SUBBD is an AI-powered platform revolutionising content monetisation in the creator-subscriber economy. Combining AI tools and Web3 enables creators to manage and monetise content, efficiently cutting out middlemen. With features like AI live streams, voice generators, and a 24/7 personal assistant, SUBBD offers a decentralised alternative to platforms like OnlyFans.

The $SUBBD token powers the platform, enabling access to content, offering tips, and facilitating creator requests. Currently in presale at $0.055375, with over $376,000 raised, the token provides exclusive perks, VIP access, and a 20% annual return through staking. Ten per cent of the total supply is allocated for airdrops and rewards.

From an idea to AI generated reality, if you can describe it, you can make it on SUBBD 📷

What idea would you bring to life?

📷: @ValentinacruzAi pic.twitter.com/bupxve9Sc1— SUBBD (@SUBBDofficial) May 7, 2025

It has also been featured on major cryptocurrency platforms, including Cryptonomist, Coinspeaker, Bitcoinist, 99Bitcoins, and TradingView via NewsBTC, highlighting its growing presence in the AI and Web3. With its increasing influence, $SUBBD is gaining rapid traction. The launch of the AI Personal Assistant further strengthens its position, offering creators continuous fan engagement and support. As AI and Web3 redefine digital content, $SUBBD shapes the future of creator income.

4. Raydium (RAY)

Raydium is an automated market maker (AMM) platform built on the Solana blockchain. It bridges liquidity and order books with Serum, Solana’s top decentralized exchange. Raydium’s AMM provides on-chain liquidity to Serum’s order book, enabling users to access the entire Serum ecosystem seamlessly.

Users can earn yield by providing liquidity through staked digital assets and participating in liquidity farming. Additionally, Raydium offers token swapping, trading, and the opportunity to participate in Initial DEX Offerings (IDOs).

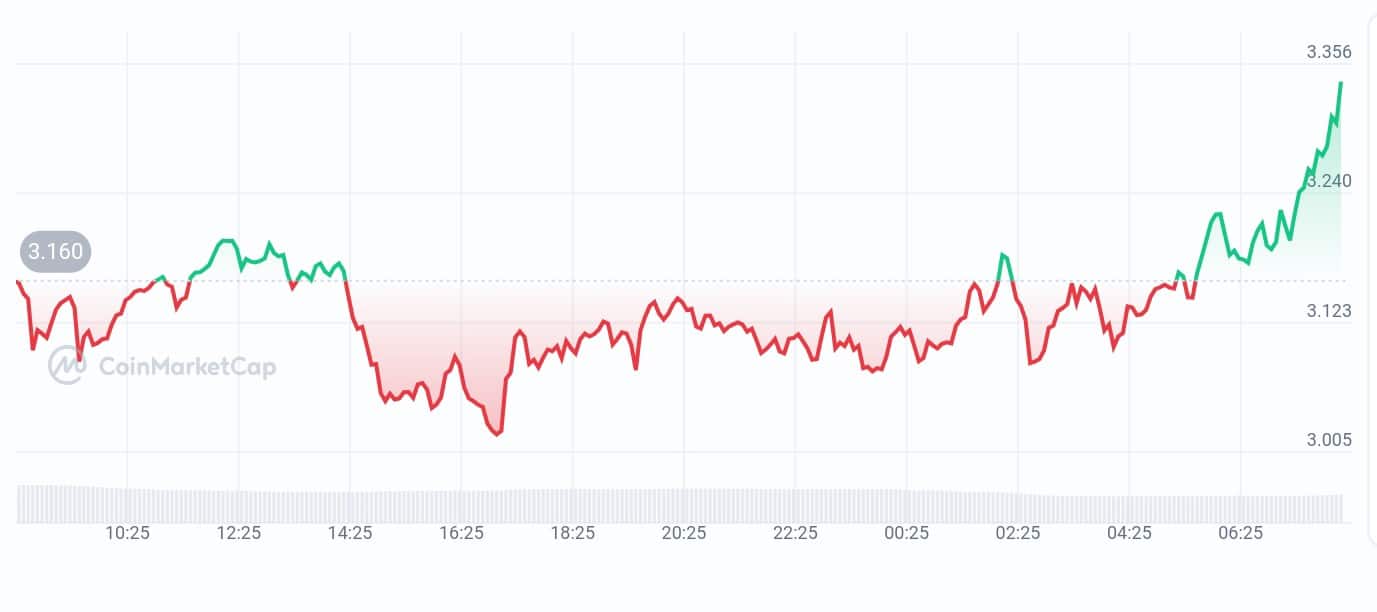

Raydium is trading at $3.34, with a notable 5.81% increase in the last 24 hours. Over the past week, it has seen a solid 23.12% gain; in the previous 30 days, the token has surged by 87.24%. With a price range of $3.00 to $3.33, Raydium’s strong performance reflects positive momentum and investor confidence, indicating a bullish sentiment in the market.

Introducing the LaunchLab Leaderboard 🏆

Trade pre-migrated LaunchLab tokens and climb the leaderboard to become eligible for daily rewards.

Start trading now to maximize your RAY rewards, the trenches are calling 🪖 pic.twitter.com/XijvaQ0RFz

— Raydium (@RaydiumProtocol) May 7, 2025

LaunchLab has introduced the LaunchLab Leaderboard, where users can trade pre-migrated LaunchLab tokens and earn RAY rewards based on their trading volume. The leaderboard is updated daily, and users can participate by trading tokens on any of LaunchLab’s integrated partner platforms.

This new feature gamifies the trading experience, incentivizing users to increase their trading volume to climb the leaderboard and earn rewards. It enhances the utility of LaunchLab tokens while promoting the platform’s integrated partners. For investors, it encourages active participation in the ecosystem and offers a way to earn rewards through strategic trading, boosting liquidity, and engagement.

5. Jupiter (JUP)

In November 2023, Jupiter, one of the leading DeFi tokens, became one of the largest DeFi protocols on the Solana network, reaching impressive transaction volumes. As one of the industry’s most advanced swap aggregation engines, Jupiter delivers essential liquidity infrastructure for the Solana ecosystem. Moreover, Jupiter is expanding its DeFi product offerings, featuring a comprehensive suite that includes Limit Order, DCA/TWAP, Bridge Comparator, and Perpetuals Trading.

The JUP token acts as a governance token, allowing community members to participate in decision-making processes, including the approval and voting on key aspects of the Jupiter platform.

Jupiter is trading at $0.5948, reflecting a 6.35% increase in the last 24 hours. Over the past week, the token has seen a significant 37.11% gain; in the previous 30 days, it has surged by 55.08%. With a price range between $0.5475 and $0.5919, Jupiter’s strong performance signals a positive market sentiment and growing investor interest.

Jupiter Mobile has launched Universal Send, a feature that enables users to send any token—like SOL, USDC, or even meme coins—anywhere in the world with ultra-low fees. The service allows users to send money instantly without needing a wallet from the recipient; if the recipient doesn’t claim the tokens, they can be returned to the sender.

Universal Send significantly lowers the barriers to crypto adoption, making it easier for users to send and receive funds globally. By offering gasless transactions and simple claim methods, it caters to crypto enthusiasts and newcomers, enhancing the utility of Solana-based tokens in everyday transactions. For investors, this streamlines the process of onboarding new users and could expand the reach of Solana’s ecosystem into everyday financial use cases.

Read More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage