The crypto is currently at a crossroads. Assets ranked among high-growth altcoins to buy now, like Litecoin and Cardano, continue to face slow price action, leading to bearish sentiments among investors, while smaller new cryptocurrencies of 2025 quietly gain popularity.

Amid all this, investors searching for the best crypto to invest in are shifting their focus from established coins to crypto presales with real growth potential.

One such project drawing fast attention is Tapzi. It is building the world’s first skill-based crypto gaming ecosystem. Besides, it has a clear roadmap and hence is emerging as a high-reward entry for those who want to invest in new crypto coins.

Tapzi: A Skill-Based Web3 Gaming Platform Built for Real Demand and Long-Term Growth

Tapzi, a project currently ranked as the best crypto presale https://www.tapzi.io/?u_id=u4zuoB, is creating the world’s first skill-based Web3 gaming platform. It will contain games like chess, tic-tac-toe, rock-paper-scissors, and more that token holders can play and win from.

It relies on skills unlike every other crypto game that depend on luck and randomness. Players will have to stake Tapzi tokens to play these skill-based games, and the winner gets the prize pool. Smart contracts of Tapzi ensure a fair and transparent gameplay with instant reward distribution.

For those concerned about security and trust, Tapzi has audited its smart contracts through CertiK and SolidProof. These audits play an important role in identifying security risks and ensuring that user funds remain protected. For long-term investors, independent audits determine project reliability.

Apart from games, Tapzi’s roadmap includes the launch of NFT avatars through which players can build digital identities on the platform. Mobile apps are also in development to support global access and increase daily active users. The project plans to host major tournaments to create competitive excitement and to allow players to win larger rewards.

Tapzi will also grow across multiple blockchains, such as Ethereum and Polygon. This multi-chain approach helps improve scalability and keeps transaction costs affordable. Another major development in the Tapzi roadmap is the upcoming SDK for game developers. Through this, outside developers could create new games inside the Tapzi ecosystem. Instead of remaining limited to only classic games, the platform can expand into a full gaming network with many skill-based titles. As more games enter the platform, user activity and token demand can grow at the same time.

Its potential is evident from its presale performance. Out of 150 million tokens, Tapzi has already sold more than 110 million, which means more than 77 percent of the token allocation. Currently, it is priced at $0.0035 for a limited time and will be listed at $0.01, marking a direct 3x gain. Hence, it’s the perfect time for investors to capitalize early on this best crypto to invest in under a dollar. https://www.tapzi.io/?u_id=u4zuoB

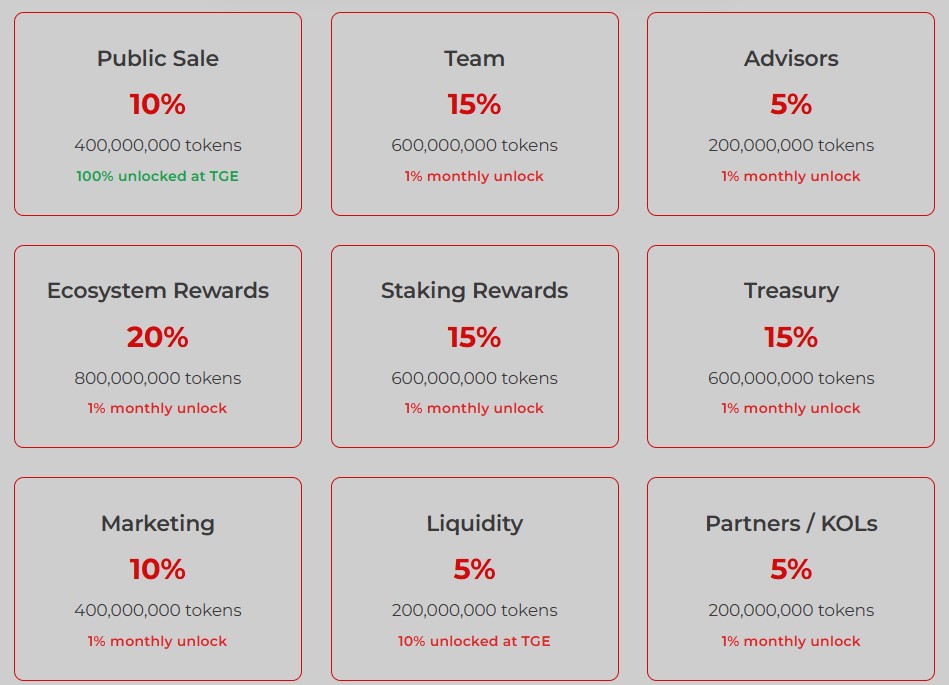

Tapzi has a capped supply of 5 billion coins, thus avoiding unnecessary token minting. Players must use TAPZI tokens to enter matches, and rewards come from those same tokens. Hence, the demand for TAPZI tokens is always high and doesn’t depend on external factors.

With a live product, fast-growing presale, upcoming audits, and a clear expansion plan, Tapzi shows the qualities that many investors look for when searching for high-reward early entries in crypto. It also stands out as the best gaming crypto currently in the market. https://www.tapzi.io/?u_id=u4zuoB

The Growing Demand for Gaming Crypto Tokens and Why Tapzi Fits the Trend

Gaming is one of the largest and fastest-growing entertainment industries in the world. Market research indicates that blockchain gaming could generate tens of billions of dollars in annual revenue over the next few years.

Growth comes from mobile gamers, casual players, competitive communities, and users in developing regions who see Web3 gaming as a new income source. Tapzi sits directly inside this growth wave because it keeps gameplay simple while offering real earning opportunities.

Tapzi chooses classic games for a reason. Chess rewards deep thinking and long-term strategy. Tic-tac-toe delivers fast gameplay for short breaks. Rock-paper-scissors offers instant matches that rely on quick decisions and pattern recognition. These games do not require training or expensive equipment. Anyone can start playing within minutes.

Tapzi turns these everyday games into reward-based competitions through staking. Two players stake TAPZI tokens https://www.tapzi.io/?u_id=u4zuoB, they compete, and the better player wins the full reward. There are no hidden rules or complex systems. The outcome depends purely on performance. This fairness builds trust and encourages repeat participation.

Many blockchain games depend heavily on chance, rare items, or expensive in-game assets. Tapzi avoids these barriers. Players do not need to buy costly objects to compete. Skill alone determines success. This makes the platform inclusive for beginners and experienced players alike.

Mobile gaming plays a major role in global adoption. Billions of users around the world rely on smartphones for daily entertainment. Tapzi’s upcoming mobile apps open the platform to massive global markets such as Asia, Africa, Latin America, and Eastern Europe.

Since Tapzi games require low device power and short play sessions, the platform fits perfectly into mobile lifestyles.

Community also drives the success of gaming platforms. Players enjoy competing with friends, tracking their rankings, and participating in tournaments.

Tapzi plans to introduce global tournaments that allow users from different regions to compete for prizes. NFT avatars will help players build identity and attachment to the platform. These social elements increase long-term engagement and token use.

Blockchain gaming also grows because it gives users real digital ownership. In traditional games, players often lose their progress or assets if servers shut down. In Web3, rewards belong to the user. Tapzi supports this through direct token rewards that players fully control.

As Web3 adoption rises and more users seek fair earning platforms, gaming tokens are likely to remain among the strongest performers. Tapzi fits this trend through its easy gameplay, fair staking model, and worldwide reach.

Other Best Crypto to Invest in Now Under $1 Along With Tapzi

1. Stellar (XLM)

Stellar focuses on fast and low-cost cross-border payments. It helps users transfer funds across countries with minimal fees. XLM remains one of the most reliable under-$1 cryptocurrencies with strong real-world financial use.

2. VeChain (VET)

VeChain supports supply-chain tracking, product authentication, and business transparency. Many global companies use their blockchain to reduce fraud. VET continues to attract long-term investors because of its strong enterprise utility.

3. The Sandbox (SAND)

The Sandbox powers a virtual world where users buy land, build games, and trade digital assets. While the metaverse sector moves in cycles, SAND still benefits from digital ownership demand and strong brand presence.

4. Harmony (ONE)

Harmony focuses on fast and low-cost blockchain transactions for decentralized apps. Developers use it for Web3 services and small-scale projects. ONE remains a technically focused under-$1 token.

All four of these top cryptos for investment offer solid value, but none combine early-stage pricing, live gaming utility, fast presale momentum, and direct player rewards the way Tapzi currently does.

Conclusion: Best Crypto To Invest in

Litecoin and Cardano are facing slow growth and uncertain momentum, due to which many investors are searching for stronger growth opportunities. Web3 gaming is one of the fastest-growing blockchain sectors, with revenue expected to reach multi-billion-dollar levels in the upcoming years.

Tapzi already works inside this high-growth space with a live gaming demo, fast presale growth, capped token supply, and a roadmap built around mobile access and developer expansion.

With more than 110 million tokens sold in Stage 1, a current presale price of $0.0035, and a confirmed listing price of $0.01, Tapzi offers a clear early-entry advantage. Its focus on skill-based rewards, fair competition, and global reach strengthens its long-term outlook. For investors actively searching for the best crypto to invest in now https://www.tapzi.io/?u_id=u4zuoB in a market filled with uncertainty, Tapzi stands out as a high-reward opportunity backed by real progress and rising demand.

Join Tapzi’s $500,000 community giveaway and compete across nine prize categories to earn $TAPZI tokens-sign up today and become an early adopter!

Media Links:

Website: https://www.tapzi.io/

Whitepaper: https://docs.tapzi.io/

X Handle: https://x.com/Official_Tapzi

Frequently Asked Questions About the Best Crypto To Invest in

Is Tapzi the best crypto to invest in for early buyers?

Tapzi offers a live gaming demo, strong presale demand, and a low entry price. These factors make it attractive for early-stage investors.

How do players earn rewards on Tapzi?

Players stake TAPZI tokens before matches. The winner receives the pooled tokens automatically through smart contracts.

Is Tapzi a safe project for long-term holding?

Tapzi plans to complete audits through CertiK and SolidProof. The platform also uses transparent blockchain settlement for rewards.

Will Tapzi add more games in the future?

Yes. The roadmap includes NFT avatars, mobile apps, tournaments, multi-chain support, and tools for developers to add new games.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile and involve significant risk, including the potential loss of principal. Always perform your own due diligence or consult a licensed financial advisor before making investment decisions.

Crypto Press Release Distribution by https://btcpresswire.com

This release was published on openPR.