The main tag of NFT News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Animoca’s Tower crypto surges 214%, gaming activity up in July: Web3 Gamer

By Editorial team of BIPNs|2025-08-18T20:19:07+03:00August 18, 2025|News, NFT News|0 Comments

Tower gaming crypto token soars 214% as smart money piles in

A gaming crypto token created by Animoca Brands has surged 214% over the past month and caught the eye of savvy investors after the company’s popular chairman, Yat Siu, gave it a social media boost.

Tower was the fifth-most popular cryptocurrency among smart investors on the Base network over the past seven days, according to onchain analytics platform Nansen.

Tower is a utility token used across a slew of Animoca titles, including play-to-earn mobile defense game Crazy Kings, Crazy Defense Heroes and real-time PvP fighting game Wreck League.

Siu said the hype for the token came down to excitement around the reboot of Wreck League, as well as momentum from the token trending on Base and Farcaster.

He also reiterated that Tower was one of Animoca’s first community Web3 gaming token launches with no investor sales.

The majority of Tower’s upside —which is also available on Ethereum, Solana, TON and Polygon — came in the past two weeks after Siu announced that Animoca would begin supporting the Tower ecosystem with open-market token buybacks on August 5.

These buybacks are typically a bullish signal for investors, as they reduce the circulating supply and can potentially drive up the token’s value.

TOWER is trading at $0.0019 at the time of publication, up 214% over the past 30 days, according to CoinMarketCap. It represents approximately 8x the 27% gains ETH has clocked over the same period, trading at $4,534.

However, like most gaming tokens, TOWER is still significantly below its 2021 all-time highs by approximately 99%.

But the Web3 gaming community anticipates only more upside ahead for Tower. Gaming commentator Boxmining said on Thursday, “$TOWER reversal is gonna melt faces,” and he is “positioning early for this huge gaming narrative.”

Meanwhile, fellow gaming commentator Hoogie said, “It’s not just a gaming token.. It’s a builder-powered ecosystem that keeps showing up early.”

Saanjana Nikita called Tower a “bear market gem.”

Web3 gaming funding surges 94% as Bitcoin and Ether rally

The Web3 gaming sector attracted $60 million in investment in July amid a Bitcoin and crypto market rally, according to Web3 analytics platform DappRadar.

“The industry is entering a more mature phase — one focused on quality gameplay, sustainable economies, and infrastructure designed to scale,” DappRadar said in its report, noting that the total investment amount represents a 94% increase compared to June’s total.

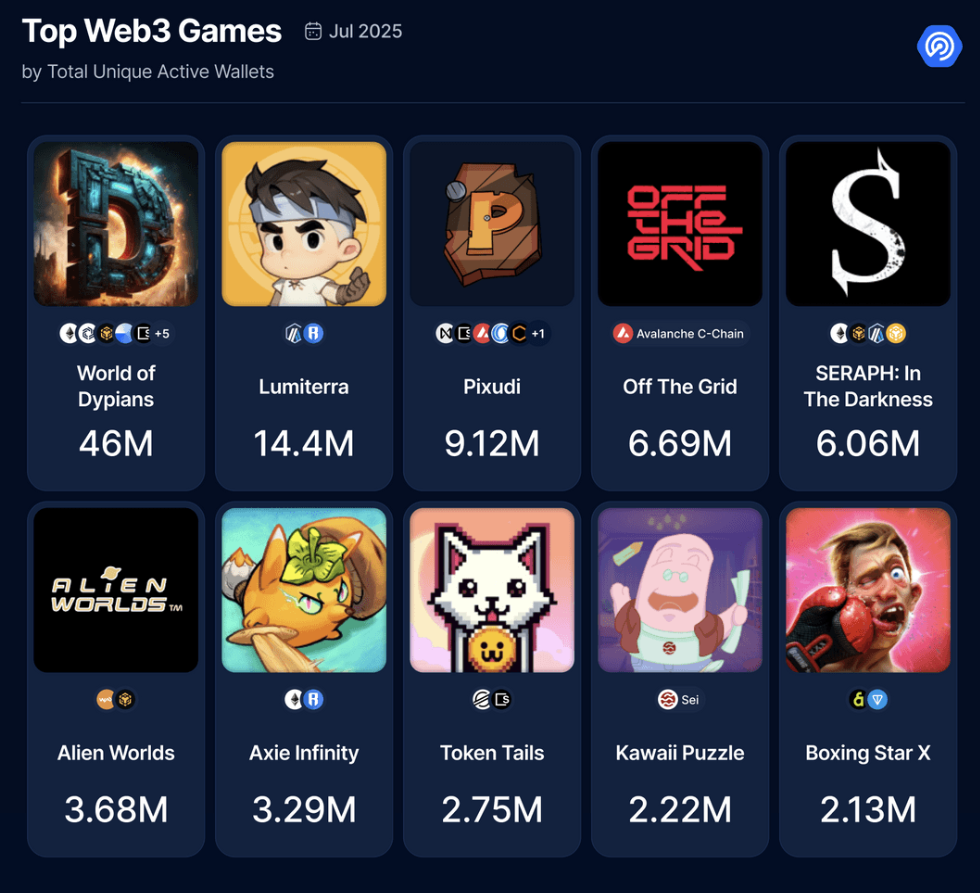

Despite prices going up, overall blockchain activity “cooled” in July. Blockchain gaming was the only segment to see growth, increasing 2% to 4.9 million daily unique active wallets, according to DappRadar.

In terms of activity, the Optimism-based layer-2 network opBNB topped the charts for gaming engagement, followed by the Sei network in second place and the Ronin Network in third place. Ronin’s spike came after launching Ronin Profiles for cross-game identity and teasing the upcoming Ronin 2.0 tokenomics.

Other notable gaming updates also helped drive activity to the sector.

Read also

Gunzilla Games’ highly anticipated shooter game Off The Grid moved from early access to a full launch across PlayStation, Xbox, the Epic Games Store and Steam. Meanwhile, the Ronin-based MMORPG Lumiterra surpassed 300,000 daily wallets.

AI won’t be nerfing game developers anytime soon, says Immutable exec

Immutable’s head of gaming isn’t worried about artificial intelligence threatening developer jobs in the gaming industry.

“I fundamentally believe there are factors that just can’t be replaced, like human creativity and human hands in the process of building a great game,” Immutable game director Patrick Wagner tells Magazine.

“People are the ones that play them,” he emphasizes.

It may seem like wishful thinking for a game developer to claim AI won’t take game developer jobs, but Wagner says he’s yet “to see a game be completely built by AI that is successful and fun.”

“I can see that if you’re a two-person band trying to build a game, it can be helpful to get you there faster and convey messages faster. But it’s not the be-all and end-all,” he adds.

Wagner explains that Immutable’s approach is to use AI as a production tool to improve efficiency.

A similar sentiment was echoed by YouTube’s former head of gaming, Ryan Wyatt, in October 2023.

More recently, AI has become increasingly popular in Telegram blockchain games. In February, gaming network GOAT Gaming launched AI agents, which play games to earn crypto for you and bet on prediction markets.

Mighty Bear Games CEO Simon Davis told Web3 Gamer in January that it was “almost like being in Rome and owning a stable of gladiators.”

Read also

Other News

— Ronin Network says it is “coming home to Ethereum.” The network explains that it was initially built four years ago to give Axie Infinity a more efficient platform, but it’s returning to mainnet now that Ethereum’s speeds and transaction capabilities are “better than ever.”

— Gaming giant Immutable opens the floodgates to Web2 games. In a recent X post, the firm said, “As of today, Immutable Play is now open to all games.” Immutable noted that gaming company Ubisoft is the first to join.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He’s also a standup comedian and has been a radio and TV presenter on Triple J, SBS and The Project.