Category: Forex News

The Market News Today: Wall Street Eyes Continued Growth Amid Fed’s Rate Cut Signals and Tech Surge

Gold Retreats Slightly Amidst Rally, Fed Rate Cut Speculations

Gold’s rally briefly paused on Thursday, as spot gold dropped 0.3% to $2,180.49 after reaching a record high of $2,222.39. U.S. gold futures, however, climbed 1.1% to settle at $2,184.7. The slight pullback was influenced by a strengthening dollar and market corrections after aggressive buying. Despite this, the overall sentiment in the gold market remains bullish, fueled by anticipation of Federal Reserve’s hinted interest rate cuts in 2024 and strong central bank buying.

Oil Prices Slip Amid Gaza Ceasefire Hopes and Strong Dollar

Oil prices declined on Friday due to potential easing of Middle East tensions with a nearing Gaza ceasefire and a robust U.S. dollar, coupled with decreasing U.S. gasoline demand. Brent crude and U.S. crude futures both fell by 0.6%. The ceasefire prospect, which could stabilize regional tensions and ease crude transit, and a strong dollar, making oil costlier for foreign buyers, are key pressures. Meanwhile, U.S. gasoline demand dip indicates a potential slowdown in crude consumption.

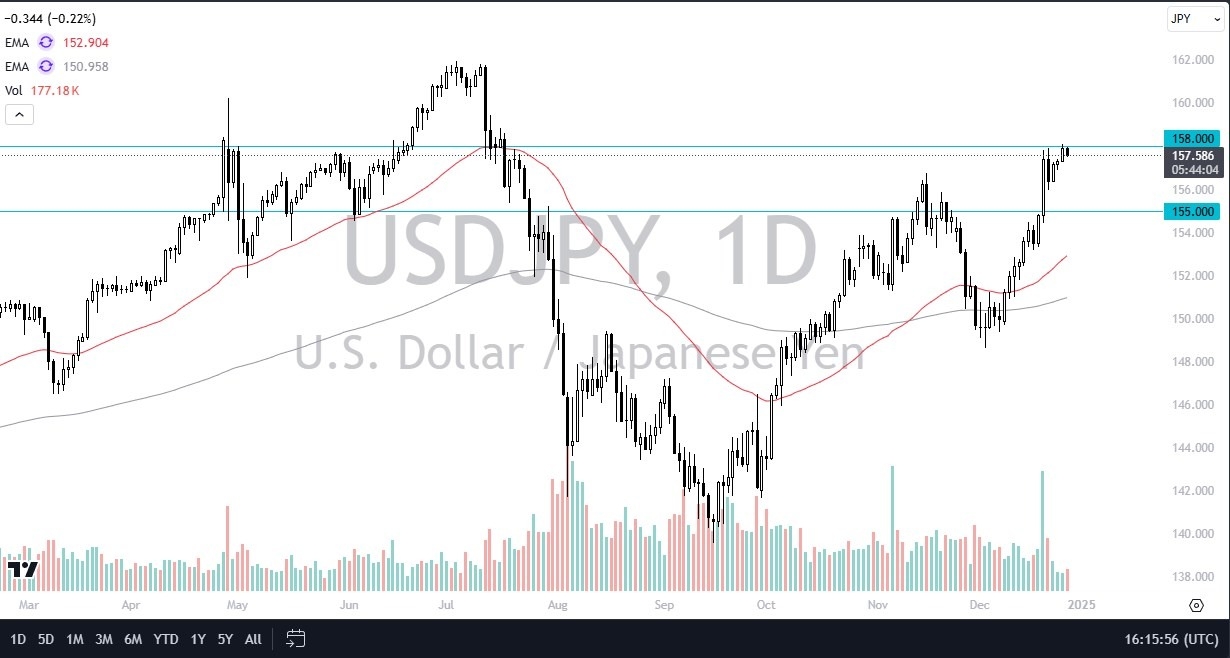

U.S. Dollar Climbs for Second Consecutive Week Amid Global Rate Divergence

The U.S. dollar is poised for its second week of broad gains, spurred by global interest rate disparities and weaker foreign currencies. A surprising rate cut in Switzerland and steady rates by the Federal Reserve contrast sharply with other central banks, bolstering the dollar. This strength is highlighted by the yen’s drop despite Japan’s rate hike and the yuan’s fall to a four-month low, prompting intervention. The dollar’s rise is impacting various currencies, with the euro, Australian, and New Zealand dollars all falling.

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: