Category: Forex News, News

The USDJPY price breaches the resistance – Forecast today

At the beginning of 2025, expectations are rising that silver could become one of the most dazzling assets in global markets this year, driven by intertwined economic and geopolitical factors

Amid the search by retail traders for financial assets to hedge against inflation or capitalize on potential bullish trends, individual investors’ appetite for the white metal is increasing

At the same time, escalating global trade tensions and growing economic uncertainty are bolstering demand for safe-haven assets, with silver remaining a favored choice alongside gold to protect wealth during volatile times

On the monetary side, major economies continue to implement a cycle of monetary easing, with central banks persistently cutting interest rates, which makes non-yielding assets such as silver more attractive compared to traditional investments like bonds

With real yields falling, the investment demand for the white metal is on the rise, potentially driving its prices to new levels throughout the year

On the industrial front, silver continues to play a vital role in multiple sectors, most notably in technology and renewable energy; the growing demand for solar panels—which rely on silver in their production—along with its widespread use in electronics and medical applications, contributes to a strong and sustainable demand for the metal

As emerging economies expand and investments in infrastructure and green technology increase, industrial demand is expected to remain a key driver for silver’s market growth, placing it at a crossroads between being an exceptional investment opportunity or merely a temporary bullish surge. Are you ready to seize the opportunity and benefit from these supporting trends?

Retail Traders

In their quest for financial assets to hedge against the risks associated with changing monetary policies of global central banks, silver has proven to be the most cost-effective and optimal choice at present, making it the focus of investors’ attention

The current surge in silver prices has caught the attention of retail traders as the white metal diverges significantly from its true value compared to gold, which continues to set new record highs, nearing the $3,000 per ounce mark for the first time in history

Silver Institute Forecasts

According to the Silver Institute, the supply shortage in the silver market is expected to continue throughout 2025, which could support price increases to levels not seen since 2011. Moreover, supportive government policies for green energy and infrastructure are anticipated to boost silver demand due to its use in renewable energy technologies

The institute, an international non-profit organization comprising members from various sectors of the silver industry, explained that stronger industrial activity will be a major catalyst for increased global demand for the white metal, potentially leading to a new high annual level this year

Global Trade Tensions

Global trade tensions have escalated with the return of U.S. President Donald Trump to the political arena and the adoption of stringent trade policies aimed at protecting the American economy, as he vowed to impose high tariffs on a wide range of imports, particularly from China and Europe

These measures have prompted strong reactions from major trading partners, who have threatened retaliatory actions, further stoking fears of a new trade war that could impact global economic growth and boost demand for safe-haven assets such as gold and silver

Additionally, silver benefits from concerns over supply chain disruptions, especially with potential restrictions on industrial metals, maintaining its investment appeal amid uncertainty over U.S. trade policies

Global Monetary Easing Cycle

Major central banks in the United States, Europe, the United Kingdom, Canada, Switzerland, and Mexico continue their cycle of monetary easing and interest rate cuts, resulting in new liquidity injections into the markets and bolstering medium-term investor optimism for stocks, real estate, gold, silver, and even cryptocurrencies

Strong Industrial Demand for Silver

Forecasts indicate that industrial demand for silver will remain robust throughout 2025, driven by its increasing use in technology, renewable energy, and electronics. This is especially true as investments in solar energy, which relies on silver for photovoltaic cells, continue to expand

Moreover, demand from the electronics and medical sectors is expected to further support the sustainable growth of silver’s market, enhancing long-term price prospects

Key Applications of Silver

Silver is primarily used for industrial purposes, playing a crucial role in the manufacturing of automobiles, solar panels, jewelry, and electronics, in addition to its use in coinage and as a safe haven for investors

Top Silver Price Forecasts for 2025

- Citibank Group forecasts silver prices to rise to $35 per ounce this year.

- Goldman Sachs Group forecasts silver prices to reach $37 per ounce by the end of this year.

- Deutsche Bank forecasts that silver could reach $38 per ounce by the end of 2025.

- Morgan Stanley forecasts silver prices to hit $35 per ounce by the end of 2025.

- UBS Bank expects silver prices to range between $36 and $38 per ounce in 2025.

- J.P. Morgan expects silver to reach $38 per ounce in 2025.

Types of Demand for Silver

Industrial Demand

- Electronics: Silver is used in electronic components such as printed circuit boards and motherboards in smartphones, computers, and other devices.

- Renewable Energy: Silver is employed in the manufacturing of solar panels and lithium-ion batteries, making it a key element in clean energy technologies.

- Medical Devices: Silver is used in medical instruments due to its antibacterial properties.

- Automotive and Household Products: It helps enhance the performance and efficiency of vehicles and household appliances.

Investment Demand

- Jewelry: Silver is a precious metal used in the production of jewelry and artistic pieces.

- Coins: Silver is used in minting coins for its value and stability.

- Safe Haven: Silver bars and coins are considered safe havens for investors during times of economic and geopolitical uncertainty.

- ETFs: Exchange-Traded Funds allow investors to buy and sell silver without the need to physically own it.

Factors Affecting Silver Demand Levels

- Global Economic Growth: Drives increased demand for silver in both industrial and consumer sectors.

- Global Interest Rates: Lower interest rates make silver a more attractive alternative investment.

- Economic and Geopolitical Uncertainty: Boosts demand for silver as a safe-haven asset.

- Technological Developments: Lead to higher requirements for silver in advanced industries.

Key Silver Price Milestones

- October 2008: Silver hit a low of $8.42 per ounce.

- April 2011: Silver reached an all-time high of $49.76 per ounce.

- May 2020: Silver recorded its lowest level in 12 years at $11.64 per ounce.

- April 2024: Silver reached its highest level in three years at $29.80 per ounce.

- 2010: Achieved the best annual gain with an increase of 83%.

- 2013: Suffered the worst annual loss with a decline of over 36%.

Best Historical Performance of Gold Prices

- 2007: Best annual performance with an increase of nearly 31%.

- Q1 2016: Best quarterly performance with an increase of over 16%.

- September 1999: Best monthly performance with an increase of approximately 17%.

Top FAQs About Silver

Is Silver Price Suitable for Investment?

Silver is currently trading at around $32 per ounce, and given forecasts that indicate a bullish market in 2025, we believe that levels between $31 and $30 per ounce are suitable for investment, with a long-term target above $35 per ounce

How to Invest in Silver?

There are several ways to invest in silver:

- Purchasing physical silver such as coins or bars.

- Investing through silver Exchange-Traded Funds (ETFs) on global exchanges.

- Buying shares in silver mining and refining companies.

- Trading silver futures, options, and other derivative contracts.

Will Silver Reach $100 per Ounce?

In light of recent developments in global markets and the economic, trade, and geopolitical risks, it is entirely possible for silver prices to climb above $50 per ounce over the coming years, eventually paving the way to reach $100 for the first time in history if strong industrial and investment demand factors materialize

Is Silver Expected to Rise in 2025?

Yes, most major institutions and banks forecast that silver prices will continue to rise this year, with the metal nearing the breakthrough of the $35 per ounce barrier

Technical Analysis of Silver Prices

The weekly chart of silver prices shows how the downward correction that began from the all-time high recorded at $49.74 was halted at the 76.4% Fibonacci level, which formed strong support around $15.34. From there, the price began its new upward journey, attempting to resume the long-term bullish trend.

Current positive attempts are facing a key resistance level formed by the previously broken 38.2% Fibonacci level, now acting as strong resistance at $32.55. Therefore, the price needs to break through this barrier and secure a weekly close above it to confirm the continuation of the upward trend and move toward new gains starting with a target of $35.30 and then the next pivotal resistance at $39.10.

On the daily timeframe, we notice that the price underwent a minor downward correction before resuming its upward movement. Additionally, the price recently formed and broke through a descending wedge pattern, triggering a positive catalyst that is expected to drive the price further upward and achieve the targets mentioned above.

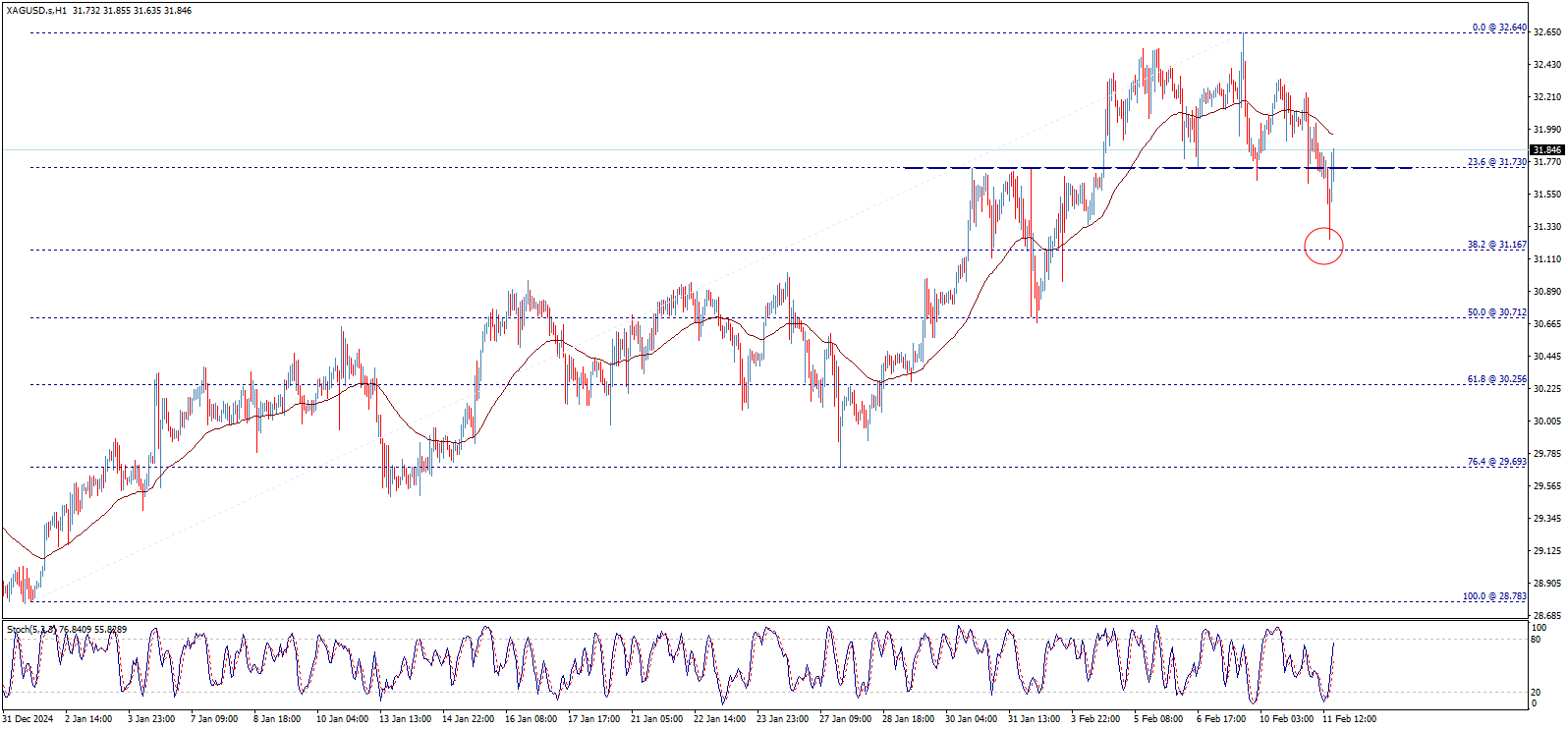

The current negative momentum across various timeframes may cause some temporary bearish fluctuations before a return to positive trading, as evidenced by the 1-hour chart. This chart shows the price forming a double top pattern, which triggered a quick downward correction before rebounding. The price needs to hold above $31.75 to avoid further negative pressure and to build a new upward wave with targets first breaking $32.64, then paving the way toward levels of $35.30 and finally $39.10, which are the next major milestones.

In summary, the aforementioned technical factors suggest that the price is on track to continue rising in the coming period, provided it overcomes certain barriers starting with the $32.55 – $32.64 range, and then moves towards the targets mentioned above. The 50-day moving average continues to offer positive support for the anticipated bullish wave.

Conversely, it is crucial to note that a reversal below $29.70 would derail the upward momentum, forcing a new downward correction with targets initially testing the $28.40 level and potentially extending losses to $24.50 before any new attempt at a recovery.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: