Category: Crypto News, News

Tom Lee Cuts Bitcoin Price Prediction to $100K, Says Tether’s Gold Buying Lifts BTC Outlook

Key Takeaways

-

Tom Lee has lowered his year-end Bitcoin target from $250,000 to “above $100,000.”

-

Lee says Tether’s gold buying will help set a higher long-term price floor for Bitcoin.

-

Despite analysts’ warnings of a bear market, Lee and other analysts still see the potential for a year-end rebound.

Veteran crypto analyst Tom Lee has scaled back his typically bullish forecast for Bitcoin to end the year at $250,000, saying he now expects the BTC to finish at a price “above $100,000.”

The analyst’s shift in tone comes as he also argues that rising gold purchases by stablecoin issuers are helping establish a higher long-term price floor for Bitcoin.

Lee, chair of BitMine and a long-time bullish voice for Bitcoin, told CNBC on Wednesday that BTC may only “maybe” retest its October all-time high of $125,100 before year-end.

“I think it’s still very likely that Bitcoin is going to be above $100,000 before year-end, and maybe even to a new high,” he said.

The comments mark the first time he has publicly softened the $250,000 target he repeated through early October.

Despite significantly reducing his outlook, Lee noted that he still believes “some of those best days are going to happen before year-end.”

Lee explained that his more tepid view on upcoming crypto pricing was due to the Oct. 10 crash, which he says was caused by a “glitch” triggering a wave of automatic liquidations.

Although Lee has never publicly mentioned any names when discussing the technical glitch, it is clear he is discussing Binance.

On Oct. 10-11, screenshots showing USDe, a “synthetic dollar” created by Ethena Labs, dropping to $0.65 on Binance spread across social media.

Because Binance’s internal oracle treated the faulty as “real,” it triggered forced liquidations for traders holding USDe-backed positions.

“Almost two million crypto accounts got wiped out, even though minutes before they were actually profitable accounts,” he previously said.

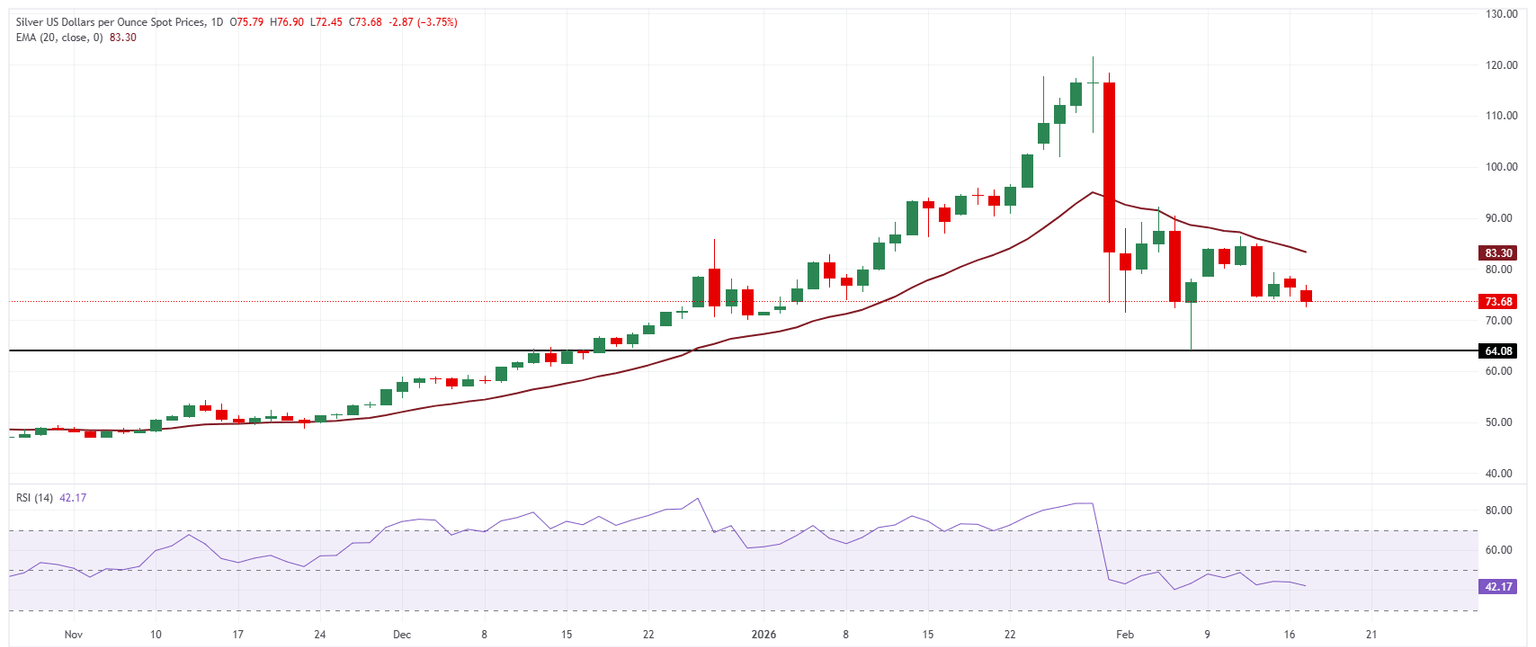

Separately, Lee pointed to rising demand for gold from crypto-backed stablecoins as a factor that could influence Bitcoin’s longer-term trajectory.

In an X post on Wednesday, he claimed that stablecoins have become the largest buyers of gold globally and have been “the singular driver of higher prices” for the precious metal since early 2026.

His comments followed news that USDT issuer Tether became the largest private holder of gold globally, surpassing several central banks.

Lee argued that the trend was not bearish for Bitcoin, but instead helped establish “a higher future price.”

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: