Category: Forex News

US CPI and UK Wage Growth Set to Take the Stage This Week

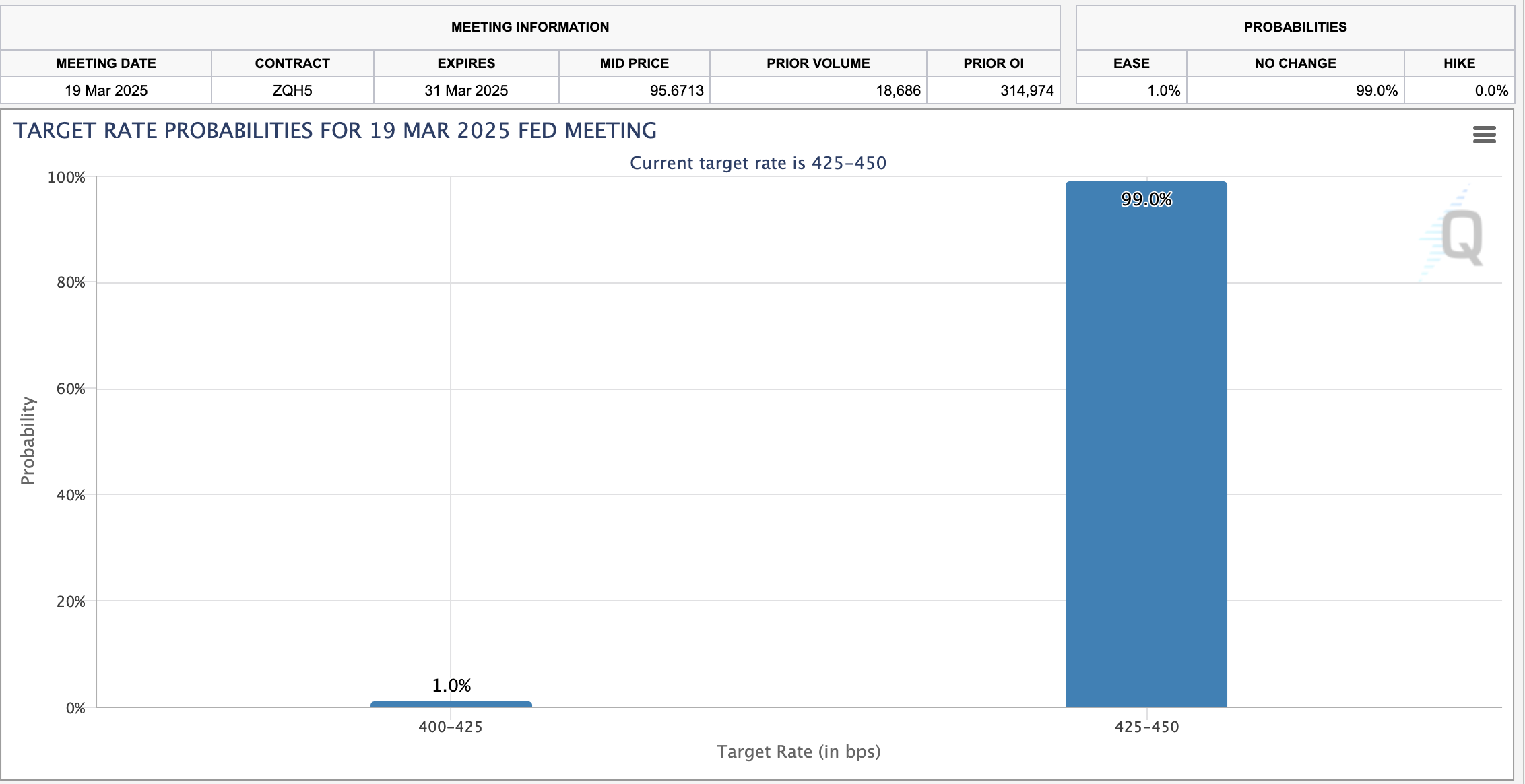

On the other side, nevertheless, the NFP beat was somewhat offset by the unemployment rate jumping to 3.9%, against market expectations forecasting the rate to remain at 3.7%. Adding to this, average hourly earnings slowed to 0.1% on a month-over-month basis from 0.5% in January and cooled slightly to 4.3% year over year (from January’s 4.4% reading). Overall, February’s jobs numbers help reinforce the soft-landing narrative and bolster market expectations of the Fed stepping up and cutting rates in June (98bps of easing are now priced in for the year following the release of the jobs numbers, compared with around 93bps of cuts before).

Where We Are This Week

Stateside this week, markets welcome CPI and PPI inflation numbers on Tuesday and Thursday at 12:30 pm GMT, with the former regarded as the highlight event for many market participants. Retail sales data will also be released on Thursday at 12:30 pm GMT, followed by industrial production and the University of Michigan consumer sentiment data on Friday at 1:15 pm GMT and 2:00 pm GMT, respectively.

As of writing, economists estimate US CPI inflation to remain unchanged in the twelve months to February, matching January’s reading of 3.1% (the estimate range is currently between 3.1% and 3.0%). On a monthly basis, headline CPI is forecast to rise 0.4% versus the 0.3% rise in January. Any meaningful deviation to the downside in the data will likely weigh on the US Dollar Index (and trigger a dovish rate repricing) and perhaps see price visit daily support between 101.44 and 101.77.

Over in the UK, Tuesday’s wage numbers (7:00 am GMT) for the three months leading up to January will be widely watched, including those at the Bank of England (BoE). The prior release showed wages fell less than expected and illustrated sticky inflation. Headline wages dipped to 5.8% (expected: 5.6%; previous: 6.7%) in the three months to December 2023, and pay excluding bonuses fell to 6.2% (expected: 6.0%; previous: 6.7%).

Market consensus heading into this week’s event forecasts wages to remain elevated; the headline print is expected to cool slightly to 5.7% (prior: 5.8%), and pay excluding bonuses is forecast to remain unchanged at 6.2%. This event will be observed closely as any marked deviation between actual and consensus data could alter rate pricing (markets are still eyeing August’s policy meeting for the first 25bp rate cut) and have sway on GBP movement as a result.

G10 FX (5-Day Change)

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: