Category: Forex News, News

USD/JPY Outlook: Yen Bulls Roar as BoJ Signals Rate Hike

- Recent Bank of Japan remarks have shown a growing urgency to strengthen the weak yen.

- BoJ’s Ueda said the central bank would focus on incoming data before the December meeting.

- The dollar eased as market participants awaited new developments in the US.

The USD/JPY outlook indicates growing enthusiasm among yen bulls after recent hawkish remarks from BoJ policymakers. Meanwhile, the dollar eased from recent peaks as traders awaited new US politics and monetary policy developments.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

Recent Bank of Japan remarks have shown a growing urgency to strengthen the weak yen. BoJ governor Kazuo Ueda noted that rising wage growth would drive inflation, allowing the central bank to continue hiking interest rates. On Thursday, he said the central bank would focus on incoming data before the December meeting to decide whether to hike interest rates.

Moreover, policymakers will focus on the impacts of a weak yen on Japan’s economy. These comments have boosted the yen as markets see a growing likelihood that interest rates in Japan will rise in December.

Before the US election, a Reuters poll had shown that most economists expected the Bank of Japan to pause in December and hike in March next year. However, Trump’s win has shifted the outlook for US monetary policy. Markets expect fewer rate cuts by the Fed, which will keep the greenback strong. Consequently, further weakness for the yen is piling more pressure on Japan to hike interest rates.

Meanwhile, after a solid Trump rally, the dollar eased as market participants awaited new developments in the US. On the other hand, Fed policymakers have assumed a more hawkish tone, lowering rate cut expectations. Nevertheless, economists still believe the central bank will cut rates in December.

USD/JPY key events today

USD/JPY technical outlook: Lower high signals bearish resurgence

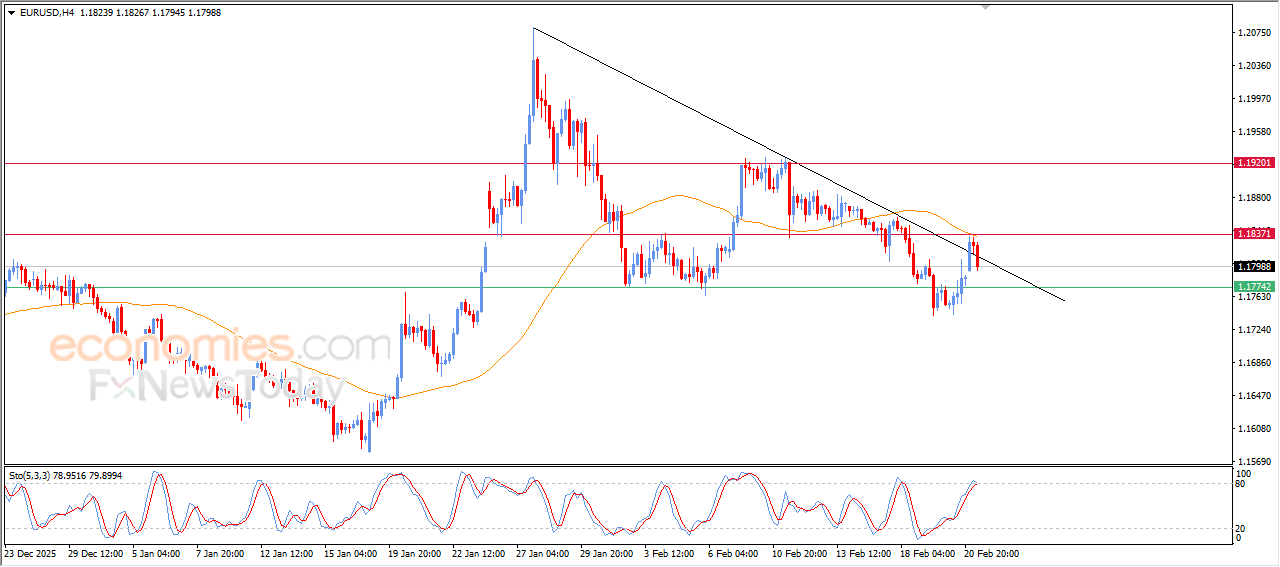

On the technical side, the USD/JPY price has broken well below the 30-SMA, showing control has shifted from bulls to bears. At the same time, the price has punctured the 154.51 support level. Meanwhile, the RSI has dipped into bearish territory below 50.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

Initially, the price broke below its bullish trendline after a surge in bearish momentum. However, bulls managed to retake control. Unfortunately, they only made a lower high, indicating weaker momentum. Consequently, bears returned and are ready to break below 154.51. Such an outcome would allow USD/JPY to revisit the 151.74 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: