Category: Forex News, News

USD/JPY Price Analysis: Inflation, Tariffs Complicate BoJ Path

- The USD/JPY price analysis indicates accelerating price pressures in Japan.

- Tokyo’s CPI increased by 3.4%, which is above forecasted to be a 3.2% increase.

- The dollar regained appeal as trade tensions between China and the US eased.

The USD/JPY price analysis indicates accelerating price pressures in Japan, which may prompt the Bank of Japan to raise rates. However, policymakers remain concerned about the economic impacts of Trump’s tariffs. Meanwhile, easing trade tensions between China and the US supported the dollar.

-Are you interested in learning about the forex indicators? Click here for details-

The yen strengthened briefly on Friday after data revealed that inflation in Tokyo beat estimates. The CPI increased by 3.4%, above forecasts of a 3.2% increase. Moreover, it recorded a massive jump from the previous reading of 2.4%. Accelerating inflation aligns with the BoJ’s recent message of more rate hikes. However, Trump’s tariffs have created uncertainty about the timing of the timing of the next move.

On the other hand, the dollar regained its appeal as trade tensions between China and the US eased. Both countries appear ready to lower tariffs and begin negotiations. The US has said it can lower tariffs on Chinese goods to 50%. Meanwhile, China is ready to exempt some US goods from tariffs. A deal to end the trade war would boost the dollar and ease economic worries. Meanwhile, the yen might lose its safe-haven appeal and drop.

USD/JPY key events today

Traders do not expect any high-impact economic releases from the US or Japan. Therefore, they will keep watching trade war developments.

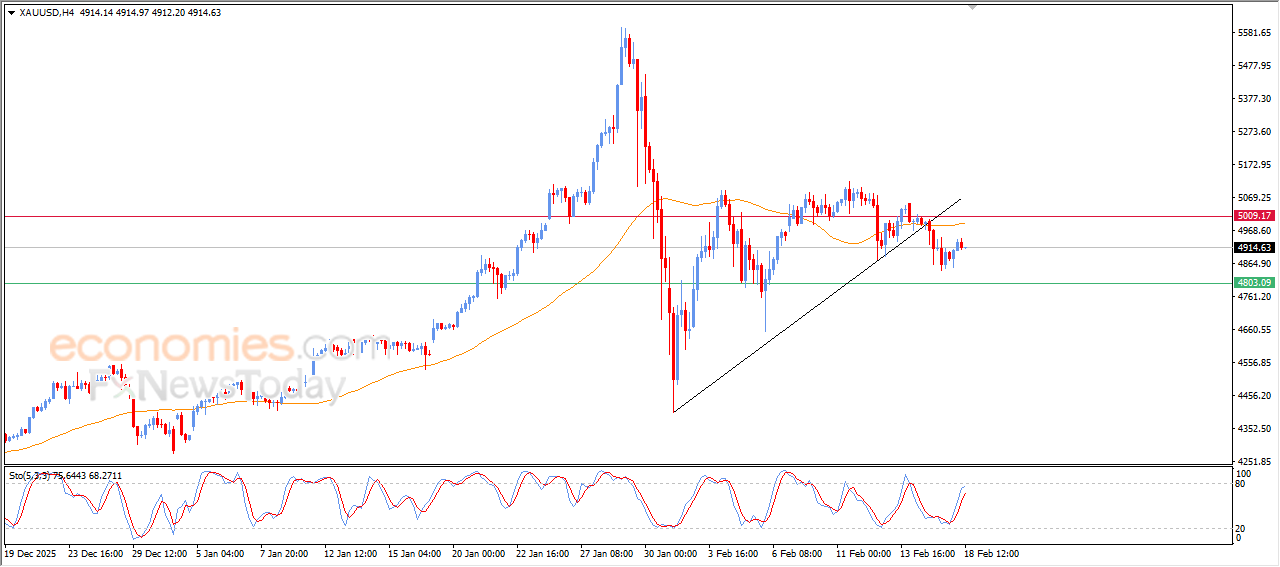

USD/JPY technical price analysis: Channel breakout signals new trend

On the technical side, the USD/JPY price has broken out of its bearish channel. Immediately after the breakout, the price pulled back to retest the channel resistance and is now climbing higher. The channel breakout indicates a bullish shift in sentiment. The price now trades above the 30-SMA, and the RSI is above 50. Therefore, the bullish bias is strong.

–Are you interested in learning more about British Trade Platform Review? Check our detailed guide-

Bears had a strong lead, maintaining a downtrend, with the price mostly below the 30-SMA. However, they could not go past the 140.01 support level. Consequently, bulls took over by pushing the price above the SMA and past the channel resistance.

Given the strong bullish bias, USD/JPY could soon retest the 145.02 resistance level. A break above this level will confirm a new uptrend.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: