Category: Forex News, News

Weakens on BOJ Outlook (Chart)

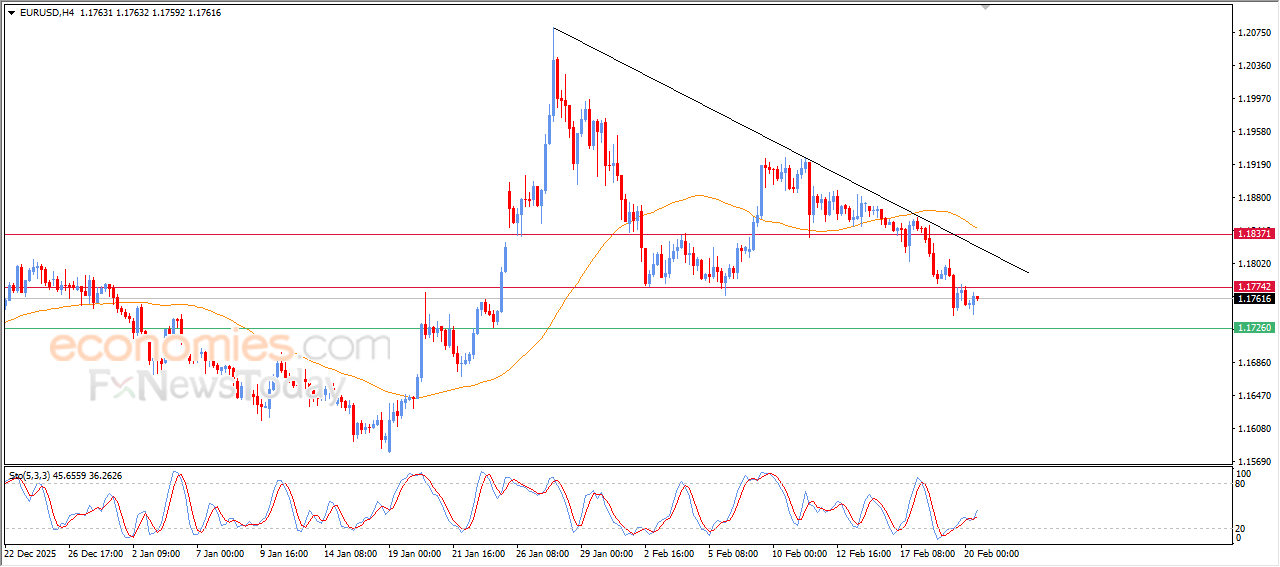

- The US dollar has been bullish during the trading session on Thursday, and that won’t be any different against the Japanese yen as it is against other currencies.

- The 153 yen level is a significantly resistant area that is now in the rearview mirror of the US dollar, and it looks like we could continue to go much higher.

Keep in mind that recently we have seen a lot of momentum in the US dollar against multiple currencies, but the Japanese yen is a little bit special in the sense that we have recently had an election in Japan. The Japanese election ushers in a new government of doves, and it is thought that the Bank of Japan will continue to keep a very loose monetary policy, so it does make a certain amount of sense that the Japanese yen gets hammered by other currencies.

FOMC Surprised a Bit

Contrast that with the FOMC meeting that we had on Wednesday, where Jerome Powell stated in the press conference that a December rate cut wasn’t necessarily a given. This has driven the US dollar higher against most things, including the Japanese yen, so it all lines up as a central bank outlook differential. Furthermore, we have an interest rate differential between the two currencies because, despite the fact that the Federal Reserve did in fact cut, the reality is that the bond market sat still.

Therefore, the interest rate differentials are even ignoring the Fed at this point. All things being equal, this is a reasonably sized candlestick. It’s explosive, it’s strong, but at the same time, it’s reasonable. It’s not out of control and impulsive. And I think this shows that short-term pullbacks are more likely than not will be bought into in this pair, and I believe that a certain amount of market memory comes into the picture at the 153 yen level as potential support.

In fact, I don’t even have a scenario at this point where I’m willing to short this pair. I think we have so much more upside. The 155 yen level could be targeted pretty quickly. And then after that, you could be looking at a move to 158 yen.

Want to trade our USD/JPY forex analysis and predictions? Here’s a list of forex brokers in Japan to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: