Category: Crypto News, News

Why is Dogecoin (DOGE) falling?

- Dogecoin price is extending its decline on Monday after falling 8.55% last week.

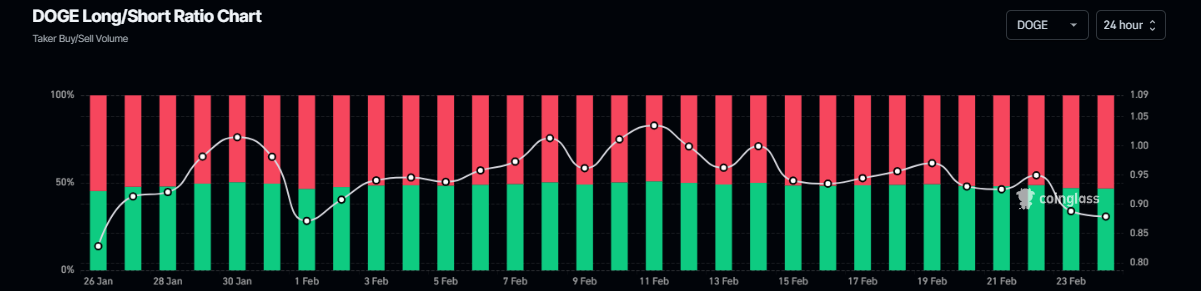

- Coinglass long-to-short ratio for DOGE reads below one, indicating more traders are betting for a correction.

- The technical outlook projects a correction towards the $0.20 level.

Dogecoin (DOGE) extends its decline, trading around $0.23 on Monday after falling 8.55% last week. Coinglass’ long-to-short ratio for DOGE reads below one, indicating more traders are betting for a correction while the technical outlook projects a pullback toward the $0.20 level.

Dogecoin bears aiming for $0.20 mark

Dogecoin price faced rejection around its 50% price retracement level (drawn from an August 14 low of $0.05 to a December 2 high of $0.48) at $0.27 last week and declined 8.55%. At the time of writing on Monday, it continues to trade down by 4.6%, around $0.23.

If DOGE continues its correction, it could extend the decline to test its February 3 low of $0.20.

The Relative Strength Index (RSI) on the daily chart reads 32, below its neutral level of 50 and approaching its oversold level of 30, indicating a strong bearish momentum.

DOGE/USDT daily chart

Another bearish sign is Coinglass’ DOGE long-to-short ratio, which reads 0.87 and continues to fall. This ratio below one reflects bearish sentiment in the markets as more traders are betting on the asset price to fall.

DOGE long-to-short ratio chart. Source: Coinglass

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: